Attorney-Approved Transfer-on-Death Deed Document for New Hampshire

When planning for the future, individuals often seek ways to pass on their cherished real estate to loved ones with minimal complications. In New Hampshire, an innovative legal instrument known as the Transfer-on-Death (TOD) Deed form serves as a beacon of hope for homeowners looking to bypass the often lengthy and complicated probate process. This form allows property owners to designate a beneficiary who will inherit their property automatically upon the owner's death, without the property having to go through probate. It's a forward-thinking approach that provides peace of mind and ensures a smooth transition of property ownership from one generation to the next. The TOD Deed is highly customizable, offering homeowners the flexibilty to name any person or entity as their beneficiary. Moreover, the form is revocable, meaning that the property owner can change their mind at any time during their lifetime without repercussions. The elegance of the TOD Deed lies in its simplicity and in its power to avoid future legal entanglements, making it a critical tool for estate planning in New Hampshire.

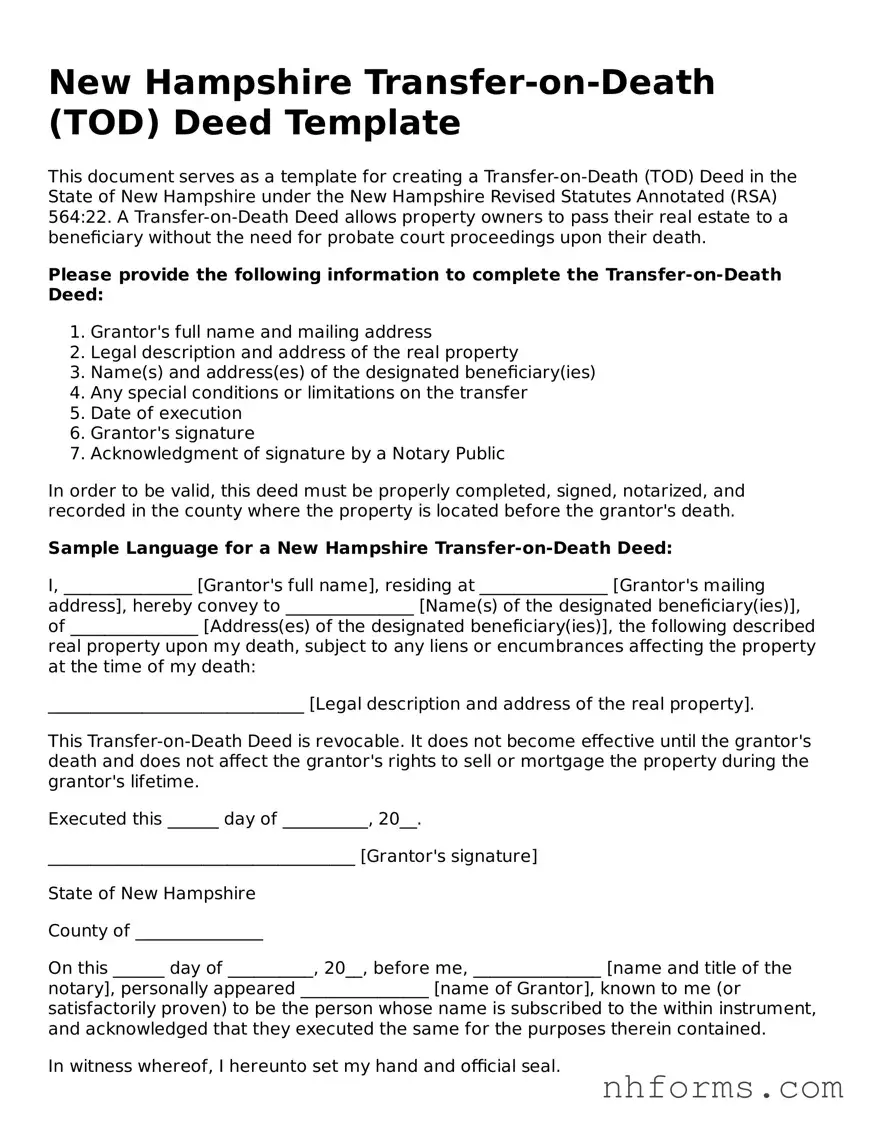

Document Preview Example

New Hampshire Transfer-on-Death (TOD) Deed Template

This document serves as a template for creating a Transfer-on-Death (TOD) Deed in the State of New Hampshire under the New Hampshire Revised Statutes Annotated (RSA) 564:22. A Transfer-on-Death Deed allows property owners to pass their real estate to a beneficiary without the need for probate court proceedings upon their death.

Please provide the following information to complete the Transfer-on-Death Deed:

- Grantor's full name and mailing address

- Legal description and address of the real property

- Name(s) and address(es) of the designated beneficiary(ies)

- Any special conditions or limitations on the transfer

- Date of execution

- Grantor's signature

- Acknowledgment of signature by a Notary Public

In order to be valid, this deed must be properly completed, signed, notarized, and recorded in the county where the property is located before the grantor's death.

Sample Language for a New Hampshire Transfer-on-Death Deed:

I, _______________ [Grantor's full name], residing at _______________ [Grantor's mailing address], hereby convey to _______________ [Name(s) of the designated beneficiary(ies)], of _______________ [Address(es) of the designated beneficiary(ies)], the following described real property upon my death, subject to any liens or encumbrances affecting the property at the time of my death:

______________________________ [Legal description and address of the real property].

This Transfer-on-Death Deed is revocable. It does not become effective until the grantor's death and does not affect the grantor's rights to sell or mortgage the property during the grantor's lifetime.

Executed this ______ day of __________, 20__.

____________________________________ [Grantor's signature]

State of New Hampshire

County of _______________

On this ______ day of __________, 20__, before me, _______________ [name and title of the notary], personally appeared _______________ [name of Grantor], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

____________________________________ [Notary's signature]

Notary Public

My commission expires: ___________

Recording

The completed and notarized Transfer-on-Death Deed must be recorded with the Registry of Deeds in the New Hampshire county where the property is located. Recording fees apply, and the rates can vary by county. It is crucial to confirm current rates and document requirements with the local Registry of Deeds.

File Information

| Fact | Detail |

|---|---|

| Purpose | Allows property owners in New Hampshire to pass real estate to beneficiaries without going through probate. |

| Governing Law | New Hampshire Revised Statutes, Chapter 564:6 |

| Revocability | The deed can be revoked by the owner at any time before death. |

| Property Types | Applies only to real property, such as houses and land. |

| Joint Ownership | If owned jointly, all owners must agree to the transfer on death. |

| Beneficiary Designations | Allows for multiple beneficiaries and contingent beneficiaries. |

| Filing | The deed must be properly completed, signed, notarized, and filed with the county registry of deeds. |

| Effect on Ownership | Ownership remains with the current owner(s) until death. |

| Cost | Recording fees may vary by county. |

Detailed Instructions for Writing New Hampshire Transfer-on-Death Deed

A New Hampshire Transfer-on-Death (TOD) deed allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the probate process. This legal document offers a simple way to ensure your property is transferred according to your wishes, without the need for a lengthy court procedure. Completing this form accurately is crucial for the transfer to occur smoothly. The process involves providing detailed information about the property, the current owner(s), and the designated beneficiary(s). Here's how to fill out the form step by step.

- Enter the full legal name(s) of the current property owner(s) as listed on the current deed of the property. If there are multiple owners, ensure all names are included.

- Provide the marital status of the owner(s) at the time of completing this form. This detail helps determine the proper distribution of the asset.

- List the full legal name(s) of the beneficiary(ies) who will receive the property upon the owner's death. Include a primary beneficiary and an alternate, if desired, to cover the possibility that the primary beneficiary predeceases the owner.

- Specify the legal description of the property being transferred. This information can be found on the current deed or property tax bill and must include lot number, subdivision name, and any other details that uniquely identify the property.

- Check whether the property is located in an unincorporated area. If so, indicate this by marking the appropriate box. This detail is important for legal and tax reasons.

- Sign and date the form in the presence of a notary public. The notary will verify the identity of the signer(s) and attest to the signing of the document.

- Have the form notarized. The notary will fill out the appropriate section, stamp, and sign the form, officially notarizing the document.

- Record the signed and notarized deed with the appropriate county office. There may be a fee for recording the deed, and the requirements can vary by county.

Filling out a New Hampshire Transfer-on-Death Deed is a forward-looking step in managing your estate. By following these detailed instructions, you can ensure that this significant asset passes smoothly to your designated beneficiary. Although this process seems straightforward, paying attention to the specific requirements and details will prevent potential issues. Always consider consulting with a legal professional to ensure the form meets all legal standards and accurately reflects your intentions.

Essential Queries on New Hampshire Transfer-on-Death Deed

What is a Transfer-on-Death Deed in New Hampshire?

A Transfer-on-Death Deed (TODD) allows property owners in New Hampshire to pass their property directly to a beneficiary upon their death, bypassing the probate process. This legal document is revocable, meaning it can be changed or voided by the property owner at any time before their death.

How do I create a Transfer-on-Death Deed in New Hampshire?

Creating a TODD in New Hampshire involves filling out the proper form, which includes listing the current property owner's details, identifying the beneficiary or beneficiaries, and providing a legal description of the property. It must then be signed by the property owner in the presence of a notary public.

Can I name multiple beneficiaries on a Transfer-on-Death Deed?

Yes, multiple beneficiaries can be named on a TODD. The property will be distributed equally among the named beneficiaries after the owner's death, unless the deed specifies a different arrangement for distribution.

Is a Transfer-on-Death Deed revocable?

Yes, a TODD is revocable. The property owner can change or cancel the deed at any time before their death, as long as they are mentally competent. This is done by preparing a new deed or other legal instrument that expressly revokes the TODD.

What happens if the beneficiary predeceases the property owner?

If the beneficiary predeceases the property owner, the TODD typically becomes void unless it includes terms for what happens in such situations. The property owner can update the deed to name a new beneficiary at any time before their own death.

Does a Transfer-on-Death Deed override a will?

A TODD takes precedence over a will when it comes to the distribution of the specific property described in the deed. This means that, regardless of what is stated in a will, the property passes to the beneficiary named in the TODD.

Are there any fees associated with filing a Transfer-on-Death Deed in New Hampshire?

Yes, there are fees associated with filing a TODD in New Hampshire. These fees vary by county and can change, so it is recommended to check with the local county recorder's office for the most current information.

Common mistakes

When completing the New Hampshire Transfer-on-Death (TOD) Deed form, individuals often encounter a plethora of pitfalls that can significantly impact the effectiveness of the document and the transfer of property upon death. Acknowledging and avoiding these common errors can ensure a smoother transition of assets to the intended beneficiaries.

One frequent mistake involves not properly identifying the beneficiares. It is crucial to provide the full legal names of the beneficiaries and clarify their relationship to the grantor, to avoid any confusion during the property's transfer. Additionally, neglecting to provide alternate beneficiaries in case the primary beneficiary predeceases the grantor can result in the property reverting to the estate and being distributed according to probate laws, potentially against the grantor's wishes.

Another common issue is failing to accurately describe the property. An exact legal description of the property, as recorded in the county's land records, is necessary. A mere address or an inaccurate description can lead to disputes about what property was intended to be transferred.

Moreover, many individuals overlook the importance of completing the form in entirety, leaving out essential information or sections. This oversight can lead to the document being considered invalid. Equally detrimental is not having the document properly witnessed or notarized, as required by New Hampshire law for a TOD deed to be considered valid. Without these formalities, the deed may not be legally enforceable.

Error often arises in the failure to file the completed form with the local county's land records office. Simply completing the TOD deed does not effectuate the transfer; the document must be recorded to be effective. Additionally, a common mistake is using a TOD deed when it conflicts with other estate planning documents, such as wills or trusts, without understanding the precedence and potential legal disputes this may cause.

Furthermore, individuals sometimes attempt to use the TOD deed to transfer property that is co-owned without the consent of the other owner(s), or without understanding how the form of ownership might affect the transfer. Lastly, a significant error is not consulting with a legal professional to ensure the TOD deed aligns with the overall estate plan and complies with all legal requirements.

To summarize the common errors succinctly:

- Not properly identifying the beneficiaries.

- Neglecting to provide alternate beneficiaries.

- Failing to accurately describe the property.

- Leaving out essential information or sections.

- Not having the document properly witnessed or notarized.

- Failure to file the completed form with the county's land records office.

- Using a TOD deed in conflict with other estate planning documents.

- Attempting to transfer co-owned property without proper consent or understanding.

- Not consulting with a legal professional.

By being aware of these pitfalls and seeking appropriate legal counsel, individuals can effectively utilize the New Hampshire Transfer-on-Death Deed form to smoothly transition their property to their chosen beneficiaries upon their demise, ensuring their final wishes are honored.

Documents used along the form

The New Hampshire Transfer-on-Death (TOD) Deed form is an important document for individuals who wish to pass on real estate to a designated beneficiary without the need for the property to go through probate after their death. Alongside the TOD Deed, there are various other documents that are often utilized to ensure that all aspects of a person’s estate are comprehensively managed. Below is a list of up to eight such documents that are commonly used in conjunction with the New Hampshire Transfer-on-Death Deed form.

- Will: A legal document that allows one to communicate their wishes regarding the distribution of their assets and the care of any minor children upon their death.

- Durable Power of Attorney for Finances: Enables a trusted person to manage financial affairs on behalf of the individual in case they become incapacitated.

- Health Care Power of Attorney: Appoints someone to make medical decisions for the individual if they are unable to do so themselves.

- Living Will: Outlines the individual's wishes concerning medical treatments and life-sustaining measures in case they become terminally ill or incapacitated.

- Revocable Living Trust: A document that allows assets to be held in a trust for the individual’s benefit during their lifetime and then transferred to designated beneficiaries when they die.

- Beneficiary Designations for Financial Accounts: Forms that allow individuals to name beneficiaries for financial accounts and insurance policies, bypassing probate.

- Real Estate Deeds for Other Properties: If the individual owns additional properties, other deeds may be needed to specify transfer plans or to change ownership structures.

- Document of Appointment of Guardian: This legal document specifies the individual's choice for a guardian in case they become incapacitated, covering decisions about their personal welfare.

Each of these documents plays a vital role in estate planning, helping individuals ensure that their wishes are respected and that their loved ones are provided for in their absence. While the Transfer-on-Death Deed facilitates the seamless transfer of real property, integrating these additional documents into one’s estate plan can offer comprehensive coverage for various assets and scenarios. It's advisable to consult with a legal professional when preparing these documents to ensure they are correctly executed and reflect the individual’s intentions accurately.

Similar forms

The New Hampshire Transfer-on-Death Deed form is similar to several other estate planning documents, but it is unique in its function and execution. It allows property owners to designate a beneficiary to receive their property upon their death, bypassing the probate process. This characteristic is shared with other instruments, yet each has its nuances that distinguish it from a transfer-on-death deed.

A Payable-on-Death (POD) Account is a financial tool that individuals use to pass assets to a beneficiary upon their death. Both the Transfer-on-Death Deed and a POD account allow for the direct transfer of assets to beneficiaries outside of probate. However, while the Transfer-on-Death Deed applies to real property, such as homes or land, a POD account is used for financial assets, including bank accounts and certificates of deposit. The key similarity lies in their ability to simplify the transfer of assets upon the death of the account holder or property owner, but they apply to different types of assets.

A Joint Tenancy with Right of Survivorship is a form of property ownership that allows co-owners to have equal shares of a property. Upon the death of one co-owner, their share of the property automatically passes to the surviving co-owner(s), not through the will or probate. Like the Transfer-on-Death Deed, this arrangement avoids probate. The crucial difference is that the Transfer-on-Death Deed does not grant any ownership rights to the beneficiary until the death of the owner, whereas in joint tenancy, co-owners have immediate ownership rights alongside each other.

A Living Trust is an estate planning tool that holds assets during an individual's lifetime for the benefit of the beneficiaries after the owner's death. Similar to a Transfer-on-Death Deed, a living trust can bypass the probate process, providing a more streamlined transfer of assets. However, unlike a Transfer-on-Death Deed, which is solely for real estate, a living trust can hold various types of assets, including real estate, bank accounts, and personal property. Additionally, a living trust can provide more comprehensive control over the distribution of assets and conditions upon which they are distributed.

Dos and Don'ts

When it comes to filling out the New Hampshire Transfer-on-Death Deed form, it’s important to do it right. Here are some dos and don'ts to help guide you through the process:

- Do read through the entire form before you start filling it out. Understanding the full scope of what’s being asked can help eliminate errors.

- Do ensure all information is accurate, especially names and addresses. Mistakes can lead to significant issues down the line.

- Do check if you need to have the form notarized. This is a crucial step for the document to be considered valid.

- Do retain a copy for your records. Once the form is filled out and filed, having your own copy is essential for reference or in case of disputes.

- Do seek legal advice if there’s anything you don’t understand. An expert’s guidance can prevent legal headaches later.

- Don’t rush through the process. Taking your time can prevent mistakes that might be hard to correct later.

- Don’t leave any sections blank unless the form specifically instructs you to do so. Incomplete forms might not be legally binding.

- Don’t use correction fluid or tape. If you make a mistake, it’s better to start fresh on a new form to maintain its cleanliness and legibility.

- Don’t forget to specify clearly who the beneficiaries will be. Vague language can make the transfer of the property difficult.

Misconceptions

When it comes to planning for the future, many people consider using a Transfer-on-Death (TOD) deed as a tool to manage the transfer of real estate. Specifically, in New Hampshire, there are some common misconceptions about how Transfer-on-Death Deeds work. It is important to understand the reality behind these documents to ensure one's assets are managed and distributed according to their wishes.

- Misconception #1: A Transfer-on-Death Deed Overrides a Will

Some believe that a Transfer-on-Death Deed will always take precedence over a will. However, a TOD deed directly transfers property to a beneficiary upon the death of the owner, bypassing the will. This means that if the property is designated to someone in the TOD deed, that designation will override conflicting instructions in a will. It's crucial to coordinate all estate documents to reflect consistent intentions.

- Misconclusion #2: The Beneficiary Can Take Immediate Control

Another misconception is that the beneficiary of a TOD deed can assume control over the property as soon as the document is signed. In reality, the beneficiary's control and ownership only activate upon the death of the property owner. Until then, the owner retains full control over the property, including the right to amend or revoke the TOD deed.

- Misconception #3: Transfer-on-Death Deeds Avoid All Forms of Probate

While it's true that a TOD deed allows property to bypass the probate process, it’s not accurate to say it avoids all forms of probate. In New Hampshire, certain situations may still require a simplified probate process to validate the transfer, especially if there are disputes among heirs or creditors with claims against the estate.

- Misconception #4: A Transfer-on-Death Deed Is Complicated to Create

There's a common belief that creating a TOD deed is a complex and cumbersome process. In fact, with the right guidance, drafting a TOD deed can be straightforward. The key is to ensure the document clearly identifies the property, the owner, and the designated beneficiary or beneficiaries and that it is properly signed and recorded according to New Hampshire state law.

- Misconception #5: Transfer-on-Death Deeds Are Suitable for Everyone

Finally, it's a misconception that a TOD deed is a one-size-fits-all solution. While TOD deeds offer a simple way to transfer property, they may not be suitable for everyone's situation. For instance, if the beneficiary is a minor, has special needs, or if the property is heavily mortgaged, alternative estate planning tools might be more appropriate. Consulting with a legal professional can help determine the best approach for individual circumstances.

Understanding these misconceptions about Transfer-on-Death Deeds in New Hampshire can help individuals make informed decisions about estate planning. It's advisable to consult with a legal professional who can offer personalized advice based on specific needs and goals.

Key takeaways

When considering the management and eventual transfer of your property upon your passing, the New Hampshire Transfer-on-Death (TOD) Deed form serves as an invaluable tool. Designed to streamline the process by which property can be passed on, the TOD deed helps avoid the complications and delays often associated with probate court. Here are some key takeaways to ensure the form is filled out and utilized correctly:

- Understand the Purpose: The TOD deed allows property owners in New Hampshire to transfer their real estate to a designated beneficiary upon death without the need for probate proceedings.

- Eligibility: Not everyone can use a TOD deed. It's essential to verify that your property type qualifies under New Hampshire law and to assess whether this method aligns with your estate planning goals.

- Selecting a Beneficiary: Careful consideration should go into choosing your beneficiary. This can be an individual, multiple individuals, or a legal entity. The right choice reflects personal wishes and relationships.

- Form Requirements: Completing the TOD deed form requires attention to detail. Accurate and complete information, adherence to state-specific legal requirements, and proper formatting are crucial.

- Signature and Witnessing: A valid TOD deed must be signed in the presence of a notary public. Witnessing requirements may also apply, further emphasizing the need for procedural accuracy.

- Recording the Deed: Merely filling out and signing the deed is not enough. For the deed to be effective and enforceable, it must be recorded with the appropriate county registrar or land records office before the property owner's death.

- Revocability: One of the key features of a TOD deed is its revocability. The property owner can change or revoke the deed without the beneficiary's consent at any time before death, providing flexibility and control.

- Considerations for Beneficiaries: Beneficiaries should be informed about the TOD deed and understand how it will impact them, including potential tax implications and responsibilities for the property after the transfer.

In applying these takeaways, it's advisable to seek guidance to ensure that the TOD deed strategy aligns with broader estate planning objectives and complies with New Hampshire's legal requirements. A carefully executed Transfer-on-Death Deed can provide peace of mind and a seamless transfer of your cherished real estate to the people or organizations you care about most.

Other New Hampshire Templates

Acknowledgement Certificate Notary - A Notary Acknowledgment verifies that the signer understands the document and is signing of their own free will.

Hold Harmless and Indemnity Agreement - It's an essential part of regulatory compliance in industries where liabilities are a significant concern.