Attorney-Approved Small Estate Affidavit Document for New Hampshire

When a loved one passes away in New Hampshire, managing their estate can feel like navigating through a maze, especially for those not familiar with legal processes. Fortunately, for estates valued under a certain threshold, the process can be simplified with a Small Estate Affidavit. This legal document allows individuals, typically the surviving spouse or closest relative, to claim the deceased's assets without the need for a formal probate proceeding. The form is designed to streamline the distribution of assets to rightful heirs, making it a vital tool for small estate management. By understanding and correctly utilizing the Small Estate Affidavit form, individuals can save time and reduce the complexities often associated with settling an estate. This form, contingent on specific criteria such as the total value of the estate and the assets involved, provides a straightforward path for asset distribution, ensuring that the deceased’s final wishes are honored with minimal legal hurdles.

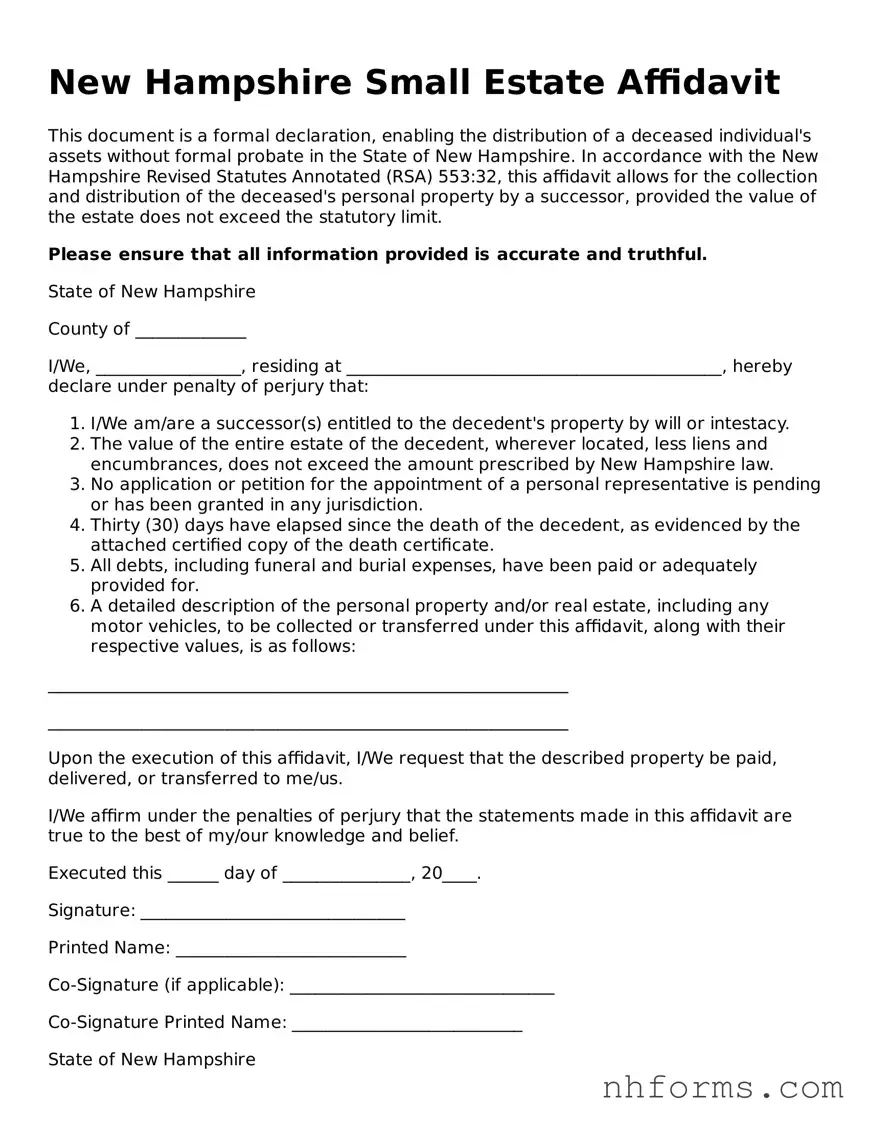

Document Preview Example

New Hampshire Small Estate Affidavit

This document is a formal declaration, enabling the distribution of a deceased individual's assets without formal probate in the State of New Hampshire. In accordance with the New Hampshire Revised Statutes Annotated (RSA) 553:32, this affidavit allows for the collection and distribution of the deceased's personal property by a successor, provided the value of the estate does not exceed the statutory limit.

Please ensure that all information provided is accurate and truthful.

State of New Hampshire

County of _____________

I/We, _________________, residing at ____________________________________________, hereby declare under penalty of perjury that:

- I/We am/are a successor(s) entitled to the decedent's property by will or intestacy.

- The value of the entire estate of the decedent, wherever located, less liens and encumbrances, does not exceed the amount prescribed by New Hampshire law.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- Thirty (30) days have elapsed since the death of the decedent, as evidenced by the attached certified copy of the death certificate.

- All debts, including funeral and burial expenses, have been paid or adequately provided for.

- A detailed description of the personal property and/or real estate, including any motor vehicles, to be collected or transferred under this affidavit, along with their respective values, is as follows:

_____________________________________________________________

_____________________________________________________________

Upon the execution of this affidavit, I/We request that the described property be paid, delivered, or transferred to me/us.

I/We affirm under the penalties of perjury that the statements made in this affidavit are true to the best of my/our knowledge and belief.

Executed this ______ day of _______________, 20____.

Signature: _______________________________

Printed Name: ___________________________

Co-Signature (if applicable): _______________________________

Co-Signature Printed Name: ___________________________

State of New Hampshire

County of _____________

Subscribed and sworn to before me this ______ day of _______________, 20____.

Notary Public: ___________________________

My Commission Expires: __________________

File Information

| Fact | Detail |

|---|---|

| Governing Law | New Hampshire Revised Statutes, Section 553:32 |

| Threshold for Use | $10,000 or less |

| Primary Purpose | To enable the transfer of a deceased person's property to their rightful heirs without a formal probate process |

| Who Can File | Legally entitled successors such as spouses, children, or parents of the deceased |

| Waiting Period | At least 30 days after the decedent's death |

Detailed Instructions for Writing New Hampshire Small Estate Affidavit

When a loved one passes away in New Hampshire with a relatively small amount of assets, you may be able to settle their estate through a simpler process using the Small Estate Affidavit form. This document allows you to claim property of the deceased without a formal probate court proceeding, provided the estate meets specific criteria set by state law. Filling out this form correctly is crucial for a smooth and successful claim process. The following steps are designed to help guide you through creating a Small Estate Affidavit, ensuring that all necessary information is accurately communicated.

- Gather all required documents, including the death certificate of the deceased and any documents proving your right to the property.

- Read through the entire form to familiarize yourself with all the sections and information required.

- Fill in the decedent's full name and date of death in the designated areas at the top of the form.

- List your name and address in the sections provided, establishing your identity as the affidavit's filer.

- Provide a full inventory of the deceased's property that you are claiming. Include descriptions, locations, and estimated values.

- Attach legal documentation that proves your right to the property. This might include wills, trusts, or other documents that name you as a beneficiary.

- If the form requires it, list any debts of the deceased that you are aware of, including creditor names, addresses, and amounts owed.

- Read the statements at the end of the form carefully. These usually require you to swear that the information you have provided is accurate to the best of your knowledge.

- Sign and date the form in front of a notary public. Many states require the Small Estate Affidavit to be notarized to confirm the identity of the person filing it.

- File the completed form with the appropriate local court or agency. This may include paying a filing fee, depending on local regulations.

Once you have filled out and filed the Small Estate Affidavit form, the process of claiming the property can move forward. Depending on the jurisdiction, there may be a waiting period or additional steps required to transfer the property officially into your name. Ensure you keep copies of all documents submitted and maintain communication with any involved parties until the transfer is complete.

Essential Queries on New Hampshire Small Estate Affidavit

What is a New Hampshire Small Estate Affidavit?

A New Hampshire Small Estate Affidavit is a legal document that allows the property of a deceased person (the decedent) to be distributed to heirs without a formal probate process. It is used for estates that fall below a certain value threshold and meet specific criteria set by New Hampshire law.

Who can file a New Hampshire Small Estate Affidavit?

Typically, the right to file a Small Estate Affidavit in New Hampshire is given to a surviving spouse or the next of kin. An executor named in the decedent's will may also file this affidavit if no probate proceedings are required.

What is the value limit for using a Small Estate Affidavit in New Hampshire?

In New Hampshire, the total value of the decedent's estate that allows for the use of a Small Estate Affidavit must not exceed $10,000. This amount excludes the value of any real estate owned by the decedent.

What property can be transferred with a Small Estate Affidavit in New Hampshire?

Personal property such as bank accounts, stocks, and vehicles can be transferred using a Small Estate Affidavit in New Hampshire. Real estate cannot be transferred using this document.

Are there any debts that must be paid before distributing property using a Small Estate Affidata?

Yes, the law requires that any outstanding debts and claims against the estate must be settled before distributing the remaining property to the heirs.

What information is needed to complete a Small Estate Affidavit in New Hampshire?

To complete a Small Estate Affidavit, you will need the decedent's full legal name, date of death, a detailed description of the property to be transferred, and the names and relationships of the heirs entitled to receive the property.

How is a Small Estate Affidavit filed in New Hampshire?

After completing the Small Estate Affidavit, it must be signed in the presence of a notary public. Then, it is typically filed with the local probate court in the county where the decedent resided at the time of their death.

Is there a waiting period to file a Small Estate Affidavit in New Hampshire?

Yes, there is a mandatory waiting period of 30 days after the death of the decedent before a Small Estate Affidavit can be filed in New Hampshire.

Can real estate be transferred using a Small Estate Affidavit in New Hampshire?

No, real estate cannot be transferred using a Small Estate Affidavit in New Hampshire. This document is only applicable for the distribution of personal property.

Who should be notified about the filing of a Small Estate Affidavit in New Hampshire?

All heirs and anyone personally interested in the estate should be notified about the filing of a Small Estate Affidavit. This includes any creditors who may have claims against the estate.

Common mistakes

Filling out the New Hampshire Small Estate Affidavit form can seem straightforward, but some common mistakes often trip people up. These errors can delay the process, leading to frustration and sometimes requiring the submission of a new form. Awareness of these pitfalls is key to ensuring the process goes as smoothly as possible.

Not verifying eligibility criteria: One of the first mistakes is not thoroughly checking if the estate actually qualifies as a 'small estate' under New Hampshire law. The requirements can change, so it’s crucial to verify the current criteria before proceeding.

Incorrect or incomplete information: Another frequent error is the submission of incorrect or incomplete information. Every detail, from the full legal names of the deceased and the claimant to the exact value of the estate, must be accurately reported. Misinformation can invalidate the affidavit.

Overlooking debts and liabilities: Often, people forget to list all of the deceased's debts and liabilities. This omission can lead to significant legal issues, as the affidavit must provide a clear picture of the estate's financial situation.

Failing to attach required documents: Some necessary documents must accompany the affidavit, such as the death certificate and proof of any assets owned by the deceased. Failure to include these can result in the rejection of the affidavit.

Not using the latest form: The state periodically updates the form to reflect current laws and requirements. Using an outdated version can mean automatic rejection. Always double-check that you have the most current form before filling it out.

Signature issues: The affidavit must be signed in the presence of a notary public, but sometimes people either forget this step or the notary’s seal and signature are missing or incorrect. This oversight can significantly delay the process.

Avoiding these mistakes requires careful attention to detail and a thorough understanding of the process. Taking the time to check, and double-check, can save a great deal of time and effort. While filling out the New Hampshire Small Estate Affidavit form is just one step in managing a loved one's affairs, doing it correctly helps to ensure that the process is as efficient and stress-free as possible.

Documents used along the form

When dealing with the complexities of settling an estate in New Hampshire, the Small Estate Affidavit form is just the starting point for a smoother process. Often, several other forms and documents are necessary to ensure compliance with state laws and thorough handling of the decedent’s estate. This set of documents varies widely depending on the specifics of the estate, the assets involved, and the legal requirements in place. Below is a collection of forms and documents frequently used alongside the New Hampshire Small Estate Affidavit to aid in the estate settlement process.

- Certificate of Appointment: This is issued by the court and proves the authority of the person appointed to act on behalf of the deceased estate. It’s often required when dealing with banks and other financial institutions.

- Death Certificate: Used to confirm the death of the individual. It’s a crucial document required by various entities when transferring ownership or accessing accounts.

- Will: If the decedent left a will, it outlines how they wanted their assets distributed. It might negate the need for a Small Estate Affidavit if the estate doesn't qualify as "small" under state law.

- Inventory of Assets: A detailed list of the deceased's assets at the time of death. This document is necessary for a comprehensive understanding of what the estate comprises.

- Appraisal Reports: Sometimes, assets need to be appraised to determine their fair market value. This is especially true for real estate and personal property of significant value.

- Debts and Liabilities Statement: A comprehensive list outlining any debts or obligations the deceased owed, which might affect the estate's value.

- Tax Forms: Depending on the estate’s size and income generated, various tax forms might be necessary, including final income tax returns or estate tax forms.

- Real Estate Transfer Forms: If the decedent owned real estate that doesn’t automatically transfer to a co-owner, this form is required to legally transfer the property to the rightful inheritors.

- Vehicle Title Transfer Forms: For transferring ownership of vehicles owned by the deceased, specific to New Hampshire regulations.

- Bank Account Closure Forms: Needed to access and distribute or close any bank accounts held by the deceased.

Utilizing these forms in conjunction with the Small Estate Affidavit can be daunting but is essential for the orderly processing of a decedent’s estate. It’s advisable to seek guidance from legal professionals to navigate this complex terrain effectively. These documents collectively ensure that all financial matters and assets are handled properly, respecting both legal obligations and the decedent's wishes. Remember, the goal is to settle the estate as smoothly and efficiently as possible, serving the best interest of all parties involved.

Similar forms

The New Hampshire Small Estate Affidavit form is similar to other legal documents aimed at simplifying the estate settlement process after someone has passed away. Specifically, it bears resemblance to the Simplified Probate Procedure and the Transfer on Death Deed in terms of its goals, the situations where it can be utilized, and the specific problems it aims to solve. Though each document has its unique specifications and uses, they all share the objective of avoiding lengthy and complicated legal procedures, ensuring that assets are transferred to the rightful heirs or designated recipients in a more straightforward manner.

Simplified Probate Procedure: This procedure is akin to the New Hampshire Small Estate Affidavit in several noteworthy ways. First, both serve as mechanisms designed to expedite the distribution of assets from a deceased person’s estate to their rightful heirs. The Simplified Probate Procedure is generally used when the total value of the estate does not exceed a certain threshold, a criterion also central to the application of the Small Estate Affidait. Furthermore, both processes reduce the need for extensive court involvement, thus lowering legal costs and expediting the distribution timeline. However, while the Small Estate Affidavit is a document that can be filed without a lawyer in some cases, the Simplified Probate Procedure may still require legal assistance to navigate, despite its name suggesting simplicity.

Transfer on Death Deed: The Transfer on Death Deed (TODD), while primarily a tool for real estate, shares the goal of bypassing traditional probate processes similar to the New Hampshire Small Estate Affidavit. Both documents allow assets to be transferred directly to beneficiaries without needing to go through the full probate court process, which can be time-consuming and costly. The primary difference lies in the type of assets they cover; the Small Estate Affidavit can apply to various asset types, including personal property, bank accounts, and sometimes vehicles, whereas the TODD is specifically designed for real estate assets. Moreover, the TODD must be executed and recorded before the death of the property owner, showcasing a proactive approach to estate planning not necessarily required by the Small Estate Affidavit.

Dos and Don'ts

When filling out the New Hampshire Small Estate Affidavit form, it's crucial to follow certain guidelines to ensure the process goes smoothly. Here is a list of things you should and shouldn't do:

- Do ensure that the estate's total value does not exceed the threshold set by New Hampshire law. This ensures you are using the correct form fit for the estate's size.

- Do provide accurate information about the decedent's assets. This includes bank accounts, vehicles, and any real property located within New Hampshire.

- Do list all known debts of the estate. Honesty in reporting obligations helps prevent legal issues down the line.

- Do include the names and addresses of all heirs. Accurate heir information ensures that all rightful heirs are notified and can claim their inheritance.

- Don't sign the form without ensuring all statements are truthful and accurate. The affidavit requires a sworn statement to its accuracy under penalty of perjury.

- Don't forget to attach a certified copy of the death certificate. This document is crucial for the process and must accompany the affidavit.

- Don't leave any sections blank. If a section doesn't apply, indicate with "N/A" or "None" to demonstrate that you didn't overlook it.

- Don't file the form without reviewing state and local rules. Specific requirements may vary, so it's important to ensure compliance with all applicable laws and regulations.

By following these guidelines, you can complete the New Hampshire Small Estate Affidavit form correctly and help facilitate a smoother process for settling the small estate.

Misconceptions

When navigating through the probate process in New Hampshire, the Small Estate Affidavit form emerges as a tool designed to simplify the settlement of small estates. However, misconceptions about its use and requirements can lead to confusion and misunderstanding. To clarify, here are ten common misconceptions about the Small Estate Affidavit form in New Hampshire:

- The Small Estate Affidavit form can be used for any estate, regardless of its size. This belief is incorrect as the form is specifically intended for estates that fall under a certain monetary threshold defined by New Hampshire law.

- The form grants immediate access to the deceased’s assets. While it does streamline the process, there's still a mandatory waiting period before the assets can be distributed.

- Real estate can be transferred using the Small Estate Affidavit form. In New Hampshire, this form is typically not used to transfer real estate property. Its use is mainly confined to the transfer of personal property.

- All debts of the estate must be settled before the form can be filed. While settling debts is a crucial part of managing an estate, the affidavit can actually be filed before all debts are fully paid off, but provisions should be made to address outstanding debts.

- A lawyer must be hired to complete and file the affidavit. While legal advice is often beneficial, especially in more complex estates, the form is designed to be straightforward enough for individuals to complete and file on their own if they choose.

- The form can be filed in any state court. The affidavit must be filed in the county court where the deceased resided or where the property is located, not just any state court.

- The affidavit automatically transfers vehicle titles to the heirs. The process for transferring titles of vehicles requires additional steps beyond just the affidavit, including coordination with the Department of Motor Vehicles.

- There’s no need to notify beneficiaries or heirs about the affidavit. New Hampshire law requires that all relevant parties be notified about the estate proceedings, including the filing of a Small Estate Affidavit.

- There’s a fee to file the Small Estate Affidavit form. While many court processes involve filing fees, the cost associated with filing a Small Estate Affidavit in New Hampshire is relatively minimal and sometimes there is no fee at all, depending on the county.

- Assets can be distributed immediately after filing the form. Even after filing the affidavit, the law requires a waiting period to ensure all claims against the estate, including debts and taxes, are properly addressed before distribution.

Clearing up these misconceptions helps facilitate a smoother legal process for individuals dealing with small estates, ensuring that the rights and responsibilities of all parties are properly understood and upheld.

Key takeaways

When dealing with the aftermath of a loved one's death, the process of handling their assets can be daunting. In New Hampshire, if the estate in question is considered small based on its value, the use of a Small Estate Affidavit can simplify this process significantly. Here are five key takeaways about filling out and using the New Hampshire Small Estate Affidavit form:

- Understand the eligibility criteria: The New Hampshire Small Estate Affidavit can be used if the total value of the decedent’s personal property (this doesn't include real estate) does not exceed a certain monetary threshold set by the state. It's important to confirm this threshold to ensure you're eligible to use this form.

- Wait the required period: New Hampshire law mandates a waiting period after the decedent's death before the Small Estate Affidavit can be filed. This ensures that all interested parties have ample time to come forward and make claims against the estate.

- Gather necessary documents: Before filling out the Small Estate Affidavit, you'll need several pieces of information, including the death certificate, a detailed list of the deceased’s personal property and its value, and any outstanding debts. Being prepared with these documents can streamline the process.

- Complete the form accurately: When filling out the form, pay close attention to detail to ensure all information is correct. This includes the legal description of assets and the full names and addresses of heirs or beneficiaries. Mistakes can lead to delays or legal challenges.

- Understand its limitations: The Small Estate Affidavit is a powerful tool for simplifying the estate settlement process, but it does have its limitations. It cannot be used to transfer real estate and may not be accepted by all financial institutions without a court order. Knowing these limitations upfront can help manage expectations.

By familiarizing yourself with these aspects of the Small Estate Affidavit in New Hampshire, you can navigate the estate settlement process more efficiently and with greater peace of mind. Remember, it's also beneficial to consult with a legal professional to ensure that you are taking the right steps according to your unique circumstances.

Other New Hampshire Templates

Power of Attorney Form Nh - It's a practical measure to facilitate continuity in financial management, especially for individuals with complex estates or business interests.

New Hampshire Power of Attorney - Protects the grantor's interests by formally defining the scope of the agent's power, preventing unauthorized actions.