Attorney-Approved Real Estate Purchase Agreement Document for New Hampshire

Embarking on the journey of buying or selling property in New Hampshire can seem overwhelming at first, but understanding the importance of the Real Estate Purchase Agreement form can make the process significantly smoother. This crucial document serves as the roadmap for the transaction, detailing the terms and conditions agreed upon by both the buyer and seller. It covers a wide range of information, including but not limited to, the purchase price, property description, closing details, and any contingencies that must be met before the deal is finalized. Moreover, the form outlines the rights and responsibilities of each party, ensuring clear communication and expectations. Given its legal significance, meticulously filling out this form is not just recommended—it's essential for safeguarding interests and facilitating a successful property transfer in the state of New Hampshire.

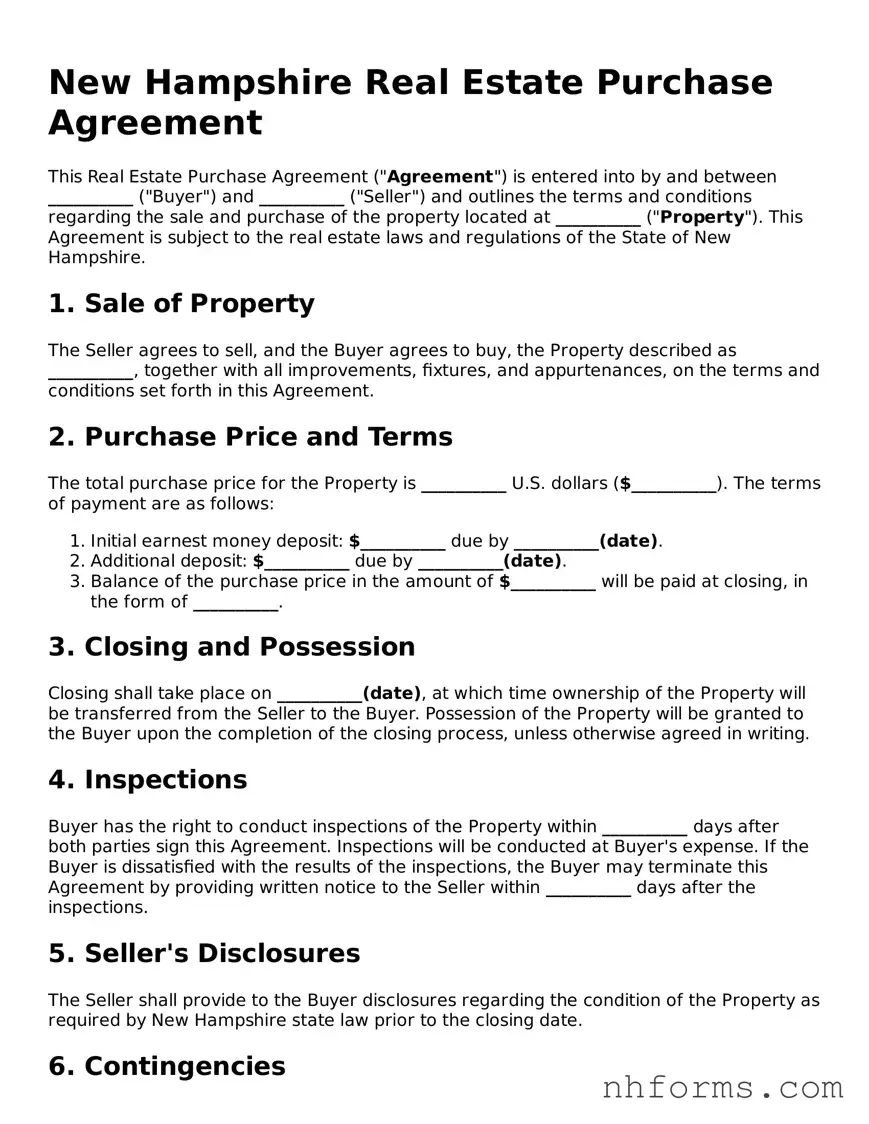

Document Preview Example

New Hampshire Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between __________ ("Buyer") and __________ ("Seller") and outlines the terms and conditions regarding the sale and purchase of the property located at __________ ("Property"). This Agreement is subject to the real estate laws and regulations of the State of New Hampshire.

1. Sale of Property

The Seller agrees to sell, and the Buyer agrees to buy, the Property described as __________, together with all improvements, fixtures, and appurtenances, on the terms and conditions set forth in this Agreement.

2. Purchase Price and Terms

The total purchase price for the Property is __________ U.S. dollars ($__________). The terms of payment are as follows:

- Initial earnest money deposit: $__________ due by __________(date).

- Additional deposit: $__________ due by __________(date).

- Balance of the purchase price in the amount of $__________ will be paid at closing, in the form of __________.

3. Closing and Possession

Closing shall take place on __________(date), at which time ownership of the Property will be transferred from the Seller to the Buyer. Possession of the Property will be granted to the Buyer upon the completion of the closing process, unless otherwise agreed in writing.

4. Inspections

Buyer has the right to conduct inspections of the Property within __________ days after both parties sign this Agreement. Inspections will be conducted at Buyer's expense. If the Buyer is dissatisfied with the results of the inspections, the Buyer may terminate this Agreement by providing written notice to the Seller within __________ days after the inspections.

5. Seller's Disclosures

The Seller shall provide to the Buyer disclosures regarding the condition of the Property as required by New Hampshire state law prior to the closing date.

6. Contingencies

This Agreement is contingent upon the following conditions:

- Buyer obtaining a mortgage loan for the purchase of the Property in the amount of $__________ on terms satisfactory to the Buyer.

- The Property being appraised for at least the purchase price.

- Buyer's approval of property inspections and Seller's disclosures.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New Hampshire.

8. Signatures

This Agreement shall be executed by the Buyer and Seller as of the date first above written. Electronic signatures are deemed valid and binding in accordance with New Hampshire state law.

Buyer's Signature: __________ Date: __________

Seller's Signature: __________ Date: __________

File Information

| Fact | Detail |

|---|---|

| 1. Purpose | This form is used to legally document the sale and purchase of real estate in New Hampshire. |

| 2. Governing Law | The New Hampshire Real Estate Purchase Agreement is governed by New Hampshire Revised Statutes, specifically within the provisions related to real property and contracts. |

| 3. Key Components | Includes details such as property description, purchase price, closing date, contingencies (e.g., financing, inspection), and rights and obligations of the parties. |

| 4. Disclosures | Sellers are required to provide certain disclosures about the property's condition, including any known material defects. |

| 5. Binding Effect | Once signed by both the buyer and seller, it becomes a legally binding contract. |

| 6. Modification | Any changes to the agreement after signing must be made in writing and agreed upon by both parties. |

| 7. Termination Rights | Includes conditions under which either party may terminate the agreement legally, such as failure to secure financing or unsatisfactory inspection results. |

Detailed Instructions for Writing New Hampshire Real Estate Purchase Agreement

Once a buyer decides to purchase real estate in New Hampshire, they must fill out a purchase agreement form. This document is crucial as it outlines the terms of the sale, including the purchase price, property description, and any conditions or contingencies. It's important to ensure all the information is accurate and complete to avoid any future disputes. The steps below will guide you through filling out the New Hampshire Real Estate Purchase Agreement form, making it a straightforward process.

- Gather all necessary information about the property, including the legal description, property address, and any relevant details such as the lot number and subdivision.

- Identify the buyer and seller by their full legal names and contact information.

- Specify the agreed-upon purchase price for the property in the designated section.

- Detail the terms of the payment, including any deposits made, financing arrangements, and when the full payment is due.

- Include any personal property that will be included in the sale. This could be appliances, furniture, or any other items not permanently attached to the property.

- Outline any contingencies that must be met before the sale can go through. These may include inspections, financing approval, or the sale of another property.

- State the closing date when the sale transaction is expected to be completed and the property officially changes hands.

- List any closing costs and who is responsible for each. This can include taxes, fees, and any agent commissions.

- Specify any pre-arranged agreements regarding repairs or modifications to the property before closing.

- Review all entered information for accuracy and completeness. Both the buyer and seller should ensure the agreement reflects their understanding.

- Sign and date the form in the designated areas. Both the buyer and seller must sign the agreement for it to be legally binding.

After both parties have signed the New Hampshire Real Estate Purchase Agreement form, the document serves as a binding contract that outlines the terms of the property sale. It's recommended that both the buyer and seller keep a copy for their records. Moving forward, the parties should work to meet any contingencies listed in the agreement and prepare for the closing date, ensuring a smooth transition of property ownership.

Essential Queries on New Hampshire Real Estate Purchase Agreement

What is the purpose of a Real Estate Purchase Agreement form in New Hampshire?

In New Hampshire, a Real Estate Purchase Agreement form serves as a binding contract between a buyer and seller for the purchase and sale of real estate. This document outlines the terms and conditions of the sale, including the purchase price, financing contingency, inspection details, and any other agreed-upon conditions. It is designed to protect both parties by ensuring there is a clear understanding of the obligations and expectations involved in the transaction.

Is a Real Estate Purchase Agreement form legally required for property transactions in New Hampshire?

While verbal agreements can sometimes be recognized, for real estate transactions in New Hampshire, a written purchase agreement is typically required to ensure enforceability. It clearly documents the terms of the transaction and provides a legal framework that can be referred back to if disputes arise, significantly reducing potential legal complications. Thus, while not strictly mandated by law, it is a crucial element of any real estate transaction.

What information is typically included in this agreement?

A typical New Hampshire Real Estate Purchase Agreement includes the names and contact information of the buyer and seller, legal description of the property, purchase price, terms of payment, closing and possession dates, contingency clauses such as financing and inspections, and any specific details pertaining to the sale. Additionally, it will contain information about the earnest money deposit and details regarding who holds it, along with any fixtures or personal property included in the sale.

Can modifications be made to a Real Estate Purchase Agreement after it has been signed?

Yes, modifications can be made to the agreement after signing, but any changes must be agreed upon by both the buyer and seller, documented in writing, and appended to the original agreement. This process ensures that the agreement accurately reflects the current understanding and agreement between the parties. Changes are common and can be negotiated as long as both parties consent.

What happens if either party breaches the agreement?

If a breach occurs, the non-breaching party has several remedies available depending on the nature of the breach and the specifics of the agreement. These remedies can include seeking specific performance, where a court orders the breaching party to fulfill their obligations under the agreement, or seeking damages to compensate for any financial losses caused by the breach. The agreement itself may also outline particular consequences or steps to be taken in the event of a breach.

How is the purchase price usually determined?

The purchase price is typically determined through negotiation between the buyer and the seller, often assisted by their respective real estate agents or attorneys. Market analysis, the property’s condition, location, and unique features, as well as current real estate market conditions, play significant roles in the negotiation process. The agreed-upon price is then recorded in the Real Estate Purchase Agreement as part of the contractual agreement between the parties.

Is an attorney required for real estate transactions in New Hampshire?

While the state of New Hampshire does not legally require an attorney to be involved in real estate transactions, it is highly recommended to consult one. An attorney can provide legal advice, ensure the contract reflects the agreed-upon terms accurately, address any legal issues that arise, and help navigate through the closing process. Working with an attorney helps protect your interests and can provide peace of mind throughout the transaction.

Common mistakes

When navigating the path of purchasing real estate in New Hampshire, individuals often encounter the crucial step of filling out a Real Estate Purchase Agreement. While this document lays the groundwork for the transfer of property, errors can lead to misunderstandings, delays, or even legal disputes. Here are ten common mistakes people make on this form, highlighting the importance of attention to detail and accuracy in the process.

- Failing to accurately describe the property - It's imperative to include a comprehensive and precise description of the property being purchased. This goes beyond the address, encompassing legal descriptions that tie the property to government records.

- Skipping over essential dates - Every step in the purchasing process is tied to specific dates, such as offer expiration and closing. Accidentally leaving these blank or entering unrealistic dates can cause complications.

- Overlooking financial specifics - The agreement should detail the purchase price, along with terms related to the deposit, balance, and any adjustments. Neglecting to outline these terms clearly can lead to financial misunderstandings.

- Ignoring contingencies - Many agreements are contingent upon financing approval, home inspections, or the sale of another property. Failing to include these conditions can lock parties into an agreement regardless of circumstances.

- Omitting fixtures and exclusions - Confusion often arises regarding what is included with the sale (like appliances). Clearly denoting these items ensures both parties have the same expectations.

- Incorrectly listing parties involved - Misnaming buyers or sellers, or failing to include all legal parties can invalidate the agreement or complicate legal ownership down the line.

- Forgetting to detail closing costs - Misunderstandings about who pays for what at closing are common. The agreement should spell out which party is responsible for specific fees and charges.

- Misunderstanding legal advice - Individuals sometimes proceed without consulting a legal professional. Professional advice can prevent errors related to state laws or unique property concerns.

- Not specifying dispute resolution methods - Without a clear process for resolving disputes, parties can find themselves entangled in lengthy and costly legal battles. Identifying mediation or arbitration as steps can save headaches.

- Leaving signatures out - The most straightforward yet often overlooked mistake is failing to get all necessary signatures. Without the signatures of all parties, the agreement may not be legally binding.

While the Real Estate Purchase Agreement form may seem just another step in the process, its importance cannot be overstated. Each section and line item has the potential to impact the outcome of a real estate transaction significantly. By understanding and avoiding these common mistakes, individuals can pave the way for a smoother purchasing experience. Diligence and attention to detail, along with seeking professional advice, can make all the difference in securing one's investment and future.

Documents used along the form

When buying or selling property in New Hampshire, the Real Estate Purchase Agreement form is a critical document. However, to ensure a seamless transaction, several other forms and documents are often used in conjunction with this agreement. These supportive documents play various roles, from disclosing property conditions to setting out the terms of a mortgage. Understanding each one can greatly simplify the real estate process for all parties involved.

- Lead-Based Paint Disclosure – This form is necessary for any property built before 1978. Sellers must disclose whether they're aware of any lead-based paint in the property. It's a safety measure that protects buyers and their families from potential health hazards.

- Seller’s Property Disclosure Statement – With this form, sellers provide comprehensive details about the condition of the property and its systems. This document ensures that buyers are well-informed about what they're purchasing.

- Title Insurance Commitment – This document outlines the terms under which a title insurance company will issue a policy. It assures the buyer that they will own the property free of any disputes or claims against the title.

- Loan Estimate and Closing Disclosure – These documents are provided by the lender. The Loan Estimate gives an overview of the terms of the mortgage, while the Closing Disclosure offers detailed information about closing costs, the interest rate, and monthly payments.

- Deed – The deed is the official document that transfers property ownership from the seller to the buyer. It's a critical document that needs to be filed with the county to be effective.

- Home Inspection Report – Generated after a professional inspection, this report details the condition of the property, including any defects or areas that require maintenance or repair. It allows buyers to negotiate repairs or adjust their offer based on the findings.

- Appraisal Report – This document provides an expert assessment of the property's value. Lenders often require appraisals to ensure that the property is worth the amount of the mortgage loan.

- Flood Zone Statement – For properties located in or near flood-prone areas, this statement indicates whether the property is in a flood zone, impacting insurance requirements and costs.

Together, these documents ensure that both buyers and sellers are fully informed and protected throughout the real estate transaction. By understanding the purpose of each document, parties can navigate the process more confidently and ensure a smooth transition of property ownership.

Similar forms

The New Hampshire Real Estate Purchase Agreement form is similar to various other documents used in the process of buying or selling real estate. Each document serves a specific purpose but shares common elements related to the transaction's terms, conditions, and the parties involved. By understanding these similarities, individuals can better navigate the complexities of real estate transactions.

The Residential Lease Agreement shares similarities with the New Hampshire Real Estate Purchase Agreement in terms of specifying the details of the property involved. Both documents detail the property's legal description, the agreed-upon price or rent, and any conditions or terms related to the use of the property. However, while the purchase agreement outlines the terms for buying the property, the lease agreement specifies the terms under which the property is rented.

The Bill of Sale is another document that resembles the New Hampshire Real Estate Purchase Agreement. It is commonly used for the sale of personal property, such as vehicles or equipment, rather than real estate. Like the real estate purchase agreement, a bill of sale includes information on the buyer, the seller, the sale price, and a description of the item being sold. The key difference lies in the type of property being transferred; one deals with real estate while the other focuses on personal property.

The Deed is closely related to the real estate purchase agreement but serves a different function. While the purchase agreement is a contract that outlines the terms of the sale, the deed is the document that officially transfers ownership of the property from the seller to the buyer. Both documents contain detailed information about the property and the parties involved, but the deed comes into play after the conditions of the purchase agreement have been met, finalizing the change in ownership.

Dos and Don'ts

When entering into a real estate transaction in New Hampshire, the Real Estate Purchase Agreement form is a critical document that legally binds the buyer and the seller to the sale. Its accuracy and completeness are paramount. Below are essential do's and don'ts for filling out this form:

- Do:

- Read every section thoroughly to ensure you understand the terms and conditions before you fill out the form. Misunderstandings can lead to legal complications.

- Use clear and concise language that leaves no room for interpretation. Ambiguities in contract language can lead to disputes.

- Ensure all financial figures, including the purchase price, earnest money, and any agreed-upon adjustments, are accurately recorded. Errors can be costly.

- Double-check the legal descriptions of the property to ensure they are accurate. Mistakes in legal descriptions can create significant issues in property transactions.

- Include all agreed-upon contingencies, such as financing, home inspections, and appraisal. These conditions protect both the buyer and the seller.

- Sign and date the form in all designated areas to validate the agreement. An unsigned or undated agreement is often considered unenforceable.

- Consult with a real estate attorney if there are any concerns or questions about the agreement or the transaction. Professional advice can prevent legal issues.

- Don't:

- Rush through filling out the form without paying attention to the details. Overlooking crucial details can lead to misunderstandings or legal problems.

- Leave any sections blank. If a section does not apply, indicate with "N/A" (not applicable) rather than leaving it empty. Empty sections can lead to confusion.

- Use vague terms or language that could be open to multiple interpretations. Clarity is crucial in legal documents.

- Forget to include any personal property that is being included in the sale. This includes appliances, fixtures, and any other relevant items.

- Make verbal agreements. All terms and conditions should be included in the written contract to be enforceable.

- Assume everything is negotiable after the form is signed. Amendments to the agreement should be agreed upon in writing.

- Ignore the requirement for witnesses or notarization if applicable under New Hampshire law. Some transactions require these for the agreement to be legally binding.

Misconceptions

When it comes to buying or selling property in New Hampshire, the Real Estate Purchase Agreement form is a crucial document. However, there are several misconceptions about this form that can lead to confusion. Here are some common misunderstandings:

- One-size-fits-all: Many people believe that the Real Estate Purchase Agreement form in New Hampshire is a standard document that cannot be altered. The reality is that while the form contains standard clauses, parties can negotiate terms and tailor the agreement to suit their specific situation.

- Only pertains to the price: Another misconception is that the form only covers the purchase price of the property. In fact, it outlines various important details, such as closing dates, contingencies (like financing and inspections), and which party pays for certain expenses.

- Does not need a lawyer's review: Some might think that filling out the form is straightforward and does not require legal advice. However, consulting with a lawyer can help prevent misunderstandings and protect your interests throughout the transaction.

- Verbally agreeing on terms is enough: A verbal agreement can seem simpler, but it's not legally binding in real estate transactions. All agreements should be in writing and included in the purchase agreement to be enforceable.

- Deposits are nonrefundable: The assumption here is that once a deposit is made, it cannot be returned. The truth is that the purchase agreement can have provisions for the return of deposits under certain conditions, such as a failed home inspection.

- Only buyers need to worry about the details: It's a common thought that the purchase agreement primarily protects the buyer's interests. While it's crucial for buyers, sellers must also carefully review and understand the agreement to ensure their rights are protected.

- Instant effect: Some believe that once the purchase agreement is signed, it immediately goes into effect. However, most agreements specify conditions that must be met in order for the sale to proceed, such as securing financing or a satisfactory home inspection report.

- Final sale: There's a misconception that signing the purchase agreement seals the deal and the sale is final. In reality, it's the closing process, when the deed is transferred and funds are paid, that finalizes the sale of the property.

Understanding the role and the nuances of the New Hampshire Real Estate Purchase Agreement form is essential for anyone involved in a real estate transaction. Clearing up these misconceptions helps both buyers and sellers navigate the process more effectively, ensuring smoother transactions and fewer surprises.

Key takeaways

When navigating the process of real estate transactions in New Hampshire, the Real Estate Purchase Agreement plays a pivotal role. This legal document outlines the terms and conditions of the sale, serving as a binding contract between the buyer and seller. Understanding the key facets of filling out and utilizing this document ensures a smoother transaction process. Here are five critical takeaways to consider:

- Accuracy is critical. Every detail entered into the New Hampshire Real Estate Purchase Agreement needs to be accurate. This includes the legal names of the parties involved, the property address, and any specific terms of the sale. Mistakes can lead to delays or legal complications.

- Understand all terms and conditions. Before signing, all parties must fully understand every term and condition outlined in the agreement. This includes, but is not limited to, the sale price, closing date, and any contingencies, such as the requirement of a satisfactory home inspection or the buyer's ability to secure financing.

- State-specific requirements. New Hampshire law may have specific requirements for real estate transactions that need to be reflected in the purchase agreement. This might include mandatory disclosures about the property's condition or certain environmental hazards. Ensuring compliance with state law prevents future liabilities.

- Modifications need agreement from all parties. Once the real estate purchase agreement is signed, any changes to the agreement must be made in writing and signed by all parties involved. Oral agreements or handshake deals are not legally enforceable in real estate transactions.

- Legal review is advised. Due to the complexities and legal ramifications of real estate purchase agreements, having the document reviewed by a legal professional before signing is highly recommended. A lawyer can provide clarity, ensure the agreement complies with state laws, and protect your rights throughout the transaction.

Filling out the New Hampshire Real Estate Purchase Agreement with diligence and a keen eye for detail can lead to a successful and smooth real estate transaction. Recognizing the importance of this document and the implications it carries is essential for both buyers and sellers in the real estate market.

Other New Hampshire Templates

Bill of Sale for Car New Hampshire - An accurate and thoroughly completed bill of sale can expedite the registration process and ensure compliance with tax laws.

Bill of Sale Nh - A document that records the sale of a trailer from one party to another, ensuring the transfer is legally recognized.