Attorney-Approved Quitclaim Deed Document for New Hampshire

In the realm of real estate transactions, precision and clarity in documentation are paramount. Among the numerous forms employed to facilitate property transfers, the New Hampshire Quitclaim Deed form emerges as a crucial tool, especially in situations where a swift and uncomplicated transfer of property rights is desired. Esteemed for its simplicity and efficiency, this legal instrument relinquishes the seller's (grantor's) claims or rights to the property, transferring them to the buyer (grantee) without warranty. This means the grantor does not guarantee the title's quality, offering no assurance against claims or encumbrances that may arise after the transfer. Its usage varies widely, from settling estate distributions and divorces to straightforward real estate transactions between familiar parties. Recognizing its significance and the legal intricacies it entails demands a comprehensive understanding not just of the form itself but also of its application and the potential implications for all parties involved.

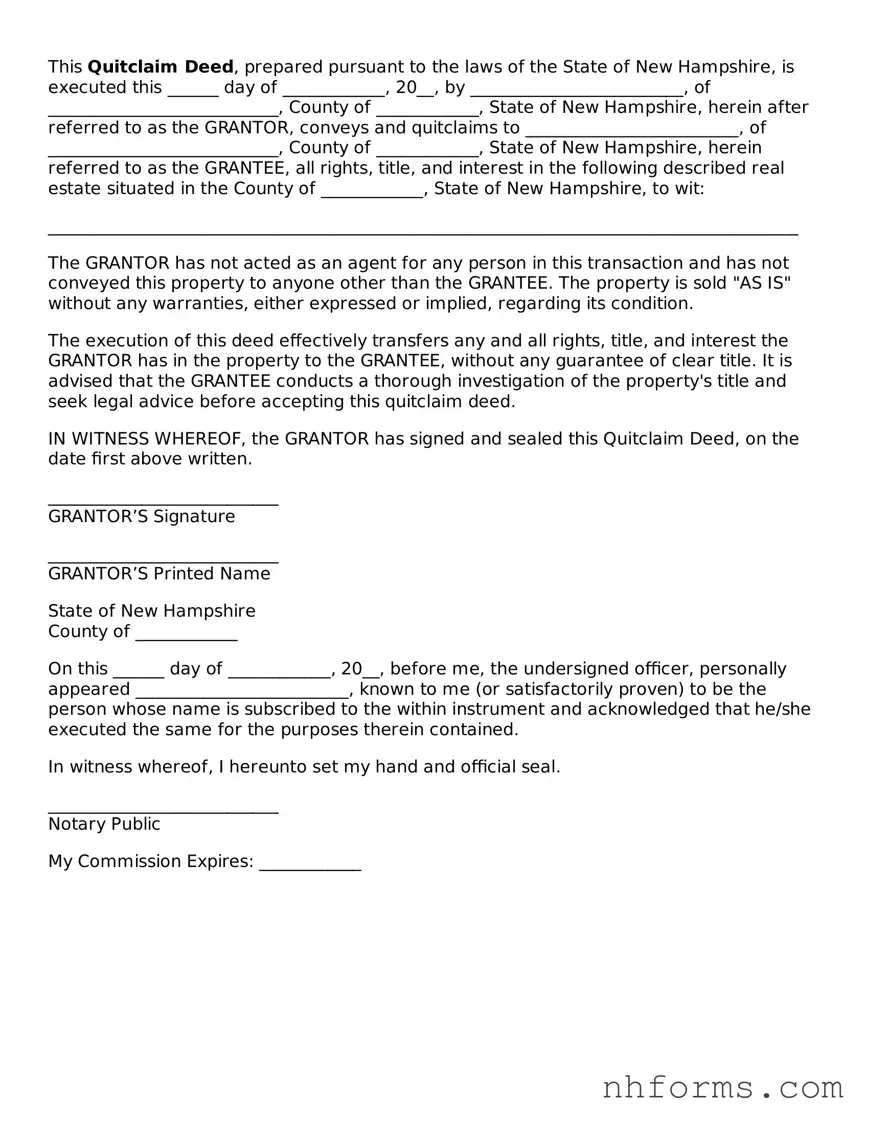

Document Preview Example

This Quitclaim Deed, prepared pursuant to the laws of the State of New Hampshire, is executed this ______ day of ____________, 20__, by _________________________, of ___________________________, County of ____________, State of New Hampshire, herein after referred to as the GRANTOR, conveys and quitclaims to _________________________, of ___________________________, County of ____________, State of New Hampshire, herein referred to as the GRANTEE, all rights, title, and interest in the following described real estate situated in the County of ____________, State of New Hampshire, to wit:

________________________________________________________________________________________

The GRANTOR has not acted as an agent for any person in this transaction and has not conveyed this property to anyone other than the GRANTEE. The property is sold "AS IS" without any warranties, either expressed or implied, regarding its condition.

The execution of this deed effectively transfers any and all rights, title, and interest the GRANTOR has in the property to the GRANTEE, without any guarantee of clear title. It is advised that the GRANTEE conducts a thorough investigation of the property's title and seek legal advice before accepting this quitclaim deed.

IN WITNESS WHEREOF, the GRANTOR has signed and sealed this Quitclaim Deed, on the date first above written.

___________________________

GRANTOR’S Signature

___________________________

GRANTOR’S Printed Name

State of New Hampshire

County of ____________

On this ______ day of ____________, 20__, before me, the undersigned officer, personally appeared _________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

___________________________

Notary Public

My Commission Expires: ____________

File Information

| # | Fact |

|---|---|

| 1 | The New Hampshire Quitclaim Deed is a legal document used to transfer interest in real property from the grantor to the grantee without any warranties of title. |

| 2 | It does not guarantee that the title is clear, meaning the buyer takes the property as-is, with all the risks that may come with it. |

| 3 | Under New Hampshire law, the Quitclaim Deed must be signed by the grantor in the presence of a notary public to be valid. |

| 4 | The deed requires a complete legal description of the property being transferred, including its boundary lines and any other identifiers. |

| 5 | It must be filed with the County Registry of Deeds in the county where the property is located for the transfer to be officially recognized. |

| 6 | The property transfer tax declaration form must accompany the deed when it is recorded, which is a requirement in New Hampshire. |

| 7 | Recording fees must be paid when the deed is filed; these fees vary by county. |

| 8 | A Quitclaim Deed does not release the grantor from financial obligations related to the property unless specifically stated in a separate agreement. |

| 9 | It is often used between family members, in divorce proceedings, or in other informal transactions where a clear title is not necessary. |

| 10 | Governing laws for Quitclaim Deeds in New Hampshire are found in RSA 477:28 and RSA 477:29, which detail the execution and recording requirements. |

Detailed Instructions for Writing New Hampshire Quitclaim Deed

Preparing a Quitclaim Deed in New Hampshire requires careful attention to detail, ensuring that the transfer of property rights is conducted clearly and effectively. This document, while straightforward in its intent to convey property from one party to another without any warranties, demands precision in its completion to prevent any potential legal complications down the line. The steps listed below guide you through the process, making it manageable to navigate the requirements set forth for such transactions within the state.

- Firstly, obtain a blank Quitclaim Deed form specific to New Hampshire, as state-specific forms may vary in terms of layout and required information.

- Enter the name(s) of the grantor(s) (the person or persons who are transferring the property) in the designated section, ensuring that the names are spelled correctly and match any existing property records or identification documents.

- Specify the legal name(s) of the grantee(s) (the person or persons receiving the property) in the appropriate field. Accuracy here is just as critical to ensure the deed is properly recorded and recognized.

- Provide the mailing address where official documents can be sent post-transaction. This address will be used for future tax statements and should be the grantee’s current mailing address.

- Include a complete description of the property being transferred. This description should be detailed, utilizing the legal description found in previous deeds or tax documents, rather than a simple address or parcel number. It may include lot numbers, block numbers, and any other identifiers used in public records.

- State the consideration being exchanged for the property. While Quitclaim Deeds often involve transactions that are not sales, there still needs to be some form of consideration stated, such as "for the sum of $1.00 and other good and valuable consideration" or a similar phrase to acknowledge the exchange.

- Have the grantor(s) sign the deed in front of a notary public to authenticate the document. The notary will also need to fill in their section, which validates the signatures. This step is crucial for the deed to be legally binding.

- Lastly, record the completed and notarized Quitclaim Deed with the County Registry of Deeds where the property is located. There may be a fee associated with the recording, which varies by county. Recording the deed is essential for the transfer to be recognized publicly and to protect the grantee’s interests.

Once these steps are completed, the process of transferring property via a Quitclaim Deed in New Hampshire is effectively finalized. It's encouraged to consult with a legal professional throughout this process to ensure that all legal requirements are met and that the document accurately reflects the parties' intentions. While a Quitclaim Deed simplifies the transfer process by not providing warranties on the title, it's paramount that the parties involved fully understand the implications and ensure the document is properly executed and recorded.

Essential Queries on New Hampshire Quitclaim Deed

What is a New Hampshire Quitclaim Deed?

A New Hampshire Quitclaim Deed is a legal document used to transfer interest in real property from one person (the grantor) to another (the grantee) without any warranties of title. This means the seller does not guarantee they own the property free and clear of all liens or claims. It's often used between family members or to clear up a title issue.

When should I use a Quitclaim Deed in New Hampshire?

Consider using a Quitclaim Deed in situations where the property transfer is among family members, such as adding or removing someone’s name on the property title during marriage or divorce. It's also useful for transferring property to a trust or correcting a title error. However, when buying property from someone you don’t know, a warranty deed, which offers buyer protections, is more appropriate.

What information is needed to fill out a New Hampshire Quitclaim Deed form?

To complete a Quitclaim Deed in New Hampshire, you need the legal description of the property being transferred, the names and addresses of the grantor and grantee, and the consideration (the value of the property). The deed must also be signed by the grantor in front of a notary public before it can be recorded with the county clerk’s office where the property is located.

Is a New Hampshire Quitclaim Deed subject to any taxes?

Yes, like most real estate transactions, filing a Quitclaim Deed in New Hampshire may be subject to the Real Estate Transfer Tax. The tax amount depends on the property's selling price or the property's current fair market value if no money changes hands. Exemptions may apply in certain situations, such as transfers between family members.

How do I file a Quitclaim Deed in New Hampshire?

After getting the Quitclaim Deed form completed and notarized, you need to take it to the Registry of Deeds in the county where the property is located. There, it will be recorded, making the transfer public record. You may be required to pay a filing fee, which varies by county, and the Real Estate Transfer Tax, if applicable.

Can a Quitclaim Deed be reversed in New Hampshire?

Reversing a Quitclaim Deed once it's been recorded is challenging but not impossible. It would require the cooperation of the original grantee to execute another Quitclaim Deed transferring the property back to the grantor or to a new party. Legal action may be necessary if the grantee is unwilling or unable to cooperate, especially if disputes or misunderstandings about the property arise.

Common mistakes

When transferring property in New Hampshire, individuals often use a Quitclaim Deed form. This document is crucial for the conveyance of real estate ownership without any warranties regarding the title. However, several common mistakes can occur when completing this form, leading to potential legal challenges or delays in the property transfer process.

One of the most frequent errors is incorrectly identifying the grantor and grantee. The grantor is the current owner who is transferring the property, while the grantee is the individual or entity receiving it. It is essential to use full legal names and ensure that they are spelled correctly to avoid confusion or disputes about the property's rightful ownership.

Another common mistake is failing to provide a complete legal description of the property. This description is crucial for precisely identifying the real estate in question and typically includes details such as the parcel number, lot number, subdivision name, and physical address. An incomplete or inaccurate legal description can lead to significant issues in establishing clear title to the property.

Also, some individuals neglect to have the form notarized. In New Hampshire, a Quitclaim Deed must be notarized to be legally valid. A notary public must witness the grantor(s) signing the deed, verifying their identity, and confirming that they are signing the document willingly and under no duress.

- Incorrect or misspelled names of the grantor or grantee can invalidate the deed or result in legal complications.

- An incomplete or inaccurate legal description of the property can lead to difficulties in identifying the property and may affect the deed's validity.

- Forgetting to have the document notarized is a crucial oversight, as notarization is a legal requirement for Quitclaim Deeds in New Hampshire.

- Another mistake is not signing the document in the presence of the required witnesses. New Hampshire law requires that Quitclaim Deeds be signed in the presence of two witnesses, in addition to the notarization, to be considered legally binding.

- Omitting pertinent attachments or addenda, which may include maps, plans, or other documents that are referenced in the deed or necessary for a complete understanding of the property transfer.

- Failing to properly file the deed with the county recorder’s office. After the Quitclaim Deed is executed and notarized, it must be filed with the appropriate county office to effectuate the transfer of ownership.

- Lastly, not seeking legal advice when uncertain about how to correctly fill out the Quitclaim Deed form or during complex transactions can lead to serious legal issues. Professional guidance ensures that the form is completed accurately and in compliance with New Hampshire law.

In summary, when completing a Quitclaim Deed form in New Hampshire, attention to detail and adherence to legal requirements are paramount. Avoiding the common mistakes outlined above can help ensure a smooth and legally sound property transfer. It is often beneficial to consult with a legal professional or title company to prevent errors and verify that all aspects of the deed comply with state laws.

Documents used along the form

When handling property transactions in New Hampshire, particularly those involving a Quitclaim Deed, it's vital to be aware of the different forms and documents that may also be necessary to ensure the process is thorough and legally sound. A Quitclaim Deed is just one piece of the puzzle. Alongside it, there are several additional documents that people typically need to use to effectively manage and complete property transactions. Understanding what each of these documents is and their purpose can help streamline the process, making it more efficient and less prone to errors.

- Warranty Deed: While a Quitclaim Deed transfers any ownership the grantor has without making any guarantee about the property's clear title, a Warranty Deed goes a step further by guaranteeing that the property is free from any liens or claims. This is a crucial document for buyers who want assurance of clear title.

- Property Disclosure Statement: This document is used by the seller to disclose the physical condition of the property. It covers a wide range of topics from the presence of hazardous materials to the state of the electrical systems, providing transparency to the buyer.

- Real Estate Transfer Tax Declaration: Required by many states, including New Hampshire, this form is filed with the deed to document the property sale and determine the transfer tax owed. It includes details about the sale price, property type, and the parties involved.

- Mortgage Agreement: If the property purchase involves a mortgage, this legal document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and the rights and obligations of both the lender and borrower.

- Title Report: A critical document that outlines the history of the property, including previous ownership, liens, and any other encumbrances on the property. Obtaining a title report is essential in ensuring that the property's title is clear.

- Closing Statement: An itemized list of all the transactions and fees paid by the buyer and seller during the closing process. This document is essential for both parties to understand the financial details of the transaction.

- Homestead Exemption Form: This form is used to apply for homestead exemption, which can provide property tax relief for homeowners. The eligibility requirements and the amount of the exemption can vary by state and locality.

Having these documents in order does not only ensure compliance with legal standards but it also provides protection for all parties involved in a property transaction. Each document serves a unique purpose, from offering guarantees about the property's condition to detailing the financial aspects of the deal. Whether you're buying, selling, or transferring property, being prepared with the right documentation is crucial to a successful and stress-free transaction.

Similar forms

The New Hampshire Quitclaim Deed form is similar to other legal documents that are used in property transactions. These documents, while serving their unique purposes, share common elements in their structure, intent, and the legal principles they embody. This similarity is rooted in their mutual aim to transfer interests in real property, but the level of warranty and protection they offer to the buyer varies significantly.

Warranty Deed: The Quitclaim Deed form and the Warranty Deed are alike in that both are used to transfer ownership of real estate. However, a Warranty Deed comes with a guarantee that the seller has the right to sell the property and that there are no hidden liens or encumbrances against the property. This guarantee provides the buyer with a higher level of protection compared to the Quitclaim Deed, which makes no assurances regarding the quality of the title being transferred.

Grant Deed: Similar to the Quitclaim Deed, a Grant Deed is used for transferring ownership rights in property from one party to another. What distinguishes a Grant Deed from a Quitclaim Deed is the provision of certain warranties to the buyer. These warranties are limited compared to those provided by a Warranty Deed, but they do assert that the property has not been sold to someone else and that there are no encumbrances (without promising against undiscovered encumbrances) at the time of sale. This difference places the Grant Deed in a position of offering more protection to the buyer than a Quitclaim Deed but less than a Warranty Deed.

Trustee's Deed: A Trustee’s Deed and a Quitclaim Deed are used in different contexts but share the purpose of conveying real estate. The Trustee's Deed is typically used when property held in a trust is being transferred. Like a Quitclaim Deed, the level of warranty provided to the buyer depends on the specific terms of the agreement and can sometimes offer no guarantees at all, making it similar in risk level to the Quitclaim Deed for the buyer.

Dos and Don'ts

When filling out the New Hampshire Quitclaim Deed form, it's crucial to understand which steps will lead to a correct and legally binding document. Below you will find a concise guide on key do's and don'ts to consider:

- Do ensure that all parties involved have their legal names accurately spelled out in the document. Mistakes in names can lead to significant complications.

- Do provide a complete and precise description of the property being transferred. This includes the physical address, and, if available, the legal description as found in prior deeds or property tax documents.

- Do verify the form complies with New Hampshire state requirements. These can include specific language or clauses that are necessary for a quitclaim deed to be valid.

- Do sign the document in the presence of a notary. New Hampshire law requires notarization for the quitclaim deed to be legally enforceable.

- Don't leave any sections incomplete. Every field should be reviewed and filled out as applicable. An incomplete form may be considered invalid.

- Don't forget to check if witness signatures are required. While not all jurisdictions need witnesses, some do, and overlooking this step can invalidate your document.

- Don't assume that a quitclaim deed guarantees clear title. It only transfers whatever interest the grantor has in the property, which may be none.

- Don't neglect to file the executed deed with the appropriate county office. Recording the deed protects against claims from third parties and completes the transfer process.

Approaching the quitclaim deed with diligence ensures that the property transfer proceeds smoothly and legally. Paying attention to these do's and don'ts will help avoid common pitfalls that could delay or disrupt the transaction.

Misconceptions

When dealing with the transfer of property rights, the New Hampshire Quitclaim Deed form is often misunderstood. People frequently harbor misconceptions about its use and implications. Below are ten common misconceptions about the New Hampshire Quitclaim Deed form, clarified to help individuals better understand its purpose and limitations.

- It guarantees a clear title: One prevailing misconception is that a quitclaim deed guarantees the grantor has a clear title to the property. In reality, it offers no warranties at all about the title's status. The grantee receives only the interest the grantor has, which might be none.

- It's only for familial transactions: While it’s true that quitclaim deeds are commonly used for transfers between family members, they are not limited to this use. They can be employed in a variety of situations where the parties involved agree on the lack of warranties.

- It overrides a will: Another misconception is that a quitclaim deed can override the terms of a will. In fact, the deed can only transfer the grantor's interest during their lifetime. A will's provisions related to property distribution after death are a separate matter.

- It immediately takes effect: Some believe that once signed, a quitclaim deed immediately transfers property rights. However, for the deed to be effective and protect the grantee, it must be properly executed and then recorded with the appropriate local government office.

- It frees the grantor from property obligations: People often mistakenly think that executing a quitclaim deed absolves the grantor of all responsibilities related to the property. This isn't necessarily true, particularly with respect to financial obligations like mortgage payments, unless specifically released by the lender.

- It is complex and requires a lawyer: While legal advice can be beneficial, especially in complex situations, the process of completing and filing a quitclaim deed in New Hampshire is relatively straightforward and does not inherently require a lawyer.

- It provides tax advantages: Another common myth is that quitclaim deeds offer tax advantages for the grantor or grantee. The reality is that tax implications depend on individual circumstances, and a quitclaim deed in itself does not provide tax benefits.

- It supersedes a mortgage: A major misunderstanding is that a quitclaim deed can transfer property free and clear of any mortgages. However, mortgages or liens against the property remain in place until they are paid off, regardless of the deed used.

- It's only for unwanted property: People often think quitclaim deeds are only used for transferring unwanted property or for "quitting" one’s interest in a property. While that can be the case, they are also used for clear strategic reasons, such as simplifying the ownership structure of a property.

- It settles disputes over property lines: Finally, there's a misconception that quitclaim deeds can settle disputes over property lines. In reality, they transfer ownership interests without addressing or resolving boundary disputes.

Understanding the realities of the New Hampshire Quitclaim Deed form is vital for anyone involved in the process of transferring property. Clearing up these misconceptions enables individuals to make informed decisions based on the actual characteristics and legal implications of using a quitclaim deed.

Key takeaways

Filling out and using the New Hampshire Quitclaim Deed form is an important process for those looking to transfer property quickly and without warranty. Here are some key takeaways to ensure the process is handled correctly:

- Understand the purpose: A Quitclaim Deed transfers any interest the grantor has in the property to the grantee without guaranteeing clear title. It's often used between family members or to clear up a title issue.

- Details matter: Fill out the form with accurate and complete information. This includes the legal description of the property, which is necessary to identify the property being transferred.

- Signatures are key: New Hampshire law requires the grantor to sign the Quitclaim Deed. Depending on local requirements, witnesses or a notary public may also need to sign the document.

- Consider the tax implications: Transferring property can have tax consequences. It’s wise to consult with a tax professional to understand any potential impact.

- Recording is essential: Once signed, the Quitclaim Deed should be filed with the local county registry of deeds. This step is crucial for the deed to be effective and to provide public notice of the property transfer.

- Keep copies for your records: Both the grantor and grantee should keep copies of the filed deed. These documents can be important for future property transactions or for record-keeping purposes.

- Seek legal advice if needed: For those unfamiliar with the process or facing complex situations, consulting with a legal professional can help navigate the considerations and ensure the deed is properly executed.

Other New Hampshire Templates

Create an Operating Agreement - Operating Agreements are particularly beneficial for multi-member LLCs, but single-member LLCs can also benefit from the clarity they provide.

Another Name for Living Will - Incorporating a Living Will into healthcare planning allows individuals to retain control over their medical treatment even when they cannot communicate.