Attorney-Approved Promissory Note Document for New Hampshire

In the realm of financial agreements, clarity and commitment are paramount, especially when it pertains to personal loans. The New Hampshire Promissory Note form serves as a pivotal tool in such circumstances, effectively delineating the terms between a borrower and a lender within the state. This document is not merely a formality but a binding legal agreement that outlines the loan amount, interest rates, repayment schedule, and the consequences of non-payment. Its significance cannot be overstated, as it provides a clear record of the loan's conditions, offering protection and peace of mind to both parties involved. By ensuring that all parties have a mutual understanding of the loan's terms, the New Hampshire Promissory Note form plays a crucial role in maintaining healthy financial relationships, thereby minimizing potential disputes and misunderstandings.

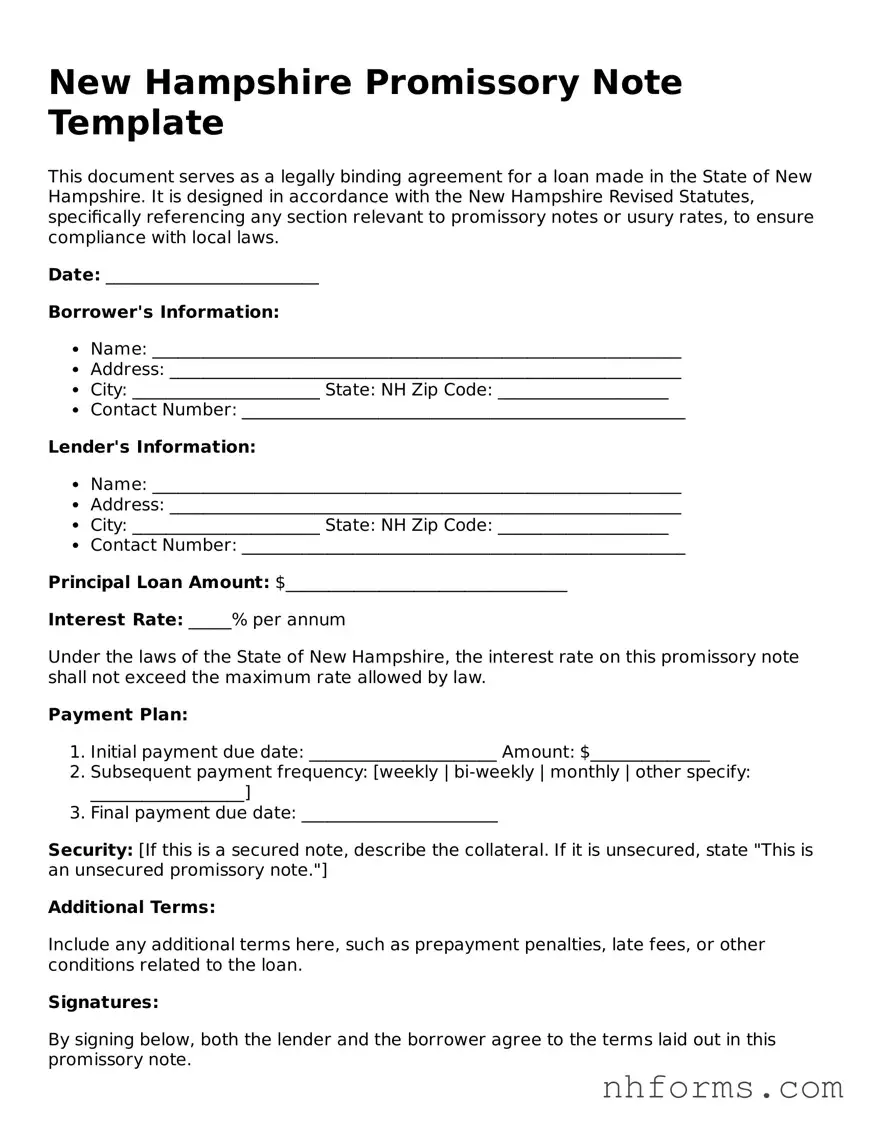

Document Preview Example

New Hampshire Promissory Note Template

This document serves as a legally binding agreement for a loan made in the State of New Hampshire. It is designed in accordance with the New Hampshire Revised Statutes, specifically referencing any section relevant to promissory notes or usury rates, to ensure compliance with local laws.

Date: _________________________

Borrower's Information:

- Name: ______________________________________________________________

- Address: ____________________________________________________________

- City: ______________________ State: NH Zip Code: ____________________

- Contact Number: ____________________________________________________

Lender's Information:

- Name: ______________________________________________________________

- Address: ____________________________________________________________

- City: ______________________ State: NH Zip Code: ____________________

- Contact Number: ____________________________________________________

Principal Loan Amount: $_________________________________

Interest Rate: _____% per annum

Under the laws of the State of New Hampshire, the interest rate on this promissory note shall not exceed the maximum rate allowed by law.

Payment Plan:

- Initial payment due date: ______________________ Amount: $______________

- Subsequent payment frequency: [weekly | bi-weekly | monthly | other specify: __________________]

- Final payment due date: _______________________

Security: [If this is a secured note, describe the collateral. If it is unsecured, state "This is an unsecured promissory note."]

Additional Terms:

Include any additional terms here, such as prepayment penalties, late fees, or other conditions related to the loan.

Signatures:

By signing below, both the lender and the borrower agree to the terms laid out in this promissory note.

Lender's Signature: _____________________________________ Date: ________________

Borrower's Signature: ___________________________________ Date: ________________

This promissory note is subject to the exclusive laws and jurisdiction of New Hampshire, and any disputes arising from this agreement shall be resolved in accordance with such laws without regard to the principles of conflict of laws.

File Information

| Fact | Detail |

|---|---|

| Purpose | Used to document a loan agreement between a lender and a borrower in New Hampshire. |

| Governing Law | New Hampshire Revised Statutes Title 53, Chapters 541-A to 541-D, which cover negotiable instruments, including promissory notes. |

| Secured vs. Unsecured | Can be either secured by collateral or unsecured, depending on the agreement between the parties involved. |

| Interest Rate | Must comply with New Hampshire's usury laws under RSA 336:1, which sets the maximum legal interest rate unless otherwise agreed upon. |

| Repayment Schedule | Details including the amount, frequency, and number of payments must be clearly outlined to meet the terms of the agreement. |

| Default Consequences | The form should specify the repercussions for the borrower if they fail to meet the conditions of repayment. |

| Signature Requirement | Must be signed by the borrower, and sometimes by the lender, to be legally binding. Witness or notary public signatures may also be required. |

| Co-signer Clause | If applicable, the presence and details of a co-signer should be noted, underscoring their agreement to fulfill the debt obligations if the primary borrower fails to do so. |

Detailed Instructions for Writing New Hampshire Promissory Note

When it comes to formalizing a loan agreement in New Hampshire, a Promissory Note is a crucial document. This legal form ensures there's a clear understanding between the borrower and the lender regarding the loan's terms, including repayment. Filling out this form accurately is essential to protect both parties involved in the transaction. Below are the step-by-step instructions you will need to follow meticulously to complete the New Hampshire Promissory Note form.

- Start by entering the date of the Promissory Note at the top of the form. Include the day, month, and year to avoid any confusion.

- Write the full legal name of the borrower and their complete address, including the city, state, and ZIP code.

- Add the lender's full legal name and address, following the same format as for the borrower.

- Specify the principal amount of the loan. This is the total amount being lent, without interest.

- Detail the interest rate. It's important to check the legal limits for interest rates in New Hampshire to ensure compliance.

- Describe the repayment conditions. This section should include the repayment schedule, installments, and if applicable, the final lump sum payment.

- Include any collateral the borrower is providing as security for the loan. Clearly describe the collateral to ensure there's no ambiguity.

- If the agreement includes co-signers, identify them by their full legal names and addresses. Co-signers provide an additional level of security for the lender.

- Both the borrower and the lender must sign and date the form. Witness signatures may also be required, depending on the stipulations.

- Last, have the form notarized if necessary. This step varies according to the specifics of the loan and local law, but it can add an additional layer of legal protection.

Taking the time to fill out the New Hampshire Promissory Note form correctly is essential for a smooth lending process. It clearly lays down the conditions of the loan, ensuring both parties understand their obligations. Completing this form with careful attention to detail is a step towards securing a successful financial agreement.

Essential Queries on New Hampshire Promissory Note

What is a Promissory Note in New Hampshire?

A Promissory Note in New Hampshire is a written agreement between two parties where the borrower promises to repay a specified sum of money to the lender by a certain date. It serves as a formal acknowledgement of the debt and outlines the repayment terms, including any interest rates and payment schedule.

Do I need a witness or notary for a Promissory Note in New Hampshire?

While New Hampshire law does not strictly require a witness or notary for a Promissory Note to be considered valid, having one or both can add a layer of protection against disputes. Notarization can provide official verification of the identities of the parties involved, and a witness can corroborate the signing of the document.

Is a Promissory Note legally binding in New Hampshire?

Yes, a Promissory Note is legally binding in New Hampshire when it is properly filled out and signed by both the borrower and lender. It is enforceable in a court of law, ensuring that lenders have a legal right to seek repayment of the debt if the borrower fails to meet the terms of the agreement.

Can interest be charged on a Promissory Note in New Hampshire, and what are the limits?

Interest can be charged on a Promissory Note in New Hampshire. However, the state imposes limits on the maximum interest rate that can be charged to prevent usury. As laws frequently change, it is advisable to consult current regulations or a legal professional to determine the maximum allowable interest rate at the time of drafting the note.

What happens if a borrower defaults on a Promissory Note in New Hampshire?

If a borrower defaults on a Promissory Note in New Hampshire, the lender may take legal action to recover the owed amount. This could involve filing a lawsuit against the borrower. If the lender prevails, the court may issue a judgment that allows for the collection of the debt through various means, such as garnishment of wages or seizure of assets.

How can a Promissory Note be enforced if the borrower moves out of New Hampshire?

Should a borrower move out of New Hampshire, the Promissory Note remains enforceable. The lender may pursue collection in the borrower's new state of residence using the judgment from New Hampshire. Most states recognize judgments issued in other states, but the process for enforcing the judgment may vary and typically involves registering the judgment in the new state.

Are there different types of Promissory Notes in New Hampshire?

Yes, there are typically two main types of Promissory Notes used in New Hampshire: secured and unsecured. A secured Promissory Note requires the borrower to pledge collateral that the lender can seize if the debt is not repaid. An unsecured Promissory Note does not require collateral, making it potentially riskier for the lender.

Can a Promissory Note be modified once it has been signed in New Hampshire?

A Promissory Note can be modified after it has been signed, but any changes must be agreed upon by both the borrower and the lender. It is best to document any amendments in writing and have both parties sign the revised terms to maintain the legal enforceability of the note.

What should be included in a Promissory Note in New Hampshire?

A comprehensive Promissory Note in New Hampshire should include the full names and contact information of the lender and borrower, the principal loan amount, interest rate, repayment schedule, and any collateral involved. It should also outline the consequences of default and any other terms agreed upon by the parties.

How can a Promissory Note be terminated in New Hampshire?

A Promissory Note is terminated when the borrower has fulfilled all obligations under the agreement, primarily the repayment of the debt in full. The lender should then provide the borrower with a release of the Promissory Note, formally acknowledging that the debt has been paid and the agreement is concluded.

Common mistakes

Filling out the New Hampshire Promissory Note form is a crucial step for anyone lending or borrowing money in the state. However, certain common pitfalls can complicate this straightforward process. By avoiding these mistakes, individuals can ensure a smoother, legally binding agreement that clearly outlines the terms of their loan.

- Not Specifying the Type of Payment Structure

One common mistake is failing to clearly define the payment structure. Whether the agreement calls for installment payments, a lump sum at a future date, or regular interest payments before the principal is due, clarity is crucial. Ambiguity in this area can lead to misunderstandings and disputes over the payment schedule, making it harder for both parties to uphold their ends of the agreement.

- Omitting Details about Interest Rates

An equally critical aspect that often gets overlooked is specifying the interest rate. In New Hampshire, the law permits lenders to charge interest, but the rate must be agreed upon by both parties and documented in the promissory note. Neglecting to detail this information can not only invalidate the agreement under certain circumstances but also lead to potential legal disputes over the amount of interest being charged.

- Forgetting to Include a Maturity Date

Another common error is not including a maturity date, the day by which the loan must be repaid in full. This omission can lead to uncertainty and conflict over when the borrower is obligated to settle their debt, potentially prolonging the repayment period indefinitely. Ensuring that a clear maturity date is set within the promissory note provides both parties with a clear timeline and enhances the enforceability of the document.

- Leaving Out Legal Names and Addresses

With any legal document, correctly identifying the parties involved is fundamental. A frequent oversight in the New Hampshire Promissory Note is the omission of full legal names and addresses of both the borrower and lender. This detail is vital for the enforceability of the note, as it identifies who is legally bound by its terms. Without this information, holding either party accountable becomes significantly more challenging.

- Lack of Notarization

While not always a requirement, failing to notarize the promissory note is a commonly missed opportunity to add an extra layer of authenticity and legal validation. Notarization can deter disputes and fraudulent claims by providing an official acknowledgment that the parties entered into the agreement willingly and understood its terms. In specific scenarios, not having the document notarized might impede its legal standing, especially in cases where the authenticity of signatures is questioned.

Avoiding these mistakes when filling out a New Hampshire Promissory Note can save individuals from unnecessary legal complications and ensure that the agreement is legally sound. By paying close attention to these details, both lenders and borrowers can protect their interests and maintain a clear, enforceable contract.

Documents used along the form

When dealing with financial agreements such as a New Hampshire Promissory Note form, it's essential to understand that this document rarely stands alone. To secure a comprehensive and legally binding agreement, other forms and documents often come into play. These documents play pivotal roles, from outlining the terms of the financial loan to ensuring both parties adhere to state laws. Below is a list of forms and documents typically used alongside the New Hampshire Promissory Note form to ensure thoroughness and legal compliance.

- Loan Agreement: This comprehensive contract details the terms and conditions of the loan between the borrower and lender. It often includes interest rates, repayment schedule, and the consequences of default, providing a more detailed framework than the promissory note alone.

- Security Agreement: For loans that are secured with collateral, a Security Agreement specifies the asset(s) pledged as security. This document is crucial as it outlines the rights of the lender to seize the collateral if the borrower fails to uphold their repayment obligations.

- Amortization Schedule: An Amortization Schedule breaks down the repayment plan into periodic payments, showing how each payment is applied to the principal amount and interest over the life of the loan. It helps both parties keep track of the balance and interest over time.

- Guaranty: This is often used when there is a need to provide additional security for the loan. A Guaranty ensures that if the borrower cannot repay the debt, another party (the guarantor) agrees to take responsibility for the payment.

- Late Payment Notice: Should the borrower fail to make a payment on time, a Late Payment Notice is a formal notification sent by the lender. It outlines the late payment and any penalties incurred, serving as a formal reminder and record of the event.

- Release of Promissory Note: Upon the complete repayment of the loan, a Release of Promissory Note is issued by the lender. This document officially acknowledges that the borrower has fulfilled their obligations under the promissory note and releases them from further liability.

Incorporating these documents alongside the New Hampshire Promissory Note form builds a solid foundation for any loan transaction. They collectively ensure clarity, enforceability, and adherence to legal standards, safeguarding the interests of all parties involved. Attention to detail and the inclusion of these complementary documents can significantly mitigate risks and foster a mutually beneficial borrower-lender relationship.

Similar forms

The New Hampshire Promissory Note form is similar to other financial documents that are used to outline the details of a loan between two parties. However, its specific similarities to certain documents, such as a Loan Agreement, an IOU, and a Mortgage Agreement, highlight its unique position in financial and legal transactions. Each of these documents shares common features with a promissory note, but also has distinct differences that cater to various needs and situations.

Loan Agreement: A Loan Agreement is a comprehensive legal document that outlines the terms and conditions of a loan between a borrower and a lender. Like the New Hampshire Promissory Note, a Loan Agreement details the loan amount, interest rate, repayment schedule, and the obligations of both parties. The key similarity lies in their function of specifying the terms of a loan deal. However, a Loan Agreement is typically more detailed and includes clauses on late fees, collateral, and legal recourse in case of default, making it a more robust document for complex transactions.

IOU (I Owe You): An IOU is a simpler acknowledgement of debt between two parties. It's similar to a promissory note in that it usually includes the basic information about the amount owed and sometimes, the repayment plan. The main similarity is their acknowledgment of a debt and a promise to repay it. However, unlike a promissory note, an IOU is often less formal and does not include detailed terms of the loan such as interest rates, repayment schedules, or legal obligations, making it less enforceable than a promissory note.

Mortgage Agreement: A Mortgage Agreement is used specifically for loans related to real estate purchases, where the property itself serves as collateral for the loan. Like the New Hampshire Promissory Note, a Mortgage Agreement includes details about the loan amount, interest rate, repayment terms, and the obligations of the borrower. The similarity lies in outlining the terms of a loan specifically backed by real estate. However, a Mortgage Agreement includes additional legal protections and terms related to the property, such as insurance requirements, property taxes responsibilities, and procedures in the event of foreclosure, which are not typically part of a promissory note.

Dos and Don'ts

Creating a New Hampshire Promissory Note is an important step in formalizing a loan agreement. It ensures that the terms of the loan are clearly defined and legally binding. Here are the things you should and shouldn't do when filling out the New Hampshire Promissory Note form:

Things You Should Do

- Clearly identify the parties involved by including the full legal names and addresses of both the borrower and the lender.

- Specify the loan amount in figures and words to avoid any confusion about the total sum being borrowed.

- Include the interest rate, ensuring it complies with New Hampshire's usury laws, to avoid illegal interest charges.

- Clearly outline the repayment schedule, including due dates and the amount due at each interval, to ensure timely payments.

- State any collateral securing the loan, if applicable, to protect the lender's interest.

- Both the borrower and lender should sign the note, possibly in the presence of a witness or notary public, to validate the agreement.

Things You Shouldn't Do

- Leave any sections blank. All fields should be completed to avoid ambiguity or potential disputes.

- Use unclear or vague terms when defining the loan's terms and conditions, as this can lead to misunderstandings.

- Forget to include a clause about what happens in the event of a default to ensure both parties understand the consequences.

- Overlook state-specific requirements or clauses that might be required in New Hampshire, which could render the note unenforceable.

- Sign the promissory note without thoroughly reading and understanding every part of it, as this is a binding legal document.

- Ignore the necessity of keeping a copy for your records, as it's crucial to have proof of the agreement and its terms.

Misconceptions

When discussing the New Hampshire Promissory Note form, various misconceptions can lead to misunderstandings. These documents are essential for formalizing loan agreements between parties, ensuring clarity, and legally binding terms. However, some people might not fully grasp their significance or the specifics involved. Below are six common misconceptions that need clarification:

- A promissory note is the same across all states. Each state may have specific clauses and requirements that tailor the promissory note to its laws and regulations, including New Hampshire. Thus, a generic approach can lead to non-compliance with state laws.

- Legal assistance is not necessary for drafting a promissory note. While templates are available, consulting with a legal professional can ensure that the note complies with New Hampshire laws and fully protects the parties involved.

- Interest rates can be set freely without any limitations. In reality, New Hampshire laws specify maximum interest rates to prevent usury. Parties must be aware of these limits to avoid creating an unenforceable note.

- All promissory notes must be notarized to be valid. Notarization is not a requirement for a promissory note to be legally binding in New Hampshire. However, notarization can add an extra layer of validity, especially in legal disputes.

- Oral agreements are just as binding as a written promissory note. While oral agreements can be legally binding, proving the terms without a written record is significantly harder. A written promissory note clearly outlines each party's rights and obligations.

- Once signed, the terms of a promissory note cannot be altered. The terms of a promissory note can be modified if both parties agree to the changes. However, any alterations should be documented in writing and agreed upon by all parties.

Understanding these misconceptions is crucial for anyone involved in drafting or signing a promissary note in New Hampshire. It ensures that the agreement is legally sound and that all parties are well-informed of their obligations and rights.

Key takeaways

Filling out and using the New Hampshire Promissory Note form involves understanding several key points to ensure that the document is effective and legally binding. This form is crucial for documenting a loan between two parties and outlines the repayment terms, interest rate, and other necessary details.

- Include Full Names and Contact Information: It's crucial to start by including the full legal names and contact information of the lender and borrower. This ensures clarity about who is involved in the agreement.

- Specify Loan Amount and Interest Rate: Clearly state the loan amount in US dollars to avoid any confusion. Additionally, the interest rate should be specified, adhering to New Hampshire's legal maximum to ensure the note is enforceable.

- Outline Repayment Terms: The promissory note should clearly outline how and when the loan will be repaid. This might include the repayment schedule, whether in installments or a lump sum, and the due date for the final payment.

- Consider Secured or Unsecured Loan: Decide whether the loan will be secured by collateral. If so, describe the collateral in the note. For an unsecured loan, acknowledge that the loan is offered on good faith without physical collateral.

- Include Signatures: For the promissory note to be legally binding, both the borrower and lender must sign and date the document. Witnesses or a notary public can provide additional legal protection and authenticity.

- Understand Default Terms: Clearly define what constitutes a default on the loan and the consequences. This might include late fees, acceleration of repayment, or legal action. It’s important for both parties to understand these terms fully.

By paying close attention to these key takeaways when filling out and utilizing the New Hampshire Promissory Note form, lenders and borrowers can ensure their interests are protected and that the agreement is clear and enforceable. Always consider consulting with a legal expert to review the document, ensuring it meets all legal requirements specific to New Hampshire.

Other New Hampshire Templates

Hold Harmless and Indemnity Agreement - This legal form may also require a witness or notary public to endorse the agreement, enhancing its legitimacy.

Quit Claim Deed Form New Hampshire - This deed type is ideal for situations where the property is not being sold but transferred, as it involves no money exchange.

State of Nh Dmv Forms - Whether selling, buying, or looking after the registration of your car, this form ensures your appointed agent can act in your best interest.