Attorney-Approved Prenuptial Agreement Document for New Hampshire

Entering into marriage is a significant event that represents not only a personal but also a financial union. Amidst the romance and excitement, it's essential to consider practical matters, such as how assets and debts will be handled during the marriage and, if necessary, upon its dissolution. Here, the New Hampshire Prenuptial Agreement form becomes a vital document for couples looking to clarify these financial aspects before they tie the knot. Serving as a mutual understanding laid down in writing, this form outlines the rights, responsibilities, and division of property between partners, aiming to protect their individual interests. It addresses various financial aspects, including but not limited to, the management of pre-marriage debts, distribution of property acquired during the marriage, and safeguarding personal assets. Importantly, while crafting this agreement, couples must adhere to specific legal requirements to ensure its enforceability. By preparing a prenuptial agreement, couples can enter into marriage with a clear financial understanding, potentially avoiding conflicts in the future.

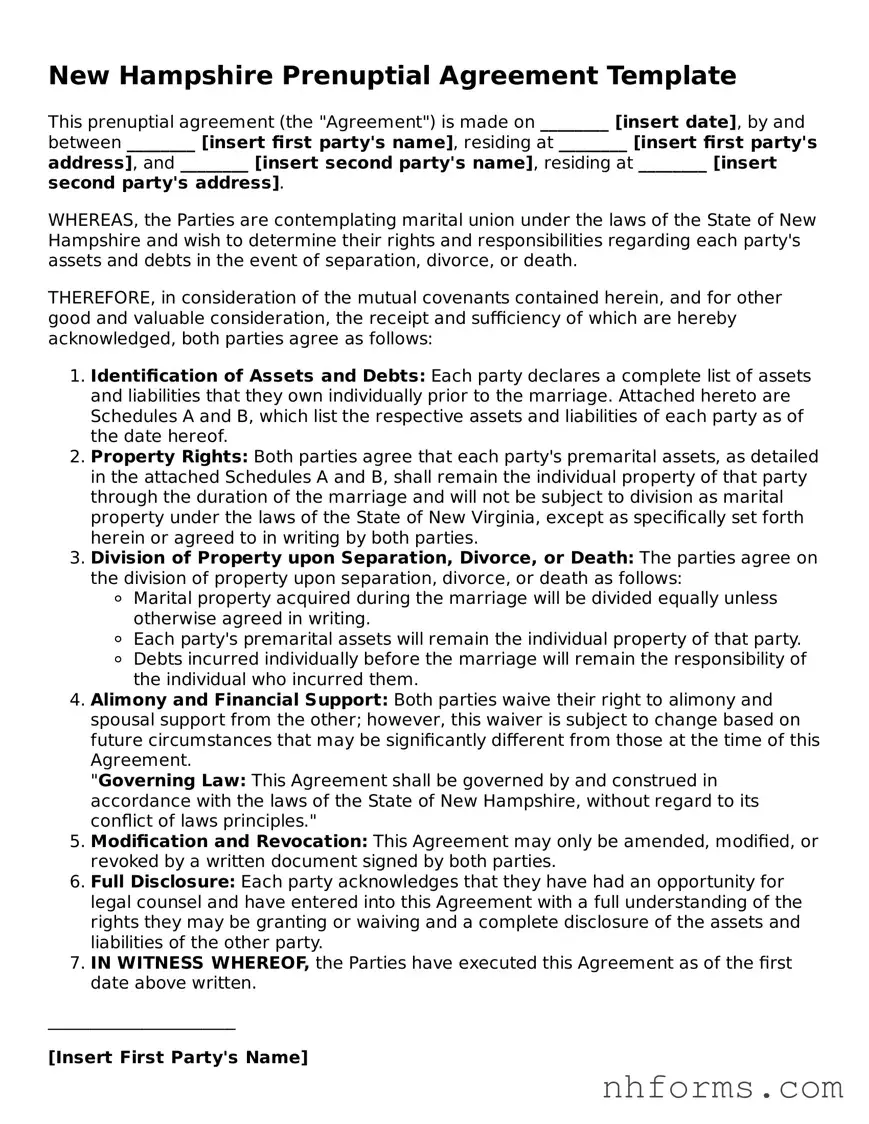

Document Preview Example

New Hampshire Prenuptial Agreement Template

This prenuptial agreement (the "Agreement") is made on ________ [insert date], by and between ________ [insert first party's name], residing at ________ [insert first party's address], and ________ [insert second party's name], residing at ________ [insert second party's address].

WHEREAS, the Parties are contemplating marital union under the laws of the State of New Hampshire and wish to determine their rights and responsibilities regarding each party's assets and debts in the event of separation, divorce, or death.

THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, both parties agree as follows:

- Identification of Assets and Debts: Each party declares a complete list of assets and liabilities that they own individually prior to the marriage. Attached hereto are Schedules A and B, which list the respective assets and liabilities of each party as of the date hereof.

- Property Rights: Both parties agree that each party's premarital assets, as detailed in the attached Schedules A and B, shall remain the individual property of that party through the duration of the marriage and will not be subject to division as marital property under the laws of the State of New Virginia, except as specifically set forth herein or agreed to in writing by both parties.

- Division of Property upon Separation, Divorce, or Death: The parties agree on the division of property upon separation, divorce, or death as follows:

- Marital property acquired during the marriage will be divided equally unless otherwise agreed in writing.

- Each party's premarital assets will remain the individual property of that party.

- Debts incurred individually before the marriage will remain the responsibility of the individual who incurred them.

- Alimony and Financial Support: Both parties waive their right to alimony and spousal support from the other; however, this waiver is subject to change based on future circumstances that may be significantly different from those at the time of this Agreement.

- Modification and Revocation: This Agreement may only be amended, modified, or revoked by a written document signed by both parties.

- Full Disclosure: Each party acknowledges that they have had an opportunity for legal counsel and have entered into this Agreement with a full understanding of the rights they may be granting or waiving and a complete disclosure of the assets and liabilities of the other party.

- IN WITNESS WHEREOF, the Parties have executed this Agreement as of the first date above written.

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of New Hampshire, without regard to its conflict of laws principles.

______________________

[Insert First Party's Name]

______________________

[Insert Second Party's Name]

File Information

| Fact | Detail |

|---|---|

| Definition | A prenuptial agreement in New Hampshire is a legally binding document that a couple signs before marriage, outlining the division of assets and responsibilities in the event of a divorce or death. |

| Governing Law | The agreement is governed by New Hampshire Statutes, specifically Chapter 460:2-a which deals with Prenuptial and Postnuptial Agreements. |

| Requirements for Validity | To be valid, the agreement must be in writing, signed by both parties, and entered into voluntarily. Full disclosure of assets by both parties is also a requirement. |

| Enforceability | In New Hampshire, prenuptial agreements are generally enforceable unless deemed unfair or unreasonable at the time of enforcement. |

| Scope of Agreement | These agreements can include terms about property division, debt allocation, and alimony, but cannot negatively affect child support obligations. |

| Modification or Revocation | Parties can modify or revoke the agreement only by a written document signed by both parties. |

| Critical Considerations | Having independent legal counsel for each party is highly recommended to ensure fairness and protect the interests of both individuals involved. |

Detailed Instructions for Writing New Hampshire Prenuptial Agreement

Before walking down the aisle, some couples decide to outline how they would like financial matters handled during their marriage or in the event of divorce. In New Hampshire, a prenuptial agreement form is a way to make these intentions legally binding. It's a practical step, ensuring that both parties are on the same page regarding their financial rights and responsibilities. Filling out this form might seem daunting, but by following a structured process, you can accomplish it with clarity and confidence.

Here are the steps to fill out the New Hampshire Prenuptial Agreement form:

- Collect necessary information: Before you start, gather all relevant financial documents, including assets, debts, income, and property owned by both parties. This comprehensive snapshot is essential for an accurate agreement.

- Read the form thoroughly: Go over the form to understand its components and the information you need to provide. Understanding each section beforehand can significantly streamline the process.

- Fill in personal details: Enter the full legal names of both parties entering the agreement, along with other personal information such as addresses and dates of birth.

- Disclose financial information: Detail the assets, liabilities, income, and any property each party owns. Transparency is crucial here; ensure that all financial data is accurately disclosed.

- Outline the terms: This section involves specifying how assets and debts will be treated during the marriage and in the event of a separation or divorce. Be clear and detailed in your descriptions to avoid ambiguity.

- Discuss future changes: Consider how future assets will be handled. This could include inheritances, gifts, or any income from future ventures. Agreeing on this upfront can prevent conflicts later on.

- Signatures: Both parties must sign the agreement. It's advisable to sign in the presence of a notary to add an extra layer of legal validity to the document.

- Seek legal advice: Before finalizing the agreement, it’s a good idea for both parties to seek independent legal advice. This ensures that both understand the agreement's implications and that it's fair and legally binding.

Once completed, this document lays a foundation for financial transparency and mutual understanding in a marriage. While it may seem like a precautionary measure, a prenuptial agreement can significantly ease the process of navigating financial matters, should the need arise. Remember, this legal form is not just about protecting assets; it's about starting your marriage with candor and clear expectations.

Essential Queries on New Hampshire Prenuptial Agreement

What is a New Hampshire Prenuptial Agreement?

A prenuptial agreement in New Hampshire is a legal document that a couple signs before getting married. This agreement outlines how assets and financial matters will be handled both during the marriage and in the event of a divorce. It can include provisions for property division, debt responsibility, and alimony, among others. Its purpose is to provide clarity and protect each person's interests.

Who should consider getting a Prenuptial Agreement in New Hampshire?

Any couple planning to marry in New Hampshire might consider a prenuptial agreement, especially if one or both parties have significant assets, debts, or children from previous relationships. It's not just for the wealthy; it can also be a practical move for anyone wanting to define financial terms and responsibilities clearly to avoid complications in the future.

Are Prenuptial Agreements enforceable in New Hampshire?

Yes, prenuptial agreements are generally enforceable in New Hampshire, provided they meet certain requirements. The agreement must be in writing and signed by both parties. It's also important that both parties had the opportunity to consult with legal counsel and that the agreement was entered into freely without any coercion. Full disclosure of assets by both parties is required for the agreement to be considered valid.

Can a New Hampshire Prenuptial Agreement decide child support and custody issues?

No, prenuptial agreements in New Hampshire cannot predetermine child custody or child support arrangements. Such issues are decided based on the child's best interests at the time of the divorce, not in advance. A court will always retain the right to review and modify agreements concerning children to ensure their welfare and best interests.

What happens if we don't sign a Prenuptial Agreement?

If you don't sign a prenuptial agreement in New Hampshire, state laws will govern the division of your property and the determination of alimony in the event of a divorce. New Hampshire follows an "equitable distribution" model, which means the court will divide marital property in a way that is considered fair, but not necessarily equal, based on a variety of factors.

Can a Prenuptial Agreement in New Hampshire be modified or revoked after marriage?

Yes, a prenuptial agreement can be modified or revoked after the marriage but this requires the consent of both parties. Any changes or the revocation must be done in writing and signed by both parties, similar to the original agreement. It's advisable to consult with a lawyer to ensure the changes are legally valid.

Is legal representation required for entering into a Prenuptial Agreement in New Hampshire?

While it's not legally required to have a lawyer to draft or enter into a prenuptial agreement in New Hampshire, it is strongly recommended. Legal representation can ensure that the agreement complies with state laws, that both parties fully understand their rights and obligations, and that the agreement is enforceable. Each party should have their own attorney to ensure their interests are fully protected.

Common mistakes

Entering into a prenuptial agreement is a crucial step for couples in New Hampshire, helping to protect their assets and financial interests before marriage. However, when filling out the New Hampshire Prenuptial Agreement form, individuals often make several common mistakes that can significantly impact the agreement's validity and effectiveness. Recognizing and avoiding these errors can ensure that the prenuptial agreement serves its intended purpose.

One of the most critical errors people make is not disclosing all assets and liabilities completely and honestly. Transparency is key in these agreements, as any omission or deception can lead to disputes or the agreement being invalidated by a court. Another stumble is neglecting to seek independent legal advice. Each party should have their own attorney to ensure their interests are fully protected and that they understand the implications of the agreement.

Here is an ordered list of mistakes often made when completing the New Hampshire Prenuptial Agreement form:

- Failing to allow adequate time for review and consideration of the agreement prior to the marriage, leading to potential claims of duress or coercion.

- Not considering or including provisions for future changes in circumstances, such as the birth of children, inheritance, or significant changes in finances.

- Using ambiguous language that can lead to different interpretations, potentially causing disputes and legal battles in the future.

- Ignoring state laws and requirements, which can render the agreement invalid or unenforceable.

- Forgetting to update the agreement as life changes occur, which can make sections of the agreement irrelevant or unfair over time.

Additionally, here are some common oversights:

- Not properly documenting the agreement, including failing to have it witnessed or notarized as required.

- Overlooking the emotional impact and failing to approach discussions about the prenuptial agreement sensitively.

- Choosing a DIY approach without understanding the legal complexities involved.

- Assuming a prenuptial agreement only benefits the wealthier party, rather than recognizing its potential to protect both parties.

- Relying on generic forms without customizing the agreement to reflect personal circumstances and state laws.

In summary, filling out a New Hampshire Prenuptial Agreement form requires careful attention to detail, thoroughness, and foresight. Avoiding these mistakes, from failing to disclose all financial information to neglecting state specific requirements, is essential for creating a legitimate and enforceable agreement. Engaging with competent legal counsel and communicating openly can help ensure that the prenuptial agreement aligns with both parties' expectations and legal standards.

Documents used along the form

When individuals in New Hampshire consider entering into a prenuptial agreement, several other documents and forms can play a critical role in ensuring that the agreement is comprehensive, legally binding, and reflective of both parties' interests. These documents not only complement the prenuptial agreement but also offer additional legal safeguards and clarity on various matters related to the couple's assets, debts, and future financial arrangements. Here is a list of up to eight significant documents often used alongside the New Hampshire Prenuptial Agreement form:

- Financial Disclosure Statements: These are comprehensive declarations of each party's financial assets, liabilities, income, and expenses. They are foundational for creating a fair and transparent prenuptial agreement.

- Will and Testament: While a prenuptial agreement deals with the financial aspects during the marriage and in the case of separation or divorce, a will and testament outline the distribution of assets upon one's death, ensuring that the agreement aligns with the couple's estate planning goals.

- Life Insurance Policies: Documents concerning life insurance, including beneficiary designations, ensure that in the case of one party's death, financial provisions are in place as agreed upon in the prenuptial agreement or as separately agreed.

- Real Estate Deeds: For couples who own or plan to purchase property together, real estate deeds must align with the terms of the prenuptial agreement, particularly regarding property division and ownership.

- Business Ownership and Valuation Documents: If one or both parties own a business, documents detailing ownership shares and valuations are crucial for determining how the business is addressed in the prenuptial agreement.

- Debt Documentation: Detailed records of any debt, either individual or joint, are necessary to ensure responsibility for debts is clearly defined in the prenuptial agreement.

- Postnuptial Agreement Form: Although not required, some couples choose to prepare a postnuptial agreement after getting married to adjust or reaffirm the terms initially set out in their prenuptial agreement, based on changes to their financial situation or relationship.

- Amendment or Revocation Forms: Should the couple wish to amend or revoke the prenuptial agreement during their marriage, these forms are used to formally make those changes.

Together with the New Hampshire Prenuptial Agreement form, these documents create a robust framework for marital agreements, addressing a wide range of legal and financial issues that couples may encounter during their marriage. By thoroughly considering and completing these complementary forms, couples can better safeguard their future, ensuring that they are prepared for various eventualities while respecting each party's rights and wishes.

Similar forms

The New Hampshire Prenuptial Agreement form is similar to other legal agreements and forms that are designed to protect the assets and financial interests of the parties involved. These documents outline terms and conditions agreed upon before a certain relationship or partnership commences, thus ensuring that both parties have a clear understanding of their rights and expectations. Several types of documents share common features with the New Hampshire Prenuptial Agreement form, including but not limited to the following:

Postnuptial Agreement: Much like a prenuptial agreement, a postnuptial agreement outlines how assets and finances are to be divided between spouses. However, the key difference is in the timing. A postnuptial agreement is executed after the marriage has taken place rather than before. Both documents are designed to clear ambiguities regarding financial arrangements and asset division, providing a predefined route in the event of separation or divorce.

Living Trusts: Living trusts are established to manage a person’s assets during their lifetime and outline the distribution upon their death. Similar to prenuptial agreements, living trusts can specify which assets are considered separate property and protect them from being distributed outside the intended beneficiaries. Both documents help in organizing and protecting assets, though living trusts focus more on the continuity beyond the individual’s life.

Business Partnership Agreements: These agreements are made between business partners to outline the workings of the partnership, roles, profit share, and steps in case of dissolution. Similar to prenuptial agreements, they are proactive measures designed to handle potential disputes or dissolution by laying out how assets and responsibilities are divided. While one targets marriage and the other business relationships, both serve to protect the interests of the parties involved against future uncertainties.

Last Will and Testament: Though not as directly analogous to a prenuptial agreement as others, a Last Will and Testament shares the proactive nature of outlining distribution of assets. It dictates how a person’s estate should be handled after their death, with specifics on asset distribution. Both documents are preventive, aiming to minimize disputes over assets by clearly defining how assets are to be allocated to various parties.

Dos and Don'ts

When entering into a prenuptial agreement in New Hampshire, it's crucial to approach the process with thorough preparation and understanding. This document, often seen as a pragmatic measure, helps ensure both parties' assets and interests are protected, should unforeseen circumstances arise. Below are key guidelines—what you should and shouldn't do—to help navigate the complexities of filling out the New Hampshire Prenuptial Agreement form effectively.

Do:- Seek Independent Legal Advice: Before signing anything, both parties should seek advice from separate lawyers. This ensures that each person's interests are fully represented and understood.

- Disclose All Assets and Liabilities: Honesty is the foundation of any prenuptial agreement. Fully disclose all financial specifics, including assets, debts, and income, to avoid future disputes or the agreement being challenged.

- Understand the Terms Completely: Make sure you completely understand every aspect of the agreement. Questions should be asked, and clarifications made until everything is clear.

- Consider Future Changes: Life is unpredictable. Include provisions for changes in circumstances, such as inheritance, changes in finances, or having children.

- Plan Ahead and Don’t Rush: Take the necessary time to draft, review, and sign the prenuptial agreement. Avoid making it a last-minute decision before the marriage.

- Use Generic Templates Without Customization: Each couple’s situation is unique. While templates can be a good starting point, ensure the document is tailored to fit your specific circumstances and needs.

- Forget to Update the Agreement: As life events unfold, revisit and potentially update your prenuptial agreement to reflect new assets, liabilities, or changes in your relationship.

Thoughtfully preparing your New Hampshire Prenuptial Agreement form can significantly contribute to a strong, transparent foundation for your marriage. By paying attention to these do’s and don’ts, you can build a framework that protects both parties' interests, providing peace of mind as you move forward together.

Misconceptions

Prenuptial agreements, particularly in New Hampshire, are surrounded by a variety of misconceptions. These misunderstandings can lead to confusion and could prevent couples from taking advantage of the benefits these agreements can offer. By clarifying these misconceptions, individuals can make informed decisions about their pre-marital arrangements.

Only Wealthy People Need Them: A common misconception is that prenuptial agreements are exclusively for the wealthy. In reality, these agreements can benefit anyone who has personal or business assets, debts, or children from previous relationships. They serve to protect both parties by specifying how assets and liabilities should be divided in the event of a divorce or death. This clarity can provide peace of mind for anyone entering into a marriage.

Prenuptial Agreements Invite Divorce: Many people believe that preparing a prenuptial agreement is akin to planning for divorce before the marriage has even begun. However, this perspective overlooks the reality that these agreements encourage couples to communicate openly about their finances. Such conversations can strengthen a relationship by ensuring both parties have a clear understanding of their financial union.

They Are Only About Divorce: It's a common misunderstanding that prenuptial agreements are only relevant in the case of divorce. Besides outlining the division of assets and debts in a divorce, these agreements can also dictate estate rights and obligations during the marriage. This includes scenarios involving the death of a spouse, showcasing the broad applicability of these agreements beyond just divorce proceedings.

Signing One Means You Don't Trust Your Partner: The notion that a prenuptial agreement indicates a lack of trust between partners is another widespread misunderstanding. On the contrary, drafting such an agreement requires a high level of trust and transparency, as both parties must fully disclose their financial situations. This process can actually enhance trust by demonstrating a commitment to open and honest communication.

Key takeaways

When considering the use of a New Hampshire prenuptial agreement form, it's important to understand its purpose, implications, and the correct way to fill it out to ensure it is legally binding and reflects the intentions of both parties. Below are key takeaways about filling out and using a New Hampshire Prenuptial Agreement form:

Understanding the purpose: A prenuptial agreement in New Hampshire is designed to clarify the financial rights and responsibilities of each partner in a marriage and outline the division of assets in the event of a divorce or death.

Fully disclosing assets: Both parties must fully disclose their assets, debts, and income. This transparency is crucial for the agreement to be enforceable.

Seeking independent legal advice: Each partner should seek independent legal advice before signing the prenuptial agreement. This ensures that both parties fully understand the agreement and its implications.

Voluntary agreement: The prenuptial agreement must be entered into voluntarily by both parties. Any hint of coercion or duress could render the agreement invalid.

Inclusion of provisions: The agreement can include provisions for the division of property, spousal support, and the rights to death benefits. Provisions that govern child support, custody, or visitation are not permissible.

Understanding state laws: New Hampshire has specific laws governing prenuptial agreements. Familiarity with these laws is essential to ensure the agreement complies and is enforceable.

Timing of execution: Signing the prenuptial agreement well in advance of the wedding date is advisable. Last-minute agreements are more susceptible to challenges about voluntariness.

Writing requirement: The prenuptial agreement must be in writing and signed by both parties to be legally binding.

Amendments and revocations: The agreement can be amended or revoked after marriage only if both parties agree and the amendments or the revocation are in writing and signed by both.

Enforceability considerations: The agreement will be scrutinized by a court for fairness at the time of execution and enforcement. It's important that it does not leave one party destitute or significantly worse off than they were before the marriage.

By paying close attention to these points and ensuring proper legal guidance, couples can draft a prenuptial agreement in New Hampshire that safeguards their interests and respects the legal standards of the state.

Other New Hampshire Templates

Articles of Incorporation Sample - This foundational document underscores a corporation’s commitment to operate within the legal frameworks of its jurisdiction.

New Hampshire Rental Agreement - By specifying rules about pets, smoking, and other activities, the Lease Agreement form helps maintain the property’s condition and the comfort of its occupants.

Quit Claim Deed Form New Hampshire - Its ease of execution makes it a preferred choice for non-commercial transfers where a simple change of ownership is needed.