Attorney-Approved Power of Attorney Document for New Hampshire

Entrusting someone with the authority to make decisions on your behalf is a significant step, one that requires a formal arrangement known as a Power of Attorney (POA). In New Hampshire, this legal document allows you to appoint a trusted person, known as an agent or attorney-in-fact, to manage your affairs if you are unable to do so yourself. This could range from financial decisions, like handling banking transactions and managing real estate, to personal welfare matters, including healthcare decisions. The form itself must be completed in accordance with New Hampshire laws to ensure its validity and enforceability. It's vital that both the person creating the POA and the appointed agent understand their rights and responsibilities under this agreement. With various types of Powers of Attorney available, such as durable, nondurable, and health care POAs, selecting the right one is critical and depends on your specific needs and circumstances. Completing this form is a forward-thinking step towards securing peace of mind for both you and your loved ones, ensuring that your affairs are in trusted hands.

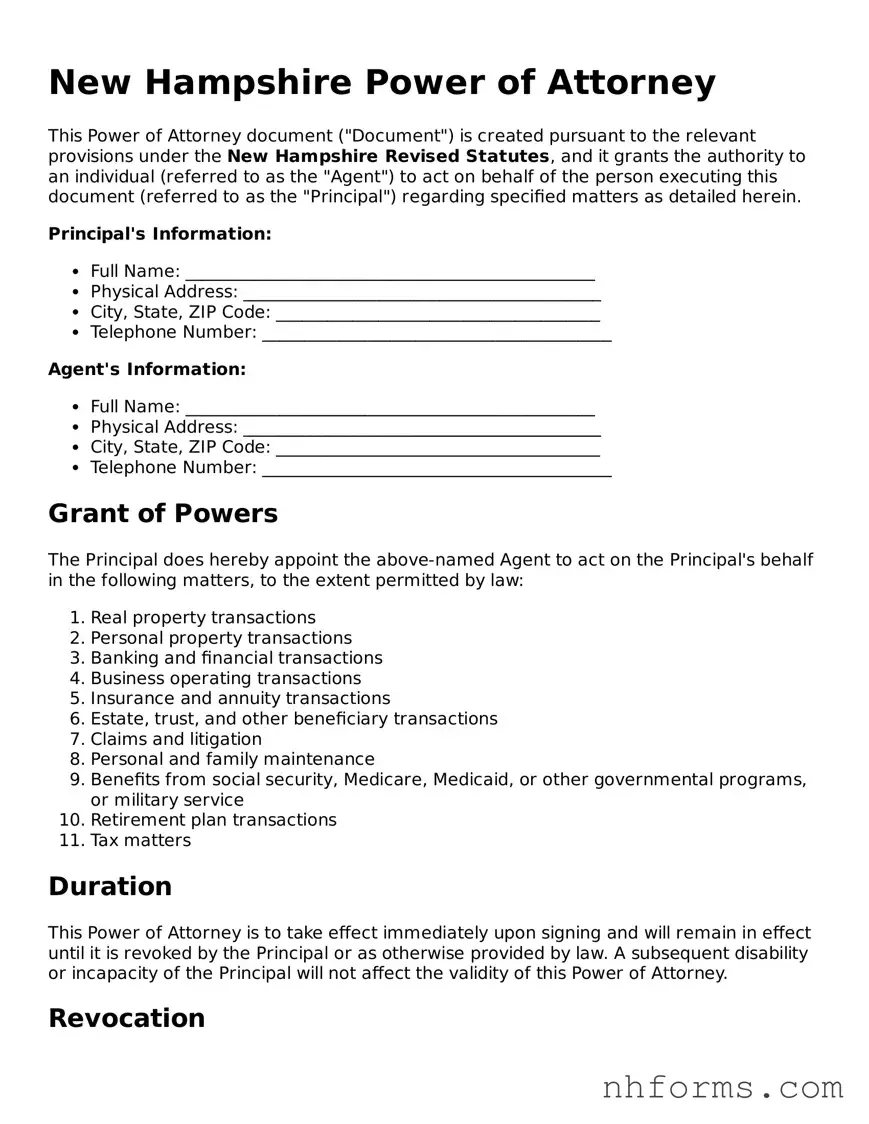

Document Preview Example

New Hampshire Power of Attorney

This Power of Attorney document ("Document") is created pursuant to the relevant provisions under the New Hampshire Revised Statutes, and it grants the authority to an individual (referred to as the "Agent") to act on behalf of the person executing this document (referred to as the "Principal") regarding specified matters as detailed herein.

Principal's Information:

- Full Name: ________________________________________________

- Physical Address: __________________________________________

- City, State, ZIP Code: ______________________________________

- Telephone Number: _________________________________________

Agent's Information:

- Full Name: ________________________________________________

- Physical Address: __________________________________________

- City, State, ZIP Code: ______________________________________

- Telephone Number: _________________________________________

Grant of Powers

The Principal does hereby appoint the above-named Agent to act on the Principal's behalf in the following matters, to the extent permitted by law:

- Real property transactions

- Personal property transactions

- Banking and financial transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

Duration

This Power of Attorney is to take effect immediately upon signing and will remain in effect until it is revoked by the Principal or as otherwise provided by law. A subsequent disability or incapacity of the Principal will not affect the validity of this Power of Attorney.

Revocation

This Power of Attorney can be revoked by the Principal at any time by providing written notice to the Agent. Furthermore, this Document will automatically be revoked upon the death of the Principal.

Signature

By signing below, the Principal acknowledges and agrees to all terms and conditions set forth in this Document.

Principal's Signature: ___________________________ Date: _________________

Agent's Signature (Optional): ______________________ Date: _________________

Witness

(Optional) This Document was signed in the presence of a witness who affirm

File Information

| Fact | Description |

|---|---|

| Definition | A New Hampshire Power of Attorney form is a legal document that lets a person appoint someone else to make decisions on their behalf. |

| Types | There are various types, including financial, healthcare, and durable powers of attorney, each serving different purposes. |

| Governing Law | It is governed by New Hampshire Revised Statutes, specifically Chapter 564-E for durable powers of attorney and Chapter 137-J for healthcare decisions. |

| Requirements | For a Power of Attorney to be valid in New Hampshire, it must be signed by the principal, witnessed by two adults, and notarized. |

Detailed Instructions for Writing New Hampshire Power of Attorney

When preparing to fill out a New Hampshire Power of Attorney (POA) form, it's pivotal to approach the task with a clear understanding. This form signifies an important legal document, through which you entrust another individual, known as the agent, with the authorization to make decisions on your behalf. Such decisions can pertain to financial, legal, or health-related matters. For those who are about to embark on this significant legal process, it's essential to carefully follow step-by-step instructions to ensure the form is filled out accurately and comprehensively, guaranteeing that your wishes are correctly documented and legally recognized.

- Begin by acquiring the correct New Hampshire Power of Attorney form. Ensure it aligns with your specific needs, as different forms exist for financial, health, or other types of decisions.

- Read through the entire form first before writing anything down. This approach helps in understanding the form's requirements and how best to answer them.

- Clearly fill in the full legal name, date of birth, and address of the principal—the person who is appointing the power of attorney.

- Identify the agent (or attorney-in-fact) by providing their full legal name, address, and contact information. This is the person you are granting authority to make decisions on your behalf.

- If the form allows, designate an alternate agent as a precautionary measure. This step involves providing the same details for the alternate agent as you did for the primary agent.

- Specify the powers you are granting to your agent. Be as clear and as detailed as necessary to avoid any misunderstandings. If the form provides checkboxes or specific categories, review them closely and mark accordingly.

- Include any special instructions or limitations you wish to impose on the agent's power. This section is crucial for tailoring the POA to your specific wishes and needs.

- Determine the effective date and any conditions related to the commencement and termination of the POA. Some forms allow for immediate effect, while others may specify conditions such as the principal's incapacitation.

- Review any legal requirements specific to New Hampshire related to witnessing and notarization of the POA form. Ensure compliance with these requirements to validate the document.

- Sign and date the form in the presence of a notary public and/or the required witnesses, adhering to New Hampshire's laws for notarization and witnessing.

- Provide the agent with a copy of the executed POA form. It may also be advisable to provide copies to relevant financial institutions, healthcare providers, or other entities that may require it.

Filling out a Power of Attorney form is a profound step towards ensuring your affairs will be handled according to your desires, in the event that you are unable to do so yourself. By meticulously following these steps, you can provide yourself and your loved ones with peace of mind, knowing that the authority to make decisions on your behalf is securely placed in trusted hands, with clear guidelines and legal validity. Understanding and completing the Power of Attorney form accurately is essential in safeguarding your autonomy and securing your well-being and assets.

Essential Queries on New Hampshire Power of Attorney

What is a Power of Attorney (POA) in New Hampshire?

A Power of Attorney in New Hampshire is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal. The scope of this authority can be broad or limited, and it may include handling financial matters, making healthcare decisions, or managing property. It's designed to provide a way for individuals to choose a trusted person to manage their affairs in case they become incapacitated or otherwise unable to do so themselves.

How do I create a Power of Attorney in New Hampshire?

To create a Power of Attorney in New Hampshire, the principal must complete a power of attorney form, which should clearly state the powers being granted to the agent. The document must be signed by the principal and should be notarized to ensure its validity. Depending on the powers granted, it might also require witness signatures. It’s important that the form complies with New Hampshire state laws to be considered valid. Consulting with a legal professional can help ensure that the POA meets all legal requirements.

Who can serve as an Agent or Attorney-in-Fact in New Hampshire?

Any competent adult can serve as an agent or attorney-in-fact in New Hampshire. The chosen individual should be someone the principal trusts implicitly, as they will have significant authority over the principal's affairs. Often, people select a family member, close friend, or a professional such as an attorney. It's crucial that the agent fully understands their responsibilities and is willing to act in the principal's best interests.

Is a Power of Attorney in New Hampshire revocable?

Yes, a Power of Attorney in New Hampshire is revocable at any time by the principal as long as the principal is mentally competent. To revoke the power of attorney, the principal should provide a written notice to the agent and to any institutions or individuals that were informed of the power of attorney. Destroying the original document and any copies can also help ensure that the POA is no longer in use.

Does a Power of Attorney in New Hampshire need to be registered?

While a Power of Attorney in New Hampshire does not need to be registered to be effective, it may be necessary to record the document with the county clerk’s office if it grants the agent authority over real estate transactions. This helps ensure that the POA is recognized in any dealings with the property. For other types of decisions, as long as the document is properly executed and notarized, it should be recognized by financial institutions, healthcare providers, and other entities.

What happens if the Power of Attorney is not followed?

If an agent under a Power of Attorney in New Hampshire fails to act according to the powers granted by the document or acts in a way that is not in the best interest of the principal, they can be held legally accountable. This might include being required to compensate the principal for any losses or being subject to other legal penalties. If someone suspects that a power of attorney is being abused, they should contact a legal professional for advice and potential intervention.

Common mistakes

In the picturesque state of New Hampshire, preparing a Power of Attorney (POA) form is a vital step for ensuring your matters are in trusted hands should you be unable to manage them yourself. However, the process is often marred by common mistakes, which can significantly impact the effectiveness of the document and the protection it provides. Awareness of these pitfalls could save individuals from complications and ensure their intentions are clearly understood and legally recognized.

Not specifying powers clearly: One of the most significant mistakes made is the lack of specificity in outlining the agent's powers. A Power of Attorney form should clearly spell out what the agent can and cannot do. Vague language can lead to confusion, making it difficult for institutions to accept the document. For instance, if the POA is meant to allow the agent to handle real estate transactions, it should explicitly state this, leaving no room for interpretation.

Choosing the wrong type of POA: New Hampshire offers various types of Power of Attorney forms, each serving different purposes, such as financial, medical, or durable POA. Selecting the incorrect type for your needs can result in your agent not having the necessary authority when it matters most. For example, a financial POA won't help in making healthcare decisions, and vice versa. Understanding the distinctions is critical to ensuring your affairs are handled as intended.

Failing to specify a successor agent: Life is unpredictable, and the initially chosen agent might become unavailable or unwilling to serve for various reasons. Neglecting to name a successor agent can lead to a lack of representation, necessitating a court intervention to appoint a new agent. This oversight could be easily avoided by appointing an alternate in the POA form, ensuring continuity in the management of your affairs.

Not updating the POA: Circumstances change, and a POA made years ago might no longer reflect your current wishes or situation. Failing to update your Power of Attorney form to reflect new relationships, assets, or intentions can render it ineffective or irrelevant. Regular reviews and updates are necessary, particularly after significant life events such as marriage, divorce, the birth of a child, or the acquisition of substantial assets.

Attention to detail and a clear understanding of your needs and intentions can make all the difference when creating a Power of Attorney in New Hampshire. Avoiding these common mistakes not only streamlines the process but ensures that your affairs will be managed exactly as you wish, providing peace of mind to you and your loved ones.

Documents used along the form

When preparing a New Hampshire Power of Attorney (POA) form, it's crucial to consider all legal documentation that might be necessary to ensure a comprehensive and proactive approach. The POA is a powerful document allowing someone to act on another’s behalf, but oftentimes, additional forms and documents are needed to complement it. These supplementary forms help cover various aspects of one’s personal, financial, and healthcare needs comprehensively.

- Advance Healthcare Directive: Sometimes known as a living will, this document specifies an individual's health care preferences in case they become unable to make these decisions themselves.

- Will and Testament: This is a legal document that spells out how a person's assets and estate will be distributed upon their death. Having a will can work alongside a POA to ensure financial affairs are handled according to the individual’s wishes both before and after their passing.

- HIPAA Authorization Form: This form allows designated individuals to have access to one’s private health information, ensuring that those acting on the individual's behalf can receive necessary medical information to make informed decisions.

- Durable Financial Power of Attorney: While a general POA might suffice for temporary situations, a durable POA is essential for long-term financial management since it remains in effect even if the principal becomes incapacitated.

- Revocation of Power of Attorney: This form is vital if the individual decides to terminate the powers granted in a previous POA, allowing for the creation of a new POA if needed.

- Declaration of Homestead: This document protects a portion of the individual's home equity from creditors. It may complement a financial POA by safeguarding the individual’s primary residence from certain types of creditors.

- Trust Agreement: A trust can manage an individual's property during their life and after death, offering a level of control and protection that complements the POA, especially in managing complex estates or providing for minors.

In conclusion, while a New Hampshire Power of Attorney form is a crucial starting point for estate planning, these additional documents are also vital in ensuring that all bases are covered. From healthcare decisions to financial management and the distribution of an estate after death, each form serves a specific purpose in the broader scope of legal and personal planning. For anyone considering a POA, it’s advisable to also review these additional documents and consider how they might fit into their overall legal strategy.

Similar forms

The New Hampshire Power of Attorney form is similar to other legal documents that empower individuals to make decisions on behalf of someone else. These documents, while sharing the core principle of delegation of authority, are tailored for specific purposes and circumstances. Understanding these variations is crucial for ensuring that the right form is used to meet the individual’s needs and intentions.

Medical Power of Attorney: This document resembles the New Hampshire Power of Attorney form in that it grants someone else the authority to make decisions on another’s behalf. However, the scope is specifically limited to health care decisions. While the general Power of Attorney might include the ability to make financial or legal decisions, a Medical Power of Attorney focuses on treatments, health care providers, and end-of-life care choices. This ensures that if someone becomes unable to make their own health care decisions, the person they trust can make these critical choices for them.

Durable Power of Attorney: The similarity with the New Hampshire Power of Attorney form lies in the legal empowerment it provides. Nevertheless, the distinguishing feature of a Durable Power of Attorney is its resilience against the principal's incapacity. Whereas a standard Power of Attorney may become null if the individual becomes mentally incapacitated, a Durable Power of Attorney remains in effect. This is essential for individuals planning for the future, who want to ensure that their appointee has the authority to act on their behalf no matter their mental state. It's like a safety net, making sure that even if unforeseen health issues arise, their affairs can be managed smoothly.

Limited or Special Power of Attorney: This form shares with the New Hampshire Power of Attorney the fundamental concept of granting authority to another. The crucial difference, however, is the confinement of this power to specific actions or situations. For instance, a person might give a Limited Power of Attorney to someone else to sell a car or handle transactions while they are out of the country. This targeted delegation makes the Limited Power of Attorney a versatile tool for precise, situation-specific tasks, ensuring that the person given this power has a clear boundary within which they can operate.

Financial Power of Attorney: Analogous to the New Hampshire Power of Attorney in the way it authorizes someone to act on the principal's behalf, a Financial Power of Attorney specifies that this authority is confined to financial matters. This can range from paying bills and managing bank accounts to buying or selling property and investing on the principal's behalf. It ensures that someone's financial affairs can continue to be managed efficiently, should they be unable to do so themselves, without the broader implications of a general Power of Attorney.

Dos and Don'ts

When preparing to fill out the New Hampshire Power of Attorney (POA) form, it is important to approach the task with care and precision to ensure that your wishes are clearly stated and legally enforceable. There are certain practices you should follow and others you should avoid to make certain that the document achieves its intended purpose without any unintended consequences.

Do:

- Review the form carefully to understand all the sections and what information is required. This ensures that you are fully informed about the type of authority you are granting.

- Clearly identify the powers you are granting to your agent. Be specific about any limitations you wish to apply to these powers to prevent any misuse or misunderstanding.

- Select a trustworthy person as your agent. This individual will have significant authority over your affairs, so choose someone who is reliable, understands your wishes, and is willing to act in your best interest.

- Sign the form in the presence of a notary public or other authorized official. This step is crucial for the document to be legally valid in New Hampshire.

- Keep a copy of the Power of Attorney form in a safe place, and provide a copy to your agent as well. You may also want to inform close family members or advisors of the arrangement.

Don't:

- Leave any sections of the form blank. If certain parts do not apply to your situation, clearly mark them as "N/A" (not applicable) rather than leaving them empty. This prevents any potential confusion or alteration after the document has been executed.

- Grant broad powers without careful consideration. Think carefully about the extent of authority you are comfortable giving to your agent, especially regarding financial decisions and property management.

- Forget to specify a termination date or event if you wish for the Power of Attorney to be limited in duration. Without such specification, the POA could remain in effect longer than you intend.

- Fail to review and update the document as necessary. Your circumstances or wishes may change, necessitating updates to the Power of Attorney form to reflect your current desires.

- Sign the form without fully understanding every aspect of it. If there are sections or terms that are not clear, consult a legal professional for clarification before proceeding.

Misconceptions

Many misconceptions surround the Power of Attorney (POA) form in New Hampshire, leading to confusion and misguided decisions. Understanding the facts can empower individuals to make informed choices about their legal and financial affairs. Below are some of the most common misunderstandings:

All POAs are the same. This notion fails to recognize the variety of POAs available, each serving different purposes. New Hampshire law allows for several types, including General, Limited, Durable, and Medical POAs, each designed for specific circumstances.

A POA grants unlimited power. In reality, the powers conferred through a POA can be as broad or as limited as the principal desires. The document can specify exactly what authorities the agent can exercise, ensuring the principal retains control over the extent of the power granted.

Only the elderly need a POA. While it's true that POAs are often associated with aging individuals, adults of any age can benefit from having one. Unexpected situations such as illness or travel can make a POA an invaluable tool for managing one's affairs.

A POA is effective after the principal's death. A common misconception is that a POA remains in effect after the principal's death. However, all POAs in New Hampshire terminate upon the death of the principal, at which point the executor of the estate takes over.

Creating a POA requires a lawyer. While legal advice is invaluable, especially for complex situations, New Hampshire law does not require a lawyer to draft or execute a POA. Templates and resources are available, but ensuring the form complies with state laws is crucial for its validity.

Once executed, a POA cannot be revoked. Principals retain the right to revoke their POA as long as they are mentally competent. This flexibility allows individuals to respond to changing relationships or circumstances by updating their legal documents accordingly.

Dispelling these misconceptions enables individuals to utilize the New Hampshire Power of Attorney forms more effectively, tailoring them to their specific needs and circumstances. It's essential for anyone considering a POA to understand the laws and options available to ensure their affairs are handled according to their wishes.

Key takeaways

The Power of Attorney (POA) form in New Hampshire is a powerful document that allows one person to grant another person the authority to make decisions on their behalf. This could range from financial decisions to medical choices, depending on the type of POA issued. For those considering filling out or using a POA in New Hampshire, here are some key takeaways to keep in mind:

- Understand the Different Types: New Hampshire recognizes several types of POA, such as General, Limited, Durable, and Medical. Each serves a different purpose and remains effective under different circumstances. It's crucial to select the one that best suits your needs and situation.

- Choosing Your Agent Wisely: The person you designate as your agent (sometimes called the "attorney-in-fact") will have significant power over your affairs. It's important to choose someone who is trustworthy, understands your wishes, and is willing to act in your best interest.

- Filling Out the Form Correctly: Ensuring that the POA form is filled out accurately is crucial for its validity. This includes clearly identifying the parties involved, the scope of powers granted, and any limitations. It may be beneficial to seek legal advice to avoid common mistakes and ensure that the form meets all legal requirements in New Hampshire.

- Legal Requirements for Execution: New Hampshire law has specific requirements for executing a POA to make it legally binding. This generally includes the need for witnesses or a notary public to validate the signature of the principal (the person granting the power). Familiarizing yourself with these requirements ensures that the document won't be rejected due to a procedural oversight.

Taking the time to understand these key aspects can help ensure that the Power of Attorney serves its intended purpose effectively and legally. It's also wise to review the document periodically, as changes in personal circumstances or state law may necessitate updates to the POA.

Other New Hampshire Templates

Nh Bill of Sale Template - It reassures the buyer of the legitimacy of the transaction and the seller's right to sell the vessel.

Does a Will Have to Be Notarized to Be Valid - Without a will, an individual’s estate is distributed according to state intestacy laws, which might not align with their wishes.

Power of Attorney Form New Hampshire - In case of the principal's incapacitation, the document ensures that essential decisions are not delayed or subject to court intervention.