Attorney-Approved Operating Agreement Document for New Hampshire

In the scenic state of New Hampshire, where small businesses flourish amidst its vibrant communities, the Operating Agreement occupies a central role in the establishment and smooth operation of Limited Liability Companies (LLCs). This legal document, not mandated by state law but highly recommended, serves as a crucial blueprint for the internal workings of an LLC, laying out the governance structure, financial arrangements, and operational guidelines. It ensures that all business owners are on the same page regarding the company's policies and procedures, thereby mitigating potential conflicts. Moreover, it offers a layer of protection for the members' personal assets, distinguishing personal liability from that of the company’s. Although often overlooked in the early stages of business planning, the value of a well-crafted Operating Agreement cannot be overstated, as it not only provides a framework for conflict resolution and decision-making but also reinforces the legitimacy of the LLC in the eyes of financial institutions and potential investors. Hence, crafting an Operating Agreement in New Hampshire is a step towards solidifying the foundation of a business, ensuring it is well-equipped to navigate the complexities of its growth and the commercial landscape.

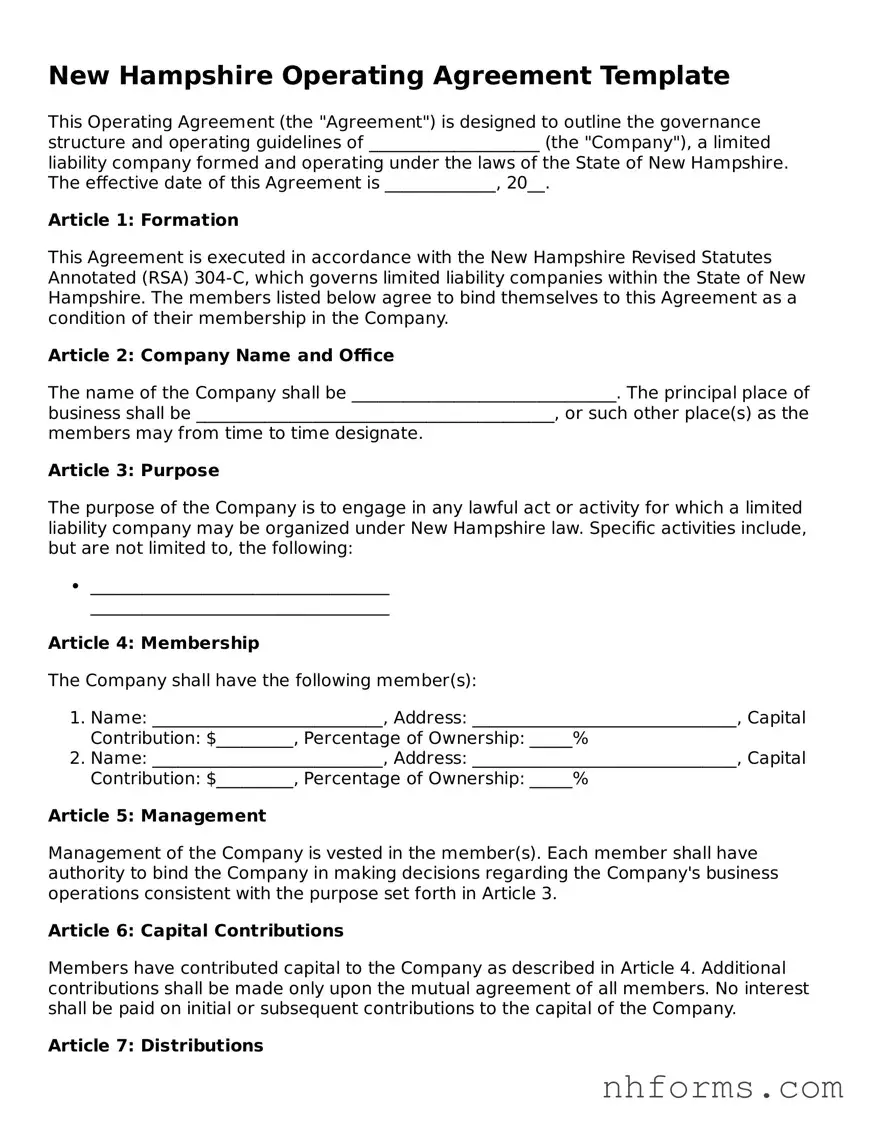

Document Preview Example

New Hampshire Operating Agreement Template

This Operating Agreement (the "Agreement") is designed to outline the governance structure and operating guidelines of ____________________ (the "Company"), a limited liability company formed and operating under the laws of the State of New Hampshire. The effective date of this Agreement is _____________, 20__.

Article 1: Formation

This Agreement is executed in accordance with the New Hampshire Revised Statutes Annotated (RSA) 304-C, which governs limited liability companies within the State of New Hampshire. The members listed below agree to bind themselves to this Agreement as a condition of their membership in the Company.

Article 2: Company Name and Office

The name of the Company shall be _______________________________. The principal place of business shall be __________________________________________, or such other place(s) as the members may from time to time designate.

Article 3: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under New Hampshire law. Specific activities include, but are not limited to, the following:

- ___________________________________

Article 4: Membership

The Company shall have the following member(s):

- Name: ___________________________, Address: _______________________________, Capital Contribution: $_________, Percentage of Ownership: _____%

- Name: ___________________________, Address: _______________________________, Capital Contribution: $_________, Percentage of Ownership: _____%

Article 5: Management

Management of the Company is vested in the member(s). Each member shall have authority to bind the Company in making decisions regarding the Company's business operations consistent with the purpose set forth in Article 3.

Article 6: Capital Contributions

Members have contributed capital to the Company as described in Article 4. Additional contributions shall be made only upon the mutual agreement of all members. No interest shall be paid on initial or subsequent contributions to the capital of the Company.

Article 7: Distributions

Distributions of the Company's assets shall be made to the members annually, or more frequently, as agreed upon by the members. Distributions shall be made in proportion to each member’s percentage of ownership in the Company.

Article 8: Membership Changes

Changes to the Company's membership, including the addition of new members or the departure of existing members, shall be made in accordance with the terms outlined in this Agreement and the governing laws of New Hampshire.

Article 9: Dissolution

The Company may be dissolved upon the agreement of _____________% of the membership interest. Upon dissolution, the Company's assets shall be liquidated, debts paid, and the remaining assets distributed to the members according to their respective ownership percentages.

Article 10: Governing Law

This Agreement and the rights of the members under this Agreement shall be governed by and interpreted in accordance with the laws of the State of New Hampshire, without regard to its conflict of laws principles.

Article 11: Amendments

This Agreement may only be amended with the written consent of all members. Any amendments made to this Agreement must be in writing and signed by all members.

Article 12: Signatures

In witness whereof, the undersigned have executed this Operating Agreement as of the effective date first above written.

Member Name: _______________________________ Signature: _______________________________ Date: _____________

Member Name: _______________________________ Signature: _______________________________ Date: _____________

File Information

| Fact | Detail |

|---|---|

| 1. Definition | An Operating Agreement is a legal document outlining the governing structure and operating procedures of an LLC in New Hampshire. |

| 2. Legal Requirement | While not legally required in New Hampshire, creating an Operating Agreement is highly recommended. |

| 3. Functionality | It details the rights, powers, duties, liabilities, and obligations of the members among themselves and with respect to the LLC. | >

| 4. Flexibility | The agreement allows for the customization of the financial and working relationships of the members in a way that suits the specific needs of the business. | 5. Liability Protection | It can enhance the liability protection of the LLC by clearly separating the business from the personal assets of the members. |

| 6. Record Keeping | Serves as an important internal document for record-keeping purposes and helps to resolve any future disputes among members. |

| 7. Governing Law | The New Hampshire Revised Statutes Annotated (RSA) 304-C is the governing law for Operating Agreements in New Hampshire. |

| 8. Amendment Procedure | The agreement should include a provision outlining the method by which it can be amended, typically requiring a majority or unanimous vote by the members. |

Detailed Instructions for Writing New Hampshire Operating Agreement

Filling out the New Hampshire Operating Agreement is a critical step for any LLC operating within the state. It outlines the structure, operations, and management of the business, ensuring a clear understanding and agreement among its members. This guide will walk you through the necessary steps to complete this form correctly and efficiently. While this document does not directly impact your status with the state, it is vital for internal documentation and the smooth operation of your LLC.

- Gather all required information about your LLC, including its official name, address, and the names and addresses of all members.

- Decide on the LLC's management structure (member-managed or manager-managed) and clearly indicate this choice on the form.

- Detail the contributions of each member, whether in cash, property, or services, and document this in the agreement.

- Outline the process for admitting new members, including any contributions they must make and how their admission affects existing percentage allocations.

- Specify the distribution of profits and losses among members. This should be in proportion to each member’s contribution, unless agreed otherwise.

- Define the decision-making process, including what constitutes a majority vote and the voting rights of each member.

- Describe the procedure for transferring membership interest, whether due to a member's death, withdrawal, or sale of interest.

- Establish a process for dissolving the LLC, including how assets will be distributed among members after debts and obligations are settled.

- Review the entire agreement to ensure accuracy and completeness. It’s beneficial to have a legal professional review the document.

- Have all members sign the agreement. Each member should keep a copy for their records.

Once completed, the Operating Agreement serves as a critical blueprint for your LLC, guiding its operations and member interactions. While New Hampshire does not require submission of this document, it should be kept up-to-date and readily available should any disputes arise between members or with external parties.

Essential Queries on New Hampshire Operating Agreement

What is an Operating Agreement and why is it important in New Hampshire?

An Operating Agreement is a key document used by LLCs that outlines the business' financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners. In New Hampshire, while not legally required, having an Operating Agreement is critically important as it helps to ensure that your business operates according to your own rules and procedures rather than default state laws. Moreover, it adds a layer of protection for the LLC members against personal liability.

Do all members of an LLC need to sign the Operating Agreement in New Hampshire?

Yes, ideally, all members of an LLC should review and sign the Operating Agreement. This ensures that all members have agreed to the terms and conditions laid out in the agreement, which governs the operation of the LLC. Signing the agreement collectively also strengthens its enforceability should disputes arise among members.

Can the Operating Agreement be modified, and if so, how?

Yes, the Operating Agreement can be modified. The process for making amendments should ideally be outlined within the agreement itself. Typically, modifications require a certain percentage of member approval, as specified in the agreement. To amend the agreement, the changes should be proposed, discussed among members, and then voted on. Approved amendments should be documented in writing and signed by all members to become effective.

What happens if an LLC in New Hampshire operates without an Operating Agreement?

While not strictly required, operating an LLC without an Operating Agreement in New Hampshire exposes the business and its members to potential risks. Without this agreement, the LLC and its members are subject to default state laws that may not align with the members' preferences for the business operation. This can lead to misunderstandings, disputes among members, and could complicate financial and management decisions. Additionally, the lack of an Operating Agreement could impact the LLC's ability to prove separation between the members and the business, which is crucial for protecting members' personal assets from business liabilities.

Are there any specific clauses that should be included in a New Hampshire Operating Agreement?

While the content of an Operating Agreement can vary according to the business needs, certain clauses are beneficial to include to ensure clarity and comprehensive governance. Key clauses to consider are: provisions for membership, including the addition or withdrawal of members; management structure and voting rights; profit and loss distribution; procedures for amending the agreement; and dissolution processes. Including these key areas can help prevent disputes and provide clear guidance for the operation and eventual winding down of the LLC.

Common mistakes

Filling out the New Hampshire Operating Agreement form is a critical step for any Limited Liability Company (LLC) operating within the state. This document serves as a roadmap guiding the company's operations, management, and ownership structure. However, individuals often encounter difficulties leading to common mistakes. Recognizing and avoiding these errors ensures the establishment of a strong foundation for the business.

Not fully customizing the agreement to fit specific business needs. A generic or "one-size-fits-all" approach may fail to cover unique aspects of the business, leaving gaps in the agreement that could lead to disputes or legal complications down the line.

Skipping important provisions. Every LLC's Operating Agreement should include clear, detailed sections on profit distribution, member responsibilities, and what happens if a member decides to leave the LLC. Missing out on these key provisions can result in uncertainties and conflicts among members.

Ignoring state-specific requirements. New Hampshire has its own legal requirements for LLCs that need to be reflected in the Operating Agreement. Failing to incorporate these state-specific guidelines can make the agreement invalid or ineffective.

Failing to update the agreement. As the business evolves, so too should the Operating Agreement. Not updating this document to reflect changes in membership, management, or business operations can cause discrepancies and legal issues.

Overcomplicating the language. Utilizing overly complex legal jargon can make the agreement difficult to understand for LLC members, especially those without a legal background. This can lead to misunderstandings and misinterpretations of the terms.

Omitting dispute resolution methods. In the event of a disagreement between members, having a predefined method for dispute resolution enshrined in the Operating Agreement can save time, preserve relationships, and prevent costly litigation. Neglecting to include such measures is a common oversight.

Conclusion: Crafting a thorough and tailored New Hampshire Operating Agreement requires attention to detail and an understanding of the state's specific legal landscape. By avoiding these common mistakes, LLC members can protect their interests, clarify their responsibilities, and provide a solid framework for the resolution of any potential disputes. It's advisable for individuals to seek legal guidance to ensure their Operating Agreement accurately reflects their business's needs and complies with New Hampshire law.

Documents used along the form

In the process of establishing a Limited Liability Company (LLC) in New Hampshire, an Operating Agreement serves as a critical document outlining the operational procedures and rules that the company agrees to follow. However, alongside the Operating Agreement, there are several other important forms and documents that business owners should be aware of to ensure compliance with state laws and to protect their legal rights. The following list provides an overview of six such documents frequently used in conjunction with the New Hampshire Operating Agreement.

- Articles of Organization: This is the primary document required to form an LLC in New Hampshire. It is filed with the state to officially register the LLC. The Articles of Organization outline basic information about the LLC, such as its name, purpose, registered agent, and the names of its members.

- Employer Identification Number (EIN) Application: Obtained from the Internal Revenue Service (IRS), the EIN is essentially a social security number for the business. It is necessary for filing taxes, opening business bank accounts, and hiring employees.

- Membership Certificates: These certificates serve as physical evidence of ownership in the LLC. They indicate how much of the company each member owns and are akin to stock certificates in a corporation.

- Operating Agreement Amendment Form: When members of an LLC decide to make changes to the Operating Agreement, this form is used to legally document those changes. It ensures that all members agree to the adjustments and understand their new rights and responsibilities.

- Annual Report: Many states require LLCs to file an annual report with the Secretary of State or similar agency. This report typically updates the state on crucial information regarding the LLC, such as its registered agent, address, and the names and addresses of its members.

- Dissolution Form: If the members decide to terminate their LLC, a Dissolution Form must be filed with the state. This document formalizes the closing of the business with the state and outlines the steps taken to dissolve the LLC, such as paying debts and distributing assets.

Together, these documents and forms play vital roles in the formation, operation, and dissolution of an LLC in New Hampshire. By ensuring that these materials are correctly completed and duly filed, LLC members can protect their legal interests and facilitate the smooth operation of their business. It's advisable for business owners to seek guidance from legal professionals or consult state resources to understand the specific requirements and implications of each document.

Similar forms

The New Hampshire Operating Agreement form is similar to other documents used in the setup and operation of a business, each serving distinct roles but overlapping in purpose and content. These documents, critical for defining the structure and governance of business entities, offer guidelines for managerial decisions, allocation of profits and losses, and the rights and responsibilities of parties involved. The Operating Agreement itself, specifically used by Limited Liability Companies (LLCs) in New Hampshire, shares commonalities with various other key business documents.

Articles of Organization: The Operating Agreement has similarities to the Articles of Organization, the document required to legally establish an LLC in most states. While the Articles of Organization are filed with the state and lay out basic information about the company for public record (such as the LLC's name, address, and the names of its members), the Operating Agreement delves deeper. It covers the internal operations of the LLC, including management structure, voting rights, and processes for adding or removing members, aspects not typically addressed in the Articles of Organization.

Partnership Agreement: Another document bearing similarity to the New Hampshire Operating Agreement is the Partnership Agreement, used by businesses formed as partnerships. Both types of agreements outline the business structure, capital contributions, and distribution of profits and losses among the business owners. However, a key distinction lies in their application to different forms of business entities; the Partnership Agreement is used by partnerships, whereas the Operating Agreement is specific to LLCs. Both serve to prevent conflicts among the owners by detailing the rights and responsibilities of each party.

Shareholders' Agreement: Also similar to an Operating Agreement is the Shareholders' Agreement used in corporations. This document outlines how the corporation will be run, the rights and obligations of the shareholders, and how shares can be bought and sold. Like the Operating Agreement, it includes provisions for the governance of the business entity, protection of minority shareholders, and procedures for resolving disputes. While serving different types of business entities—a Shareholders' Agreement for corporations and an Operating Agreement for LLCs—both documents aim to ensure smooth internal operations and minimize conflicts among owners.

Dos and Don'ts

When filling out the New Hampshire Operating Agreement form, members and managers of a Limited Liability Company (LLC) establish the governance and operational structure of their business. This document, while not required by the state of New Hampshire, is crucial for clarifying business operations and preventing misunderstandings among members. Below are 10 critical do's and don'ts to keep in mind when completing this form:

Do:- Review New Hampshire's specific requirements for LLCs to ensure your Operating Agreement complies with state laws.

- Gather all necessary information about your LLC, including the business name, principal place of business, and names of members before starting.

- Clearly define the roles, rights, and responsibilities of each member to avoid potential disputes.

- Include provisions for the distribution of profits and losses, which reflect the agreement among members.

- Outline the process for admitting new members and the exit process for current members.

- Discuss and include dispute resolution mechanisms within the agreement.

- Draft and fill out the Operating Agreement with attention to detail to avoid any ambiguities.

- Ensure that all members review the Operating Agreement thoroughly before signing.

- Keep the Operating Agreement in a safe, accessible place after all members sign it.

- Review and update the Operating Agreement as needed to reflect changes in the LLC or its operation.

- Overlook the importance of a written Operating Agreement, even though it's not required by New Hampshire state law.

- Use vague language that could lead to interpretation disputes among members later on.

- Forget to detail the financial contributions of each member and how additional contributions will be handled.

- Ignore setting clear rules for decision-making processes, including voting rights and quorum requirements.

- Skip the inclusion of how profits and losses will be distributed among members.

- Assume all members understand the terms and conditions of the Operating Agreement without discussing it as a group.

- Rely solely on generic Operating Agreement templates without customizing them to fit your LLC's specific needs.

- Leave out provisions for the dissolution of the LLC, should that become necessary.

- Fail to have all members sign the Operating Agreement, as each signature is critical for its enforcement.

- Miss the opportunity to consult with a legal professional when drafting the Operating Agreement, especially for complex arrangements.

Misconceptions

When it comes to the New Hampshire Operating Agreement form, there are several common misconceptions that may lead business owners astray. Operating Agreements are important documents for Limited Liability Companies (LLCs) as they outline the operational structure and financial arrangements of the business. Understanding these misconceptions is key to ensuring that your LLC operates effectively and in compliance with state laws.

It's not legally required, so it's not important. Even though New Hampshire does not legally require an LLC to have an Operating Agreement, it is still incredibly important. It helps protect your limited liability status, prevents misunderstandings among owners, and gives you more control over your business.

One size fits all. Many people think they can just download a template and that will suffice. Operating Agreements should be tailored to the specific needs and structure of your LLC. A generic form may not cover all the nuances and unique agreements among members.

Only multi-member LLCs need an Operating Agreement. Single-member LLCs also benefit from having an Operating Agreement. It adds credibility, helps in financial and legal situations, and provides a framework for running your business.

You can wait to create it until you need it. Waiting until a conflict arises or when a legal issue is at your doorstep is too late. An Operating Agreement should be one of the first documents you create as it sets clear expectations and roles from the beginning.

The terms set in the Operating Agreement are set in stone. Actually, Operating Agreements can be amended as your LLC grows and changes. It's wise to revisit and possibly revise this document periodically to ensure it still reflects the current operation and ownership structure of your LLC.

Any changes to the Operating Agreement need to be filed with the state. While it's important to keep your Operating Agreement updated, these changes do not need to be filed with the state of New Hampshire. However, keeping all members informed of any amendments is crucial.

The Operating Agreement isn't important for obtaining financing. Lenders often request to see your Operating Agreement as part of their due diligence. A well-structured agreement can enhance your credibility and demonstrate the stability and organization of your LLC.

If my business partner and I agree on everything, we don't need an Operating Agreement. No matter how well you get along with your business partner, disagreements can occur. An Operating Agreement serves as a valuable tool for resolving disputes and clarifying any misunderstandings.

By dispelling these misconceptions and understanding the importance of a customized New Hampshire Operating Agreement, you can ensure your business operates smoothly and is prepared for future growth and challenges.

Key takeaways

When business owners in New Hampshire decide to form a Limited Liability Company (LLC), creating an Operating Agreement is a critical step in establishing the governance structure and operational framework of their business. The Operating Agreement, although not legally required in New Hampshire, serves as a comprehensive document that outlines the procedures, policies, and dispute resolution methods for the LLC. Here are seven key takeaways about filling out and using the New Hampshire Operating Agreement form:

- It's not mandated by state law, but highly recommended. Even though New Hampshire law doesn't require LLCs to have an Operating Agreement, having one in place can provide clarity and protect the business owners’ personal assets from legal disputes.

- Customization is key. The Operating Agreement should be tailored to the specific needs and structure of your LLC. It’s important to ensure that it accurately reflects the agreement among the members regarding the operation and management of the LLC.

- Detail the ownership structure. Clearly outline each member's ownership percentage, which is typically proportionate to their investment in the LLC. This section should include how profits and losses are distributed among members.

- Define management roles. Specify whether your LLC will be member-managed or manager-managed, and describe the duties and powers of the managers or managing members.

- Voting rights and procedures must be identified. It’s crucial to establish how decisions are made within the LLC, including what constitutes a quorum, the required majority for routine decisions, and any decisions requiring a unanimous vote.

- Include provisions for adding or removing members. The agreement should detail the process for changes in membership, including how new members can join the LLC and under what circumstances a member can be removed.

- Detail the dissolution process. Outline the conditions under which the LLC may be dissolved and the steps to be taken during the dissolution process, including the distribution of assets.

Comprehensively addressing these areas in your New Hampshire Operating Agreement form can mitigate potential conflicts and provide a clear framework for the operation of your LLC. It’s advisable to consult with a legal professional to ensure that the Operating Agreement is properly drafted and that it complies with New Hampshire laws and regulations.

Other New Hampshire Templates

Dnar Meaning - An advance directive focusing on the refusal of CPR in life-threatening situations.

Promissory Note Friendly Loan Agreement Format - The form includes key details such as the loan amount, interest rate, repayment schedule, and any collateral.