Nhjb 2117 P Template

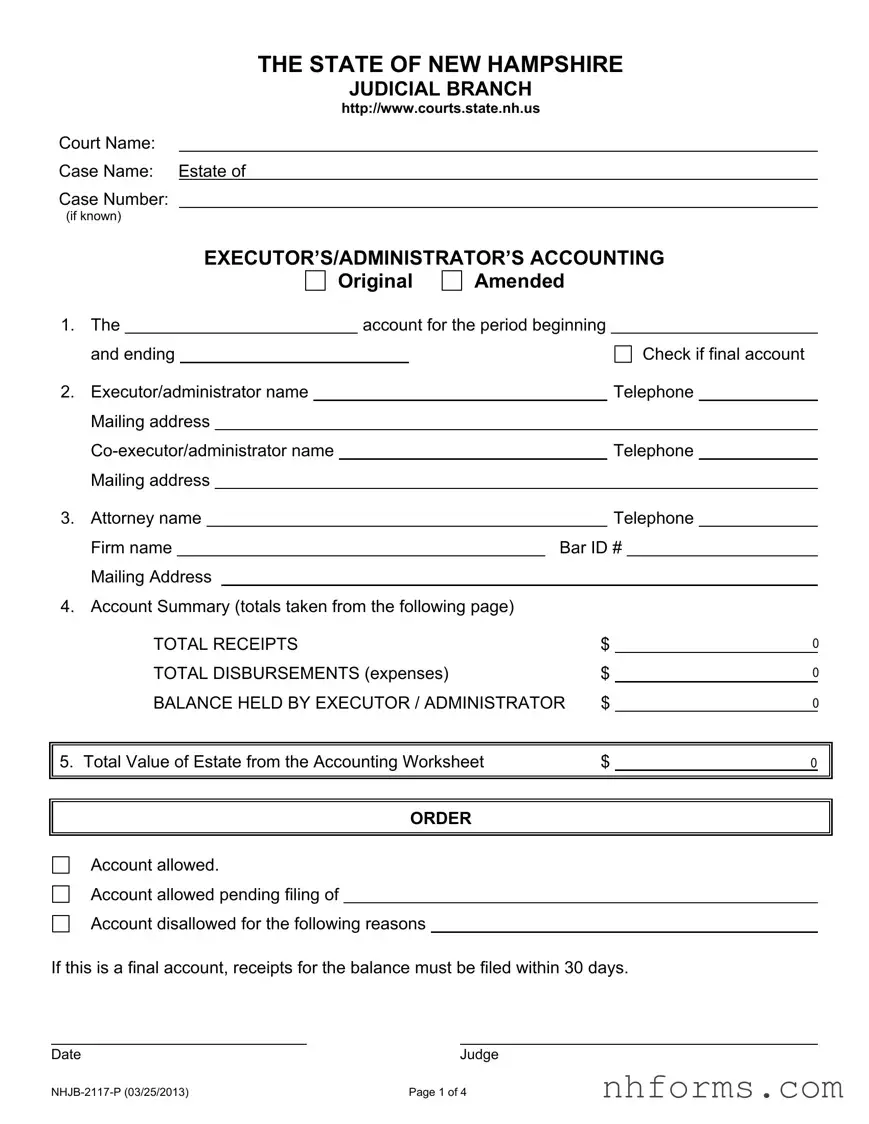

In navigating the complexities associated with managing an estate after someone passes away, having clear guidance and structure is invaluable. The NHJB-2117-P form, issued by the State of New Hampshire Judicial Branch, serves this very purpose for executors and administrators tasked with this responsibility. This detailed document functions as an essential tool for recording both the financial inflows and outflows within the estate. It requires a comprehensive account to be provided, starting from an initial summary of the estate's value to the recording of every transaction made during the administration period. Information such as the executor’s or administrator’s personal details, attorney information, and a broad categorization of receipts and disbursements need to be systematically reported. The form takes into account various aspects of estate management, including the sale of personal and real property, income on investments, administrative expenses, and disbursements made to beneficiaries. Importantly, it includes sections for the reporting of the final balances held, along with a declaration regarding the complete and accurate reporting of the estate's financial activities. Additionally, the form serves as a legal document that, upon submission, undergoes a review by a judge who then decides on its approval, modification, or rejection based on the presented information and existing legal standards. This process underscores the necessity of precise and truthful accounting to ensure the equitable distribution of the deceased’s assets in accordance with their will or state law if no will exists. Furthermore, the NHJB-2117-P form provides space for reporting significant transactions that don't affect the amount for which the executor or administrator is accountable, ensuring a comprehensive view of the estate's financial undertakings throughout the administration process.

Document Preview Example

THE STATE OF NEW HAMPSHIRE

JUDICIAL BRANCH

http://www.courts.state.nh.us

Court Name:

Case Name: Estate of

Case Number:

(if known)

|

|

|

|

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING |

|||||||||||||

|

|

|

|

|

|

|

|

|

Original |

Amended |

|||||||

1. |

The |

|

|

account for the period beginning |

|

||||||||||||

|

and ending |

|

|

|

|

|

|

|

|

Check if final account |

|||||||

2. |

Executor/administrator name |

|

|

|

|

|

|

|

Telephone |

|

|||||||

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Telephone |

||||||||||

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

||||||

3. |

Attorney name |

|

|

|

|

|

|

|

Telephone |

|

|||||||

|

Firm name |

|

|

|

|

|

Bar ID # |

|

|||||||||

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

||||||

4. |

Account Summary (totals taken from the following page) |

||||||||||||||||

TOTAL RECEIPTS |

$ |

TOTAL DISBURSEMENTS (expenses) |

$ |

BALANCE HELD BY EXECUTOR / ADMINISTRATOR |

$ |

5. Total Value of Estate from the Accounting Worksheet |

$ |

ORDER |

|

Account allowed. |

|

Account allowed pending filing of |

|

Account disallowed for the following reasons |

|

0

0

0

0

If this is a final account, receipts for the balance must be filed within 30 days.

Date |

Judge |

Page 1 of 4 |

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

6.RECEIPTS

Schedule A – Inventory Total of Personal Estate or

Balance held at Prior Accounting |

$ |

On a separate sheet of paper, list all the personal estate (but not real estate) that was listed on the Inventory form. For accounts other than the first account, list each item included in Schedule 9 of the prior accounting.

Schedule B – Net Gains (or losses) on Sales/Other Dispositions |

$ |

|

|

On a separate sheet of paper, list the Inventory value and sale |

|

|

|

price for any asset sold (other than real estate), and show the difference |

|

|

|

between the two amounts. Also list the date of the sale. |

|

|

|

Schedule C – Income on all personal property, including dividends, |

|

|

|

during accounting period |

$ |

|

|

On a separate sheet of paper, list all income including dividends |

|

|

|

and interest received during this accounting period. List the |

|

|

|

individual amounts and date each was received. |

|

|

|

Schedule D – Cash received from sale of real estate |

$ |

|

|

If real estate was listed on the Inventory, and has been sold during |

|

|

|

this accounting period, on a separate sheet of paper list the address |

|

|

|

of the real estate, sale price, amounts deducted from sale price, |

|

|

|

amount received by the estate, and the date of sale. (May also attach |

|

|

|

a copy of the HUD settlement statement.) |

|

|

|

Schedule E – Cash collected on rents of real estate |

$ |

|

|

If real estate was listed on the Inventory, and was not sold but rent |

|

|

|

was collected during this account period, on a separate sheet of paper, |

|

|

|

list the amount collected and the months for which the rent was collected. |

|

|

|

Schedule F – Personal estate not listed on the Inventory |

$ |

|

|

On a separate sheet of paper, list each asset that was not listed on the |

|

|

|

Inventory with an explanation as to why it was not listed. Also list |

|

|

|

the description and value for each asset. |

|

|

|

Schedule G – Money advanced or contributed to estate |

$ |

|

|

On a separate sheet of paper, list the name of the person who |

|

|

|

gave money to the estate, the amount and date given. |

|

|

|

TOTAL RECEIPTS (Schedules A - G) |

$ |

0 |

|

Add the amounts in Schedules A through G. Also enter this amount |

|

|

|

on Page 1, #4. |

|

|

|

Page 2 of 4 |

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

7. DISBURSEMENTS (expenses) |

|

|

|

|

|

|

|

Schedule 1 – Administrative expenses including taxes |

$ |

|

|

|

|||

Administrative expenses are all expenses incurred in administering the |

|

|

|

||||

estate, such as filing fees, publication fees, bond premiums, etc. On a |

|

|

|

||||

separate sheet of paper, list the date paid, each expense and the amount. |

|

|

|

||||

Schedule 2– Attorney and Fiduciary Fees |

|

|

|

|

|

||

Total Fees (show breakdown below) |

$ |

0 |

|||||

Attorney fees $ |

|

Exec / Admin fees |

$ |

|

|

|

|

Prior fees allowed to date: |

|

|

|

|

|

|

|

Attorney fees $ |

|

Exec / Admin fees |

$ |

|

|

|

|

Probate rules require fees to be shown in summary form. |

|

|

|

|

|

||

This summary is sufficient unless the Court requires further detail. |

|

|

|

||||

Schedule 3– Funeral and burial expenses |

$ |

|

|

|

|||

List all funeral and burial expenses, the amount and the date paid.

Schedule 4– Paid spouse's allowance out of personal estate |

$ |

If a Motion for Spousal Allowance has been filed and granted by the court, on a separate sheet of paper, list the name of the spouse, amount disbursed and the date Motion was granted by the court. If Receipt (Form

Schedule 5– Debts, including expenses of last sickness |

$ |

On a separate sheet of paper, list all debts and/or claims paid during this accounting period that existed prior to death. List the last sickness expenses individually. List the amount paid, the date of payment and to whom the payment was made.

Schedule 6 – Distribution to legatees, not residuary legatees .... $

On a separate sheet of paper, list each person who received specific bequests under the will. List name, amount received or item received and its value. If Receipts (Form

Schedule 7 – Interim distributions made with prior court approval $

If a Motion for Distribution was filed and granted by the court during this accounting period, you must list the names that were on the Motion, the amounts distributed, and date the Motion was granted by the court. If Receipts (Form

Schedule 8 – Other Disbursements |

$ |

|

|

On a separate sheet of paper, list any other disbursements not listed in |

|

|

|

Schedules 1 through 7 above. List the amount disbursed, date it was |

|

|

|

disbursed and the name of the person receiving the disbursement. |

|

|

|

TOTAL DISBURSEMENTS (Schedules 1 - 8) |

$ |

0 |

|

Add the amounts in Schedules 1 through 8. Also enter this amount |

|

|

|

on Page 1, #4. |

|

|

|

Page 3 of 4 |

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

8. SCHEDULE 9– BALANCE HELD BY EXECUTOR / ADMINISTRATOR |

|

|

(Total Receipts minus Total Disbursements) |

$ |

0 |

On a separate sheet of paper, list all the assets, except real estate, Remaining in the estate and the value of each asset. If there is no will, a Motion for Order of Distribution

9.Is an information schedule pursuant to Probate Rule 108(E) attached to this accounting?

Yes

Yes

No

No

10.Have all Federal and State Income Tax Returns of the deceased for the period ending with

his/her death been filed and the related taxes paid? |

Yes |

No |

11. Have all Federal and State Income Tax Returns of the Estate, which are due at the time of filing

this account, been filed and the related taxes paid? |

Yes |

No |

12.Have there been any changes to the beneficiaries of the estate or have any of the beneficiaries’ addresses changed? 0 Yes 0 No If yes, on a separate sheet of paper, list those changes. If any beneficiary has died, attach a death certificate for that person.

13.The undersigned hereby represent(s) that the above accounting is true and accurate to the best of his/her/their knowledge and belief, and certifies that the following has been sent to all persons beneficially interested in this account and all parties appearing of record: a copy of the account which includes a notice to beneficially interested parties stating that the account may be approved unless a written objection is filed within 30 days after the date the account is filed in the probate court.

I state that on this date I provided this document(s) to the parties who have filed an appearance for

this case or who are otherwise interested parties by: |

OR |

US Mail OR |

||||||||||

Email |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

Executor/Adminis. Signature |

|

|

|||||||||

|

|

|

|

|

|

(must be signed in the presence of a Notarial Officer) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

Executor/Adminis. Signature |

|

|

|||||||||

|

|

|

|

|

|

(must be signed in the presence of a Notarial Officer) |

||||||

State of |

|

, County of |

|

|

|

|

|

|||||

This instrument was acknowledged before me on |

|

|

|

by |

|

|

|

|

||||

|

|

|

|

|

|

Date |

|

Executor/Administrator |

||||

My Commission Expires |

|

|

|

|

|

|

|

|

|

|||

Affix Seal, if any |

Signature of Notarial Officer / Title |

|||||||||||

IMPORTANT NOTICE

To Beneficially Interested Parties

This Account may be approved by the probate court unless a written objection, containing the specific factual or legal basis for the objection, is filed within 30 days after the date the Account is filed in the probate division. Failure to file an objection may forfeit your right to a hearing concerning the Account or your objection, and the probate division may then act without a hearing or any further notice to you.

ASSENT and WAIVER OF NOTICE

If all the parties interested in the account want to certify that they have examined the account, find it correct and request that it be allowed without further notice to them, please complete an “Assent” form

Page 4 of 4 |

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

ACCOUNTING WORKSHEET

To Calculate Total Value of Estate (Page 1, Item #5)

and use for determining any court fees.

1. |

Total Value of Entire Estate |

$ |

|

|

For this amount, see Inventory or Amended Inventory, page 1, section 6C. |

|

|

2. |

Personal estate not inventoried and other receipts (current) |

$ |

0 |

|

For this amount, see this Accounting form, Section 6, Schedule F. |

|

|

3. |

Personal estate not inventoried and other receipts (previous) |

$ |

|

To calculate this amount, see all prior Accounting forms, Section 6, Schedule F.

4. TOTAL Value of Estate |

$ |

0 |

|

|

|

|

|

Add 1+2+3. Enter total on the line to the right and also enter this amount on Page 1, #5 of the Accounting form. Do not file this page with the court.

PROBATE DIVISION RULE 108(E).

The account shall show significant transactions that do not affect the amount for which the executor/administrator is accountable.

1.The schedule listing such transactions shall consist of an information schedule, which shall be set forth at the end of the other schedules required in an account, setting forth each transaction by a separate number.

2.All changes in investments not reflected as gains or losses reported on other schedules of receipts shall be listed. These would include, but not be limited to, stock dividends; stock splits; changes in name; exchanges; or reorganizations.

3.All new investments made within the accounting period, and in hand at the close thereof, shall be noted on the schedules of assets on hand at the close of the accounting period. Totally new investments, and increased or additional investments in the same investment as shown on the schedules of assets on hand at the beginning of the account period of the account, shall be separately designated or annotated.

4.With regard to book accounts, notes or installment obligations (whether secured or not), detail regarding collections or payments shall be provided to permit reconciliation of the balances shown on schedules of assets on hand at the beginning and the close of the accounting period.

5.The executor/administrator shall also report on the information schedule the details of any events causing or resulting in a change in the manner, method or course of the executor/administrator's administration. Such events would include, but not be limited to, death of an interim income beneficiary; shifting enjoyment of the income to another beneficiary; death of a remainderman during the course of administering an estate; or a beneficiary reaching a designated age, after which time the beneficiary has a right to mandate partial withdrawals of principal.

Do not file this page with the court.

Document Breakdown

| Fact | Description |

|---|---|

| Form Type | Executor’s/Administrator’s Accounting (NHJB-2117-P) |

| Purpose | To account for the financial activities undertaken by an executor or administrator of an estate. |

| Governing Law | New Hampshire Probate Laws |

| Final Account | The form allows for the indication of whether the account is final, requiring receipts for the balance to be filed within 30 days. |

| Components | Includes schedules for receipts, disbursements, and a summary of the estate’s value. |

| Requirement for Detail | Details of all transactions, including receipts and disbursements, must be provided on separate sheets of paper, organized by schedules indicated on the form. |

Detailed Instructions for Writing Nhjb 2117 P

After completing the NHJB 2117 P form, which pertains to executor’s or administrator’s accounting for an estate, the next steps involve the scrutiny of the filed account by the court and interested parties. Filing this form accurately is critical as it documents all financial transactions undertaken by the executor or administrator of the estate, including receipts, disbursements, and the balance held. Any inaccuracies or omissions can lead to objections from beneficiaries or further inquiries by the court. If objections are raised or inaccuracies found, the court may not approve the account until all issues are resolved. If it's a final account, and once approved by the court, the executor or administrator will be responsible for distributing the remaining assets according to the will or the law if there's no will. Filing this form is a significant step in the process of estate administration, ensuring legal compliance and diligence in managing and distributing the estate’s assets.

- Start by entering the Court Name where the estate is being processed.

- Fill in the Case Name

- Enter the Case Number if it is already known. This can be found on any previously filed court documents related to the estate.

- Indicate whether the accounting is Original or Amended and check if it's the final account.

- Provide the Executor/Administrator’s Name, Telephone, and Mailing Address. If there is a Co-executor/Administrator, enter their details as well.

- Enter the Attorney’s Name, Telephone, Firm Name, Bar ID#, and Mailing Address involved in the estate.

- Under Account Summary, input the Total Receipts, Total Disbursements, and the Balance Held by the Executor/Administrator. These totals will be taken from detailed calculations on the following pages.

- Fill in the Total Value of Estate from the Accounting Worksheet, which involves detailed calculations based on the estate's inventory and other financial activities.

- Attach separate sheets for Schedules A through G, detailing all receipts including inventory total, net gains or losses, income, cash received from sales, rents collected, further estate inputs, and money contributed to the estate.

- List Disbursements on separate sheets as instructed, covering administrative expenses, fees, funeral expenses, spouse's allowance, debts paid, distributions, and any other disbursements under Schedules 1 through 8.

- Calculate and enter the Balance Held by Executor/Administrator after subtracting total disbursements from total receipts. provide details on a separate sheet.

- Answer all Yes/No questions relating to additional schedules, tax returns filed, changes in beneficiaries, and verify that all required documents have been sent to interested parties.

- Confirm and sign the document in the presence of a Notarial Officer, providing the date and your printed name. The notarial officer must then acknowledge this before signing, dating, and possibly affixing their seal.

- Submit the completed NHJB 2117 P form, along with all required attachments and schedules, to the appropriate court.

Essential Queries on Nhjb 2117 P

What is the NHJB-2117-P form?

The NHJB-2117-P form, also known as the Executor's/Administrator's Accounting, is a document used in the state of New Hampshire within its Judicial Branch. This form is utilized by the executor or administrator of an estate to report all financial transactions related to the estate's administration, including receipts, disbursements, and the final balance held. It serves to provide a transparent record of how the estate's assets have been managed.

When should the NHJB-2117-P form be filed?

This form needs to be filed at periodic intervals as required by the probate court, as well as for the final accounting when the estate is ready to be closed. The initial accounting typically occurs after the executor or administrator has gathered all the estate's assets and begins managing them. Timing for subsequent filings varies based on court orders or the estate's needs.

Who is required to sign the NHJB-2117-P form?

The executor or administrator of the estate is required to sign this form. If there is a co-executor or co-administrator, they must also sign. Signatures must be made in the presence of a Notarial Officer to ensure authenticity. This formal acknowledgment is crucial for the form's acceptance by the probate court.

What information is needed to complete the NHJB-2117-P form?

To accurately fill out this form, detailed financial records of the estate are necessary. This includes an inventory of personal and, if applicable, real estate assets, details of any assets sold and the income generated, receipts for all disbursements including administrative expenses, taxes, debts, and distributions to beneficiaries. Accurate and complete records ensure that the report reflects a transparent and responsible administration of the estate.

Is there a specific format to follow when listing receipts and disbursements?

Yes, the form requires that receipts and disbursements be organized into specific schedules, such as receipts from the sale of assets, income on personal property, and administrative expenses. Each category has its designated schedule (A-G for receipts and 1-8 for disbursements) to maintain clarity and organization in reporting.

What should be done if the estate has more receipts or disbursements than what can be detailed in the provided schedules?

If the estate's financial transactions exceed the space provided in the form's schedules, additional sheets of paper should be attached to provide the necessary detail. Each attachment must clearly reference the schedule it complements to ensure easy review and understanding.

Can this form be used for both initial and final accountings?

Yes, the NHJB-2117-P form is designed to accommodate both initial and final accountings. There is a checkbox to indicate if the filing is a final account, signaling to the court that the estate is ready for closure pending any last obligations.

What steps should be taken if a final accounting is being filed?

For a final accounting, after filling out the NHJB-2117-P form and checking the final account box, the executor or administrator must ensure that all receipts for the estate balance are filed within 30 days. This is key to completing the estate's administration and discharging the executor/administrator from their duties.

What happens if the form is not filed on time or is incomplete?

Failing to file the form on time or submitting an incomplete form can lead to complications in estate administration, including delays and potential legal challenges. It is the executor's or administrator's responsibility to comply with deadlines and ensure the form is thoroughly completed to avoid these issues.

Are beneficiaries notified of the accounting?

Yes, the form requires that a copy of the completed accounting, along with a notice, be sent to all persons beneficially interested in the estate. This ensures transparency and provides beneficiaries an opportunity to review the accounting and file any objections within a specified period, typically 30 days after the account is filed with the probate court.

Common mistakes

Filling out legal documents can be tricky and the NHJB-2117-P form, used for executor or administrator accounting in the State of New Hampshire, is no exception. There are common pitfalls that people often encounter when completing this form. Being aware of these mistakes can help ensure the process goes as smoothly as possible.

One major mistake is the incomplete listing of assets and transactions. The form requires detailed accounts of receipts, disbursements, and the balance held by the executor or administrator. Each section, from Schedules A to G for receipts and 1 to 8 for disbursements, needs thorough documentation. Forgetting to list or incompletely listing items such as the personal estate from prior accounting (Schedule A) or money advanced to the estate (Schedule G) can cause significant issues. Similarly, on the disbursements side, not detailing out all administrative expenses or skipping the breakdown of legal and executor fees can raise red flags.

Another area prone to errors is the failure to properly document changes to the estate or beneficiaries. The form asks whether there have been changes to beneficiaries or their addresses and if all tax returns have been filed. Overlooking or inaccurately reporting these can lead to legal complications, potentially delaying the settlement of the estate. This oversight often stems from a lack of organization or updates throughout the estate management process.

- Inadequate detail in financial reporting: Every dollar accounted for needs a corresponding description. This includes accurately totaling the value of the estate and breaking down receipts and disbursements.

- Omission of required schedules or supplementary documents: The form necessitates various attachments detailing the assets, transactions, and any changes. Skipping these or failing to attach the right supporting documents can invalidate or delay the account's approval.

- Incorrect or incomplete beneficiary information: Any changes to beneficiaries or their statuses must be clearly documented, including the provision of death certificates where applicable.

- Lack of acknowledgement regarding notices and consents: Executors are responsible for informing interested parties about the accounting, a step which, if missed, can have legal repercussions.

These mistakes are avoidable with careful attention to detail and by thoroughly reviewing each section of the form before submission. Ultimately, the accuracy of this document impacts the swift and lawful management of an estate, underscoring the importance of filling it out diligently.

Documents used along the form

Completing the NHJB-2117-P form, also known as the Executor’s/Administrator’s Accounting form, is a crucial step in the process of managing an estate through the probate court in New Hampshire. This document helps to track the financial activities related to the estate, ensuring transparency and accountability. However, successfully navigating the probate process often requires more than just this form. Various other documents are typically used alongside the NHJB-2117-P to comprehensively address the estate's needs.

- Inventory Form (NHJB-2145-P): This document lists all personal and real property in the estate at the time of the decedent’s passing. It serves as the basis for understanding the estate's composition and value.

- Assent and Waiver of Notice (NHJB-2121-P): Utilized by beneficiaries or parties with an interest in the estate to acknowledge and agree upon actions proposed in probate filings without the need for a formal hearing.

- Petition for Estate Administration (NHJB-2141-P): Filed to initiate the administration process, this petition provides the court with information about the deceased, the estate, and the proposed executor or administrator.

- Motion for Distribution (NHJB-2128-P): This motion requests the court's approval to distribute assets of the estate to beneficiaries, either during the administration process or upon its conclusion.

- Notice to Creditors (NHJB-2134-P): Published in a local newspaper, this notice informs potential creditors of the estate about the administration process, giving them a chance to present any claims against the estate.

- Receipts (NHJB-2139-P): Completed by beneficiaries upon receiving their inheritance, these forms serve as proof that assets have been distributed according to the decedent's wishes or the court's orders.

- Final Account (NHJB-2122-P): Summarizes all financial transactions undertaken during the estate administration, marking the process's conclusion and requesting the court's approval to close the estate.

Together, these forms and documents streamline the probate process, ensuring clarity and conformity with legal requirements. The executor or administrator plays a pivotal role in compiling and filing these documents, often with the assistance of a lawyer. This collaborative effort ensures that the estate is managed effectively, respecting the decedent's final wishes and adhering to state laws.

Similar forms

The NHJB 2117 P form is similar to several other legal documents used in probate and estate administration. These documents share common purposes such as accounting for an estate's financial transactions, detailing assets and liabilities, and ensuring legal compliance throughout the administration of an estate. Below are examples of forms with similar functions:

- Inventory and Appraisement Form: Like the NHJB 2117 P form, an Inventory and Appraisement form is a key document in estate administration. It lists all the assets belonging to the estate at the time of the decedent’s death. Both documents are essential for providing a clear financial picture of the estate but differ in their specific focus; while the NHJB 2117 P form includes financial transactions and balances held by the executor or administrator, the Inventory and Appraisement form focuses more on quantifying and categorizing estate assets.

- Federal Estate Tax Return (Form 706): Although serving a different primary purpose, the Federal Estate Tax Return shares similarities with the NHJB 2117 P form, as it involves detailing the assets of the estate for tax assessment purposes. Both require thorough documentation of the estate's assets and transactions. However, the Federal Estate Tax Return is specifically designed for calculating any taxes owed to the IRS based on the estate's value, while the NHJB 2117 P form is broader, including accounting for receipts, disbursements, and the balance held by the administrator or executor.

- Accountings and Reports in Trust Administration: These documents, used by trustees to report on the administration of a trust, have objectives similar to those of the NHJB 2117 P form in estate administration. They require a detailed accounting of the trust's assets, liabilities, receipts, and disbursements over a reporting period. Both types of documents ensure transparency and accountability in the management of the assets held by an estate or trust, providing beneficiaries or interested parties with a comprehensive view of financial activities.

Dos and Don'ts

When completing the NHJB-2117-P form for Executor’s/Administrator’s Accounting, it’s important to approach it with attention to detail and accuracy. Below are four key things you should do, followed by four things you should avoid to ensure the process is smooth and effective.

Things You Should Do:

- Review all instructions carefully: Before you start filling out the form, make sure to thoroughly read through all the provided instructions. This ensures clarity on what information is required and how it should be presented.

- Gather necessary documents: Compile all relevant documents such as receipts, invoices, and bank statements ahead of time. These are crucial for accurately reporting the estate's financial activities.

- Use additional sheets when necessary: Given the complexity of estate accounting, you might need more space than what is provided in the form. Attach separate sheets as needed, ensuring they are clearly labeled and referenced in the main form.

- Double-check your entries: Before submitting the form, review your entries for accuracy. This includes verifying sums, checking the completeness of information, and ensuring that all required attachments are included.

Things You Shouldn’t Do:

- Rush through the form: Take your time to fill out the form meticulously. Rushing through it increases the risk of errors, which could lead to delays or questions from the court.

- Skip sections: Even if a section doesn’t apply, don’t leave it blank. Instead, write “N/A” (not applicable) to indicate you didn’t overlook it.

- Forget to list all assets and liabilities: It’s crucial to report all aspects of the estate’s finances, including any debts or assets not previously inventoried.

- Submit without checking for updates: Legal forms and requirements may change. Check for the most current version of the NHJB-2117-P form or any updated instructions before submitting.

By following these dos and don'ts, you can confidently complete the NHJB-2117-P form, helping to ensure the estate is accurately and efficiently managed.

Misconceptions

There are several misconceptions about filling out and filing the NHJB-2117-P form, which is used for Executor’s/Administrator’s Accounting in the estate management process. Understanding these misconceptions can help in correctly completing the form and avoiding common errors.

Misconception 1: "The NHJB-2117-P form is only for final accountings."

This is not true. While the form can be used for final accountings, it also accommodates original and amended accountings. Executors or administrators should indicate whether the account is original, amended, or final by checking the appropriate box on the form.Misconception 2: "Personal and real estate assets are reported together on the NHJB-2117-P form."

In reality, the form requires personal estate assets to be listed separately from real estate. Receipts from the sale of real estate, rent collected from real estate, and the personal estate that was not previously inventoried are listed on different schedules, ensuring a clear distinction between different types of assets.Misconception 3: "All detailed disbursements and receipts should be directly listed on the NHJB-2117-P form."

Instead, detailed lists of disbursements and receipts are to be attached on separate sheets of paper, as outlined in the various schedules. The form itself provides a summary and directs the executor or administrator to attach detailed accounts for each category, maintaining clarity and organization.Misconception 4: "Executor's or administrator's compensation is automatically approved with the account."

Executor or administrator fees and attorney fees must be clearly listed and are subject to court approval. These fees are summarized on the form, but the court may require further detail or documentation before approval.Misconception 5: "Once filed, the NHJB-2117-P form does not require further action from beneficiaries."

Beneficiaries have rights and may raise objections. The form includes an important notice to beneficiaries informing them that the account will be approved unless a written objection is filed within 30 days after the form is filed. Beneficiaries should review the account carefully and act within this timeframe if they have concerns.

Correctly understanding and addressing these misconceptions is crucial for the proper execution of an executor’s or administrator's duties in the estate management process.

Key takeaways

Understanding the NHJB-2117-P form, used for Executor’s/Administrator’s Accounting within the State of New Hampshire Judicial Branch, is crucial for accurately managing and reporting on an estate's financial activities. Here are some key takeaways regarding the completion and use of this form:

- Detailed Documentation: Executors or administrators must provide detailed accounting of the estate's financial transactions. This includes reporting all receipts, disbursements, and the balance held. Transparency and accuracy in these disclosures are imperative for complying with judicial expectations and ensuring the estate is managed according to legal standards.

- Supplemental Schedules Required: The form necessitates the attachment of supplemental schedules that detail the transactions within the estate. These schedules, covering everything from the inventory of personal estate to administrative expenses and distributions made, must be prepared carefully to provide a comprehensive view of the estate's financial dealings.

- Importance of Tracking Estate Value: The total value of the estate, calculated based on inventory and additional receipts or adjustments, plays a critical role in the accounting process as well as in determining any court fees that may apply. Keeping accurate records of these values is essential for both compliance and for informing interested parties about the estate’s status.

- Final Account Requirement: If the submitted account is final, it must be accompanied by receipts for the balance held, and these receipts need to be filed within 30 days. This step is crucial for closing out the estate's financial responsibilities in the eyes of the court.

- Tax Compliance Confirmation: Executors/Administrators are required to affirm that all Federal and State Income Tax Returns for the deceased and the estate have been filed and the taxes paid. Ensuring tax compliance is a significant aspect of estate administration that can influence the probate process.

- Change in Beneficiaries or Their Information: Any changes to beneficiaries or their information must be reported. This includes changes due to a beneficiary's death, which requires the attachment of a death certificate, ensuring that the estate's records remain up-to-date and reflective of current beneficiary statuses.

Completing the NHJB-2117-P form is a structured process that demands attention to detail and an understanding of the broader legal and financial implications. For executors and administrators, adhering to these requirements is part of fulfilling their fiduciary duties effectively, ensuring the estate is managed and distributed in accordance with the law and the decedent's wishes.

Different PDF Templates

Can I Get My W2 From the Irs - Child care providers must be at least 16 years of age and not reside in the same household as the child they are caring for.

Nh Criminal Records - The form serves as a formal request to the court to consider clearing an individual’s criminal record, allowing for potential relief and a clean slate.

New Hampshire Load - Details required for completing the form include vehicle type, total axles, and overall vehicle and load dimensions.