Nh Pa34 Template

Navigating forms from the New Hampshire Department of Revenue Administration can feel like a daunting task, but understanding the purpose and requirements of specific documents, such as the Nh Pa34 form, is essential for a smooth experience. This particular form plays a crucial role in the realm of tax documentation and compliance within the state. Designed to collect vital information, the Nh Pa34 form is a key piece in ensuring that both individuals and entities are aligning properly with New Hampshire's tax codes and regulations. With its repetitive mention indicating its importance, this form encapsulates a variety of data points essential for accurate tax processing and enforcement. As individuals embark on the journey to complete this form, they engage with a process that underscores their contribution to the state's financial infrastructure, emphasizing the interconnectedness of civic duties and state governance.

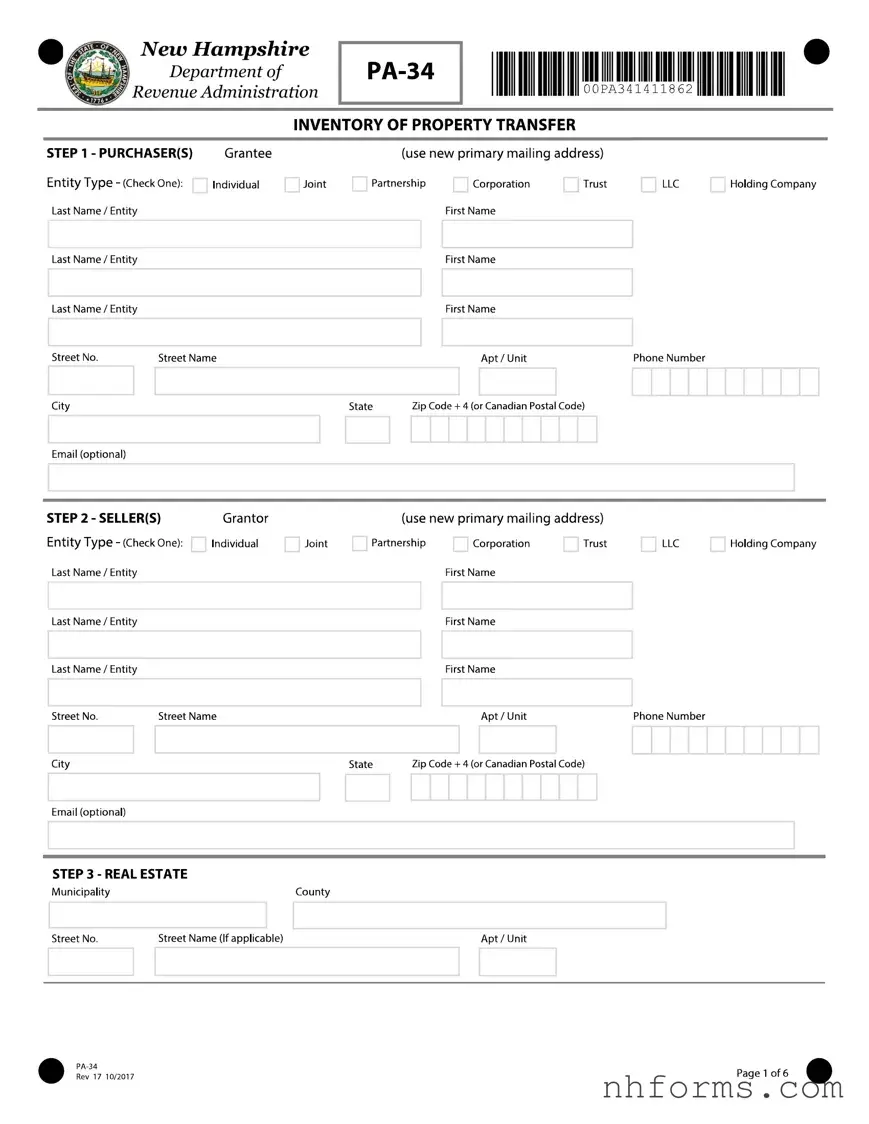

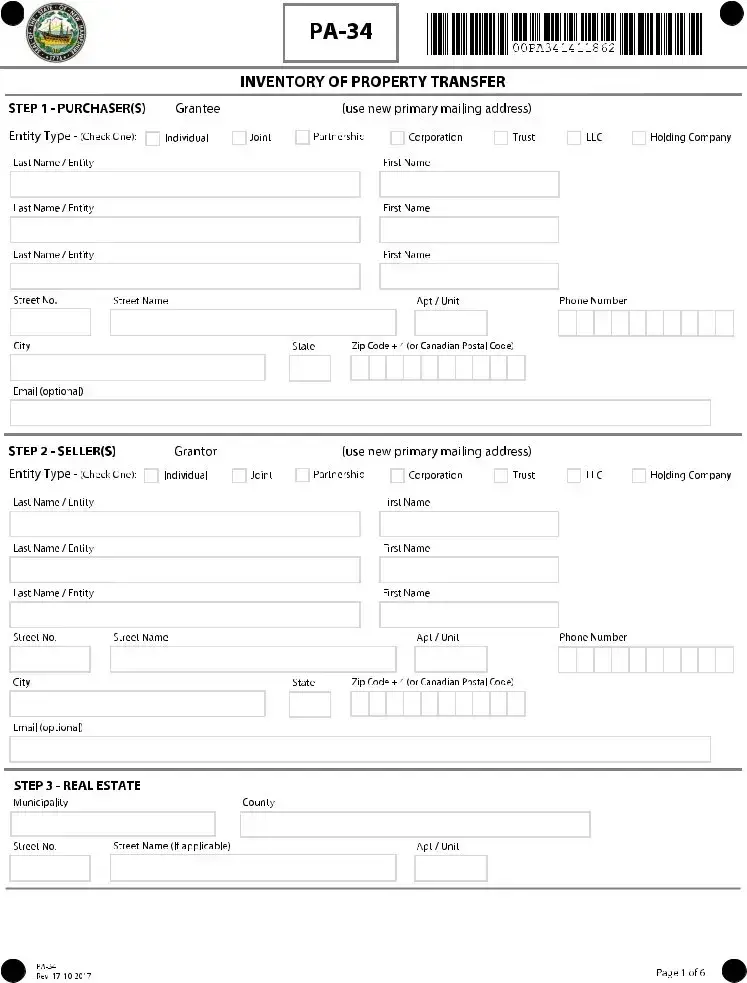

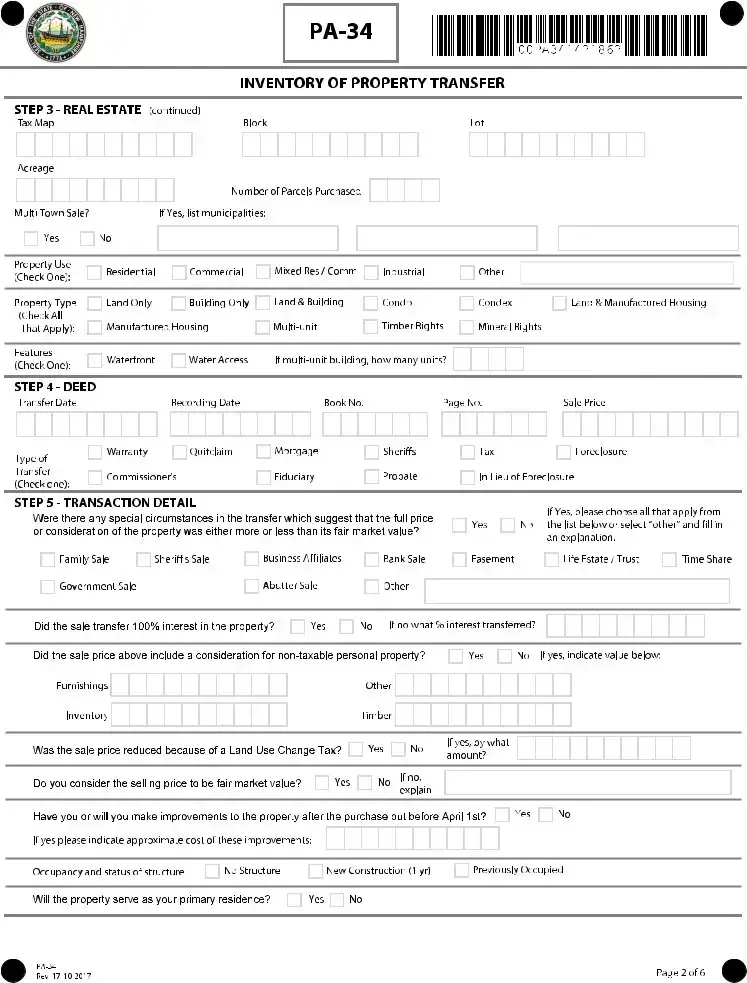

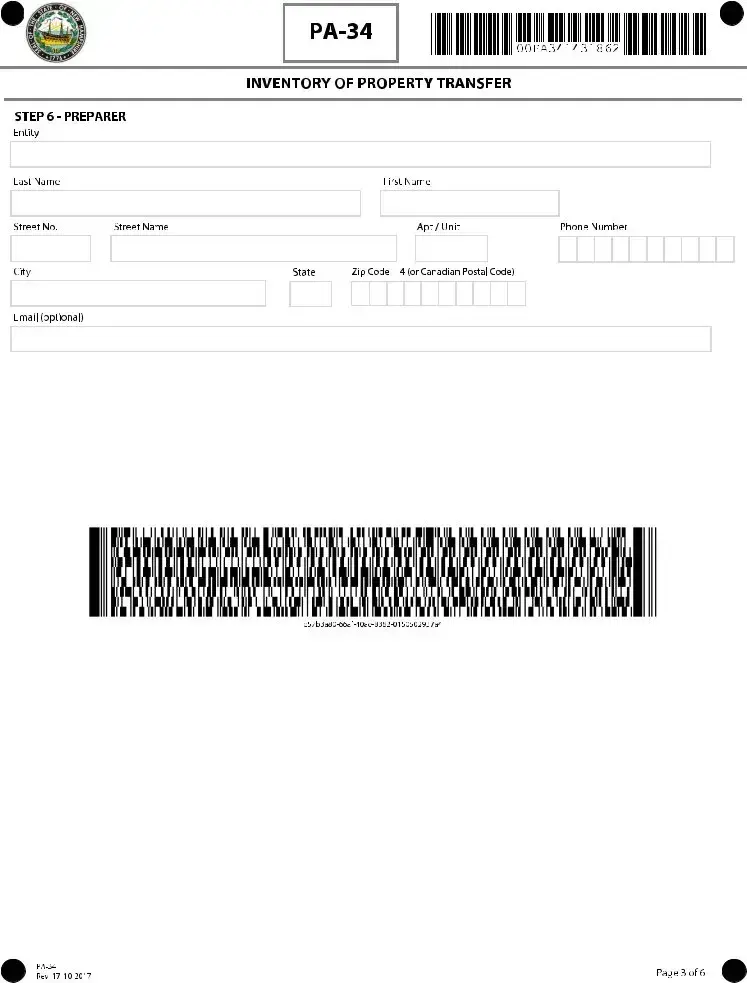

Document Preview Example

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

New Hampshire

Department of

Revenue Administration

Document Breakdown

| Fact | Description |

|---|---|

| 1. Form Name | NH PA-34 Form |

| 2. Also Known As | Inventory of Property Transfer Form |

| 3. Administering Agency | New Hampshire Department of Revenue Administration |

| 4. Primary Use | Used for reporting property transfers to the state. |

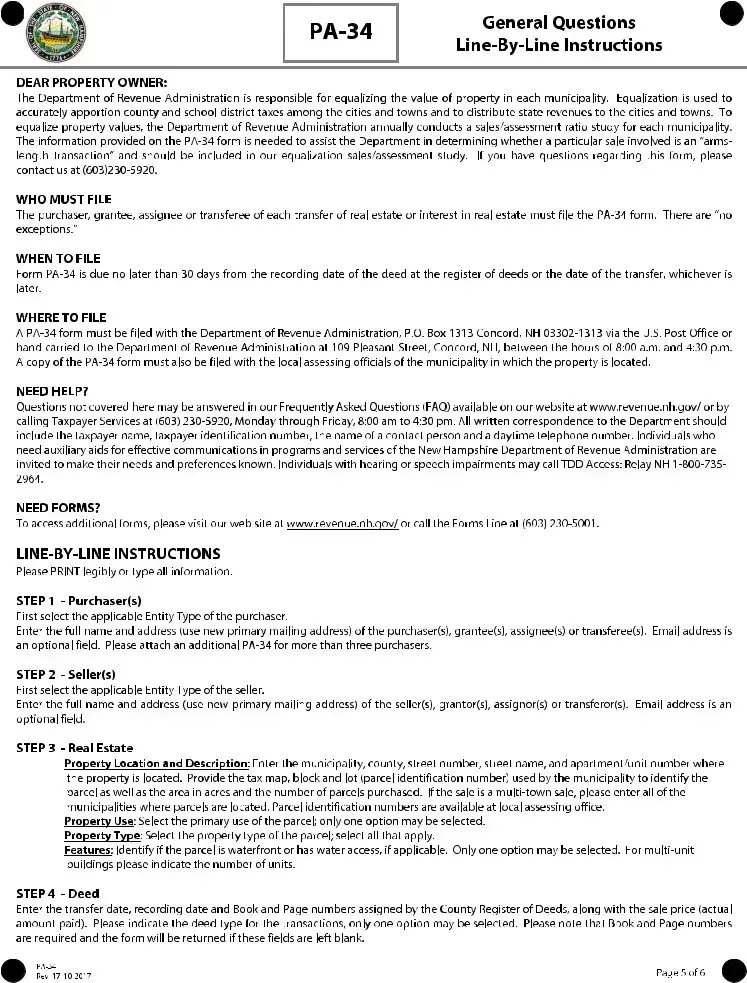

| 5. Who Must File | Individuals or entities transferring real estate located in New Hampshire. |

| 6. Filing Frequency | Filed with each qualifying real estate transaction. |

| 7. Governing Law(s) | New Hampshire Statutes related to property and revenue. |

| 8. Deadline | Due within 30 days of the property transfer. |

Detailed Instructions for Writing Nh Pa34

Upon completing the New Hampshire Department of Revenue Administration NH PA-34 form, the submitted information will undergo a review to ensure compliance with state regulations. This process is essential for individuals and entities to fulfill their reporting obligations correctly. Accuracy and attention to detail when filling out this form are crucial to avoid potential issues during the review process. The next steps after submission usually involve waiting for any communication from the Department, which may include requests for additional information or clarification. It's important to respond promptly to any such requests to ensure a smooth process.

- Begin by gathering all required information, including property identification and financial details that pertain to the reporting period.

- Head to the top section of the form and fill in your personal or entity information, such as name, address, and contact details.

- Locate the section designated for property information. Enter all relevant details, including property location, identification number(s), and ownership information.

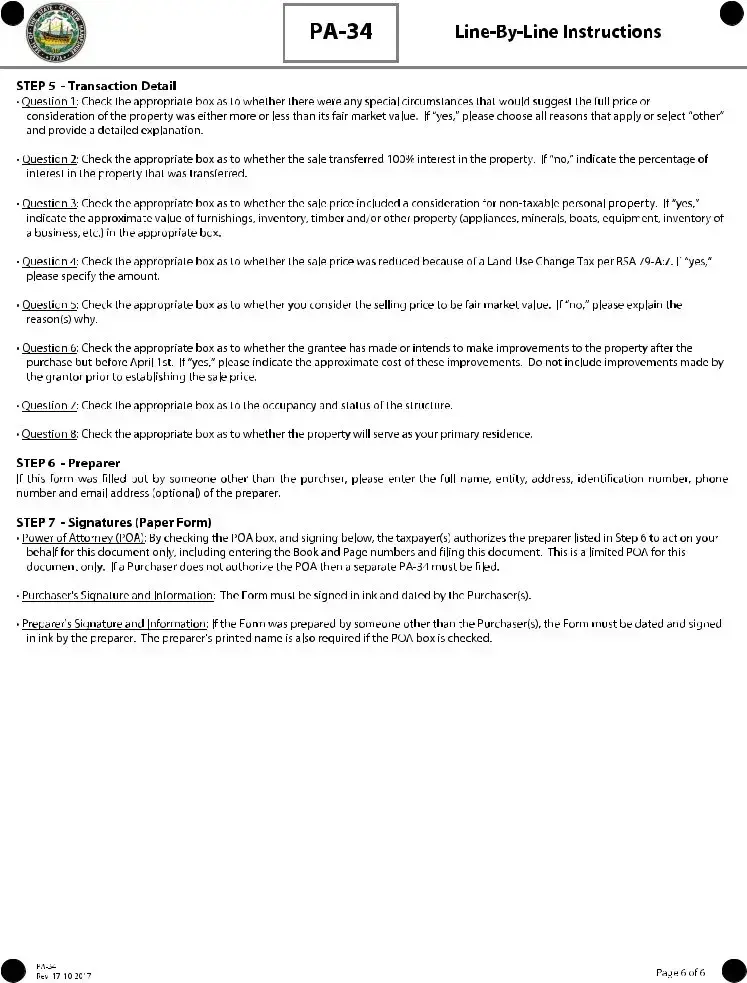

- Proceed to the financial section of the form. Here, you will input all financial data related to the property, such as income generated, expenses incurred, and the net income. Ensure the accuracy of these figures as they play a critical role in the review process.

- Review the form thoroughly to ensure all information is accurate and complete. Missed or incorrect entries may lead to delays or requests for correction, which can extend the review process.

- If the form requires supporting documents, ensure they are prepared and in compliance with the instructions provided. Attach these documents with the form submission.

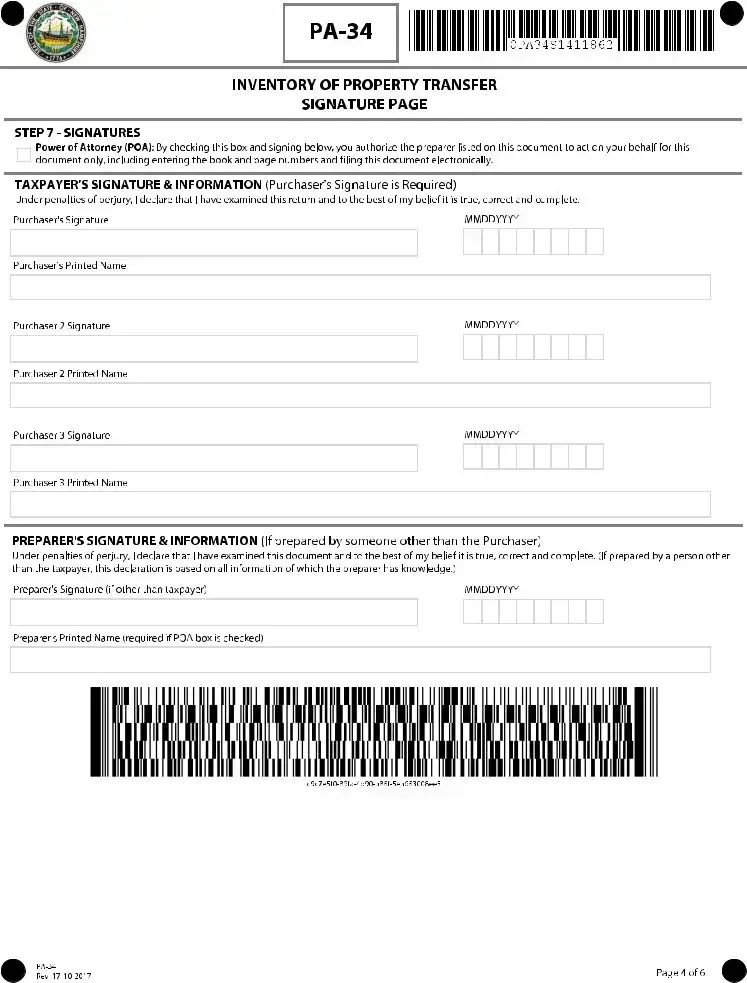

- Lastly, sign and date the form at the designated section. Submission without a proper signature may render the form invalid and lead to its rejection.

- Submit the completed form and any supporting documents to the specified address or through the electronic submission option if available. Make sure to keep a copy of all submitted documents for your records.

Following these steps carefully will help streamline the submission process, ensuring that your form is reviewed without unnecessary delays. Remember, the accuracy and comprehensiveness of the information provided are crucial for a successful review by the New Hampshire Department of Revenue Administration.

Essential Queries on Nh Pa34

What is the NH PA-34 form?

The NH PA-34 form, also known as the "Inventory of Property Transfer," is a document required by the New Hampshire Department of Revenue Administration. It's used to report the transfer of real estate within the state. This form helps in the accurate assessment of property taxes and ensures all necessary details regarding property transfers are officially recorded.

Who needs to file the NH PA-34 form?

Any individual or entity that transfers real estate located in New Hampshire must file the NH PA-34 form. This includes both sellers and buyers involved in the property transfer. It's crucial for ensuring that the state's records reflect the current ownership and valuation of the property.

When is the NH PA-34 form due?

The NH PA-34 form must be filed within 30 days following the recording of the deed or the finalization of the property transfer, whichever comes first. Timely filing is important to avoid penalties and ensure compliance with state requirements.

Where can I find the NH PA-34 form?

The form is available on the New Hampshire Department of Revenue Administration's website. You can download the form directly from their site and either fill it out electronically or print it and fill it out by hand.

What information is required on the NH PA-34 form?

The form requires detailed information about the property transfer, including the date of the transfer, the names and addresses of both the seller and buyer, the property address, the sale price, and the property's assessment values. Accurate and complete information is crucial for the form's acceptance.

How do I submit the NH PA-34 form?

Once completed, the form can be submitted either electronically through the New Hampshire Department of Revenue Administration's online system or via mail to their office. The choice of submission method depends on your preference and the specific guidelines provided by the department.

Is there a penalty for filing the NH PA-34 form late?

Yes, there are penalties for late filing. These can include fines and interest charges on any unpaid taxes deemed due as a result of the property transfer. It's essential to file on time to avoid these additional costs.

Can I get help if I have questions about filling out the NH PA-34 form?

Yes, the New Hampshire Department of Revenue Administration provides assistance for those filling out the NH PA-34 form. You can contact their office directly via phone or email for help with any questions or concerns about the form or the filing process.

Common mistakes

Filling out forms accurately is crucial, especially when they pertain to financial and legal obligations. The New Hampshire PA-34 form, known as the Inventory of Property Transfer, is no exception. Individuals often face challenges during this process, leading to common mistakes that could have been avoided with proper guidance and attention to detail.

One prevalent mistake involves neglecting to assess the entire document before beginning to fill it out. This oversight can cause individuals to miss important instructions or sections, leading to incomplete or incorrect entries. Additionally, the assumption that all sections apply to every filer can result in irrelevant information being provided, complicating the submission process.

Another area where errors occur is in the treatment of the property description section. Many filers do not provide adequate detail about the property being transferred. This includes overlooking the necessity to mention any easements, rights of way, or other legal encumbrances that could affect the property’s valuation or legal standing.

Incorrect or outdated personal information is also a common error. Filers sometimes input old addresses, misspelled names, or incorrect contact details, which can delay processing and lead to further complications in communication between the filer and the New Hampshire Department of Revenue Administration.

Sometimes, individuals misunderstand the financial sections of the form. This misunderstanding often results in reporting errors, such as incorrect valuation of the property or failure to accurately calculate adjustments for any pre-existing mortgages or liens against the property. Such inaccuracies can significantly impact the legal and financial outcomes of the property transfer.

Moreover, there's a tendency to overlook the signature and date sections at the end of the form. The completeness of this form hinges on its being properly signed and dated. An unsigned or undated form is considered invalid and will be returned to the sender, thus delaying the entire process.

Lastly, failing to consult with a professional when uncertain about how to correctly fill out the form is a widespread mistake. Many individuals attempt to complete the PA-34 without seeking advice from a tax advisor or a legal professional, leading to potentially costly errors.

To summarize, the frequent mistakes made when filling out the NH PA-34 form include:

- Not reviewing the whole form before starting.

- Providing unnecessary information.

- Omitting crucial property details.

- Entering incorrect personal information.

- Misunderstanding the form's financial sections.

- Forgetting to sign and date the form.

- Avoiding professional consultation.

Avoiding these common errors requires diligence, attention to detail, and, when in doubt, professional guidance. Accurate completion and submission of the NH PA-34 form are critical steps in ensuring that property transfers are processed efficiently and without legal complication.

Documents used along the form

When dealing with property transactions in New Hampshire, the NH PA-34 form, also known as the Inventory of Property Transfer Form, is a crucial document. This form is often the starting point for reporting a real estate transfer to the New Hampshire Department of Revenue Administration. However, it's rarely the only document required. Several other forms and documents commonly accompany the NH PA-34 form to ensure a smooth and legally compliant property transfer process. Here's a look at some of these essential documents and what they entail.

- Warranty Deed: This document provides a guarantee from the seller to the buyer that the property title is clear, indicating that the property is free from liens or other encumbrances.

- Title Insurance Policy: Offers protection to the property buyer and lender against losses arising from any defects in the property title that were not discovered at the time of the sale.

- Real Estate Transfer Tax Declarations: This form is required to calculate and report the state transfer tax due on the real estate transaction. It is essential for both buyer and seller to submit this form at the closing of the sale.

- Mortgage Documents: If the property purchase is being financed, the buyer will need to complete and sign various mortgage-related forms, including the mortgage agreement and promissory note.

- Property Tax Forms: These forms are necessary to ensure that property taxes are appropriately adjusted and prorated between the buyer and seller at the time of transfer.

- Disclosure Statements: Sellers are often required to provide buyers with disclosure statements, revealing any known defects or issues with the property.

- Federal Tax Withholding Forms: In certain transactions, especially those involving foreign sellers, specific federal tax withholding forms may need to be completed to comply with IRS regulations.

- Closing Statement: This document summarizes the financial aspects of the property transaction, including the sales price, taxes, and fees, and how they are divided between buyer and seller.

- 1099-S Form: Utilized to report the proceeds from real estate transactions to the IRS, this form is typically prepared by the person or company responsible for closing the sale, such as a real estate attorney or title company.

- Power of Attorney: If either the buyer or seller cannot be present to sign the necessary documents, a Power of Attorney may be required to authorize another party to act on their behalf during the transaction.

Each of these forms plays a vital role in the property transfer process, serving to protect the interests of all parties involved and ensuring compliance with state and federal laws. Understanding how these documents interact with the NH PA-34 form can provide both buyers and sellers with a smoother transaction process. While this list covers many of the common documents needed, the specific requirements can vary based on the details of the transaction and local regulations, so it's always a good idea to consult with a real estate professional or attorney when navigating a property sale or purchase in New Hampshire.

Similar forms

The Nh Pa34 form, utilized by the New Hampshire Department of Revenue Administration, shares similarities with several other documents used in tax and revenue contexts. A closer look reveals how its structure, purpose, and requirements align with these documents, helping to streamline processes and ensure consistency in the collection of vital financial information.

The IRS Form 1040 is one of the documents similar to the Nh Pa34 form. Both forms are integral in tax collection processes but serve slightly different purposes. The IRS Form 1040 is designed for individuals to report their annual income and calculate federal income tax in the United States. Like the Nh Pa34 form, it collects detailed financial information, requiring taxpayers to report income from various sources. Both forms include sections for personal identification, income details, and potential deductions, making them indispensable tools for assessing tax obligations accurately.

The W-2 Form, commonly issued by employers, also shares similarities with the Nh Pa34 form. This form outlines an employee's annual wages and the amount of taxes withheld from their paycheck. Similar to the Nh Pa34 form, the W-2 is crucial for tax reporting purposes. It provides a breakdown of taxable income, which both individuals and the Department of Revenue use to ensure correct tax payments and refunds. Each form plays a pivotal role in reconciling an individual's tax responsibilities with actual earnings and withholdings throughout the year.

The Schedule E (Form 1040) is another document that resembles the Nh Pa34 form, specifically in the context of reporting income from rental properties, royalties, partnerships, S corporations, trusts, and estates. Both forms require detailed financial reporting and are used to calculate the tax owed based on income not subject to standard wage withholding. This necessitates accurate income reporting from various sources beyond traditional employment, underscoring the role of these forms in comprehensive tax planning and reporting.

Dos and Don'ts

When filling out the NH PA-34 form, also known as the Inventory of Property Transfer form, individuals must provide detailed and accurate information about real estate transactions in New Hampshire. To ensure the process is completed effectively and in compliance with guidelines set by the New Hampshire Department of Revenue Administration, consider the following dos and don’ts:

Do:- Read the instructions carefully before you start filling out the form to make sure you understand all the requirements.

- Provide accurate information about the transfer, including the date, property address, and parties involved.

- Use black ink for better legibility and to ensure the information can be scanned correctly into the system.

- Sign and date the form if you are the declarant. The form is not considered valid without the signature of the person completing it.

- Keep a copy of the completed form for your records. This can be helpful if there are any questions or discrepancies later on.

- Rush through the form without checking for errors. Take the time to review all the information you've provided to ensure it's correct.

- Ignore the deadline for submitting the form. Late submissions may result in penalties.

- Forget to include necessary documentation, such as proof of the property transfer. Incomplete submissions may be returned or delayed.

- Use pencil or colors other than black ink, as this can make the form difficult to read and process.

Misconceptions

When it comes to understanding the complexities of tax documentation, it is crucial to dispel various misconceptions. The New Hampshire PA-34 form, formally known as the Inventory of Property Transfer, is subject to its own set of misunderstandings. Here are eight common misconceptions and the clarifications for each.

- Misconception 1: The NH PA-34 form is universally required for all property transactions. Clarification: This form is specifically designed for the transfer of real property in New Hampshire and is not universally required for all types of property transactions within the state.

- Misconception 2: Filing the PA-34 form is complicated and requires a lawyer. Clarification: While legal advice can be beneficial, especially for complex transactions, the form is designed to be completed by the property owner with clear instructions provided.

- Misconception 3: The form must be filed immediately after the property transfer. Clarification: There is a specified time frame after the transfer date within which the form must be filed, allowing property owners time to accurately complete and submit their documentation.

- Misconception 4: The NH PA-34 is the only form needed for property transfer taxes. Clarification: Other documents may be required for a complete tax filing on property transfers, depending on the specific details of the transaction and local regulations.

- Misconception 5: There is a fee to file the NH PA-34 form. Clarification: The form itself does not have a filing fee, though taxes or other fees may be associated with the property transfer itself.

- Misconception 6: Electronic submissions of the form are not accepted. Clarification: While submission requirements may vary, electronic filing options may be available, facilitating easier submission processes for property owners.

- Misconception 7: Every section of the PA-34 form must be completed. Clarification: While thorough completion of the form is encouraged for accuracy, some sections may not be applicable to every property owner's situation.

- Misconception 8: Personal tax information is required on the NH PA-34. Clarification: The focus of the form is on the property being transferred, not on the personal tax information of the former or current owners.

Clearing up these misconceptions aids in understanding the specific requirements and procedures involved in the property transfer process, ensuring that such transactions are handled correctly and efficiently within the boundaries of New Hampshire law.

Key takeaways

The NH PA-34 form, known as the Inventory of Property Transfer form, plays a crucial role in the property transfer process within New Hampshire. Understanding the completion and usage of this form is essential for anyone involved in property transactions in the state. Here are key takeaways to keep in mind regarding the NH PA-34 form:

- Accuracy is Mandatory: Ensure all information provided on the NH PA-34 form is accurate and complete. Any inaccuracies can result in delays or legal complications during the property transfer process.

- Timely Submission: The NH PA-34 form must be submitted to the New Hampshire Department of Revenue Administration within 30 days following the recording of the deed. Late submissions can lead to penalties or additional scrutiny.

- Supporting Documentation: Alongside the NH PA-34 form, you may need to provide additional documents to support the information you have given. This might include proof of property value or documentation relating to exemptions.

- Understanding Exemptions: Certain transfers might be exempt from filing the NH PA-34 form. It’s important to understand these exemptions thoroughly to know whether they apply to your situation.

- Clarity on Property Types: The NH PA-34 form covers various property types. Being clear on the type of property being transferred ensures that the form is correctly filled out.

- Signatures are Crucial: The NH PA-34 form requires the signature of the seller or transferor. Unsigned forms are considered incomplete and are not processed.

- Online Resources: The New Hampshire Department of Revenue Administration provides resources and guidance for completing the NH PA-34 form. Utilizing these resources can simplify the process.

- Seek Professional Help: If you find the process confusing or have specific questions, consulting with a legal professional versed in New Hampshire property law can be invaluable.

- Keep Records: After submitting the NH PA-34 form, maintain a copy for your records. This is crucial for future reference or if any questions arise about the property transfer.

Completing and using the NH PA-34 form correctly is a key step in the property transfer process in New Hampshire. By adhering to these key takeaways, individuals can navigate this process more smoothly and efficiently.

Different PDF Templates

New Hampshire Parenting Plan - Utilized across multiple jurisdictions within the state, this form standardizes the submission process, ensuring consistency and clarity in legal proceedings.

Nh Corporate Tax Rate - It acts as a preemptive tool for businesses to gauge their tax standings, promoting financial clarity and preparedness.