Nh Bpt Rcd Template

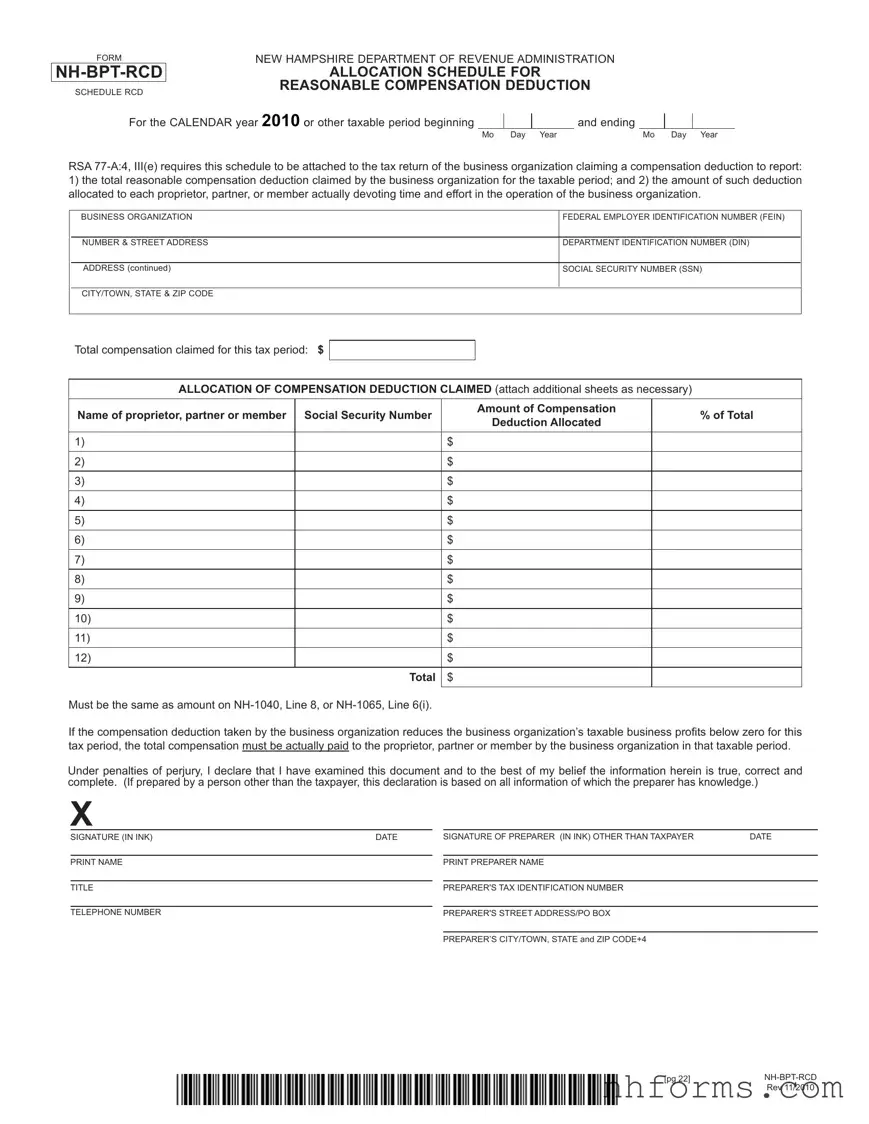

In the often complex world of tax documentation and reporting, the New Hampshire Department of Revenue Administration has made a significant stride towards simplifying the process for business organizations seeking to claim compensation deductions. The FORM NH-BPT-RCD, known as the Schedule RCD, represents a pivotal tool for entities navigating the fiscal landscape of the Granite State for the 2010 calendar year or any other taxable period falling within these dates. Specifically, RSA 77-A:4, III(e) mandates the attachment of this schedule to the business's tax return, a move aimed at streamlining the reporting of the total reasonable compensation deduction claimed. Furthermore, it meticulously details the allocation of this deduction across proprietors, partners, or members dedicating their time and effort to the business's operations. By necessitating business organizations to list the federal employer identification number (FEIN), personal identification details, and the total compensation claimed, the form ensures transparency and accountability in how compensation deductions are calculated and claimed. Additionally, it underscores the requirement that the total compensation must be actually paid if the deduction brings the organization's taxable profits below zero, fortifying the state's commitment to fair and verifiable tax reporting practices. As such, the Schedule RCD embodies New Hampshire's approach to fostering an environment where businesses can thrive while adhering to stringent tax reporting standards.

Document Preview Example

FORM

SCHEDULE RCD

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

ALLOCATION SCHEDULE FOR

REASONABLE COMPENSATION DEDUCTION

For the CALENDAR year 2010 or other taxable period beginning

and ending

Mo Day Year |

Mo Day Year |

RSA

1)the total reasonable compensation deduction claimed by the business organization for the taxable period; and 2) the amount of such deduction allocated to each proprietor, partner, or member actually devoting time and effort in the operation of the business organization.

BUSINESS ORGANIZATION

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

NUMBER & STREET ADDRESS

DEPARTMENT IDENTIFICATION NUMBER (DIN)

ADDRESS (continued)

SOCIAL SECURITY NUMBER (SSN)

CITY/TOWN, STATE & ZIP CODE

Total compensation claimed for this tax period: $

ALLOCATION OF COMPENSATION DEDUCTION CLAIMED (attach additional sheets as necessary)

Name of proprietor, partner or member |

Social Security Number |

Amount of Compensation |

% of Total |

|

Deduction Allocated |

||||

|

|

|

||

|

|

|

|

|

1) |

|

$ |

|

|

|

|

|

|

|

2) |

|

$ |

|

|

|

|

|

|

|

3) |

|

$ |

|

|

|

|

|

|

|

4) |

|

$ |

|

|

|

|

|

|

|

5) |

|

$ |

|

|

|

|

|

|

|

6) |

|

$ |

|

|

|

|

|

|

|

7) |

|

$ |

|

|

|

|

|

|

|

8) |

|

$ |

|

|

|

|

|

|

|

9) |

|

$ |

|

|

|

|

|

|

|

10) |

|

$ |

|

|

|

|

|

|

|

11) |

|

$ |

|

|

|

|

|

|

|

12) |

|

$ |

|

|

|

|

|

|

|

|

Total |

$ |

|

|

Must be the same as amount on |

|

|

||

|

|

|||

If the compensation deduction taken by the business organization reduces the business organization’s taxable business profits below zero for this tax period, the total compensation must be actually paid to the proprietor, partner or member by the business organization in that taxable period.

Under penalties of perjury, I declare that I have examined this document and to the best of my belief the information herein is true, correct and complete. (If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.)

X

SIGNATURE (IN INK) |

DATE |

PRINT NAME

TITLE

TELEPHONE NUMBER

SIGNATURE OF PREPARER (IN INK) OTHER THAN TAXPAYER |

DATE |

PRINT PREPARER NAME

PREPARER'S TAX IDENTIFICATION NUMBER

PREPARER'S STREET ADDRESS/PO BOX

PREPARER’S CITY/TOWN, STATE and ZIP CODE+4

[pg 22] |

|

|

Rev 11/2010 |

Document Breakdown

| Fact | Detail |

|---|---|

| Form Title | NH-BPT-RCD Schedule RCD |

| Administering Body | New Hampshire Department of Revenue Administration | Full

| Purpose | Allocation Schedule for Reasonable Compensation Deduction |

| Applicable Period | For the calendar year 2010 or other taxable period beginning and ending |

| Governing Law | RSA 77-A:4, III(e) |

| Main Requirement | This schedule must be attached to the tax return of the business organization claiming a compensation deduction. |

| Objective | To report the total reasonable compensation deduction claimed by the business organization and the amount of such deduction allocated to each proprietor, partner, or member actively involved in the business. |

Detailed Instructions for Writing Nh Bpt Rcd

Filling out the NH BPT RCD form is a straightforward process that involves reporting the total reasonable compensation deduction your business claims for a specific tax period, along with detailing the allocation of this deduction among proprietors, partners, or members who contribute time and effort in the operations of the business. This step is mandatory for any business organization that seeks to claim this deduction. Below are the steps to accurately complete the form. Make sure all information provided is accurate and reflects the financial activities of your business for the reported period.

- Start with the basics: enter the CALENDAR year or other taxable period your report will cover at the top of the form, including both starting and ending dates (Mo Day Year).

- Provide your BUSINESS ORGANIZATION's details, including the FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN), NUMBER & STREET ADDRESS, and if applicable, the DEPARTMENT IDENTIFICATION NUMBER (DIN). Don't forget to include the address continuation if necessary, along with the CITY/TOWN, STATE & ZIP CODE.

- In the field provided, write down the Total compensation claimed for this tax period in dollars.

- For the ALLOCATION OF COMPENSATION DEDUCTION CLAIMED section, list each proprietor, partner, or member who has dedicated time and effort to the business. For each, you will need to fill out their Name, Social Security Number, Amount of Compensation, and % of Total Deduction Allocated. If needed, attach additional sheets to ensure all relevant individuals are included.

- Ensure that the total amount listed at the bottom of the allocation section matches the total compensation amount you claimed above. This total must also match the amount reported on NH-1040, Line 8, or NH-1065, Line 6(i).

- Read the declaration carefully. When satisfied that all information is true, correct, and complete, sign the form in ink. Include your SIGNATURE, the DATE of signing, your printed NAME, and TITLE within the organization. Also, provide a TELEPHONE NUMBER where you can be reached.

- If the form was prepared by someone other than the taxpayer, that individual must also sign the form in the designated section, printing their name and providing their preparer's tax identification number, along with their complete address and contact information.

After completing all steps, review the form to ensure accuracy and completeness. Once ready, the form should be attached to your business's tax return submission to the New Hampshire Department of Revenue Administration. Filling out this form accurately is crucial for your business to claim the reasonable compensation deduction properly. This can ultimately impact your business's taxable profits and tax liability for the period.

Essential Queries on Nh Bpt Rcd

What is the NH BPT RCD form?

The NH BPT RCD form, officially designated as Form NH-BPT-RCD, is a schedule required by the New Hampshire Department of Revenue Administration. It serves as an allocation schedule for the Reasonable Compensation Deduction. Businesses use this form to report the total reasonable compensation deduction claimed for a taxable period, along with the distribution of this deduction among proprietors, partners, or members actively involved in the business's operations.

Who needs to file the NH BPT RCD form?

This form must be filed by any business organization operating within New Hampshire that claims a reasonable compensation deduction on its tax return. This includes, but is not limited to, corporations, partnerships, and sole proprietorships whose proprietors, partners, or members are allocating compensation deductions among themselves.

What is the purpose of this form?

The primary purpose of the NH BPT RCD form is to ensure compliance with RSA 77-A:4, III(e), which mandates that a detailed allocation schedule of the reasonable compensation deduction be attached to a business's tax return. It facilitates the accurate and fair assessment of tax liabilities by detailing how the compensation deduction is distributed among those contributing time and effort to the business.

For what period is the NH BPT RCD form filed?

This form is filed for the calendar year 2010 or other taxable periods beginning and ending as specified by the filer on the form. The taxable period should align with the business's fiscal year if it does not operate on a calendar year basis.

What information is required on the NH BPT RCD form?

Filers are required to provide the business organization's federal employer identification number (FEIN), address, Department Identification Number (DIN), and the total compensation claimed for the tax period. Additionally, detailed allocation of the compensation deduction, including the name, social security number, and amount of compensation allocated to each proprietor, partner, or member, must be reported.

How is the compensation deduction allocated among proprietors, partners, or members?

The compensation deduction is allocated based on the percentage of the total deduction each individual is entitled to, which corresponds to their contribution of time and effort in the operation of the business. The specific allocations should reflect the fair value of each person's involvement.

What happens if the compensation deduction reduces the business’s taxable profits below zero?

If claiming the compensation deduction results in the business organization’s taxable business profits falling below zero for the tax period, the total compensation must actually be paid out to the proprietor, partner, or member within that same tax period. This requirement ensures that the deductions claimed correspond to real monetary disbursements.

What are the penalties for not properly completing the NH BPT RCD form?

Failure to properly complete and attach the NH BPT RCD form to the tax return can result in penalties. These penalties may include fines and interest on unpaid taxes, as the form is crucial for accurately calculating a business's tax obligations. Additionally, inaccuracies or omissions may lead to audits or further scrutiny from the New Hampshire Department of Revenue Administration.

How can a business file the NH BPT RCD form?

The form should be completed and attached to the relevant tax return (NH-1040 for sole proprietorships or NH-1065 for partnerships) and filed by the standard tax filing deadline. Specific instructions regarding filing electronically or by mail can be obtained directly from the New Hampshire Department of Revenue Administration's website or by contacting their office.

Where can additional guidance on the NH BPT RCD form be found?

For further assistance or clarification regarding the NH BPT RCD form, taxpayers are encouraged to consult the New Hampshire Department of Revenue Administration's official website. Here, detailed instructions, frequently asked questions, and contact information for direct support are available. Additionally, consulting with a tax professional familiar with New Hampshire tax law can provide personalized guidance.

Common mistakes

Filling out forms for tax purposes can be tricky. The NH-BPT-RCD form, used by the New Hampshire Department of Revenue Administration, is no exception. A few common mistakes can lead to errors that might complicate tax filings for businesses. Understanding these pitfalls can save time and reduce the likelihood of running into issues with your tax return.

One of the primary mistakes is not providing accurate information for the business. This includes inaccuracies in the federal employer identification number (FEIN) and the department identification number (DIN). It's crucial these numbers are double-checked for accuracy.

Omitting social security numbers (SSN) of the proprietors, partners, or members is another common oversight. Each individual who devotes time and effort to the operation of the business must have their SSN listed along with their allocated compensation deduction.

Incorrectly calculating the total compensation claimed can also lead to issues. It's imperative to ensure that the total amount of compensation listed is accurate and corresponds with the amounts designated to each business member.

Here are a few more issues to watch out for:

- Not attaching additional sheets when necessary. If you have more members than spaces available, make sure to attach extra sheets detailing their information.

- Failure to ensure that the compensation deduction taken does not reduce the business's taxable profits below zero. If it does, the total compensation must have been actually paid out during the tax period.

- Forgetting to sign and date the form. This oversight can lead to the form being considered incomplete.

Another error is neglecting to provide the preparer’s information, if applicable. If someone other than the taxpayer prepared the document, their signature, tax identification number, and address need to be included.

Make sure to avoid these common mistakes:

- Skipping the declaration statement which asserts the accuracy of the information provided.

- Incorrectly listing the allocation percentages of the compensation deduction. Each percentage must accurately reflect the proportion of the total deduction allocated to each person.

- Miscalculation of the total compensation deduction claimed. It's vital to verify this figure to ensure it matches the sum of individual compensations listed.

By keeping these points in mind and double-checking each section of the NH-BPT-RCD form, businesses can sidestep these common pitfalls, ensuring a smoother process when filing their taxes.

Documents used along the form

When businesses and individuals prepare for tax filing, particularly in the context of claiming specific deductions like the reasonable compensation deduction in New Hampshire, several forms and documents often work in conjunction with the NH-BPT-RCD Form. These documents play pivotal roles in ensuring the accuracy and legality of the tax filing process.

- NH-1040 - This form is the Business Profited Tax Return for individuals, partnerships, and fiduciaries in New Hampshire. It is used to report the income and calculate the taxes owed by the entity. The total compensation figure claimed on the NH-BPT-RCD needs to be reported here to maintain consistency between the records.

- NH-1065 - Similarly, NH-1065 is the Partnership Business Tax Return. It is specifically designed for partnerships reporting their income, deductions, and tax liabilities. This form also requires information from the NH-BPT-RCD form for partnerships claiming the reasonable compensation deduction to ensure the accurate calculation of tax obligations.

- Form W-2 - Wage and Tax Statements for employees are crucial when detailing the compensation paid to proprietors, partners, or members listed in the NH-BPT-RCD form. These documents substantiate the amounts declared as compensation deductions.

- Form 1099-MISC - This form is used to report miscellaneous income, including rents, royalties, and non-employee compensation. For business entities, reporting compensation paid to non-employees who might qualify under the reasonable compensation deduction criteria is essential. This substantiates the payments claimed on the NH-BPT-RCD.

- Supporting accounting records - Business organizations must maintain detailed accounting records, such as general ledgers and payroll reports, that outline the compensation paid to each individual. These records provide the foundational support for the amounts declared on both the NH-BPT-RCD and any related tax forms.

Together, these documents form a comprehensive suite that supports the details entered into the NH-BPT-RCD form. By having all the information presented cohesively across these forms, businesses can ensure that they are in compliance with reporting standards and tax laws, thereby minimizing the risk of inaccuracies or potential disputes with tax authorities.

Similar forms

The NH BPT RCD form is similar to other tax documents that also relate to deductions and allocations of income or expenses within a business entity. These documents are used to ensure that businesses report their financial activities accurately and in compliance with federal and state tax laws.

One document similar to the NH BPT RCD form is the IRS Form 1065, U.S. Return of Partnership Income. This form is used by partnerships to report their income, gains, losses, deductions, credits, and to distribute shares of income or losses to partners. Like the NH BPT RCD, Form 1065 includes schedules where the partnership must detail how amounts are allocated to partners, although the focus is broader, encompassing entire income and loss allocations, not just compensation deductions.

Another document that shares similarities is the Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc. Specifically, this schedule, attached to Form 1065, is used to show the share of income and deductions allocated to each partner, similar to how the NH BPT RCD form allocates the compensation deduction among proprietors, partners, or members. The main purpose of both documents is to provide detailed information to both the tax authorities and the individuals receiving the income on how specific amounts were calculated and allocated.

The IRS Form 1120, U.S. Corporation Income Tax Return, while used by corporations rather than partnerships or sole proprietorships, also has sections related to deductions, including salaries and wages. These sections require the corporation to list the compensation paid to officers, akin to how the NH BPT RCD form requires listing of compensation deductions allocated to each owner or member. The similarity lies in the reporting of compensation amounts, although Form 1120 is for corporations and the NH BPT RCD form is for various types of business organizations.

Dos and Don'ts

When completing the New Hampshire Business Profits Tax Reasonable Compensation Deduction form (NH BPT RCD), accuracy and attention to detail are key. To help navigate the filing process, here are 10 important tips on what you should and shouldn't do:

Do:- Review the instructions carefully before starting the form to ensure you understand each section completely.

- Gather all necessary documentation related to compensation for proprietors, partners, or members actively involved in the business.

- Double-check the Federal Employer Identification Number (FEIN) and the Social Security Numbers (SSNs) for accuracy to avoid processing delays.

- Ensure the total compensation claimed matches the amount reported on NH-1040, Line 8, or NH-1065, Line 6(i) as required.

- Verify that the compensation deduction does not reduce the organization's taxable business profits below zero, unless it has been paid out in the same tax period.

- Leave any sections incomplete. An incomplete form may cause delays or result in the rejection of the deduction claim.

- Estimate or guess amounts. Use actual figures from your financial records to fill out the compensation and deduction sections.

- Forget to add additional sheets if you have more than the provided lines for compensation allocation. Ensure each page is clearly marked and attached securely to your form.

- Overlook the declaration statement at the end of the form. Signing it verifies that the information provided is true and accurate to the best of your knowledge.

- Delay in seeking professional help if you're unsure about any part of the form. Tax professionals or the New Hampshire Department of Revenue Administration can provide guidance.

Misconceptions

When examining the New Hampshire Business Profits Tax (NH BPT) Reasonable Compensation Deduction (RCD) Schedule, a form which businesses in New Hampshire use during tax filing, there are several misconceptions that often arise. These misconceptions can significantly impact the understanding and the correct application of tax laws related to reasonable compensation deductions. Let's correct some of these misunderstandings.

Misconception #1: Any compensation amount can be claimed as a deduction. It's important to understand that the compensation must be reasonable in relation to the services provided. The amount claimed must reflect the value of the effort and time devoted to the business operation, ensuring compliance with RSA 77-A:4, III(e).

Misconception #2: Only the business owner's compensation is eligible for deduction. The reality is that the deduction can also be allocated to proprietors, partners, or members who contribute time and effort in operating the business, as clearly indicated in the schedule instructions.

Misconception #3: The compensation deduction can reduce taxable business profits to less than zero. In fact, if claiming the compensation deduction results in the business's taxable profits falling below zero, the total compensation must be actually paid out within that tax period. This ensures the deduction does not lead to a loss situation in the business’s financial reports.

Misconception #4: Supplementary sheets for allocation are optional. Depending on the number of individuals involved and the complexity of the allocations, attaching additional sheets to accurately report compensation allocation is not just recommended but may be necessary to comply with the documentation requirements.

Misconception #5: Personal information is not crucial for claiming a deduction. The accurate provision of personal details, including Social Security Numbers (SSN) for each proprietor, partner, or member, is essential for the proper allocation and substantiation of the compensation deduction claimed.

Misconception #6: The form is only for internal record-keeping. The NH BPT RCD Schedule is a required attachment to the tax return for businesses claiming a compensation deduction. Thus, it's a legal document that must be submitted to the New Hampshire Department of Revenue Administration, not just an internal record.

Misconception #7: Any preparer can sign off on the document. The form necessitates a declaration under penalties of perjury that the information provided is true, correct, and complete. Therefore, it's crucial that either the taxpayer or a preparer with adequate knowledge of the business’s finances signs the document.

Misconception #8: There are no consequences for inaccuracies. Given that the declaration includes a statement under penalties of perjury, inaccuracies could lead to legal consequences, including penalties or audits. Ensuring the information provided is accurate and complete is crucial for compliance.

Understanding these misconceptions and correcting them is vital for businesses in New Hampshire. Proper adherence to the instructions and legal requirements of the NH BPT RCD Schedule not only ensures compliance with state tax laws but also aids in avoiding potential legal complications arising from incorrect filings.

Key takeaways

When filling out and using the NH-BPT-RCD form, there are key takeaways that individuals and business organizations should keep in mind to ensure compliance and accuracy. Here are five important points:

- The NH-BPT-RCD form is used for allocating the reasonable compensation deduction among proprietors, partners, or members who devote time and effort to the operation of the business. This allocation is essential for reporting purposes and must reflect actual contributions to the business.

- Accuracy is crucial when reporting the total reasonable compensation deduction claimed by the business for the taxable period. This involves not only identifying the correct amount but also ensuring that it matches the figures reported on associated forms, such as NH-1040 or NH-1065.

- Each individual receiving a portion of the compensation deduction must be listed with their social security number and the specific amount allocated to them. This detailed record-keeping helps in maintaining transparency and facilitates the review process by the New Hampshire Department of Revenue Administration.

- If the compensation deduction results in the business's taxable profits falling below zero, it is mandatory that the compensation accounted for by the deduction be actually paid out to the proprietors, partners, or members within that tax period. This requirement underscores the practical impact of the deduction on the business's financial operations.

- Completing the form requires a declaration under the penalties of perjury that the information provided is true, correct, and complete. This declaration adds a layer of legal responsibility to the process, emphasizing the importance of accuracy and honesty in financial and tax reporting.

Comprehending these key points will help taxpayers in properly filling out the NH-BPT-RCD form, ensuring compliance with the New Hampshire Department of Revenue Administration's requirements, and accurately representing their business's financial state.

Different PDF Templates

Nheasy - Used by facilities to notify the Bureau of Elderly & Adult Services of critical information, including a resident's Medicare eligibility dates.

Can I Get My W2 From the Irs - The inclusion of tax responsibilities highlights the financial aspects of receiving CCDF Scholarship payments.