Nh Annual Report Template

Fulfilling legal obligations in New Hampshire, particularly for charitable organizations, encompasses an array of requirements, one of which is the completion and submission of the New Hampshire Annual Report form. Rooted in the diligence of the Office of the New Hampshire Attorney General Charitable Trusts Unit, this form stands as a testament to the accountability and transparency that governs charitable entities within the state. With a filing fee set at $75.00, payable to the State of New Hampshire, the document serves not merely as a financial declaration but as a comprehensive report that encapsulates the organization's yearly activities and fiscal health. This form, demanding the signature of a president, treasurer, or trustee—explicitly excluding the executive director—underscores the importance of higher-level oversight in the affirmation of the report’s accuracy under the penalties of perjury as outlined in RSA 641:1-3. Beyond its function as a financial ledger, this annual report is a covenant of trust between charitable organizations and the state, ensuring that their operations remain aligned with their mission and the law. Moreover, it prompts an examination of the leadership's role in safeguarding the integrity of their organization’s reporting processes, further amplified by the notarization requirement that solidifies the document's legitimacy. This intricate blend of fiscal responsibility, legal compliance, and operational transparency forms the backbone of the New Hampshire Annual Report form, anchoring charitable organizations in the principles of good governance and public trust.

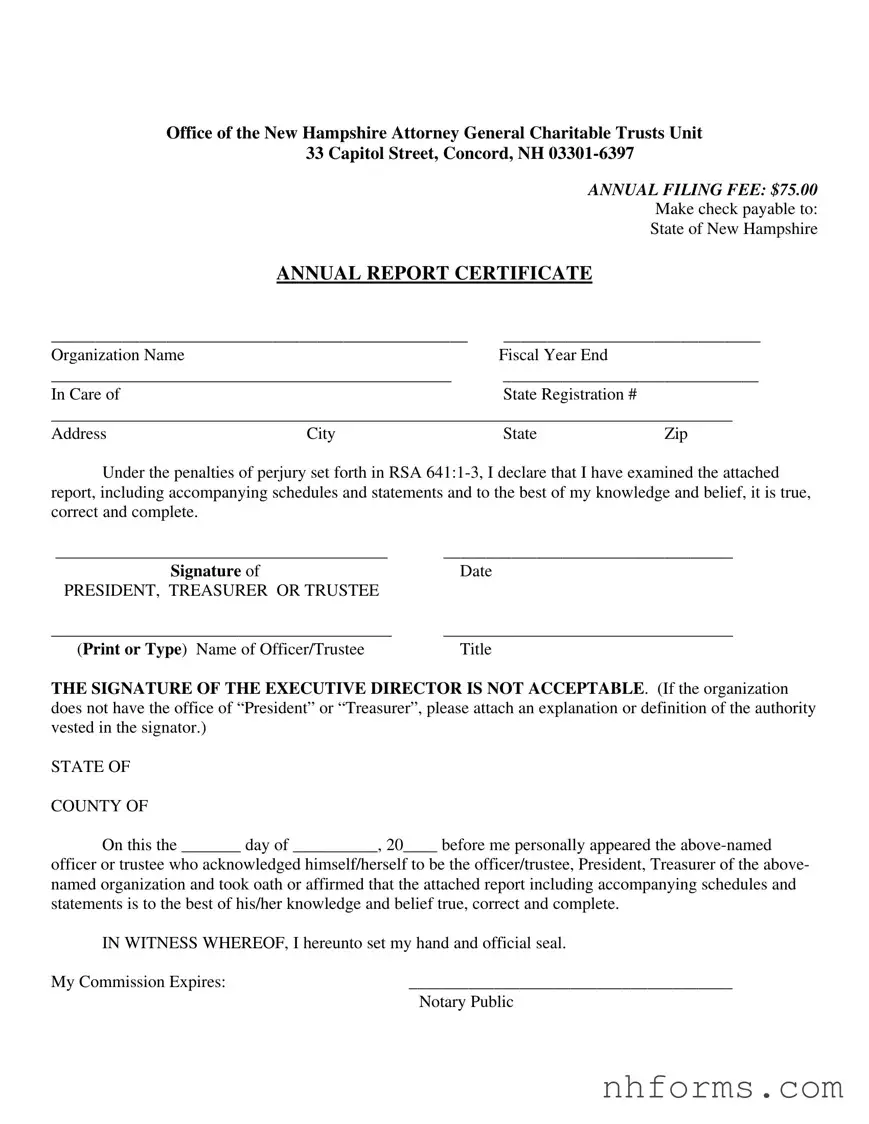

Document Preview Example

Office of the New Hampshire Attorney General Charitable Trusts Unit 33 Capitol Street, Concord, NH

ANNUAL FILING FEE: $75.00

Make check payable to:

State of New Hampshire

ANNUAL REPORT CERTIFICATE

_______________________________________________ |

_____________________________ |

Organization Name |

Fiscal Year End |

_______________________________________________ |

______________________________ |

In Care of |

State Registration # |

________________________________________________________________________________

Address |

City |

State |

Zip |

Under the penalties of perjury set forth in RSA

_______________________________________ |

__________________________________ |

Signature of |

Date |

PRESIDENT, TREASURER OR TRUSTEE |

|

________________________________________ |

__________________________________ |

(Print or Type) Name of Officer/Trustee |

Title |

THE SIGNATURE OF THE EXECUTIVE DIRECTOR IS NOT ACCEPTABLE. (If the organization does not have the office of “President” or “Treasurer”, please attach an explanation or definition of the authority vested in the signator.)

STATE OF

COUNTY OF

On this the _______ day of __________, 20____ before me personally appeared the

officer or trustee who acknowledged himself/herself to be the officer/trustee, President, Treasurer of the above- named organization and took oath or affirmed that the attached report including accompanying schedules and statements is to the best of his/her knowledge and belief true, correct and complete.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

My Commission Expires: |

______________________________________ |

|

Notary Public |

Document Breakdown

| Fact Number | Detail |

|---|---|

| 1 | The Annual Report is handled by the Office of the New Hampshire Attorney General Charitable Trusts Unit. |

| 2 | It is located at 33 Capitol Street, Concord, NH 03301-6397. |

| 3 | The filing fee for the Annual Report is $75.00. |

| 4 | Checks for the filing fee should be made payable to the State of New Hampshire. |

| 5 | Organizations must list their name, the end of their fiscal year, their address, and their state registration number on the report. |

| 6 | The report requires a signature from the President, Treasurer, or a Trustee of the organization. The Executive Director's signature is not acceptable. |

| 7 | Signatories declare under the penalties of perjury, as set forth in RSA 641:1-3, that the report is true, correct, and complete to the best of their knowledge. |

| 8 | If an organization lacks the office of President or Treasurer, an explanation or definition of the authority vested in the signatory must be attached. |

| 9 | The report requires a notarial acknowledgment which includes a declaration that the signatory is the President, Treasurer, or a Trustee, and affirms the report's truthfulness, correctness, and completeness. |

Detailed Instructions for Writing Nh Annual Report

Filing the Annual Report for an organization with the New Hampshire Attorney General's Charitable Trusts Unit marks a critical step in maintaining compliance with state regulations. It ensures that your organization’s information is up to date and that you're operating within the legal boundaries set by the state. Careful preparation of this document is essential. The form requires accurate details regarding your organization’s financial activities, registration number, and official addresses. It also necessitates an attestation to the document's truthfulness under the penalties of perjury, meaning it's crucial to review all information thoroughly before submission. Following the steps outlined below will guide you through the process, ensuring your organization meets its legal obligations efficiently.

Steps to Complete the NH Annual Report Form

- Begin by writing the Organization Name and the Fiscal Year End date on the designated lines at the top of the form.

- Next, provide the contact information in the In Care Of (C/O) line, intended for the primary contact person or office space where correspondence should be directed.

- Enter your organization's State Registration Number. This number is assigned by the state when your organization is first registered and is crucial for identification purposes.

- Fill out the Address, City, State, and Zip fields with the current address of your organization. This address is where official documents and notices will be sent, so it must be correct and up to date.

- Complete the certification section. The person authorized as the President, Treasurer, or Trustee should sign their name and then print or type it below the signature line, indicating their title in the organization. Remember, the signature of the Executive Director is not accepted unless accompanied by an explanation of their signing authority.

- If the organization does not have the offices of "President" or "Treasurer," attach a separate document that explains or defines the authority vested in the signatory.

- The form requires notarization. Therefore, on the appropriate date, an officer or trustee of the organization must appear before a Notary Public to sign the form. The Notary Public will fill out the STATE OF and COUNTY OF sections, the date, and will affix their official seal and signature, certifying the identity of the signatory and the truthfulness of the attached documents.

- Review the entire form and accompanying documents for accuracy and completeness. Errors or omissions can lead to delays or even fines.

- Finally, prepare a check for the $75.00 filing fee, payable to the State of New Hampshire. Attach this check to your Annual Report Form.

- Mail the completed form, along with the check and any additional required documents, to the provided address: Office of the New Hampshire Attorney General Charitable Trusts Unit, 33 Capitol Street, Concord, NH 03301-6397.

By carefully following these steps, you can ensure your organization's Annual Report is filled out correctly and submitted in a timely manner. This not only keeps your organization in good standing with the state but also reinforces the transparency and accountability essential to your operations. Should you have any questions during this process, do not hesitate to contact the Charitable Trusts Unit for guidance.

Essential Queries on Nh Annual Report

What is the annual filing fee for the NH Annual Report form?

The annual filing fee for the NH Annual Report form is $75.00. This fee should be made payable to the State of New Hampshire.

Who needs to sign the NH Annual Report?

The NH Annual Report requires the signature of the organization's President, Treasurer, or a Trustee. It's important to note that the signature of the Executive Director is not acceptable for this form. If the organization does not have the office of “President” or “Treasurer”, an explanation or definition of the authority vested in the signator must be attached.

Can the Executive Director of our organization sign the NH Annual Report?

No, the Executive Director cannot sign the NH Annual Report. The form expressly states that the signature of the Executive Director is not acceptable. Only the President, Treasurer, or a Trusted Trustee of the organization can sign the report. If these positions do not exist within your organization, you must provide an explanation or definition of the authority of the person signing the report.

What information is needed to complete the NH Annual Report form?

To complete the NH Annual Report form, you need to provide the organization's name, the fiscal year end date, the name and title of the person filling out the form (who can be the President, Treasurer, or Trustee), and the organization’s address including city, state, and zip code. Additionally, you need to include the state registration number and ensure that the form is signed under the penalties of perjury, declaring that the attached report is true, correct, and complete to the best of your knowledge.

What happens if our organization doesn't have a President or Treasurer?

If your organization does not have the office of President or Treasurer, you must attach an explanation or definition of the authority vested in the person who will sign the report. This ensures that the person signing the NH Annual Report has the proper authorization to do so on behalf of the organization.

Where should the NH Annual Report form and filing fee be sent?

The completed NH Annual Report form along with the $75.00 filing fee should be sent to the Office of the New Hampshire Attorney General, Charitable Trusts Unit, at 33 Capitol Street, Concord, NH 03301-6397. The check for the filing fee should be made payable to the State of New Hampshire.

Common mistakes

Filling out the New Hampshire Annual Report form can be a straightforward task, but it's also easy to make mistakes if you're not careful. These common errors can lead to your form being returned or, worse, your organization facing compliance issues. Here are five common mistakes people often make:

Incomplete Correct Organization Name or Fiscal Year End: Many filers inadvertently leave out important details such as the full legal name of the organization or accurately entering the fiscal year end. This leads to confusion and delays in processing the form. The organization's name should match exactly as it's officially registered, including any suffixes or abbreviations.

Incorrect or Missing State Registration Number: Every charitable organization in New Hampshire has a unique state registration number. Forgetting to include this number or entering it incorrectly can lead to significant processing delays. This number helps the Charitable Trusts Unit quickly identify your organization in their system.

Payment Issues: The form clearly states that there is an annual filing fee of $75.00, payable by check to the State of New Hampshire. Some common mistakes include forgetting to attach the check, writing the check for the wrong amount, or making the check payable to the wrong entity. Such errors can result in the rejection of your filing.

Signature Discrepancies: The Annual Report Certificate mandates that either the President, Treasurer, or a Trustee's signature must be included. A notable error is the inclusion of the Executive Director’s signature, which is explicitly not acceptable unless accompanied by an additional explanation or definition of authority. Moreover, missing signatures or incomplete sections concerning the signatory's print name, title, and date can further complicate the submission.

Notarization Omissions: The requirement for notarization is often overlooked. The form needs to be notarized before submission, which involves an additional validation step where a notary public confirms the identity of the signer. Neglecting this step can invalidate the whole report, as it fails to meet the state's verification standards.

To avoid these mistakes, here are a few tips:

Always review the entire form before filling it out to ensure you understand all requirements.

Double-check the organization's legal name and the state registration number for accuracy.

Prepare the filing fee check ahead of time, making sure it's for the correct amount and payable to the correct entity.

Ensure the correct individual signs the form and that it is duly notarized if required. If there is any uncertainty about who should sign, consult the state's guidance or seek legal advice.

Before submitting, review the form for completeness and accuracy to prevent any unnecessary issues with your filing.

By sidestepping these common pitfalls, organizations can ensure a smooth filing process for their New Hampshire Annual Report, maintaining good standing and focusing on their important charitable work.

Documents used along the form

Completing the New Hampshire Annual Report form is a critical step for organizations in maintaining compliance with state regulations. This necessity for accurate and timely submission is part of a broader requirement that often necessitates the preparation and filing of several other forms and documents. These additional documents ensure that an organization's filing is complete, keeping its status in good standing and ensuring compliance with the state's legal and financial reporting requirements.

- IRS Form 990, 990-EZ, or 990-N: Non-profit organizations may need to submit one of these forms depending on their gross receipts and assets. These forms provide the IRS with information on the organization's finances, activities, and governance, helping to ensure compliance with federal tax obligations.

- Articles of Amendment: If an organization has undergone changes to its original articles of incorporation, such as changes to its name, purpose, or membership rules, it must file Articles of Amendment. This document formalizes changes in the organization's structure or operations, keeping the state informed about its current status.

- Change of Registered Agent Form: Organizations are required to maintain a registered agent in the state as a point of contact for legal and official correspondence. If an organization changes its registered agent or the agent's address, it must file this form to update the state records, ensuring that it can be reached by the state when necessary.

- Conflict of Interest Policy: While not always mandatorily filed with the state, a written conflict of interest policy is crucial for non-profit organizations. It outlines procedures to handle potential conflicts between the organization's operations and the personal interests of its officers or trustees. Having this policy in place and adhering to it is essential for maintaining the integrity and trustworthiness of the organization.

Together with the New Hampshire Annual Report form, these documents form a comprehensive suite of filings that support an organization’s legal and regulatory compliance. It's essential for organizations to stay informed about the specifics of each document, ensuring they meet all filing deadlines and requirements. Proper adherence to these requirements helps maintain the legal standing of the organization, paving the way for continued operations and activities within the state.

Similar forms

The NH Annual Report form shares similarities with other crucial documents required for organizational compliance and reporting. These resemblances not only exist in the nature of information requested but also in their purpose and structure. Two notably comparable documents are the IRS Form 990 and the Corporate Annual Report filed with a state's Secretary of State office.

The IRS Form 990 is a document that tax-exempt organizations must submit annually to the Internal Revenue Service (IRS). This form and the NH Annual Report share a core similarity in that both require detailed financial information and operational summaries for the reporting year. They both ask for an overview of the organization's activities, a breakdown of income and expenses, and information on key personnel. However, the IRS Form 990 delves deeper into financial specifics and governance practices to ensure compliance with federal tax-exempt status requirements. This comprehensive scrutiny aims to maintain public transparency and to uphold the organization's commitment to its mission.

The Corporate Annual Report filed with a state's Secretary of State is another document that bears resemblance to the NH Annual Report. Typically, this report includes basic information about the company, such as its legal name, principal address, and the names of directors and officers. Like the NH Annual Report, its primary purpose is to keep the state updated on the company’s status and maintain its good standing within the state. Both reports serve as a public record, ensuring transparency and accountability. However, the Corporate Annual Report often focuses more on the identification of the business and compliance with specific state regulations rather than detailed financial data.

Dos and Don'ts

When filling out the New Hampshire (NH) Annual Report form, entities are required to provide accurate and complete information to the Office of the New Hampshire Attorney General Charitable Trusts Unit. This document plays a crucial role in maintaining the transparency and accountability of charitable organizations within the state. To ensure a seamless process, here is a comprehensive list of dos and don'ts:

Dos:

Ensure the organization’s name and fiscal year-end are accurately filled in, reflecting the current reporting period.

Verify the correctness of the ‘In Care of,’ ‘State Registration No.,’ ‘Address,’ ‘City,’ ‘State,’ and ‘Zip’ fields to facilitate smooth communication.

Include the signature of an authorized officer—such as the President, Treasurer, or an equivalent role—if the organization lacks these titles, attach a clear explanation of the signatory’s authority.

Print or type the name and title of the officer or trustee signing the report to ensure legibility and official recognition.

Prepare a $75.00 check for the filing fee, making it payable to the State of New Hampshire, ensuring the financial transaction is aligned with the report’s submission.

Have the report sworn or affirmed before a Notary Public to confirm the veracity and completeness of the information provided.

Review the report thoroughly, along with accompanying schedules and statements, to affirm it is true, correct, and complete under the penalties of perjury as outlined in RSA 641:1-3.

Adhere to submission deadlines to avoid penalties or potential administrative complications.

Consult with legal or financial advisors if there are uncertainties regarding the report’s content, ensuring compliance with statutory requirements.

Maintain a copy of the submitted report and all accompanying documentation for the organization's records.

Don'ts:

Do not allow the signature of the Executive Director to serve as the primary authorization unless they hold one of the designated titles or provided an attached explanation.

Do not leave any fields incomplete, as each section contributes to a comprehensive understanding of the organization’s status and activities.

Do not overlook the necessity of the notarization process; its omission can render the submission incomplete or invalid.

Do not delay the review and preparation process, as timely submission is critical for compliance.

Do not submit the report without verifying the accuracy of all financial schedules and statements included, ensuring they are consistent with the organization’s records.

Do not disregard the importance of the filing fee; submission without the fee or with an incorrect amount may lead to processing delays.

Do not hesitate to contact the Charitable Trusts Unit for clarification on filling out the report if any sections are confusing or ambiguous.

Do not submit inaccurate or misleading information; doing so under the penalties of perjury can have serious legal implications.

Do not forget to retain proof of mailing or submission, providing a safeguard against disputes regarding compliance.

Do not neglect the value of thorough internal review by multiple officers or trustees, fostering collective responsibility for the report’s contents.

Misconceptions

Understanding the New Hampshire Annual Report form can often come with its fair share of misconceptions. Here are 10 common misunderstandings clarified to ensure accurate compliance and submission:

- Misconception 1: Any member of the organization can sign the annual report. In reality, only the president, treasurer, or a trustee is allowed to sign it. This is explicitly stated, and having the incorrect individual sign can invalidate the submission.

- Misconception 2: The filing fee is negotiable or can be waived under certain circumstances. The filing fee is a fixed amount of $75.00, payable to the State of New Hampshire, and is required for all submitting organizations without exceptions.

- Misconception 3: Digital signatures are acceptable for the annual report. As per the current guidelines, a physical signature is required to validate the document, emphasizing the importance of a traditional ink signature.

Misconception 4: The Executive Director can sign the report if they're acting as the head of the organization. Despite their role, the form specifies that the Executive Director's signature is not acceptable, and an attached explanation is needed if the organization does not have a president or treasurer.Misconception 5: The annual report form is optional for some charities. In fact, all registered organizations are obliged to submit this form to the Charitable Trusts Unit as part of maintaining their registration and compliance.Misconception 6: Submission deadlines are flexible. The due date is tied to the fiscal year end of the organization, and timely submission is crucial. Delayed filings can lead to penalties or additional fees.Misconception 7: The form is the only thing needed for annual reporting. Besides the form, accompanying schedules and statements are also required to provide a comprehensive overview of the organization's activities and finances for the year.Misconception 8: If there are no financial changes, the report doesn't need to be filed. Regardless of financial activity, the annual report is a regulatory requirement to confirm the ongoing operations and compliance of the organization.Misconception 9: Only organizations based in New Hampshire need to file. Any organization registered to operate in New Hampshire, regardless of where it is based, must submit this form annually.Misconception 10: Information provided on the form is kept confidential. While certain sensitive details are protected, the form itself is a public record, contributing to transparency and public trust in the charitable sector.

Correcting these misconceptions helps organizations ensure that their submission process is smooth and in full compliance with the requirements set out by the Office of the New Hampshire Attorney General Charitable Trusts Unit.

Key takeaways

Filling out the New Hampshire Annual Report form is an essential task for charities operating within the state. Here are seven key takeaways to help you navigate the process:

- The filing fee for the report is $75.00, which must be made payable to the State of New Hampshire. This fee is crucial for the processing of your annual report.

- It's important to provide accurate information about your organization, including its name, the fiscal year end date, and the contact details of the person in care of the report.

- The report must include the state registration number and the address details of the organization. This helps in validating the charity's legitimacy and operational status.

- A crucial requirement is that the report must be signed by the President, Treasurer, or a Trustee of the organization. The Executive Director's signature will not be accepted, highlighting the need for endorsement by a high-ranking official.

- If your organization does not have a President or Treasurer, you must attach an explanation or definition of the authority vested in the signer. This ensures clarity regarding the responsibility and authority matrix within the organization.

- Under the penalties of perjury laws set forth in RSA 641:1-3, the signer declares that they have examined the report, including any accompanying schedules and statements, and to the best of their knowledge, it is true, correct, and complete. This emphasizes the importance of accuracy and honesty in the reporting process.

- The form must be notarized, requiring the presence of a Notary Public who will verify the identity of the officer or trustee signing the report. This step adds an additional layer of verification to the process.

By following these guidelines and ensuring that all information provided is accurate and complete, organizations can fulfill their reporting obligations effectively. This not only aids in maintaining compliance with New Hampshire laws but also contributes to the transparency and accountability of charitable activities within the state.

Different PDF Templates

Nheasy - Important for the proper tracking and management of Medicaid eligibility and coverage dates for residents in nursing facilities.

New Hampshire Parenting Plan - Guidelines for legal representation are included, recognizing scenarios where parties may be self-represented or assisted by counsel.

New Hampshire Load - This form is managed by the New Hampshire Department of Transportation and includes specifics such as applicant information and load details.