Nh 1120 Es Template

Navigating the complexities of estimated business taxes in New Hampshire is made more straightforward with the use of Form NH-1120-ES, a crucial document provided by the New Hampshire Department of Revenue Administration for the 2010 tax year. This form serves as a guide for entities required to pay Business Profits and/or Business Enterprise Taxes, indicating who must make estimated tax payments and under what conditions. Filing this form is mandatory for any entity whose estimated tax for either category exceeds $200, necessitating quarterly payments to avoid penalties. Interestingly, the form also addresses the recognition of civil unions, ensuring all entities are aware of their obligations and rights under state law. Payment of estimated taxes can be conveniently made online, streamlining the process for busy professionals. Furthermore, penalties for underpayment are succinctly outlined, providing entities with a clear understanding of the consequences of failing to meet their estimated tax obligations. Additionally, the form offers guidance on when payments are due, based on the entity's filing status as either calendar year or fiscal year filers, and includes provisions for various tax credits that might reduce the overall tax liability. For those in need of further assistance, the form directs filers to additional resources, including a Frequently Asked Questions section on the department's website and contact information for Central Taxpayer Services. Form NH-1120-ES not only simplifies the process of estimating and paying business taxes but also ensures entities remain compliant with New Hampshire tax laws, contributing to the state's fiscal health.

Document Preview Example

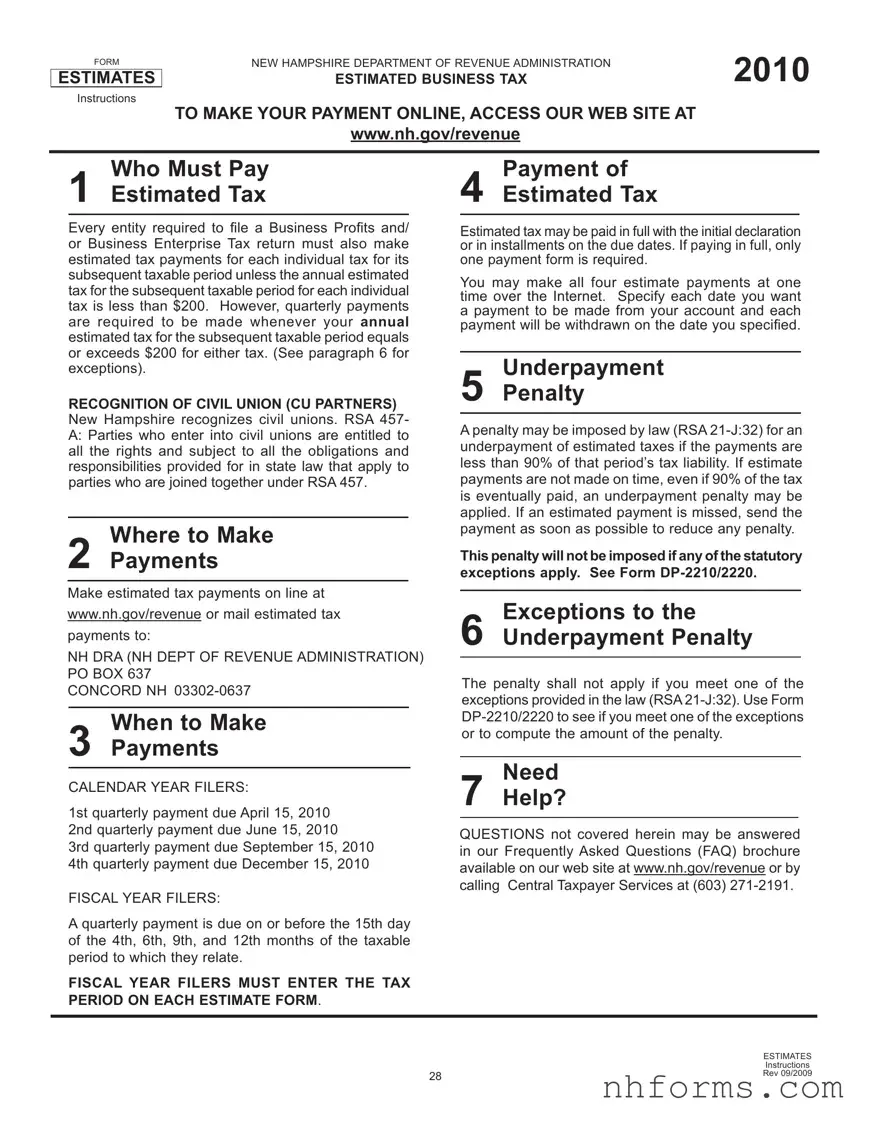

FORM

ESTIMATES

Instructions

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

2010 |

ESTIMATED BUSINESS TAX |

TO MAKE YOUR PAYMENT ONLINE, ACCESS OUR WEB SITE AT

www.nh.gov/revenue

Who Must Pay

1Estimated Tax

Every entity required to file a Business Profits and/ or Business Enterprise Tax return must also make estimated tax payments for each individual tax for its subsequent taxable period unless the annual estimated tax for the subsequent taxable period for each individual tax is less than $200. However, quarterly payments are required to be made whenever your annual estimated tax for the subsequent taxable period equals or exceeds $200 for either tax. (See paragraph 6 for exceptions).

RECOGNITION OF CIVIL UNION (CU PARTNERS) New Hampshire recognizes civil unions. RSA 457-

A:Parties who enter into civil unions are entitled to all the rights and subject to all the obligations and responsibilities provided for in state law that apply to parties who are joined together under RSA 457.

Where to Make

2 Payments

Make estimated tax payments on line at

Payment of

4Estimated Tax

Estimated tax may be paid in full with the initial declaration or in installments on the due dates. If paying in full, only one payment form is required.

You may make all four estimate payments at one time over the Internet. Specify each date you want a payment to be made from your account and each payment will be withdrawn on the date you specified.

Underpayment

5Penalty

A penalty may be imposed by law (RSA

payments are not made on time, even if 90% of the tax

is eventually paid, an underpayment penalty may be applied. If an estimated payment is missed, send the payment as soon as possible to reduce any penalty.

This penalty will not be imposed if any of the statutory exceptions apply. See Form

www.nh.gov/revenue or mail estimated tax

payments to:

NH DRA (NH DEPT OF REVENUE ADMINISTRATION) PO BOX 637

CONCORD NH

When to Make

3Payments

CALENDAR YEAR FILERS:

1st quarterly payment due April 15, 2010 2nd quarterly payment due June 15, 2010 3rd quarterly payment due September 15, 2010 4th quarterly payment due December 15, 2010

FISCAL YEAR FILERS:

A quarterly payment is due on or before the 15th day

of the 4th, 6th, 9th, and 12th months of the taxable period to which they relate.

FISCAL YEAR FILERS MUST ENTER THE TAX PERIOD ON EACH ESTIMATE FORM.

Exceptions to the

6Underpayment Penalty

The penalty shall not apply if you meet one of the exceptions provided in the law (RSA

Need

7Help?

QUESTIONS not covered herein may be answered in our Frequently Asked Questions (FAQ) brochure available on our web site at www.nh.gov/revenue or by calling Central Taxpayer Services at (603)

|

ESTIMATES |

|

Instructions |

28 |

Rev 09/2009 |

|

|

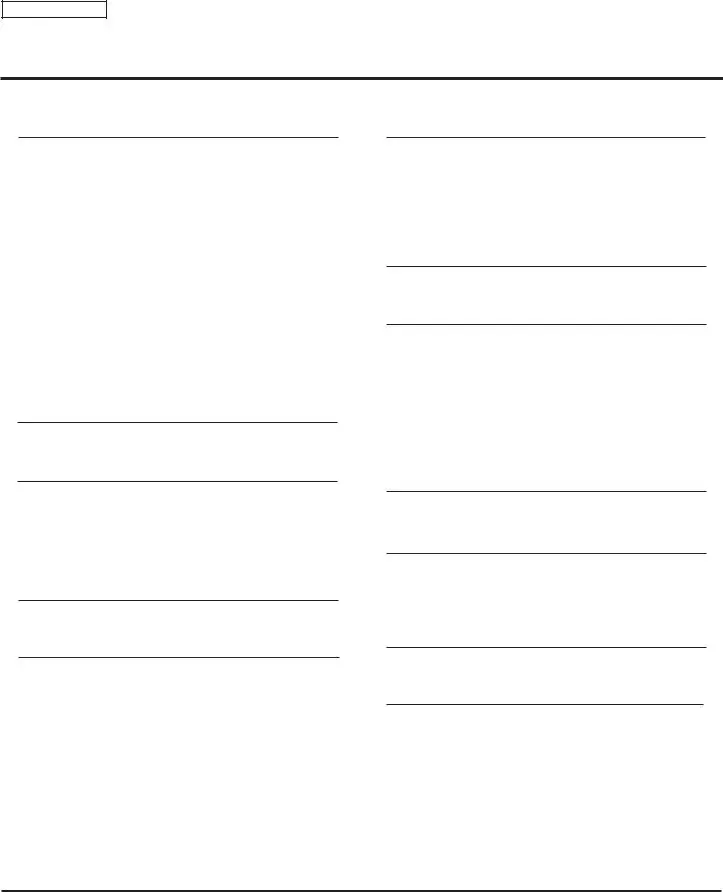

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

||

ESTIMATED CORPORATION BUSINESS TAX |

|

||||

|

TO MAKE YOUR PAYMENTS ONLINE, ACCESS OUR WEB SITE AT www.nh.gov/revenue |

|

|||

|

|

|

|

|

|

|

1 ESTIMATED TAX BASE AND/OR GROSS BUSINESS PROFITS |

BET(a) |

BPT(b) |

||

|

...............................................a BET Taxable Base After Apportionment |

|

|

|

|

|

|

|

|

|

|

bNew Hampshire Taxable Business Profits After Apportionment

2 TAX

a Line 1(a) x .0075...........................................................................................

b Line 1(b) x .085..................................................................................

3CREDITS

a |

RSA |

|

|

|

|

|||||

b |

RSA |

|

|

|

|

|

|

|

||

|

(Community Reinvestment Opportunity Program) |

|

|

|

|

|||||

c |

..........................RSA |

|

|

|

|

|||||

d |

RSA |

|

|

|

|

|

||||

|

|

|

|

|||||||

e |

RSA |

|

|

|

|

|

||||

|

|

|

|

|||||||

f |

RSA |

|

|

|

|

|

||||

|

|

|

|

|||||||

3 |

..............................................CREDITS TOTAL [sum of Lines 3(a) - 3(f)] |

|

|

|

|

|||||

4 Estimated tax for current year (Line 2 minus Line 3) |

|

|

|

|

|

|||||

|

|

|

|

|||||||

5 Overpayment from previous taxable period |

|

|

|

|

|

|||||

|

|

|

|

|||||||

.................................6 Balance of Business Taxes Due (Line 4 minus Line 5) |

|

|

|

|

||||||

|

|

|

COMPUTATION and RECORD of PAYMENTS |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

BET |

Amount of each Installment |

BPT |

Total Due |

CALENDAR YEAR |

||||

Date Paid |

(1/4 of Line 6 of worksheet) |

(BET and/or BPT) |

DUE DATES |

|||||||

|

|

|

||||||||

1 |

$ |

$ |

|

$ |

April 15, 2010 |

|||||

2 |

$ |

$ |

|

$ |

June 15, 2010 |

|||||

3 |

$ |

$ |

|

$ |

Sept. 15, 2010 |

|||||

4 |

$ |

$ |

|

$ |

Dec. 15, 2010 |

|||||

|

|

|

|

|

|

|

|

|

|

|

ESTIMATED TAX FORM INSTRUCTIONS

Line 1 Enter ¼ of the Business Enterprise Tax calculated on Line 6 BET(a) in the tax worksheet above.

Line 2 Enter ¼ of the Business Profits Tax calculated on Line 6 BPT(b) in the tax worksheet above.

Line 3 Enter the TOTAL payment sum of Lines 1 and 2.

IMPORTANT:

THE PENALTY PROVISIONS OF RSA

_ _ _ _ _ _ _ _ _ _ (Cut_ along_ this_line _and keep_ the_Estimated_ _Tax Worksheet_ _ above_ for_ your_records)_ _ _ _ _ _ _ _ _ _ _

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

||||||||||

|

|

|

ESTIMATED CORPORATION BUSINESS TAX - 2010 |

|

|

|

|

||||||||

702 |

|

|

|

|

|

|

|||||||||

For the CALENDAR year 2010 or other taxable period beginning |

|

|

and ending |

|

|

|

|

|

|

||||||

|

|

|

|

|

Mo |

Day Year |

|

Mo Day Year |

|

FOR DRA USE ONLY |

|||||

|

PRINT OR TYPE |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

NAME OF CORPORATION |

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

LIMITED LIABILITY COMPANY |

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

FOR DRA USE ONLY |

NUMBER AND STREET ADDRESS |

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET 1 |

$ |

|

|

||||

|

ADDRESS (continued) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BPT 2 |

$ |

|

|

||

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Amount of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment 3 |

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

NH DRA |

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

||||||||||

|

|

TO: |

PO BOX 637 |

|

|

||||||||||

|

|

|

|

Enclose, but do not staple or tape your payment to |

|||||||||||

|

|

|

CONCORD NH |

|

|

this estimate. Do not file a $0 estimate. |

|||||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|

|

|

|

|

||

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|||

|

ESTIMATED CORPORATION BUSINESS TAX - 2010 |

||

702 |

|||

|

|

||

For the CALENDAR year 2010 or other taxable period beginning |

and ending |

||

FOR DRA USE ONLY

|

|

|

|

|

|

|

|

Mo |

Day |

Year |

|

|

Mo |

|

Day |

Year |

|

|

|

|

|||

PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

NAME OF CORPORATION |

|

|

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DRA USE ONLY |

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET 1 |

$ |

|

||||

|

|

|

ADDRESS (continued) |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BPT 2 |

$ |

|

||||

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment 3 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

NH DRA |

|

|

|

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

|||||||||||||

|

|

|

|

PO BOX 637 |

|

|

|

|

|

||||||||||||||

|

|

|

|

TO: |

CONCORD NH |

|

|

|

|

|

Enclose, but do not staple or tape your payment to |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

|

(Cut along this line) |

|

|

|

|

|

|

|

|

|

|

|

|||||

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

|||||||||||||||||||||||

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

|

|

|||||||||||||||

|

|

ESTIMATED CORPORATION BUSINESS TAX - 2010 |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

702 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the CALENDAR year 2010 or other taxable period beginning |

|

|

|

|

and ending |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Mo |

Day |

Year |

|

Mo |

|

Day |

Year |

|

FOR DRA USE ONLY |

||||||

|

|

|

PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

NAME OF CORPORATION |

|

|

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

FOR DRA USE ONLY |

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET 1 |

$ |

|

|||||||

|

|

|

ADDRESS (continued) |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BPT 2 |

$ |

|

||||

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment 3 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

||||||||||

|

|

|

|

NH DRA |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

Enclose, but do not staple or tape your payment to |

|||||||||||||

|

|

|

|

TO: |

PO BOX 637 |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

|||||||||||||

|

|

|

|

|

CONCORD NH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

|

(Cut along this line) |

|

|

|

|

|

|

|

|

|

|

|

|||||

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

|||||||||||||||||||||||

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

ESTIMATED CORPORATION BUSINESS TAX - 2010 |

|

|

|

|

|

|

||||||||||||

702 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the CALENDAR year 2010 or other taxable period beginning |

|

|

|

|

and ending |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

Mo |

Day |

Year |

|

|

Mo |

|

Day |

Year |

|

FOR DRA USE ONLY |

||||

|

|

|

PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

NAME OF CORPORATION |

|

|

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

FOR DRA USE ONLY |

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET 1 |

$ |

|

||||

|

|

|

ADDRESS (continued) |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BPT 2 |

$ |

|

||||

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment 3 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

NH DRA |

|

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

|||||||||||||||

|

|

|

|

TO: |

PO BOX 637 |

|

|

|

Enclose, but do not staple or tape your payment to |

||||||||||||||

|

|

|

|

CONCORD NH |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Breakdown

| Fact | Detail |

|---|---|

| Form Name | NH-1120-ES | ro

| Purpose | Estimated Corporation Business Tax |

| Issuing Agency | New Hampshire Department of Revenue Administration |

| Who Must File | Entities required to file a Business Profits and/or Business Enterprise Tax return |

| Minimum Estimated Tax Requirement | Payments required if annual estimated tax is $200 or more |

| Payment Submission | Online via www.nh.gov/revenue or by mail to NH DRA, PO BOX 637, CONCORD NH 03302-0637 |

| Quarterly Payment Due Dates for Calendar Year Filers | April 15, June 15, September 15, December 15 |

| Underpayment Penalty | Imposed if payments are less than 90% of tax liability, unless statutory exceptions apply |

| Governing Law(s) | RSA 21-J:32 (Penalty for Underpayment), RSA 457-A (Recognition of Civil Union) |

| Assistance | FAQs available at www.nh.gov/revenue or by calling (603) 271-2191 |

Detailed Instructions for Writing Nh 1120 Es

Filling out the NH-1120-ES form is a key step for entities required to make estimated business tax payments in New Hampshire. This document ensures compliance with state tax regulations and helps avoid potential penalties for underpayment of estimated taxes. The process of filling out this form involves reporting estimated taxes on business profits and enterprise activities, and if applicable, applying credits. Here's a clear step-by-step guide on how to complete the form correctly.

- Start by accessing the New Hampshire Department of Revenue Administration's website to either fill out the form online or download a copy for mail submission.

- Identify whether the business entity is filing for a calendar year or a fiscal year. Mark the applicable period at the top of the form.

- Print or type the legal name of the corporation or limited liability company in the designated space.

- Enter the Federal Employer Identification Number (FEIN) or Department Identification Number (DIN) if previously issued, in the appropriate field.

- Provide the complete address of the business, including street address, city/town, state, and ZIP code.

- Calculate the Business Enterprise Tax (BET) based on the taxable base after apportionment (provided in Line 1(a)) and multiply it by .0075 as indicated on Line 2(a) of the form.

- Calculate the New Hampshire Taxable Business Profits after apportionment (provided in Line 1(b)) and multiply it by .085 as indicated on Line 2(b) of the form.

- List any applicable credits from RSA 162-L:10, RSA 162-N, and other specified tax credit programs in section 3, summing them up for the total credits.

- Subtract the total credits (Line 3) from the estimated tax for the current year (Line 2) to find the balance of business taxes due and enter this amount in Line 6.

- Divide the balance due (Line 6) by four to determine the amount of each installment payment for calendar year filers.

- Enter the date paid and amount of each installment in the computation and record of payments section for BET and BPT separately.

- If preparing a paper submission, make a check payable to "State of New Hampshire" and mail it to NH DRA, PO BOX 637, Concord NH 03302-0637 along with the completed form. Ensure no attachments like staples or tape are used to affix the payment to the form.

- Retain a copy of the completed form and any payment records for your business records.

After submitting the NH-1120-ES form, ensure that future payments are made in accordance with the established due dates to avoid penalties. Staying proactive with these payments and any adjustments throughout the tax year will help maintain compliance and minimize any potential financial liabilities.

Essential Queries on Nh 1120 Es

Who is required to file an NH-1120-ES form?

Entities that need to file a Business Profits and/or Business Enterprise Tax return must also make estimated tax payments for each individual tax for its subsequent taxable period if their annual estimated tax for each tax is $200 or more. Entities with estimated taxes below this amount for either tax are not required to make estimated payments.

How can I make estimated tax payments for the NH-1120-ES form?

Payments can be made online through the official website of the New Hampshire Department of Revenue Administration at www.nh.gov/revenue. Alternatively, payments can be mailed to the NH DRA at PO BOX 637, CONCORD NH 03302-0637. Payments may be paid in full with the initial declaration or in installments on the due dates.

When are the estimated tax payments due?

For calendar year filers, the estimated payments are due on April 15, June 15, September 15, and December 15 of the tax year. For fiscal year filers, payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable period.

Is there a penalty for underpaying estimated taxes?

Yes, a penalty may be imposed for underpaying estimated taxes if the payments are less than 90% of the tax liability for that period. However, this penalty may be waived if one of the statutory exceptions applies, which can be determined using Form DP-2210/2220.

Where can I find help if I have questions not covered in the instructions?

For questions not addressed in the provided instructions, assistance is available through the New Hampshire Department of Revenue Administration's Frequently Asked Questions (FAQ) brochure available at their official website www.nh.gov/revenue or by contacting Central Taxpayer Services at (603) 271-2191.

Common mistakes

When filling out the NH-1120-ES form for estimated corporation business tax, mistakes can lead to complications, delays, and potentially increased liabilities. Here are six common errors individuals make:

Not paying enough estimated tax when due. Entities are required to pay estimated taxes quarterly when their annual estimate is $200 or more. Failure to do so, or underestimating the amount, may result in underpayment penalties, despite eventual full payment.

Missing deadlines for quarterly payments. Specific dates are set for calendar and fiscal year filers. Not respecting these deadlines can lead to penalties, even if the taxpayer pays at least 90% of the tax liability eventually.

Inaccurately applying tax credits. The NH-1120-ES form allows for various credits, such as the CDFA Investment Tax Credit and the Research & Development Tax Credit. Incorrect calculation or improper application of these credits can alter the amount of estimated tax due, leading to overpayment or underpayment.

Misunderstanding when payments are required. Every entity that files a Business Profits and/or Business Enterprise Tax return needs to make estimated tax payments if the tax is above a certain threshold unless exceptions apply. Misinterpreting these requirements can result in noncompliance.

Incorrectly identifying the taxable period and not properly marking the fiscal year on each estimate form if applicable, potentially causing confusion and processing delays.

Failure to include sufficient information or including incorrect information, such as using a Department Identification Number (DIN) instead of a Federal Employer Identification Number (FEIN) where required, which can lead to processing errors.

To avoid these mistakes, individuals should pay close attention to the form's details, ensure accurate calculations, and adhere to the specified deadlines. Utilizing online resources for payment and keeping a careful record of payments and calculations can also help in maintaining compliance and avoiding penalties.

Seeking clarification on confusing aspects or gaining additional information through the NH Department of Revenue Administration's website or by calling Central Taxpayer Services can prevent common errors. Moreover, consulting with a tax professional may be beneficial to navigate the complexities of estimated tax payments.

Documents used along the form

When businesses in New Hampshire prepare their NH-1120-ES form for estimated corporation business taxes, it is often a part of a broader tapestry of required documentation. Each document plays a crucial role in ensuring compliance with state tax laws and supporting accurate financial reporting. Understanding these documents helps streamline the tax preparation process and ensures businesses meet their obligations with ease.

- NH-1120: This is the Business Profits Tax (BPT) return form. Businesses use it to report their income and calculate the taxes due on profits earned within New Hampshire.

- NH-BET: The Business Enterprise Tax (BET) return form is required for entities to report their enterprise value tax, which is based on the enterprise value tax base after certain adjustments.

- Form DP-2210/2220: Employed to calculate underpayment penalties for estimated taxes, this document is vital for businesses that did not meet the estimated tax payment threshold.

- Form NH-1040: The Proprietorship Business Profits Tax Return is for sole proprietors in New Hampshire to report their business profits for tax purposes.

- NH-ES-WE: A worksheet for estimating business enterprise and business profits taxes, it helps entities in New Hampshire determine their estimated tax liabilities.

- NH DIV 100: The Declaration of Estimated Dividend and Interest Tax form is used by entities to estimate and report taxes due on dividends and interest income.

- Form CDFA 100: This form is relevant for claiming the Community Development Finance Authority (CDFA) Investment Tax Credit, a credit that businesses can apply against their BPT, BET, or other New Hampshire taxes.

Together, these documents form a comprehensive framework for tax preparation and compliance in New Hampshire. The interconnected nature of these forms highlights the importance of a detailed and informed approach to tax planning and reporting. By understanding each document's role and requirements, businesses can navigate their fiscal responsibilities with confidence and precision.

Similar forms

The NH 1120 ES form is similar to the IRS Form 1040-ES, which is used for calculating and paying estimated taxes on a federal level. Both forms serve the purpose of helping taxpayers - whether individuals or businesses - estimate their tax liability for the year and make payments in advance to avoid penalties. The NH 1120 ES focuses on businesses operating within New Hampshire, guiding them through estimating their business profits and enterprise taxes. Like the IRS Form 1040-ES, it allows for quarterly payments and provides instructions on how to calculate the estimated tax due. The idea is to ensure that businesses pay at least 90% of their tax liability during the fiscal year or 100% of the prior year's liability to avoid underpayment penalties, paralleling the requirements set forth in the IRS form for individual taxpayers.

Another document the NH 1120 ES form bears resemblance to is the Form 990-W, a worksheet provided by the IRS for tax-exempt organizations to estimate their federal tax liability. While Form 990-W is tailored towards non-profits calculating their unrelated business taxable income (UBTI), the NH 1120 ES is designed for corporations to estimate their state tax obligations. Both forms guide the taxpayer in determining the amount of tax that might be owed for the year and in making quarterly estimated payments. They aim to help taxpayers avoid underpayment penalties by accurately estimating and prepaying their tax liability through regular, installment-based payments. Despite their different target audiences, the core purpose of facilitating estimated tax payments and preventing underpayment penalties links these forms closely together.

Dos and Don'ts

When it comes to filing the NH-1120-ES form, entities must navigate through a series of guidelines to ensure compliance with the New Hampshire Department of Revenue Administration's requirements for estimated corporation business tax. Understanding both what should be done and what should be avoided is crucial for the accurate and timely submission of this form. Here is a comprehensive list to guide through the process:

- Do verify if you're required to make estimated tax payments. If your entity's annual estimated tax for either the Business Profits Tax (BPT) or Business Enterprise Tax (BET) is $200 or more, you're obligated to make quarterly estimated tax payments.

- Don't wait if you've missed a payment. To minimize penalties, make the missed payment as soon as possible even if the due date has passed.

- Do calculate your payments accurately. Ensure you've correctly identified your estimated taxes due for both BET and BPT based on your business's taxable base and profits after apportionment.

- Don't forget to account for credits. Reduce your estimated tax by any applicable credits such as the CDFA Investment Tax Credit or the Economic Revitalization Zone Tax Credit, among others listed in the form.

- Do make payments online for convenience. The New Hampshire Department of Revenue Administration offers an online payment system, which allows for timely and secure transactions.

- Don't neglect to include your Federal Employer Identification Number (FEIN) or Limited Liability Company Department Identification Number (if applicable), as failing to do so could result in filing errors or processing delays.

- Do adhere to the filing deadlines. For calendar year filers, the quarterly payments are due on April 15, June 15, September 15, and December 15. For fiscal year filers, payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of your taxable period.

- Don't send a $0 estimate. If you determine no estimated tax is due, you should not file an NH-1120-ES form for that period.

- Do seek assistance if needed. If you have questions or require further clarification on how to complete the form or make payments, utilize the resources available on the New Hampshire Department of Revenue Administration website or contact Central Taxpayer Services.

Following these guidelines will help ensure that your estimated corporation business tax payments are made correctly and on time, avoiding potential penalties and interest for underpayment or late payments. It's essential to stay informed of any changes to state tax regulations that may affect the filing process.

Misconceptions

When it comes to filing the NH-1120-ES form, or the Estimated Corporation Business Tax for New Hampshire, there are several misconceptions that can confuse or mislead businesses. Understanding these misconceptions is crucial to ensuring that your business complies with tax regulations accurately. Below are eight common misunderstandings:

- Only corporations need to file: It's a common misconception that only corporations are required to file the NH-1120-ES. In reality, any entity subject to Business Profits Tax (BPT) and/or Business Enterprise Tax (BET) needs to make estimated tax payments if the estimated taxes exceed $200 for the tax period.

- Estimated tax payments are optional: Some businesses mistakenly believe that estimated tax payments are optional. In fact, if a business's estimated annual tax is $200 or more, quarterly estimated tax payments are mandatory to avoid penalties.

- Same due dates for all: Another false assumption is that estimated tax payments have the same due dates for every business. While calendar year filers have specific quarterly due dates, fiscal year filers must make payments by the 15th day of the 4th, 6th, 9th, and last month of their fiscal year.

- Civil union partners are excluded: The fact that New Hampshire recognizes civil unions means that businesses owned by civil union partners are entitled to the same rights, obligations, and responsibilities as those owned by married couples under state law. This includes joint filing of taxes.

- No online payment options: Contrary to what some may believe, the NH Department of Revenue Administration does allow online payments for estimated taxes, offering convenience and efficiency in tax administration.

- Paying in full avoids penalties: While paying the full amount of estimated tax can minimize penalties, it is not a guaranteed way to avoid them. Penalties can still apply if the paid amount is less than 90% of the actual tax liability for that period.

- Penalties are unavoidable if a payment is missed: If an estimated tax payment is missed, sending the payment as soon as possible can help to reduce penalties. Moreover, penalties may not apply if the business meets certain statutory exceptions outlined in the tax code.

- Estimate forms are complicated: Though tax forms can be intimidating, the NH-1120-ES form includes clear instructions for entering information and calculating payments. Additionally, resources and assistance from the NH Department of Revenue Administration are available for those who need help.

Addressing these misconceptions can help businesses fulfill their tax obligations more accurately and avoid unnecessary penalties. Understanding the specific requirements and options available for payment can improve compliance and reduce the stress around tax season.

Key takeaways

When it comes to filing the NH 1120 ES form, which concerns the estimated corporation business tax in New Hampshire, there are several key takeaways for businesses to understand:

- Estimated tax payments are mandatory for businesses expected to owe at least $200 in either Business Profits Tax (BPT) or Business Enterprise Tax (BET) for the year. These taxes must be calculated and paid in advance to avoid penalties.

- Payment flexibility is offered through the option to pay the estimated taxes in full at the beginning of the year or in quarterly installments. This allows businesses to manage cash flow more effectively throughout the year.

- Penalties for underpayment are enforced if the paid estimated taxes are less than 90% of the actual tax liability for that period. It’s crucial for businesses to accurately calculate their estimated taxes to avoid these penalties, although some exceptions may apply.

- Multiple options are available for making payments, including online payment through the official New Hampshire Department of Revenue Administration website or mailing to the designated P.O. Box address. This ensures convenience and accessibility for all businesses.

Understanding these key aspects of the NH 1120 ES form is vital for businesses operating in New Hampshire to comply with state tax regulations, avoid unnecessary penalties, and ensure smooth financial operations throughout the fiscal year.

Different PDF Templates

Nh Annual Report - It is critical for filing organizations to review all accompanying schedules and statements for completeness and accuracy before submission.

New Hampshire Trust Execution Requirements - Provides a comprehensive format for reviewing estate income from various sources like dividends and rent.