Nh 1065 Es Template

Navigating the requirements of tax filings and payments can be a complex process for businesses, and the NH-1065-ES form represents a crucial aspect of this for partnerships operating in New Hampshire. Mandated by the New Hampshire Department of Revenue Administration, this form is designed to facilitate the estimated tax payments specifically for partnerships, ensuring that these entities comply with local tax obligations in a timely manner. Tax season brings about the need for these businesses to project and remit payments on their business profits and/or business enterprise taxes, if their estimated taxes exceed $200 for the tax year. It's noteworthy that the form accommodates quarterly payments, an option that eases the financial burden by spreading tax liabilities over the fiscal year. Furthermore, the NH-1065-ES form recognizes civil unions, aligning with state policies to acknowledge all taxpayers equitably. Penalties for underpayment serve as a deterrent against non-compliance, emphasizing the significance of accurate and punctual submissions. Additionally, technological advances have simplified the process, enabling online payments and thereby providing a convenient, secure, and efficient method for fulfilling these tax obligations. With resources available for assistance, including a comprehensive FAQ section on the Department's website, partnerships are supported in navigating the intricacies of tax payments to avoid common pitfalls and penalties associated with late or incorrect filings.

Document Preview Example

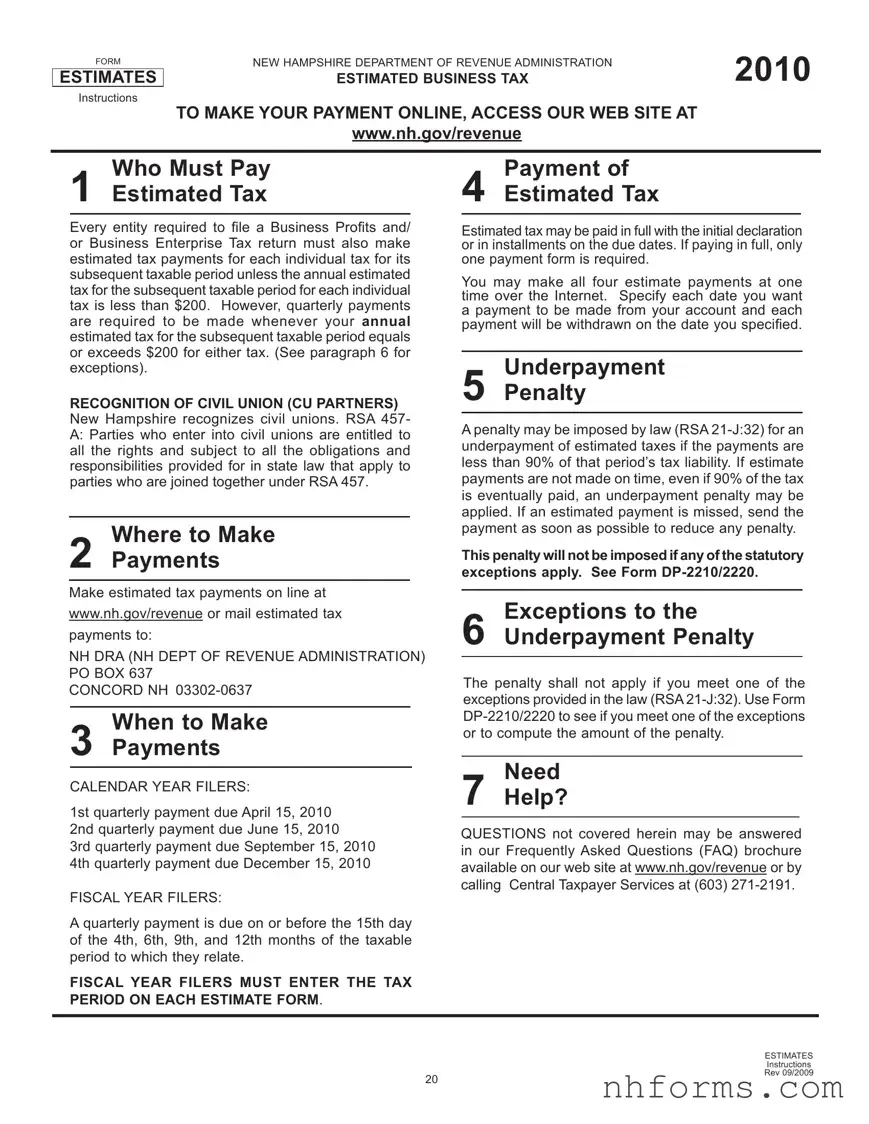

FORM

ESTIMATES

Instructions

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

2010 |

ESTIMATED BUSINESS TAX |

TO MAKE YOUR PAYMENT ONLINE, ACCESS OUR WEB SITE AT

www.nh.gov/revenue

Who Must Pay

1Estimated Tax

Every entity required to file a Business Profits and/ or Business Enterprise Tax return must also make estimated tax payments for each individual tax for its subsequent taxable period unless the annual estimated tax for the subsequent taxable period for each individual tax is less than $200. However, quarterly payments are required to be made whenever your annual estimated tax for the subsequent taxable period equals or exceeds $200 for either tax. (See paragraph 6 for exceptions).

RECOGNITION OF CIVIL UNION (CU PARTNERS) New Hampshire recognizes civil unions. RSA 457-

A:Parties who enter into civil unions are entitled to all the rights and subject to all the obligations and responsibilities provided for in state law that apply to parties who are joined together under RSA 457.

Where to Make

2 Payments

Make estimated tax payments on line at

Payment of

4Estimated Tax

Estimated tax may be paid in full with the initial declaration or in installments on the due dates. If paying in full, only one payment form is required.

You may make all four estimate payments at one time over the Internet. Specify each date you want a payment to be made from your account and each payment will be withdrawn on the date you specified.

Underpayment

5Penalty

A penalty may be imposed by law (RSA

is eventually paid, an underpayment penalty may be

applied. If an estimated payment is missed, send the payment as soon as possible to reduce any penalty.

This penalty will not be imposed if any of the statutory exceptions apply. See Form

www.nh.gov/revenue or mail estimated tax

payments to:

NH DRA (NH DEPT OF REVENUE ADMINISTRATION) PO BOX 637

CONCORD NH

When to Make

3Payments

CALENDAR YEAR FILERS:

1st quarterly payment due April 15, 2010 2nd quarterly payment due June 15, 2010 3rd quarterly payment due September 15, 2010 4th quarterly payment due December 15, 2010

FISCAL YEAR FILERS:

A quarterly payment is due on or before the 15th day

of the 4th, 6th, 9th, and 12th months of the taxable period to which they relate.

FISCAL YEAR FILERS MUST ENTER THE TAX PERIOD ON EACH ESTIMATE FORM.

Exceptions to the

6Underpayment Penalty

The penalty shall not apply if you meet one of the exceptions provided in the law (RSA

Need

7Help?

QUESTIONS not covered herein may be answered in our Frequently Asked Questions (FAQ) brochure available on our web site at www.nh.gov/revenue or by calling Central Taxpayer Services at (603)

20

ESTIMATES

Instructions

Rev 09/2009

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

||

|

|

||||

|

ESTIMATED PARTNERSHIP BUSINESS TAX |

|

|||

|

TO MAKE YOUR PAYMENTS ONLINE, ACCESS OUR WEB SITE AT www.nh.gov/revenue |

|

|||

|

|

|

|

|

|

|

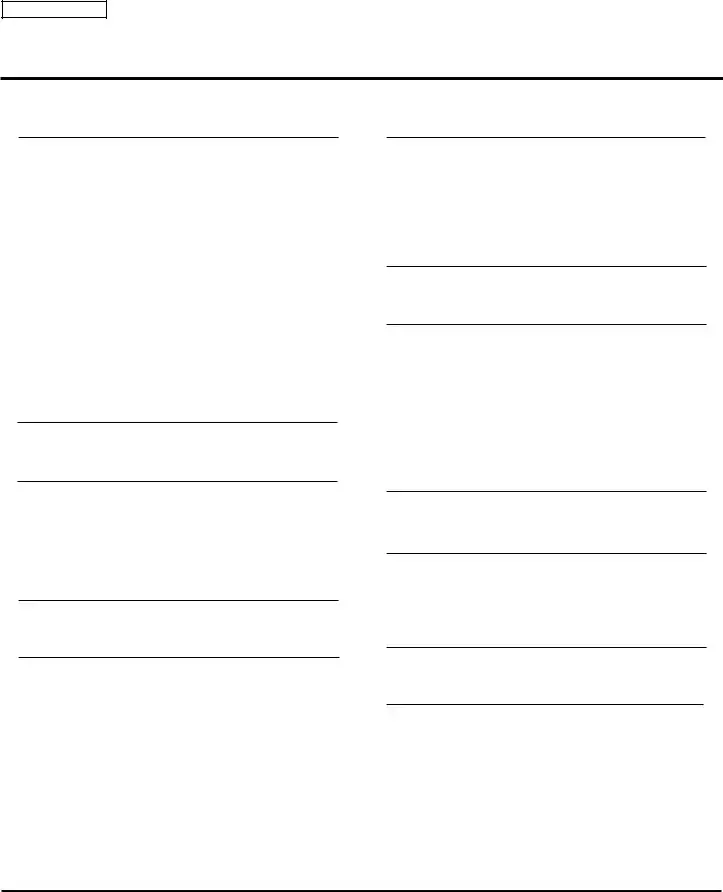

1 ESTIMATED TAX BASE AND/OR GROSS BUSINESS PROFITS |

BET(a) |

BPT(b) |

||

|

...............................................a BET Taxable Base After Apportionment |

|

|

|

|

|

|

|

|

|

|

bNew Hampshire Taxable Business Profits After Apportionment

2 TAX

a Line 1(a) x .0075...........................................................................................

b Line 1(b) x .085..................................................................................

3CREDITS

a |

RSA |

|

|

|

|

|

|

|||||

b |

RSA |

|

|

|

|

|

|

|

|

|

||

|

(Community Reinvestment Opportunity Program) |

|

|

|

|

|

|

|||||

c |

..........................RSA |

|

|

|

|

|

|

|||||

d |

RSA |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

e |

RSA |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

f |

RSA |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

3 |

..............................................CREDITS TOTAL [sum of Lines 3(a) - 3(f)] |

|

|

|

|

|

|

|||||

4 Estimated tax for current year (Line 2 minus Line 3) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

5 Overpayment from previous taxable period |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

.................................6 Balance of Business Taxes Due (Line 4 minus Line 5) |

|

|

|

|

|

|

||||||

|

|

|

COMPUTATION and RECORD of PAYMENTS |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BET |

Amount of each Installment |

BPT |

Total Due |

CALENDAR YEAR |

||||||

Date Paid |

(1/4 of Line 6 of worksheet) |

(BET and/or BPT) |

DUE DATES |

|

||||||||

|

|

|

||||||||||

1 |

$ |

$ |

|

$ |

April 15, 2010 |

|||||||

2 |

$ |

$ |

|

$ |

June 15, 2010 |

|||||||

3 |

$ |

$ |

|

$ |

Sept. 15, 2010 |

|||||||

4 |

$ |

$ |

|

$ |

Dec. 15, 2010 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTIMATED TAX FORM INSTRUCTIONS

Line 1 Enter ¼ of the Business Enterprise Tax calculated on Line 6 BET(a) in the tax worksheet above.

Line 2 Enter ¼ of the Business Profits Tax calculated on Line 6 BPT(b) in the tax worksheet above.

Line 3 Enter the TOTAL payment sum of Lines 1 and 2.

IMPORTANT:

THE PENALTY PROVISIONS OF RSA

_ _ _ _ _ _ _ _ |

(Cut along this line and keep the Estimated Tax Worksheet above for your records) |

|||||

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

||||||

|

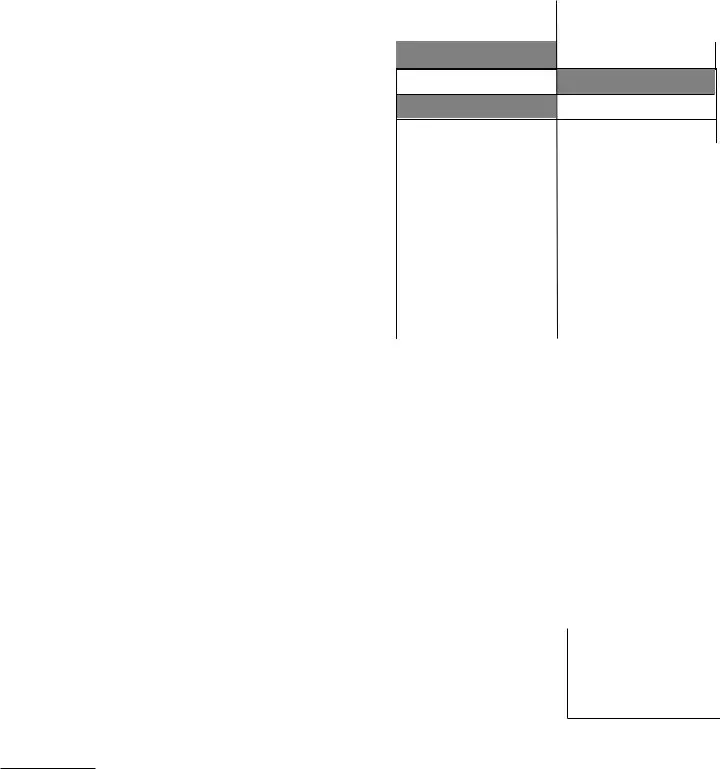

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

||||

|

|

|||||

|

|

ESTIMATED PARTNERSHIP BUSINESS TAX - 2010 |

||||

712 |

|

|

|

|

|

|

|

For the CALENDAR year 2010 or other taxable period beginning |

|

and ending |

|

||

|

|

|

Mo Day Year |

|

Mo Day Year |

|

|

PRINT OR TYPE |

|

|

|||

_ _ _ _ _ _ _ _

FOR DRA USE ONLY

FOR DRA USE ONLY

|

NAME OF PARTNERSHIP |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

||||

|

|

|

|

||||

|

LIMITED LIABILITY COMPANY |

|

DEPARTMENT IDENTIFICATION NUMBER |

||||

|

|

|

|

|

|||

|

NUMBER AND STREET ADDRESS |

|

If issued a DIN, DO NOT USE FEIN |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS (continued) |

|

¼ BET |

1 |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BPT |

2 |

$ |

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of This Payment 3 |

$ |

|

||

|

NH DRA |

|

|||||

|

TO: |

PO BOX 637 |

Make checks payable to: STATE OF NEW HAMPSHIRE |

||||

|

|

CONCORD NH |

Enclose, but do not staple or tape your payment to |

||||

|

|

|

|||||

|

|

|

this estimate. Do not file a $0 estimate. |

||||

|

|

|

|

|

|

||

|

|

|

21 |

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

|

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

||||||||||

|

ESTIMATED PARTNERSHIP BUSINESS TAX - 2010 |

|

|

|

|

||||||||||

712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the CALENDAR year 2010 or other taxable period beginning |

|

|

|

and ending |

|

|

|

FOR DRA USE ONLY |

|||||||

|

|

PRINT OR TYPE |

Mo |

Day Year |

|

|

Mo Day Year |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

NAME OF PARTNERSHIP |

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DRA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS (continued) |

|

|

|

|

|

¼ BET |

1 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

¼ BPT |

2 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of This Payment 3 |

$ |

|

||||

|

|

|

NH DRA |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

TO: |

PO BOX 637 |

|

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

|||||||

|

|

|

CONCORD NH |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Enclose, but do not staple or tape your payment to |

|||||||

|

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _(Cut along_ this_ line)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

|

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

||||||||||

712 |

|

|

|

ESTIMATED PARTNERSHIP BUSINESS TAX - 2010 |

|

|

|

|

|||||||

For the CALENDAR year 2010 or other taxable period beginning |

|

|

|

and ending |

|

|

|

FOR DRA USE ONLY |

|||||||

|

|

PRINT OR TYPE |

Mo |

Day Year |

|

|

Mo Day Year |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

NAME OF PARTNERSHIP |

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DRA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET |

1 |

$ |

|

|||

|

|

ADDRESS (continued) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

¼ BPT |

2 |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of This Payment 3 |

$ |

|

||||

|

|

|

NH DRA |

|

|

|

|

|

|||||||

|

|

|

TO: |

PO BOX 637 |

|

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

|||||||

|

|

|

CONCORD NH |

|

|

|

|||||||||

|

|

|

|

|

|

Enclose, but do not staple or tape your payment to |

|||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

|||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _(Cut along_ this_ line)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

|||||||||

|

ESTIMATED PARTNERSHIP BUSINESS TAX - 2010 |

|

|

|

|

|||||||||

712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the CALENDAR year 2010 or other taxable period beginning |

|

|

and ending |

|

|

FOR DRA USE ONLY |

||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

PRINT OR TYPE |

Mo Day Year |

|

|

Mo Day Year |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

NAME OF PARTNERSHIP |

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

DEPARTMENT IDENTIFICATION NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DRA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

If issued a DIN, DO NOT USE FEIN |

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¼ BET |

1 |

|

$ |

|

||

|

|

ADDRESS (continued) |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

¼ BPT |

2 |

|

$ |

|

|

|

CITY/TOWN, STATE & ZIP CODE |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of This Payment 3 |

$ |

|

||||

|

|

|

NH DRA |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

TO: |

PO BOX 637 |

|

|

Make checks payable to: STATE OF NEW HAMPSHIRE |

|||||||

|

|

|

|

CONCORD NH |

|

|

Enclose, but do not staple or tape your payment to |

|||||||

|

|

|

|

|

|

|

this estimate. Do not file a $0 estimate. |

|||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 09/2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23

Document Breakdown

| Fact | Detail |

|---|---|

| Who Must Pay Estimated Tax | Any entity required to file a Business Profits and/or Business Enterprise Tax return in New Hampshire and whose annual estimated tax for each individual tax exceeds $200 for the subsequent taxable period. |

| Payment Method | Payments can be made online at the New Hampshire Department of Revenue Administration website or mailed to NH DRA, PO BOX 637, CONCORD NH 03302-0637. |

| Due Dates for Payments | For calendar year filers, payments are due on April 15, June 15, September 15, and December 15. Fiscal year filers must pay on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable period. |

| Governing Law | Payments and penalties are governed by RSA 21-J:32, which outlines the liabilities for underpayment of the estimated taxes in New Hampshire. |

Detailed Instructions for Writing Nh 1065 Es

Understanding and fulfilling tax obligations is critical for all businesses, including those established as partnerships in New Hampshire. Specifically, partnerships must complete and submit the NH-1065-ES form if their estimated taxes for business profits and business enterprise exceed $200 annually. In doing so, partnerships adhere to state tax requirements, avoiding potential penalties for underpayment. The process involves calculating estimated taxes based on business profits and allocations, then making payments, either in a lump sum or through quarterly installments. Here's a straightforward guide to assist you in filling out the NH-1065-ES form, ensuring your business remains compliant with New Hampshire tax laws.

- Calculate Estimated Taxes: Review your business's financial records to estimate the Business Enterprise Tax (BET) and Business Profits Tax (BPT) for the coming tax period. Use the current tax rates: 0.75% for BET and 8.5% for BPT. Apply these rates to your estimated taxable base and gross business profits, respectively.

- Record and Adjust for Credits: Identify any applicable tax credits your business may qualify for, such as the CDFA Investment Tax Credit or the Research & Development Tax Credit. Deduct these credits from your estimated taxes to find the net amount due.

- Determine Payment Amounts: If opting for quarterly payments, divide the net estimated tax due by four to find the amount of each installment. Ensure the sum of these payments meets or exceeds 90% of your tax liability to avoid underpayment penalties.

- Provide Partnership and Payment Information: On the NH-1065-ES form, fill in the tax year or period for which you are estimating taxes. Include your partnership's name, Federal Employer Identification Number (FEIN), and the Department Identification Number (DIN) if available.

- Enter Calculated Tax Amounts: In the provided fields, enter the quantified ¼ BET and ¼ BPT estimates, along with the total payment amount for each installment if paying quarterly.

- Choose Payment Method: Decide whether you will pay online or by mail. For online payments, visit the New Hampshire Department of Revenue Administration website. To mail your payment, ensure checks are payable to the State of New Hampshire and address them to the NH DRA at PO Box 637, Concord, NH 03302-0637.

- Finalize and Submit: Double-check all entered information for accuracy. If mailing, print the form, include your check (do not staple or tape), and send it to the address specified. If paying online, follow the website's instructions for submitting payment.

By systematically following these steps, partnerships can efficiently manage their tax responsibilities, ensuring compliance and contributing to their sustainable operation and growth within New Hampshire.

Essential Queries on Nh 1065 Es

Who needs to make estimated tax payments using the NH-1065-ES form?

Entities required to file a Business Profits and/or Business Enterprise Tax return in New Hampshire must make estimated tax payments if their annual estimated tax is $200 or more for each tax. This includes both parts of the tax, requiring quarterly payments if the threshold is met.

Can payments be made online for the NH-1065-ES form?

Yes, payments can be made online. To make a payment, visit the New Hampshire Department of Revenue Administration website at www.nh.gov/revenue. You can make the full payment or installment payments directly through their site.

Is there an underpayment penalty for the NH-1065-ES?

If your payments are less than 90% of the tax liability for that period, or if payments are made late, you could face an underpayment penalty. However, if you eventually pay 90% of the tax liability or meet any statutory exceptions, the penalty may not apply.

When are estimated payments due for calendar year filers?

For those who follow a calendar year, the due dates are April 15, June 15, September 15, and December 15.

What if my annual estimated tax is less than $200?

If your annual estimated tax for each tax is less than $200, you are not required to make estimated tax payments for that year.

How can I calculate my estimated tax?

The NH-1065-ES provides a calculation worksheet where you can calculate your Business Enterprise Tax (BET) and Business Profits Tax (BPT) based on your taxable base and profits after apportionment. Use the provided rates to calculate your estimated tax.

What should I do if I missed an estimated tax payment?

If you miss a payment, submit it as soon as possible to minimize any penalties. The sooner you make the missed payment, the lesser the potential penalty might be.

Where can I find help if I have more questions?

If the information provided here doesn't cover your questions, you can visit the New Hampshire Department of Revenue Administration's website at www.nh.gov/revenue or call Central Taxpayer Services at (603) 271-2191 for assistance.

Common mistakes

Filling out the NH-1065-ES form, which pertains to estimated partnership business tax in New Hampshire, may seem straightforward, but errors can occur. These errors not only lead to potential penalties but also delay processing times. Here's an overview of common mistakes to avoid when completing this form.

One prevalent mistake is underestimating or overestimating tax payments. Accurately predicting your business’s profits can be challenging, but significant discrepancies can result in underpayment penalties or overpayments, which could have been utilized elsewhere in the business.

- Not making payments on time is a common oversight. Adhering to the due dates (April 15, June 15, September 15, and December 15 for calendar year filers) ensures businesses avoid late fees and penalties.

- Inaccurate calculation of the BET (Business Enterprise Tax) and BPT (Business Profits Tax) can lead to incorrect estimated tax payments, affecting the financial standing of the business.

- Failing to update business information can result in miscommunication or lost mail from the New Hampshire Department of Revenue Administration.

- Omitting credits such as the CDFA Investment Tax Credit, CROP Carryforwards, Economic Revitalization Zone Tax Credit, Research & Development Tax Credit, and Coos County Job Creation Tax Credit could mean paying more taxes than required.

- Failing to apply an overpayment from a previous taxable period to the current year's tax liability. This could be an overlooked opportunity to reduce current year tax payments.

- Incorrectly filing or not using the Department Identification Number (DIN) if issued, instead of the Federal Employer Identification Number (FEIN), where applicable.

- Neglecting to check if you qualify for underpayment penalty exceptions can lead to unnecessary penalty payments.

- Opting to staple or tape payment to the estimate form, contrary to instructions, could cause processing delays or damage to the document.

- Submitting a zero-estimate ($0 estimate) when not applicable is misadvised and can cause confusion during processing.

Understanding and avoiding these mistakes can lead to a smoother handling of your NH-1065-ES form submissions. Here are some additional tips:

- Always double-check calculations for BET and BPT based on the most current financial data.

- Mark your calendar with payment due dates to prevent missing deadlines.

- Consult the FAQ section on the New Hampshire Department of Revenue Administration website or contact their office directly for clarification on complex issues.

Being attentive and proactive when filling out the NH-1065-ES form helps ensure that your business remains in good standing with the New Hampshire Department of Revenue Administration while avoiding unnecessary financial penalties.

Documents used along the form

When preparing the NH-1065-ES form for estimated partnership business tax payments in New Hampshire, certain documents and forms might be necessary to ensure accuracy and compliance. Handling these requirements efficiently is critical for businesses to manage their tax obligations effectively. Here is a brief overview of up to 10 documents and forms often used alongside the NH-1065-ES form:

- NH-1065 Form: This is the New Hampshire Partnership Business Tax Return. It is filed annually and provides the details of the income, deductions, and credits of the partnership.

- DP-2210/2220 Form: Penalty Computation for Underpayment of Estimated Tax. Businesses use this form to calculate any penalty for not paying enough tax through estimated payments or for paying estimated taxes late.

- IRS Form 1065: U.S. Return of Partnership Income. This federal form reports the income, gains, losses, deductions, credits, etc., of a partnership. It helps to determine the state taxable income for New Hampshire purposes.

- Schedule K-1 (Form 1065): Partner’s Share of Income, Deductions, Credits, etc. This schedule is used to report each partner’s share of the partnership’s earnings, losses, and other items.

- Form BET: Business Enterprise Tax Return. This form is used for calculating the business enterprise tax due on the value of the enterprise tax base of the business.

- Form DP-10: Interest & Dividends Tax Return. Some partners might need individual forms related to their portions of interest and dividends from the partnership.

- Form CDFA 12-10: Invest NH Tax Credit. Businesses that qualify for Community Development Finance Authority tax credits must file this form to claim the credit.

- Form NH-1040: Business Profits Tax Return. This form is for reporting the profit earned by the business and calculating the tax due.

- Form NH-UI: Unemployment Insurance Tax Reports. Although not directly related to NH-1065-ES, it's a necessary form for businesses with employees.

- FAQ Brochure: Frequently Asked Questions from the New Hampshire Department of Revenue Administration. This brochure provides additional guidance on tax-related queries that partners may have.

Together, these documents support the accurate filing of the NH-1065-ES form, ensuring businesses can fulfill their tax obligations while taking advantage of any eligible credits or deductions. Being familiar with each document's purpose helps streamline the tax preparation process, making it easier to navigate the complexities of tax reporting and payment.

Similar forms

The NH-1065-ES form, designed for estimating partnership business tax, shares similarities with forms like the IRS Form 1040-ES, "Estimated Tax for Individuals," and the IRS Form 1120-W, "Estimated Tax for Corporations," in both purpose and structure. Like its federal counterparts, the NH-1065-ES facilitates the calculation of estimated taxes that need to be paid throughout the year. These forms aim to help taxpayers comply with the "pay-as-you-go" tax system implemented by both the federal and state tax authorities. Taxpayers, be they individuals, partnerships, or corporations, use these forms to calculate and remit their estimated tax liabilities for the year to avoid underpayment penalties. Although the specific tax rates and thresholds may vary between the forms, the underlying principle of providing periodic payments towards expected tax liabilities remains constant.

Particularly akin to the NH-1065-ES, the IRS Form 1040-ES is utilized by individuals, including sole proprietors, partners, and S corporation shareholders, anticipating that they will owe $1,000 or more in taxes when their return is filed. The form assists in estimating the amount of federal income tax and self-employment tax (if applicable) for the current tax year. Users of both forms are required to estimate their income for the year, calculate the tax on that income, and make payments quarterly. The IRS Form 1040-ES also considers credits, just like the NH-1065-ES, which includes the calculation of credits toward the tax estimated, affecting the total estimated tax payment required.

Similarly, the IRS Form 1120-W is another counterpart focused on corporations, which also serves as a guide for calculating estimated taxes throughout the fiscal year. Corporations anticipate their income, tax deductions, and credits, thereby determining their tax liability. Like the NH-1065-ES form, the IRS Form 1120-W is structured to facilitate these entities in making corresponding quarterly estimated tax payments. The main goal is to mitigate the risk of incurring penalties due to underpayment of taxes owed. While the NH-1065-ES is tailored towards partnership business entities, and the IRS Form 1120-W is specifically for corporations, both documents underscore the significance of accurate tax estimation and the timely remittance of payments to the respective tax authorities.

Dos and Don'ts

When completing the NH-1065-ES form for Estimated Partnership Business Tax in New Hampshire, it's essential to follow specific guidelines to ensure the process is done correctly and efficiently. This guide outlines the crucial dos and don'ts you should adhere to:

What You Should Do

- Ensure Accuracy: Double-check all entries for accuracy. This includes verifying the calculated taxes based on the business's gross profits and taxable base after apportionment. Inaccurate information can lead to underpayment penalties.

- Make Payments On Time: Adhere strictly to the payment deadlines. For calendar year filers, payments are due on April 15, June 15, September 15, and December 15. Fiscal year filers must pay by the 15th day of the 4th, 6th, 9th, and 12th months of their taxable period.

- Consider Online Payment: Utilize the online payment option available at www.nh.gov/revenue. This convenient method allows you to specify payment dates, ensuring payments are made promptly and accurately.

- Understand Penalty Exceptions: Familiarize yourself with underpayment penalty exceptions. If you believe you qualify for an exception, use Form DP-2210/2220 to document your case, potentially avoiding unnecessary penalties.

What You Shouldn't Do

- Ignore Underpayment Penalties: Do not disregard the underpayment penalty clause. Understand that failing to make payments that are less than 90% of the tax liability can result in penalties, regardless of eventual payment completion.

- Misuse IDs: Do not confuse the Federal Employer Identification Number (FEIN) with the Department Identification Number (DIN). Ensure the correct identification number is used as specified.

- Delay Missed Payments: If a payment is missed, do not procrastinate. Send the overdue payment as soon as possible to minimize any penalties.

- File a $0 Estimate: Do not file an estimate if no payment is due. The form stipulates not to file a $0 estimate, adhering to this instruction helps avoid processing unnecessary documentation.

Following these guidelines helps ensure the smooth filing of the NH-1065-ES form, keeping your partnership in good standing with the New Hampshire Department of Revenue Administration.

Misconceptions

Understanding the complexities of tax forms is crucial for businesses, particularly when it comes to state-specific requirements like those found in New Hampshire's NH-1065-ES form. Misconceptions about this form can lead to errors in filing and payment, potentially resulting in penalties. Here, we dispel eight common misunderstandings to ensure accurate compliance for partnerships operating within the state.

Only large partnerships need to file the NH-1065-ES form: This misconception often leads smaller partnerships to believe they are exempt from filing. However, any partnership required to file a Business Profits and/or Business Enterprise Tax return must also make estimated tax payments if their annual estimated tax for the subsequent taxable period for each tax is $200 or more.

Estimated payments are optional: Contrary to this belief, quarterly payments are required whenever the annual estimated tax for the subsequent taxable period equals or exceeds $200 for either the Business Profits Tax or the Business Enterprise Tax, with specific exceptions outlined by the New Hampshire Department of Revenue Administration.

Civil unions do not affect tax filings: This is incorrect. New Hampshire recognizes civil unions, and parties in a civil union have the same state tax obligations and responsibilities as those who are married, affecting how tax forms, including the NH-1065-ES, are completed.

Estimated tax payments can only be made by mail: Today, the convenience of technology extends to tax payments. Estimated tax payments can easily be made online through the New Hampshire Department of Revenue Administration's website, offering a secure and time-efficient option for filers.

Penalties for underpayment are unavoidable: Penalties for underpaying estimated taxes are not a foregone conclusion. The law provides for exceptions and if the payments are at least 90% of the period’s tax liability and made on time, the underpayment penalty may not be applied.

There is only one due date for estimated payments: In reality, estimated tax payments are divided into quarterly payments with specific due dates throughout the fiscal year for both calendar year filers and fiscal year filers. This structure assists partnerships in budgeting and managing their cash flow more effectively over the year.

Overpayments from the previous period cannot be applied to current estimated taxes: Overpayments from a prior taxable period can be applied to the current year’s estimated tax. This can reduce the amount needed for upcoming estimated payments, providing a form of financial relief and planning for partnerships.

All partnerships are aware of available tax credits: Many partnerships may not fully explore or understand the tax credits available to them, such as investment tax credits, research and development tax credits, and others listed in the form instructions. Utilizing these credits can significantly reduce the amount of estimated tax due.

Dispelling these misconceptions about the NH-1065-ES form is essential for partnerships to ensure compliance and to leverage potential advantages. Accurate and informed filings can ultimately save time, reduce liability, and potentially lower the amount of tax due through the application of credits and careful planning.

Key takeaways

The NH 1065 ES form is a requirement for entities needing to file a Business Profits and/or Business Enterprise Tax return in New Hampshire. This document serves as a guide for making estimated tax payments to the New Hampshire Department of Revenue Administration. The key aspects of using this form include understanding who must pay, when payments are due, how and where to make these payments, the implications of underpayment, and where to find help if needed. Below are seven key takeaways that are crucial for anyone preparing to fill out and submit this form.

- Entities required to file Business Profits and/or Business Enterprise Tax returns must make estimated tax payments if their annual estimated tax exceeds $200 for each tax.

- New Hampshire recognizes civil unions, granting them the same rights, obligations, and responsibilities as married couples in the context of tax filing.

- Estimated tax payments can be made online, a convenient option for timely submissions and reducing errors in payment processing.

- Payments can be distributed across four due dates throughout the fiscal year, or paid in full with the initial declaration, depending on the taxpayer's preference and financial situation.

- A penalty for underpayment of estimated taxes applies if payments are less than 92% of the tax liability, emphasizing the importance of accurate calculation and timely payment.

- Exceptions to the underpayment penalty exist, providing relief under certain conditions, which can be reviewed in Form DP-2210/2220.

- For questions or additional guidance, the New Hampshire Department of Revenue Administration provides resources and taxpayer services accessible online or by phone.

Understanding these key points ensures compliance with New Hampshire tax regulations, helping to avoid penalties and interest for underpayment or late submissions. Individuals and entities are encouraged to review the detailed instructions provided by the New Hampshire Department of Revenue Administration to meet their tax obligations accurately and efficiently.

Different PDF Templates

Nh Bugs - An easy-to-use New Hampshire New Hire form that simplifies the reporting process, with fields for all necessary information.

Nh Corporate Tax Rate - The form acknowledges civil unions, meaning partners in such relationships must adhere to the same tax obligations as married couples, reflecting inclusivity.

New Hampshire W4 - By requiring detailed financial information, it helps in the prevention of tax evasion and fraud.