New Hampshire Reporting Template

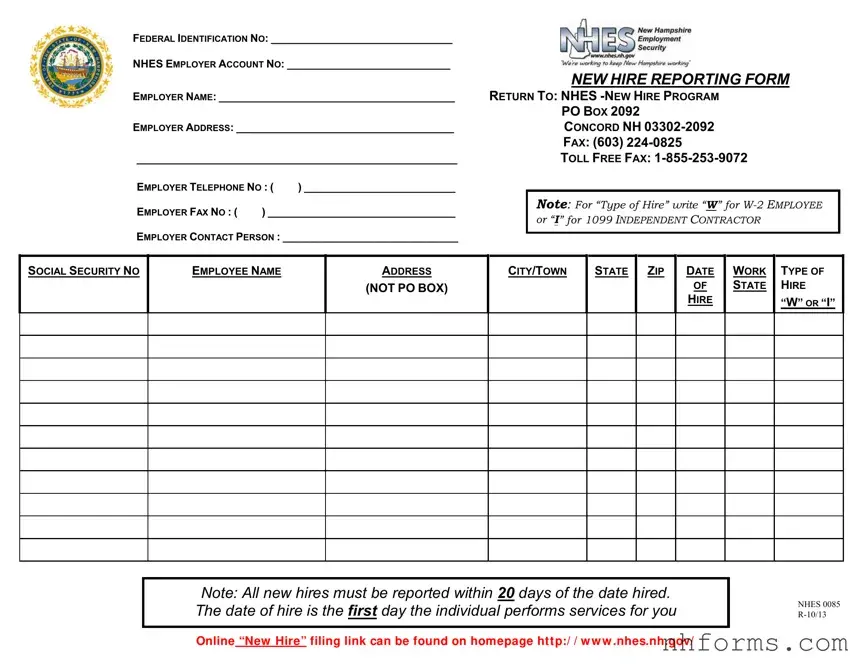

In the landscape of employment and tax regulation, the New Hampshire Reporting Form plays a crucial role in the proper administration of employment and tax records. This mandatory document, to be filed by employers with the New Hampshire Employment Security (NHES), captures essential information regarding new hires, including their social security number, name, address, and the date they commence employment. Employers are required to indicate the type of hire, distinguishing between W-2 employees and 1099 independent contractors, which has important implications for employment rights and tax responsibilities. The form demands accurate employer identification details too, such as Federal Identification Numbers and NHES Employer Account Numbers. All this information contributes to the state's efforts to monitor employment activity, enforce child support orders, and maintain accurate tax records. The stipulation that this information must be submitted within 20 days of the hire date underscores the seriousness with which the state regards this process. Furthermore, the provision of an online filing link simplifies compliance, reflecting an understanding of the importance of easy access to governmental requirements for busy employers. The return address, along with fax and toll-free fax numbers, demonstrates NHES's commitment to offering multiple communication channels to facilitate this reporting obligation.

Document Preview Example

FEDERAL IDENTIFICATION NO: ______________________________

NHES EMPLOYER ACCOUNT NO: ___________________________

|

NEW HIRE REPORTING FORM |

EMPLOYER NAME: _______________________________________ |

RETURN TO: NHES |

|

PO BOX 2092 |

EMPLOYER ADDRESS: ____________________________________ |

CONCORD NH |

|

FAX: (603) |

_____________________________________________________ |

TOLL FREE FAX: |

EMPLOYER TELEPHONE NO : ( |

) _________________________ |

|

EMPLOYER FAX NO : ( |

) _______________________________ |

|

EMPLOYER CONTACT PERSON : _____________________________

NOTE: For “Type of Hire” write “W” for

or “I” for 1099 INDEPENDENT CONTRACTOR

SOCIAL SECURITY NO |

EMPLOYEE NAME |

ADDRESS |

CITY/TOWN |

STATE |

ZIP |

DATE |

WORK |

TYPE OF |

|

|

(NOT PO BOX) |

|

|

|

OF |

STATE |

HIRE |

|

|

|

|

|

HIRE |

|

|

|

|

|

|

|

|

|

|

“W” OR “I” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Note: All new hires must be reported within 20 days of the date hired. The date of hire is the FIRST day the individual performs services for you

NHES 0085

Online “New Hire” filing link can be found on homepage ht t p:/ / w w w .nhes.nh.gov/

Document Breakdown

| Fact | Detail |

|---|---|

| Governing Law | New Hampshire state law requires the reporting of new hires to assist in the enforcement of child support obligations. |

| Submission Deadline | All new hires must be reported within 20 days of their first day of work. |

| Report Submission Methods | Reports can be sent to the New Hampshire Employment Security (NHES) via mail, fax, or through an online "New Hire" filing link available on the NHES homepage. |

| Information Required | Employer details (name, federal identification number, NHES employer account number, address, telephone, fax, and contact person), employee details (social security number, name, address, city/town, state, zip, date of hire, and type of hire). |

Detailed Instructions for Writing New Hampshire Reporting

Completing the New Hampshire Reporting Form is an essential task for employers in the state. This form ensures you're compliant with local employment laws by reporting newly hired or rehired employees. The process is straightforward and requires attention to detail, especially when entering employee information. Here’s how to fill out the form correctly.

- Start by entering your FEDERAL IDENTIFICATION NO and NHES EMPLOYER ACCOUNT NO in the designated spaces at the top of the form.

- Write the EMPLOYER NAME and EMPLOYER ADDRESS, including the zip code, in the appropriate fields. Make sure this information matches what is on record with the New Hampshire Employment Security (NHES).

- Include your EMPLOYER TELEPHONE NO and EMPLOYER FAX NO, providing both allows for easy contact by NHES if they need further information or clarification.

- Fill in the name of the EMPLOYER CONTACT PERSON. This is who NHES will reach out to with any questions about the form.

- Under the employee information section, enter the new hire's SOCIAL SECURITY NO, EMPLOYEE NAME, and their ADDRESS (city/town, state, and zip code) ensuring you don’t use a P.O. Box for the address.

- Fill in the DATE OF HIRE, which is the first day the employee performed services for you. Remember, all new hires must be reported within 20 days of their start date.

- Specify the TYPE OF HIRE by writing “W” for W-2 EMPLOYEE or “I” for 1099 INDEPENDENT CONTRACTOR in the appropriate space.

- Review the form to ensure all information has been entered correctly and legibly.

- Send the completed form to NHES - NEW HIRE PROGRAM via mail at PO BOX 2092, CONCORD NH 03302-2092, or use the toll-free fax number 1-855-253-9072. Fax submissions are also accepted at (603) 224-0825.

After submitting the form, it's a good practice to keep a copy for your records. This documentation is vital for compliance and can be helpful in the event of any disputes or inquiries from the state. Timely reporting supports the state's efforts to collect child support payments and reduces fraudulent benefit claims, making it an important part of hiring and payroll processing.

Essential Queries on New Hampshire Reporting

What is the purpose of the New Hampshire Reporting Form?

This form serves a critical role in ensuring compliance with state employment laws, specifically for the timely reporting of newly hired employees to the New Hampshire Employment Security (NHES). It aids in the state's efforts to collect child support payments by quickly matching employees with support obligations and helps in detecting unemployment benefits fraud. Reporting new hires is not just a legal requirement but a fundamental part of supporting employment and family services in New Hampshire.

Who needs to fill out the New Hampshire Reporting Form?

Every employer in New Hampshire, regardless of size or sector, is required to complete this form for each newly hired employee or rehired individual. This obligation includes reporting employees who reside or work in the state of New Hampshire. The form must cover employees on the payroll who are subject to state income tax withholding, including both W-2 employees and 1099 independent contractors.

What information is required on the New Hampshire Reporting Form?

The form requires comprehensive details about the employer and the new or rehired employee. This includes the employer's name, address, telephone and fax numbers, the employer’s contact person, Federal Identification Number, and NHES Employer Account Number. For the employee, the form asks for their social security number, full name, home address (excluding P.O. Boxes), city, state, zip code, date of hire, and the type of hire (indicating "W" for W-2 employees or "I" for 1099 independent contractors).

How and where should the New Hampshire Reporting Form be submitted?

Employers have multiple options for submitting the form. They can mail it to the NHES - New Hire Program at PO Box 2092, Concord, NH 03302-2092. For a more immediate transmission, employers can choose to fax the form to (603) 224-0825 or the toll-free fax number at 1-855-253-9072. Additionally, online filing links are available on the NHES website, offering a convenient and quick way to comply with the reporting requirement.

What is the deadline for submitting the New Hampshire Reporting Form?

It is imperative for employers to submit this form within 20 days of the employee's first day of work. This quick turnaround is crucial for the state to effectively use the information in support services and compliance measures. Adhering to this deadline also ensures that employers remain in good standing with state employment regulations.

Are there any penalties for failing to report or late reporting of new hires?

Yes, employers who fail to report new hires or rehires within the specified 20-day period can face penalties. The New Hampshire Department of Employment Security enforces compliance with this requirement and may impose fines or other sanctions on employers who do not adhere to the reporting deadlines. The intention behind this enforcement is not punitive but to ensure the effectiveness of state employment and child support services.

Common mistakes

When filling out the New Hampshire Reporting Form, it's crucial to avoid common mistakes that can delay processing or result in the need for corrections. Here's a list of 10 common mistakes:

- Forgetting to include the Federal Identification Number or the NHES Employer Account Number. These identifiers are crucial for ensuring that your report is correctly associated with your business.

- Failure to provide complete employer information, including the full name and address of the business. This information helps to verify the employer’s identity and contact information.

- Omitting the employer contact person's name. Having a point of contact is necessary for any follow-up questions or clarifications regarding the form.

- Incorrectly listing the type of hire. Remember to write “W” for W-2 employee or “I” for 1099 independent contractor. This distinction is important for tax and reporting purposes.

- Not providing the employee’s social security number. This is a critical piece of information for accurately reporting new hires.

- Failing to include the employee’s full name and address. Without complete address information, the report might not comply with state requirements.

- Using a P.O. Box instead of a physical address for the employee. A physical address is necessary for certain legal and verification processes.

- Forgetting to enter the date of hire, which is the first day the individual performed services for you. This date is essential for determining compliance with the 20-day reporting requirement.

- Not indicating the type of work the hire will be doing. This information can be essential for various state employment and labor statistical purposes.

- Sending the form without verifying that all filled-out information is correct and complete. Oversights can result in the form being returned or the need to submit a corrected form.

Attention to detail when filling out the New Hampshire Reporting Form can save time and prevent potential issues with compliance. Employers are encouraged to review the form thoroughly before submission. Also, consider using the online filing link provided on the NHES website for a more streamlined process. This can help in avoiding many of the common mistakes made when manually filling out and mailing the form.

By ensuring that all information provided is accurate and complete, employers can contribute to a smoother processing experience, not only for their own benefit but also for the efficient operation of state employment services.

Documents used along the form

When dealing with employment and new hire reporting in New Hampshire, a range of essential documents often accompanies the New Hampshire Reporting Form. These forms serve various functions, from tax compliance to verifying employee eligibility. Understanding these documents can streamline the hiring process and ensure compliance with state and federal regulations.

- W-4 Form (Employee’s Withholding Certificate): This IRS form is used by employers to determine the correct federal income tax to withhold from employees' paychecks. It is crucial for ensuring that employees are taxed appropriately based on their filing status and other factors.

- I-9 Form (Employment Eligibility Verification): Required by the U.S. Citizenship and Immigration Services, this form verifies the identity and employment authorization of individuals hired for employment in the United States. It's a critical step in the compliance process, ensuring employees are legally permitted to work.

- State Tax Withholding Form: Similar to the federal W-4 form, this document is for state taxes. It ensures that the correct amount of state income tax is withheld from the employee's paycheck, varying by state.

- Direct Deposit Authorization Form: This form allows employees to have their paychecks directly deposited into their bank accounts. It requires the employee’s bank account information and authorization, simplifying the payment process.

- Employment Application Form: A comprehensive application that collects a prospective employee's work history, references, and qualifications. This form is crucial for the employer’s assessment during the hiring process.

- Employee Handbook Acknowledgment Form: This form is an acknowledgment by the employee that they have received, read, and understood the company’s employee handbook. It's important for setting expectations and policies.

- Emergency Contact Form: Collects information about whom to contact in case of an employee’s emergency. It's vital for workplace safety and emergency preparedness plans.

Together with the New Hampshire Reporting Form, these documents form a comprehensive toolkit for employers. They address legal compliance, employee welfare, and administrative efficiency. Familiarizing oneself with these forms ensures a smoother hiring process, upholds legal standards, and promotes a well-organized work environment.

Similar forms

The New Hampshire Reporting form is similar to other forms used across different states for the purpose of reporting new hires, with each form catering to specific state requirements while serving the broader objective of registering employment details with state agencies. The similarity between these documents lies in their foundational purpose, which is to ensure employers report new or rehired employees, yet they exhibit differences that are finely tuned to address state-specific legal and administrative requirements.

One such document is the California New Employee Registry Form. Like the New Hampshire Reporting form, this form collects essential information about the employer and the new employee, including Federal Identification Numbers, employee social security numbers, and addresses. Both forms are designed to streamline the process of reporting new hires to the relevant state department, in this case, the California Employment Development Department (EDD). They serve not only to foster compliance with employment laws but also to aid in the enforcement of child support orders. However, the California form notably includes details pertinent to state-specific tax withholding and employment eligibility verification, reflecting California's unique regulatory environment.

Another analogous document is the Texas Employer New Hire Reporting Form. This form, similar to New Hampshire's, must be filed by employers to report newly hired or rehired employees to the Texas Workforce Commission. It requests similar data fields such as employer identification numbers, names, and addresses. What sets the Texas form apart is its integration with child support enforcement efforts; it specifically notes that timely reporting can directly impact the effectiveness of locating non-custodial parents. The focus on potentially aiding child support enforcement showcases a common goal among these forms, despite the variances tailored to address the demographic and legal peculiarities of each state.

The Florida New Hire Reporting Form shares commonalities with New Hampshire's in that it collects similar employer and employee information for the state's database, used to enforce child support orders. Both states require reporting within a specified timeframe from the date of hire, emphasizing the urgency in updating employment records. Despite these similarities, the Florida form places a significant emphasis on the optional reporting of employee's health insurance availability, reflecting Florida's nuanced interests in health coverage tracking amidst its workforce. This difference underscores how state-specific concerns can shape the content and focus of otherwise similar administrative documents.

Dos and Don'ts

When filling out the New Hampshire Reporting form for new hires, it's essential to abide by specific dos and don'ts to ensure the accuracy and timeliness of your submission. Here are eight crucial points to consider:

- Do ensure you have the correct Federal Identification Number and NHES Employer Account Number before you start filling out the form. Accuracy in these numbers is crucial for identification and processing.

- Do provide complete information for the employer, including the full name, address, telephone number, and contact person. This information is essential for any follow-up or clarification needed.

- Do accurately record the employee's Social Security Number, full name, residential address, city/town, state, and ZIP code. PO Boxes are not acceptable for addresses.

- Do carefully select the correct type of hire by writing “W” for W-2 employees or “I” for 1099 independent contractors. This designation affects tax and legal responsibilities.

- Don't delay the submission of the New Hire Reporting form. All new hires must be reported within 20 days of their first day of service.

- Don't submit incomplete forms. Every field in the form is required and must be filled out to avoid processing delays or legal issues.

- Don't use outdated forms. Always double-check that you are using the most current form version to comply with any new regulations or changes. The form provided is NHES 0085 R-10/13, but newer versions may exist.

- Don't hesitate to contact NHES directly if there are any uncertainties or questions about the form. Using the provided contact details, including the toll-free fax number, can help ensure that your reporting is accurate and timely.

Adhering to these guidelines helps fulfill legal obligations efficiently, supports the accurate reporting of new hires, and contributes to the smooth operation of employment and tax reporting systems in New Hampshire.

Misconceptions

Understanding the New Hampshire Reporting Form can sometimes be confusing due to some common misconceptions. Here's a clear breakdown to help employers navigate through the reporting process correctly:

Only W-2 employees need to be reported. This is not true. The form specifically asks for the type of hire, indicating a choice between “W” for W-2 employees or “I” for 1099 independent contractors. This means that both types of workers must be reported, not just those who receive a W-2.

All information is reported to the IRS. While it's easy to think that all data goes directly to the Internal Revenue Service because the form asks for a Federal Identification Number, this report is actually sent to the New Hampshire Employment Security (NHES). The purpose of the NHES is to gather data on new hires within the state, not to report earnings to the IRS.

Employers can wait to batch reports before submitting. Some might assume it's okay to wait and submit new hires in batches, but the form clearly stipulates that new hires must be reported within 20 days of their hire date. This requirement ensures timely reporting and helps the NHES keep accurate records.

The form is only for in-state hires. Despite common belief, employers must report all new hires, regardless of whether the employee lives in New Hampshire or another state. The key criterion is that the individual performs services for an employer within New Hampshire. This broadens the scope of who needs to be reported, extending beyond just in-state residents.

Getting these details right not only complies with the law but also helps maintain accurate employment records in the state of New Hampshire. It's crucial for employers to understand these aspects to avoid common pitfalls associated with the New Hire Reporting Form.

Key takeaways

Understanding the New Hampshire Reporting Form is crucial for employers within the state to comply with legal requirements regarding new hires. Here are the key takeaways to ensure proper completion and submission of this form:

- The Federal Identification Number and NHES Employer Account Number are mandatory fields, identifying the employer with federal and state tax agencies respectively.

- Both W-2 employees and 1099 independent contractors must be reported using this form. The type of hire, "W" for W-2 employee or "I" for 1099 independent contractor, must be clearly indicated.

- The form requires comprehensive information about the new hire, including Social Security Number, full name, address (no PO Boxes allowed), city/town, state, zip code, date of hire, and the type of hire.

- All new hires must be reported within 20 days of the date hired. The date of hire is defined as the first day an individual performs services for the employer.

- Employers can return the completed form via fax to the numbers provided (both a standard and a toll-free fax number are available) or utilize the online "New Hire" filing link available on the NH Employment Security website.

- Accurate and timely reporting of new hires helps the state in preventing unemployment insurance fraud, ensuring accurate child support collection, and maintaining up-to-date employment records. It is part of compliance with state employment laws.

- The form provides contact information for the employer, including the telephone and fax number, and a designated contact person. This information is essential for any follow-up or clarification that may be needed.

By meticulously adhering to these guidelines, employers can contribute to a smoother administrative process that benefits both the state and the workforce. Timely and accurate reporting is not just a legal requirement but a responsibility that supports the broader social infrastructure.

Different PDF Templates

New Hampshire Trust Execution Requirements - Ensures that executors or administrators account for every financial aspect of estate administration.

Nh Probate Court Forms - Designed to ensure guardianship petitions are filled with precision, enhancing the prospects for a favorable and expeditious judicial review.