New Hampshire 2631 Template

The New Hampshire 2631 form plays a pivotal role in the Child Care and Development Fund (CCDF) Scholarship Program, serving as a binding agreement between child care providers and the Department of Health and Human Service's Division for Children, Youth, and Families. This form necessitates that providers adhere to a set of requirements pivotal for maintaining the integrity and quality of childcare services offered to families participating in CCDF. Upon signing, providers commit to billing practices that reflect only the services rendered and for the time the child was actually in their care, ensuring a transparent and accountable partnership with the state. Additionally, the form outlines various operational requirements, including the age prerequisite for providers, restrictions on care for own children, and the necessity to avoid residential overlap with the cared-for children. It emphasizes the importance of accurate invoicing, introduces an automated web billing option complemented by a Personal Identification Number (PIN) for security, and details the record-keeping responsibilities vital for compliance and auditing purposes. Moreover, the agreement highlights the confidentiality of information about children and their families and the proper tax and income reporting protocols. Failure to comply with these terms can result not only in termination from the CCDF Scholarship Program but also legal action by the Department of Health & Human Services (DHHS). This reflects the state’s commitment to safeguard the welfare of the children under care while also providing a structured framework for providers to contribute positively to the development and well-being of New Hampshire’s children.

Document Preview Example

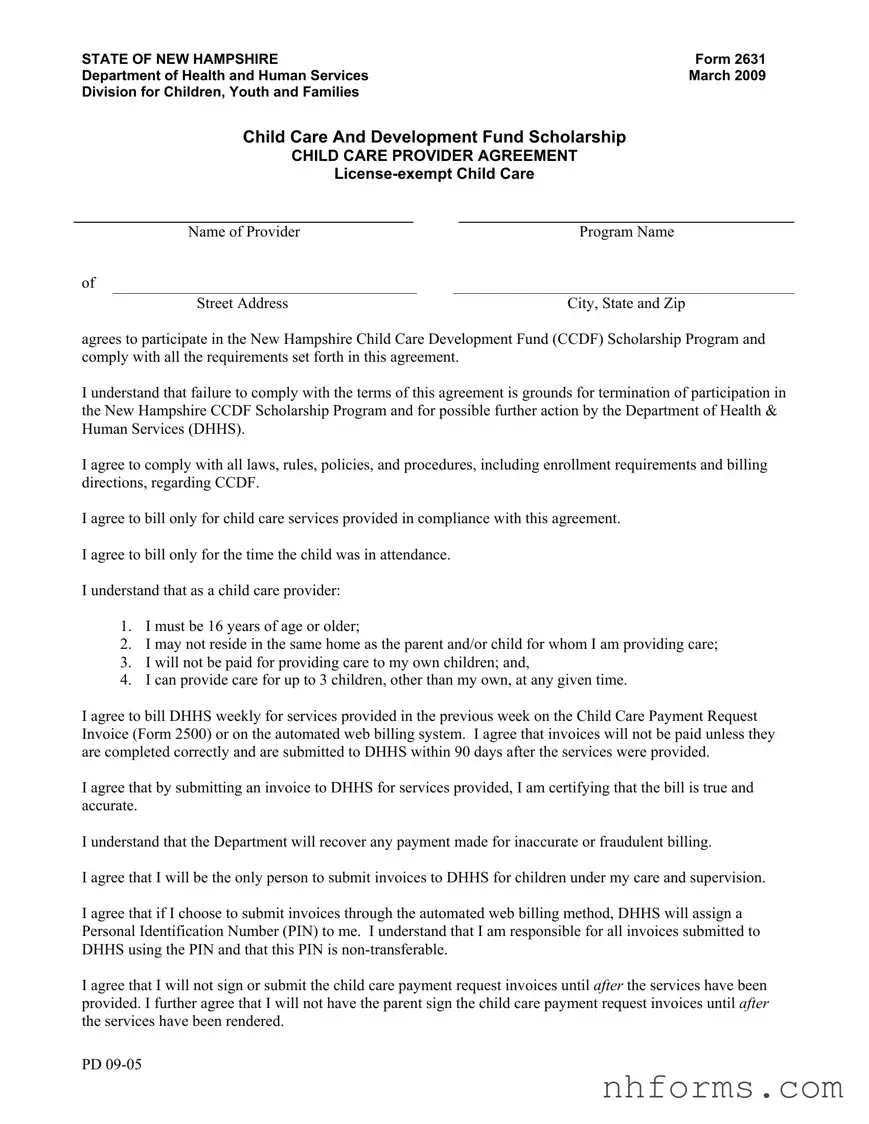

STATE OF NEW HAMPSHIRE |

Form 2631 |

Department of Health and Human Services |

March 2009 |

Division for Children, Youth and Families |

|

Child Care And Development Fund Scholarship

CHILD CARE PROVIDER AGREEMENT

Name of Provider |

Program Name |

of

Street Address |

City, State and Zip |

agrees to participate in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program and comply with all the requirements set forth in this agreement.

I understand that failure to comply with the terms of this agreement is grounds for termination of participation in the New Hampshire CCDF Scholarship Program and for possible further action by the Department of Health & Human Services (DHHS).

I agree to comply with all laws, rules, policies, and procedures, including enrollment requirements and billing directions, regarding CCDF.

I agree to bill only for child care services provided in compliance with this agreement.

I agree to bill only for the time the child was in attendance.

I understand that as a child care provider:

1.I must be 16 years of age or older;

2.I may not reside in the same home as the parent and/or child for whom I am providing care;

3.I will not be paid for providing care to my own children; and,

4.I can provide care for up to 3 children, other than my own, at any given time.

I agree to bill DHHS weekly for services provided in the previous week on the Child Care Payment Request Invoice (Form 2500) or on the automated web billing system. I agree that invoices will not be paid unless they are completed correctly and are submitted to DHHS within 90 days after the services were provided.

I agree that by submitting an invoice to DHHS for services provided, I am certifying that the bill is true and accurate.

I understand that the Department will recover any payment made for inaccurate or fraudulent billing.

I agree that I will be the only person to submit invoices to DHHS for children under my care and supervision.

I agree that if I choose to submit invoices through the automated web billing method, DHHS will assign a Personal Identification Number (PIN) to me. I understand that I am responsible for all invoices submitted to DHHS using the PIN and that this PIN is

I agree that I will not sign or submit the child care payment request invoices until after the services have been provided. I further agree that I will not have the parent sign the child care payment request invoices until after the services have been rendered.

PD

I agree that at all times for children receiving CCDF Scholarship under my care and supervision, I will be present and will directly provide care for those children.

I agree to keep all information concerning children and their families confidential except as otherwise allowed under law.

I agree to keep daily attendance records, which include start and stop times and parent/guardian’s signature, and other records related to billing for a period of seven years. I agree to provide all such records and information related to billing and/or services provided to DHHS or its agents as requested.

I agree to contact DHHS if I believe that I have received an overpayment.

I agree to be responsible for reporting funds received under this agreement as income to DHHS each calendar year as required if I am receiving any other services from DHHS.

I agree that I am responsible for the payment of all required federal and state taxes accrued. DHHS will issue a Form 1099 in January of each year if total reportable payment from all state agencies equal $600 or more.

**Note Form 1099 will not be issued for nonprofit agencies or corporations.

I agree that signing this form does not create an

I agree that the decision to charge or not to charge all or part of the cost share determined by DHHS is between the provider and the parent.

I agree that the decision to charge all or part of the difference between what DHHS reimburses and the actual charge is between the provider and the parent.

I understand that I may be terminated from participation in CCDF for failure to comply with this agreement or DHHS rules related to child care assistance. Additionally, I understand that either party may terminate this agreement without cause following 30 days written notification by registered mail. This agreement may be terminated without advance notice if the provider has not billed in over one year, a child’s health or safety is endangered or if the provider is determined to have fraudulently billed DHHS.

Any provider that has a founded fraudulent claim against them will be disqualified from participating in the CCDF Scholarship program for a minimum period of five years.

This agreement becomes effective upon the date of your signature:

__________________________________________________________________________________

Name of Child Care Provider

___________________________________ |

_______________________________________ |

Signature |

Date |

Return this signed form to the Child Development Bureau

129 Pleasant Street

Concord, New Hampshire 03301

Keep a copy for your records

PD

STATE OF NEW HAMPSHIRE |

Form 2631(i) |

Department of Health and Human Services |

March 2009 |

Division for Children, Youth and Families |

|

Instructions for

PURPOSE:

All

INSTRUCTIONS:

Form 2631 must be completed by the child care provider. The completed form must be returned to the Child Development Bureau, Division for Children, Youth and Families.

The Child Development Bureau will return forms that have missing or incomplete information.

The Child Development Bureau will retain a copy of the completed form in the provider file.

FORM COMPLETION:

Enter the full legal name and physical address of the child care provider.

Read the entire document and if you have any questions contact the Child Development Bureau.

Sign and date the form.

Send original and keep a copy for your records.

RETENTION:

Form 2631 is retained permanently in the provider file.

PD

Document Breakdown

| Fact | Detail |

|---|---|

| Purpose of Form 2631 | For license-exempt child care providers to agree to the terms for participating in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program. |

| Eligibility to Provide Care | Providers must be at least 16 years old, cannot reside in the same home as the child receiving care unless the provider is the parent, cannot be paid for caring for their own children, and can care for up to 3 non-own children at a time. |

| Billing Requirements | Providers must bill the Department of Health & Human Services (DHHS) weekly for services in the previous week, ensure invoices are completed correctly, and submit within 90 days after services are provided. |

| Payment and Tax Reporting | Providers agree to report income to DHHS and are responsible for federal and state taxes. A Form 1099 is issued if payments total $600 or more, except for non-profit agencies or corporations. |

| Confidentiality and Records | Providers agree to keep all information about children and their families confidential and to retain daily attendance and billing records for seven years, providing them to DHHS upon request. |

| Termination of Agreement | The agreement can be terminated by either party with 30 days written notice, immediately if the provider hasn't billed in over a year, a child’s health or safety is at risk, or in cases of fraudulent billing. |

| Governing Law | The agreement is governed by New Hampshire state laws and regulations related to the Child Care Development Fund Scholarship Program as administered by the Department of Health and Human Services. |

Detailed Instructions for Writing New Hampshire 2631

When engaging with the State of New Hampshire's processes, especially in regards to child care provision, it's paramount to navigate forms with precision and authority. The Form 2631 is one pivotal document in this journey, bridging the gaps between child care providers, legal structures, and the overarching aims of the Child Care And Development Fund (CCDF) Scholarship Program. Ensuring the form is completed correctly marks a crucial step in validating an agreement that underpins the provider's eligibility and compliance within the program. This step-by-step guide is crafted to assist license-exempt child care providers in accurately navigating this crucial document.

- Begin by entering the full legal name of the child care provider at the top of Form 2631.

- Proceed to input the program name, if applicable, directly below the provider's name.

- Fill in the street address, city, state, and zip code below the program name to indicate the location of the childcare service.

- Read through the agreement carefully, noting the commitments and obligations it entails, including compliance with all laws, policies, and billing directions relevant to the CCDF Scholarship Program.

- Pay particular attention to the sections regarding billing practices, understanding that billing can only be for the time the child was in attendance and must be submitted within the stipulated timeframe.

- Review the qualifications required of the child care provider, including age and residency restrictions, alongside the maximum number of children one can care for under this agreement.

- Understand the importance of confidentiality and record-keeping as outlined in the agreement, ensuring the safekeeping of daily attendance records, billing documents, and all pertinent information for a period of seven years.

- Upon thorough review, sign and date the form at the designated area at the bottom of the document to indicate your agreement and understanding of all terms.

- Finally, send the original signed document to the Child Development Bureau at the address provided, ensuring to keep a copy for your records.

This straightforward approach to completing Form 2631 ensures that license-exempt child care providers are accurately informed of their roles and responsibilities within the CCDF Scholarship Program. By meticulously following these steps, providers take a significant step toward fostering a compliant and supportive environment for child care, reinforcing their commitment to quality and legally-sound practices in New Hampshire.

Essential Queries on New Hampshire 2631

What is the New Hampshire Form 2631?

New Hampshire Form 2631 is an agreement between child care providers and the Department of Health and Human Services. Specifically, it applies to license-exempt child care providers who wish to receive payments for child care services provided through the Child Care and Development Fund (CCDF) Scholarship Program. By signing this form, providers agree to adhere to program requirements, billing instructions, and to comply with all relevant laws and regulations.

Who needs to complete the New Hampshire Form 2631?

The form must be completed by license-exempt child care providers who are enrolling in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program. This includes any provider who is not licensed by the state but wants to participate in this funding program to provide child care services.

What are the key commitments made by providers in this form?

Providers agree to various commitments, such as billing only for provided services and for the time the child was actually in attendance, maintaining proper records, including daily attendance and billing details, and submitting invoices accurately and on time. Providers also commit to direct care for the children, ensuring confidentiality of information, and reporting any received overpayments. Additionally, they must handle their own tax obligations and not expect an employer-employee relationship with DHHS.

How should the Form 2631 be submitted?

After completing and signing Form 2631, providers need to send the original document to the Child Development Bureau at the specified address in Concord, New Hampshire. It's important to keep a copy of the signed form for their records. Incomplete forms will be returned for correction and completion.

Is a background check required for license-exempt providers under this agreement?

The form does not explicitly mention the need for a background check in the text provided. However, providers must comply with all laws, rules, policies, and procedures related to the CCDF program, which may include background checks as per New Hampshire state law or DHHS policies.

What happens if a provider fails to comply with the terms of the agreement?

Failure to comply with the terms of the agreement can result in termination from the CCDF Scholarship Program. Additionally, such failure could lead to further action by the Department of Health & Human Services, including recovery of payments made for inaccurate or fraudulent billing. Providers may also be disqualified from participation in the CCDF Scholarship program for a minimum of five years if a fraudulent claim is founded against them.

Common mistakes

Completing the New Hampshire Form 2631, associated with the Department of Health and Human Services for license-exempt child care providers intending to participate in the Child Care and Development Fund (CCDF) Scholarship Program, necessitates meticulous attention to detail. Nevertheless, individuals frequently make errors that could jeopardize their participation in the program. Recognizing and avoiding these common mistakes is crucial for a smooth application process.

One prevalent error is the failure to provide comprehensive and accurate provider information. The Form 2631 requires the full legal name and physical address of the child care provider. It's not uncommon for providers to inadvertently omit crucial details, such as including a P.O. Box instead of a physical address or not using the legal name under which they are doing business. Such oversights can lead to unnecessary delays in the provider's application process or, worse, outright rejection of their application.

Another significant mistake is not reading the agreement in its entirety before signing. This form outlines all the requirements and obligations of a child care provider under the CCDF Scholarship Program. By skipping or merely skimming through the document, providers might miss important information about compliance, billing only for actual time children were in attendance, and the necessity of maintaining daily attendance records alongside other documentation. This oversight can later lead to breaches of the agreement, which could result in termination of participation in the program.

A third error involves the mismanagement of invoices. Providers agree to bill the Department of Health & Human Services (DHHS) weekly for services provided in the previous week using the Child Care Payment Request Invoice (Form 2500) or an automated web billing system. However, inaccuracies or delays in submitting these invoices within the 90-day period after the services were provided can lead to non-payment. Moreover, inaccuracies in these invoices may not only result in delayed payments but also in the obligation to repay any amounts overcharged.

Lastly, a critical mistake is the improper handling of personal identification numbers (PINs) associated with the automated web billing system. When providers opt to submit invoices through this method, they are assigned a PIN that is non-transposable. Despite this, situations occur where PINs are shared or not securely stored, leading to unauthorized access and potentially fraudulent billing. It is paramount for providers to safeguard their PINs to prevent misuse and ensure the security of their billing processes.

In conclusion,

- Providing incomplete or inaccurate provider information can lead to application delays or rejection.

- Failing to thoroughly read the agreement can result in non-compliance with CCDF requirements.

- Inaccurate or delayed invoice submission can obstruct payment and obligate repayment of inaccurately billed amounts.

- Improper handling of PINs for automated billing can risk unauthorized access and fraudulent billing.

By avoiding these errors, license-exempt child care providers can ensure a smoother application process and compliance with the Child Care and Development Fund Scholarship Program's requirements.

Documents used along the form

When partnering with the New Hampshire Department of Health and Human Services for the Child Care and Development Fund (CCDF) Scholarship Program, as outlined in the New Hampshire 2631 form, several other documents often play a crucial role. These forms and documents ensure compliance, financial accuracy, and support the overarching goal of providing quality child care. Understanding each is vital for a smooth operation within the program.

- Form 2500 - Child Care Payment Request Invoice: Used by providers to bill the Department for child care services provided, this form must be submitted weekly for the previous week's services.

- Form 1099 - Miscellaneous Income: Issued by DHHS to report the income paid to child care providers, assuming the amount exceeds $600 in a year, except for non-profits.

- Daily Attendance Records: These records track the start and stop times of child care services, including signatures from parents or guardians, and are essential for billing accuracy and compliance.

- Income Reporting Forms: Required for providers receiving other services from DHHS, these forms report the income received under the CCDF agreement for taxation purposes.

- Personal Identification Number (PIN) Setup Documents: For those choosing automated web billing, documents to set up and manage a PIN for secure online submissions are necessary.

- Confidentiality Agreement Forms: Ensure all child and family information remains protected, except as permitted by law, maintaining privacy and trust.

- Tax Documentation: Providers are responsible for paying federal and state taxes on income earned, necessitating proper filing of tax documents based on the earnings reported by DHHS.

- Termination Notice: If either party decides to end the agreement, a formal termination notice documented through registered mail is required following the outlined procedures.

- Fraudulent Claim Documentation: In cases where a provider is found to have billed fraudulently, documentation outlining the founded claim and subsequent disqualification from the CCDF program is necessary.

In conclusion, while the New Hampshire 2631 form is a critical document for child care providers participating in the CCDF Scholarship Program, it is just one piece of a larger compliance puzzle. Keeping accurate records, following billing procedures, and maintaining transparency with financial and operational documentation are all essential components of a successful partnership with the Department of Health & Human Services. Understanding and properly managing these related documents ensures both compliance with the program's requirements and the continued delivery of quality child care services.

Similar forms

The New Hampshire 2631 form, central to facilitating the participation in the Child Care and Development Fund (CCDF) Scholarship Program for license-exempt child care providers, is notably similar to several other types of documents that navigate the operational aspects of child care funding and compliance within and across states. Although tailored specifically to New Hampshire's regulations and the CCDF program's requirements, its structure and the nature of the agreement it presents share characteristics with other regulatory and agreement forms used in child care programs nationally.

One document the New Hampshire 2631 form closely resembles is the Child Care Certificate Program Agreement used in many states to establish the terms under which child care providers deliver services to families eligible for subsidies. Like the 2631 form, these agreements typically require providers to adhere to specific state regulations and program guidelines, bill correctly for provided care, and maintain accurate attendance records. Additionally, both documents outline the responsibilities of child care providers concerning compliance with state laws and the confidentiality of client information, emphasizing accountability and the integrity of care provided to children.

Another similar document is the IRS Form W-10, which is used to provide taxpayer identification information for child care providers as part of tax credit claims. While the W-10 form serves a different primary function—facilitating tax benefits for families rather than directly governing the provision of child care services—it shares with the New Hampshire 2631 form the fundamental role of ensuring that providers are appropriately recognized and that financial transactions related to child care are properly documented. Both forms contribute to a larger framework that supports and regulates child care provision, emphasizing the importance of transparency and accurate record-keeping.

Lastly, the New Hampshire 2631 form mirrors aspects of the License-Exempt Provider Registration Form that many states use for in-home and other non-traditional child care setups not requiring formal licensing. These forms, similar to the 2631, collect detailed information about the provider and the care environment and set forth conditions related to safety, health, and operational standards. They serve as key instruments in the broader regulatory efforts to ensure child care quality and safety, even outside conventional licensed facilities, reinforcing the shared goal of protecting children's well-being while under care.

Dos and Don'ts

When completing the New Hampshire 2631 form for Child Care Provider Agreement, certain practices should be followed to ensure correctness and completeness. Here is a list of do's and don'ts:

- Do thoroughly read the entire document before signing to understand all the terms, conditions, and responsibilities you are agreeing to.

- Do enter the full legal name and physical address of the child care provider accurately to avoid any issues with identification.

- Do contact the Child Development Bureau if there are any parts of the agreement or instructions that are unclear to you.

- Do sign and date the form to validate the agreement. A signed and dated document is a legal requirement for participation in the program.

- Do keep a copy of the signed form for your records. This will be helpful for any future references or clarifications.

- Don't leave any sections incomplete or provide misinformation. Inaccuracies can lead to delays or denial of participation in the Child Care Development Fund (CCDF) Scholarship Program.

- Don't submit the form without ensuring that all information is correct and complete. The Child Development Bureau will return forms that have missing or incomplete information, delaying your enrollment.

- Don't forget to update the Child Development Bureau if there are any changes to your information or status as a provider to maintain accurate records.

- Don't ignore the requirement to retain the form permanently in the provider file. This documentation is critical for compliance and audit purposes.

Adhering to these guidelines will facilitate a smoother process in completing and submitting the New Hampshire 2631 form, thereby ensuring your eligibility and participation in the CCDF Scholarship Program without unnecessary interruptions or complications.

Misconceptions

Many people have misconceptions about New Hampshire's Form 2631, particularly regarding its requirements and implications for child care providers participating in the Child Care Development Fund (CCDF) Scholarship Program. Here are eight common misunderstandings:

- Only licensed child care providers need to fill out Form 2631. This is incorrect. The form is specifically for license-exempt child care providers enrolling to receive payments through the CCDF Scholarship Program.

- Filling out Form 2631 creates an employer-employee relationship with the Department of Health and Human Services (DHHS). Signing the form does not create such a relationship; it is merely an agreement to comply with the program's terms.

- Child care providers can bill for services in advance. Providers must only bill for child care services after they have been provided, ensuring accuracy and compliance.

- There is no deadline for billing DHHS for services rendered. In fact, invoices must be submitted within 90 days after the services were provided to be considered for payment.

- Providers can care for any number of children under this program. The agreement stipulates that a provider can care for a maximum of three children, other than their own, at any given time.

- Child care providers are automatically enrolled in the program upon submitting Form 2631. Submission of the form is a necessary step, but enrollment also depends on meeting all specified requirements and obtaining approval from DHHS.

- The agreement does not cover tax responsibilities. Providers are responsible for reporting income received under the agreement and for paying all applicable federal and state taxes. DHHS will issue a Form 1099 if total payments equal $600 or more, except for nonprofit agencies or corporations.

- The signing of Form 2631 does not require record-keeping. Providers must keep detailed daily attendance records and other related documentation for a period of seven years and provide them to DHHS or its agents upon request.

Clearing up these misconceptions is essential for ensuring that child care providers fully understand their responsibilities and the regulations put forth by the New Hampshire Department of Health and Human Services when they participate in the CCDF Scholarship Program.

Key takeaways

- Providers must be at least 16 years old and cannot reside in the same home as the child or parent they are providing care for.

- Care for one's own children is not covered under this program, and a provider can care for up to three children, excluding their own, at a time.

- Accurate weekly billing to the Department of Health & Human Services (DHHS) is required for the previous week's services, using Form 2500 or an automated web billing system, must be submitted within 90 days.

- By submitting an invoice, providers are attesting to the truth and accuracy of the billing, and understand that any payment made on fraudulent claims will be recovered.

- A Personal Identification Number (PIN) will be assigned for submitting invoices electronically, which is non-transferable and for exclusive use by the provider.

- Providers must keep detailed daily attendance records and all related billing records for seven years and provide these to DHHS upon request.

- Providers agree to maintain confidentiality of all information regarding children and their families, except as permitted by law.

- The agreement does not establish an employer-employee relationship between the provider and DHHS.

- Providers are obligated to report income received under this agreement to DHHS and are responsible for all applicable federal and state taxes. A Form 1099 will be issued if the total payment is $600 or more, unless the provider is a nonprofit entity.

- Any decision to charge the family any portion of the cost difference between DHHS reimbursement rates and the provider's charges is solely between the provider and the parent.

- Failure to adhere to the agreement’s terms, including DHHS rules for child care assistance, may result in termination from the CCDF program. Such termination can occur with 30 days' written notice, immediately under certain conditions such as fraud, endangerment to a child's health or safety, or over a year of billing inactivity.

- Providers found to have fraudulently billed DHHS will be disqualified from participating in the CCDF Scholarship program for a minimum of five years.

Different PDF Templates

Nh Department of Revenue Forms - Form designed to streamline legal requests within the New Hampshire court system, complete with judicial review sections.

Nh Business Tax - The Department of Revenue Administration provides additional assistance and FAQs for entities filling out the NH-1065-ES form on their website.

New Hampshire 2620 - Child care services provided must be clearly indicated by checking the appropriate box in section 3 of the form.