New Hampshire 2620 Template

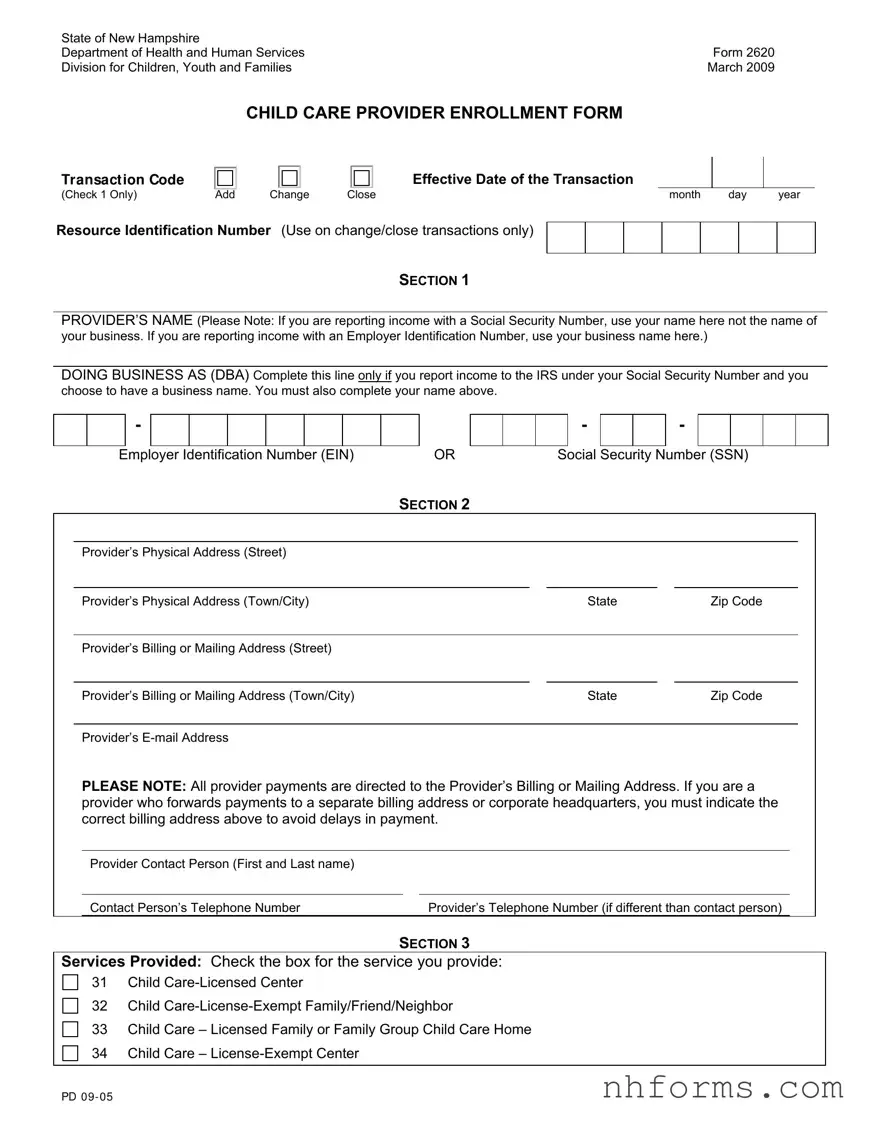

The New Hampshire Department of Health and Human Services facilitates child care services through a comprehensive process, requiring potential child care providers to complete the thoroughly detailed Form 2620. Updated in March 2009 and integral to the Division for Children, Youth, and Families, this document serves multiple crucial functions—from initiating enrollment to altering provider details or even closing an enrollment. Thoughtfully designed, Form 2620 canvasses essential information, including provider names, whether individual or business, supported by the relevant Social Security or Employer Identification Numbers. It requires detailed contact and address information to ensure accurate communication and payment processing. The form meticulously categorizes child care services into licensed centers, license-exempt conditions, and familial setups, demanding providers to clearly identify the nature of their service. It sets the foundation for a streamlined engagement with the Department of Health and Human Services, emphasizing the necessity for providers to adhere to state regulations, policies, and procedures. Availability for payment is contingent upon completing this enrollment, underscoring the Department’s stance on regulatory compliance and the importance of accurate, up-to-date provider information. Form 2620, accompanied by an Alternate W-9 Form, must be submitted to the Department of Health and Human Services Data Management Unit, signifying a critical step for child care providers aiming to serve New Hampshire’s families effectively.

Document Preview Example

State of New Hampshire |

|

Department of Health and Human Services |

Form 2620 |

Division for Children, Youth and Families |

March 2009 |

CHILD CARE PROVIDER ENROLLMENT FORM

TRANSACT ION CODE

Effective Date of the Transaction

(Check 1 Only) |

Add |

Change |

Close |

month |

day |

year |

Resource Identification Number (Use on change/close transactions only)

SECTION 1

PROVIDER’S NAME (Please Note: If you are reporting income with a Social Security Number, use your name here not the name of your business. If you are reporting income with an Employer Identification Number, use your business name here.)

DOING BUSINESS AS (DBA) Complete this line only if you report income to the IRS under your Social Security Number and you choose to have a business name. You must also complete your name above.

-

Employer Identification Number (EIN) |

OR |

- |

|

|

- |

|

|

|

|

Social Security Number (SSN)

SECTION 2

Provider’s Physical Address (Street) |

|

|

|

|

|

|

|

|

|

Provider’s Physical Address (Town/City) |

|

State |

|

Zip Code |

|

|

|

|

|

Provider’s Billing or Mailing Address (Street) |

|

|

|

|

|

|

|

|

|

Provider’s Billing or Mailing Address (Town/City) |

|

State |

|

Zip Code |

|

|

|

|

|

Provider’s |

|

|

|

|

PLEASE NOTE: All provider payments are directed to the Provider’s Billing or Mailing Address. If you are a provider who forwards payments to a separate billing address or corporate headquarters, you must indicate the correct billing address above to avoid delays in payment.

Provider Contact Person (First and Last name)

Contact Person’s Telephone Number |

Provider’s Telephone Number (if different than contact person) |

SECTION 3

Services Provided: Check the box for the service you provide:

31 Child

32 Child

33 Child Care – Licensed Family or Family Group Child Care Home 34 Child Care –

PD 09 - 05

INSTRUCTIONS FOR COMPLETION OF PROVIDER ENROLLMENT FORM

All providers of child care services who wish to receive payment from the Department of Health and Human Services (DHHS) must be enrolled and are subject to all Department rules, regulations, policies, and procedures. This is done with completion of a child care enrollment packet. No payments will be made to any provider until the enrollment process has been completed. DHHS does not withhold tax money for individuals receiving payments for services. Payment of taxes is the responsibility of the individual.

Enrollment and Billing: At time of enrollment, all providers will be assigned a Resource Identification (ID) Number. A Provider Enrollment Notice will be sent informing you that the enrollment process has been completed.

Please retain this notice! The Provider Notice will give you the information required to be entered on all billing invoices that you submit to DHHS. To be reimbursed for child care services, you must bill on

DHHS billing invoice Form 2500.

Reporting Changes: Providers are required to report all changes to DHHS such as changes of address, incorporation, or provider name. Changes must be reported to DHHS by submitting them on a new FORM 2620 and ALTERNATE

Form Completion

Transaction Code Add- Check when you request a new enrollment. Transaction Code Change- Check when you report a change, or are

Resource ID Number- Enter your Resource ID number when you report a change or request an enrollment closing. Enter your number from left to right leaving unused spaces blank at the end.

Effective Date- Enter month, day, year. This date will be your first date of enrollment, date child care services will be provided by you, the effective date of your change, or your enrollment end date.

SECTION 1

Provider Name - This line must be completed whether you report income under your SSN# or EIN# Enter your own name here if you report income to the IRS under your Social Security Number.

Enter the name of your business here only if you report income to the IRS with an Employer Identification Number.

Doing Business As- Complete this line only if you report income to the IRS under your Social Security Number. If you have a business name, enter it. You must also indicate your first name, middle initial and last name on the line provided above.

Employer ID Number or Social Security Number- Enter the number you use to report income to the IRS (Enter only one number- either the SSN# or the EIN#).

SECTION 2

Provider Address- Enter your physical and billing or mailing address. (See note on the front of this form)

Contact Person- Enter the name, telephone number and email address of the person to contact for questions.

SECTION 3

Services Provided- Check the box for the child care service you provide.

Return this form, along with a completed ALTERNATE

Department of Health and Human Services

Data Management Unit

Box 2000

Concord, NH

PD 09 - 05

Document Breakdown

| Fact | Detail |

|---|---|

| Form Number | 2620 |

| Department | Department of Health and Human Services, State of New Hampshire |

| Division | Division for Children, Youth and Families |

| Date of Issue | March 2009 |

| Title | CHILD CARE PROVIDER ENROLLMENT FORM |

| Purpose | Enrollment of child care providers wishing to receive payment from the Department of Health and Human Services (DHHS) for services provided |

| Key Sections | Provider Information, Service Provided, Enrollment Data |

| Required Actions | Completing the enrollment packet, and, when necessary, submitting changes with a new FORM 2620 and ALTERNATE W-9 FORM |

| Payments & Taxes | DHHS does not withhold taxes; payment of taxes is the provider's responsibility |

| Governing Law(s) | New Hampshire state rules, regulations, policies, and procedures regarding child care service provision and payment |

| Submission Address | Department of Health and Human Services Data Management Unit Box 2000 Concord, NH 03302-2000 |

Detailed Instructions for Writing New Hampshire 2620

Filling out the New Hampshire Form 2620 is an essential process for child care providers seeking to enroll or update their services with the Department of Health and Human Services. This form is important for those who wish to receive payments from the Department for child care services provided. It's crucial to complete this form accurately to ensure a smooth collaboration with the Department, facilitating timely payments for services rendered. Keep in mind, changes in your service details, such as address or incorporation status, need to be communicated efficiently through this form to avoid any delays or complications in the billing process. Follow the steps below meticulously to complete the Form 2620.

- Start by deciding the nature of your transaction with the Department: adding new enrollment, changing details of existing enrollment, or closing an enrollment. Check the appropriate Transaction Code box at the top of the form.

- If you're changing or closing your enrollment, enter your Resource Identification Number in the space provided. If you're new, leave this blank.

- Enter the Effective Date of the transaction by filling in the month, day, and year relevant to your application or update.

- In Section 1, under "Provider’s Name," enter your name if you report income using your Social Security Number (SSN) or your business name if you use an Employer Identification Number (EIN) for tax purposes.

- If applicable, complete the "Doing Business As (DBA)" line with your business name, especially if your income is reported under your SSN and you operate under a different name.

- Provide either your SSN or EIN, depending on which one you use for income reporting to the IRS. Make sure to include this critical identifier accurately.

- In Section 2, fill in your physical and billing or mailing addresses in the appropriate fields. Note that all payments will be directed to the billing or mailing address listed, so ensure this information is correct.

- Provide the contact details of the person the Department should communicate with, including their name, email address, and telephone numbers.

- Proceed to Section 3 and check the box corresponding to the child care service you provide, whether it's a licensed center, license-exempt family/friend/neighbor, licensed family or family group child care home, or a license-exempt center.

- After completing the form, gather an ALTERNATE W-9 FORM, fill it out, and mail both forms together to the Department of Health and Human Services, Data Management Unit, Box 2000, Concord, NH 03302-2000.

By carefully following these steps, you ensure the accurate and timely processing of your child care provider enrollment or update request with the New Hampshire Department of Health and Human Services. This not only helps in maintaining an organized record of your service but also facilitates a smoother operation and payment process for the child care services you provide.

Essential Queries on New Hampshire 2620

What is the purpose of the New Hampshire 2620 form?

The New Hampshire 2620 form serves as an enrollment document for child care providers who wish to receive payment from the Department of Health and Human Services (DHHS) for their services. By completing this form, providers agree to comply with all DHHS rules, regulations, policies, and procedures. The form collects essential information such as the provider's name, contact details, and the type of child care services offered. This enrollment is a mandatory step to ensure that child care providers are properly registered with DHHS and eligible to submit billing invoices for reimbursement.

How do I report a change in my information after I have enrolled?

If you need to report any changes in your information, such as a new address, incorporation, or a change in your provider name, you must complete a new New Hampshire 2620 form, indicating the changes. Along with the updated 2620 form, you are required to submit an ALTERNATE W-9 FORM. These documents must be mailed together to the Department of Health and Human Services, Data Management Unit, Box 2000, Concord, NH 03302-2000. It is crucial to keep your enrollment information current to avoid any delays or issues in payment for child care services provided.

What are the different check boxes in the Transaction Code section, and when should they be used?

In the Transaction Code section of the form, there are three check boxes: Add, Change, and Close. These are used to indicate the purpose of the form submission. You should check "Add" when you are requesting a new enrollment with DHHS. If you are reporting any changes to your existing enrollment details or you are re-enrolling, the "Change" box should be checked. Lastly, the "Close" checkbox is to be used when you are requesting to close your enrollment. This section helps DHHS to process your form correctly based on your current needs.

What steps should I follow to be reimbursed for child care services?

After successfully completing your enrollment process with the New Hampshire 2620 form, you'll be assigned a Resource Identification (ID) Number, and you will receive a Provider Enrollment Notice. It is important to retain this notice as it contains information necessary for billing. To be reimbursed for child care services, you must submit your billing invoices using the DHHS billing invoice Form 2500. Ensure all invoices include the required information as outlined in your Provider Enrollment Notice to facilitate a smooth reimbursement process. Remember, no payments will be made until the enrollment and billing process have been properly completed.

Common mistakes

Filling out the New Hampshire 2620 form, a crucial document for child care providers seeking to enroll or update their enrollment with the Department of Health and Human Services, requires attention to detail and an understanding of the information requested. Mistakes during the completion process can lead to delays or issues with enrollment, affecting a provider’s ability to receive payment for services. Four common mistakes made when completing this form underscore the importance of careful review and accurate reporting.

Incorrect or Incomplete Provider Name: One frequent mistake involves the provider’s name in Section 1. Providers must ensure that they enter their own name if they are reporting income under their Social Security Number (SSN) but should use their business name if they report income with an Employer Identification Number (EIN). This distinction is crucial for tax purposes and ensures that payments are accurately processed and directed.

Failure to Specify the Correct Transaction Code: The form requires selecting a transaction code at the start, indicating whether the form is for a new enrollment, a change, or to close enrollment. A common oversight is failing to check the appropriate box or not updating this information if the form is being used to report a change or closure. This can lead to confusion and may result in the wrong type of processing by the Department of Health and Human Services.

Omitting the Resource Identification Number in Change/Close Transactions: When filling out the form to report a change or close enrollment, it is essential to include the Resource Identification Number. This number is crucial for the Department to locate the provider’s existing enrollment information quickly. Without it, processing changes or closing the enrollment can be significantly delayed, impacting the provider’s operational functions.

Inaccurate or Incomplete Addresses: Section 2 requires both the physical and billing or mailing addresses of the provider. A common mistake is entering incomplete address information or failing to indicate a separate billing address when payments are directed elsewhere. This can lead to payment delays, as the Department sends provider payments to the billing or mailing address specified on the form. Accurate and complete address information is critical to ensure timely payment.

These mistakes can be mitigated by thoroughly reviewing the form before submission, ensuring all information is accurate and complete. Providers should pay particular attention to the sections mentioned above, as these are areas where errors commonly occur. Double-checking details like the transaction code, provider name, Resource Identification Number, and address details can save considerable time and prevent issues with enrollment and payment processing. Taking the time to review and correct these mistakes is crucial for a smooth enrollment process with the New College Hampshire Department of Health and Human Services.

Documents used along the form

In New Hampshire, when someone is involved in providing child care services and seeks to receive payment from the Department of Health and Human Services, completing the New Hampshire 2620 form is a crucial step. However, to ensure the process is comprehensive and adheres to all requirements, additional forms and documents are often needed alongside the New Hampshire 2620 form. The following list highlights some of these critical documents, each serving its unique purpose in the enrollment and operational framework of child care providers.

- Alternate W-9 Form: This form is essential for tax identification and certification. It must be submitted alongside Form 2620 to provide the necessary tax identification information, ensuring the provider is properly registered for tax purposes.

- Form 2500 - DHHS Billing Invoice: To receive reimbursement for child care services provided, this billing invoice form must be completed and submitted. It is used by providers to bill the Department of Health and Human Services for their services.

- Licensing Application for Child Care Program: For those providing licensed child care services, completing the application for licensure is a foundational step. This document outlines the provider's program details and adheres to state regulatory requirements.

- Child Care Provider Agreement: This agreement outlines the terms and conditions between the child care provider and the state or local government. It includes details on service expectations, payment rates, and other operational guidelines.

- Background Check Authorization Form: A necessary step in ensuring the safety of children in care, this form authorizes the state to perform a background check on the provider and any staff members.

- Health and Safety Training Certification: Providers must submit proof of completion of state-required health and safety training. This certification ensures that providers are equipped with essential knowledge and skills to maintain a safe environment for children.

The successful submission and approval of these documents, along with the New Hampshire 2620 form, set the foundation for a compliant and effective child care provision. Each document plays a significant role in establishing transparent, accountable, and quality services, ensuring that children's welfare and safety are at the forefront of care provided under the New Hampshire Department of Health and Services guidelines.

Similar forms

The New Hampshire 2620 form is similar to various other documents used within the realms of child care provider registration and tax reporting. Specifically, its functions and purposes align closely with forms like the IRS W-9 Form and state-specific child care provider enrollment or registration forms. Each of these documents is integral to the operational and financial aspects of child care service provision, yet they serve unique roles within the broader context of regulatory compliance and financial management.

The IRS W-9 Form: This form is used to collect correct taxpayer identification numbers (TIN) from individuals or entities in the United States, to ensure proper reporting by businesses to the IRS. Similar to the section in the New Hampshire 2620 form where providers enter their Social Security Number or Employer Identification Number, the W-9 requests this information to ensure accurate tax documentation. Both forms are essential for reporting income and managing tax obligations, making them vital for child care providers operating as independent contractors or businesses.

State-Specific Child Care Provider Enrollment or Registration Forms: Many states have their own versions of child care provider forms that are necessary for licensing, enrollment in subsidy programs, or both. These forms, like New Hampshire's 2620, collect detailed information on the provider, including types of services offered, facility addresses, and contact information. What makes the 2620 form particularly akin to these documents is its emphasis on formal enrollment and adherence to state regulations, policies, and procedures. Despite variations in format and specific requirements, all such forms serve the unified purpose of bringing child care providers into compliance with state mandates and enabling them to receive government funds or subsidies.

In essence, while these documents—including the New Hampshire 2620 form, IRS W-9, and other state-specific enrollment forms—possess their unique identifiers and are used within different contexts of the legal and regulatory spectrum, their similarities underscore the interconnected nature of operational, financial, and regulatory requirements in the child care provision sector.

Dos and Don'ts

When completing the New Hampshire 2620 form for Child Care Provider Enrollment, it is important to pay attention to detail and follow the instructions carefully. Here are eight dos and don'ts to help ensure your form is filled out correctly and efficiently.

- Do check the appropriate transaction code box (Add, Change, Close) to indicate the purpose of your submission.

- Do fill out the effective date of the transaction carefully, including the month, day, and year.

- Do enter your Provider Name correctly, ensuring you use your personal name for SSN reporting or your business name for EIN reporting.

- Do complete the "Doing Business As" section if you report income under your Social Security Number but have a different business name.

- Do not leave the Employer Identification Number (EIN) or Social Security Number (SSN) fields blank. You must enter the number you use for IRS reporting.

- Do provide both the physical address and the billing or mailing address, noting that payments will be directed to the billing or mailing address.

- Do not forget to check the box for the service you provide under Section 3, ensuring it matches the services you are licensed for and intend to offer.

- Do return the form along with a completed ALTERNATE W-9 FORM to the Department of Health and Human Services at the address provided, ensuring both documents are sent together to avoid processing delays.

By following these guidelines, you will help ensure your enrollment or update is processed smoothly and efficiently, allowing you to focus on providing quality child care services.