Attorney-Approved Last Will and Testament Document for New Hampshire

Thinking about the future, especially in terms of what happens after we're gone, can be a daunting task. However, the process of preparing for it doesn't have to be. In New Hampshire, the Last Will and Testament form plays a crucial role in this preparation, offering individuals a powerful tool to ensure their wishes are respected and followed regarding the distribution of their assets, the care of their minor children, and any final arrangements they desire. This document, which is legally binding when executed correctly, provides peace of mind not just to the person creating it, but also to their loved ones, by laying out clear instructions for handling the individual's estate. Understanding the major aspects of this form, from its basic requirements to how it can be customized to fit unique family situations and asset configurations, is essential. The form acts as a guiding beacon, navigating through the complexities of estate planning, ensuring wishes are honored and legal complications minimized for those left behind.

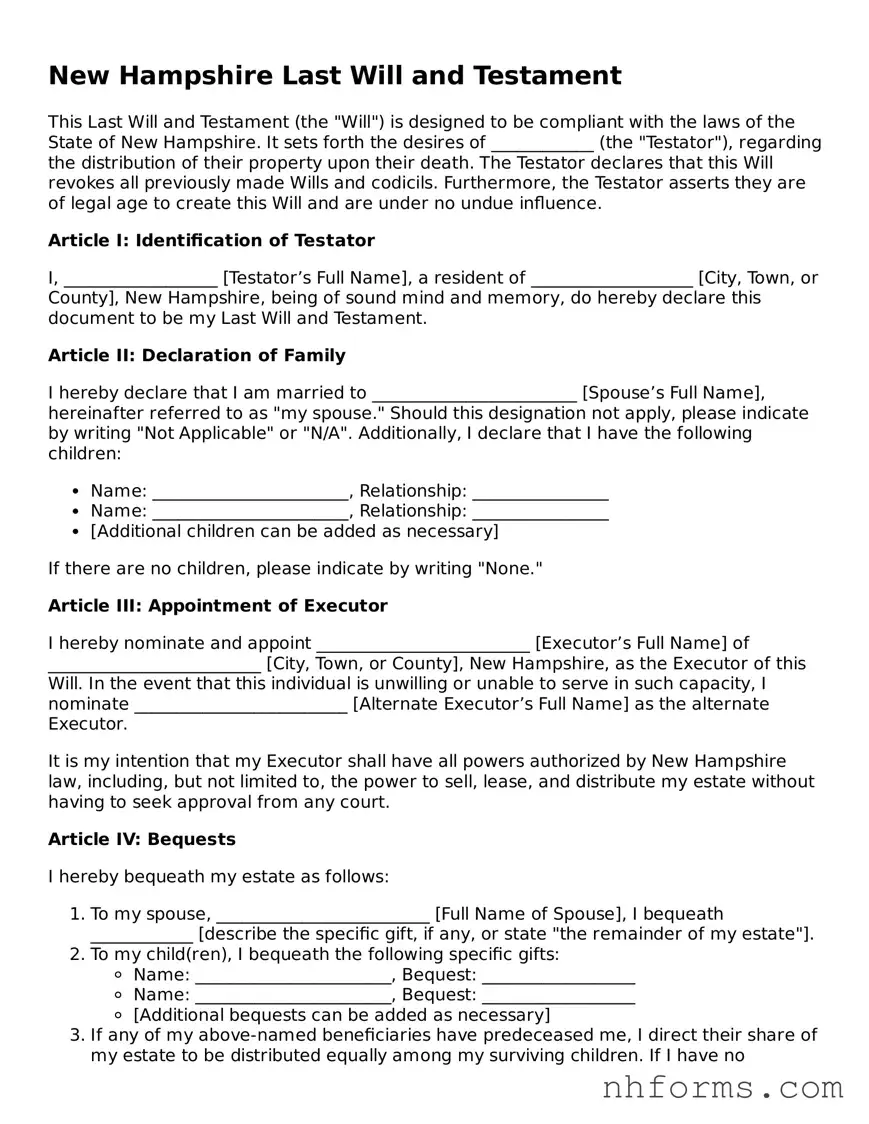

Document Preview Example

New Hampshire Last Will and Testament

This Last Will and Testament (the "Will") is designed to be compliant with the laws of the State of New Hampshire. It sets forth the desires of ____________ (the "Testator"), regarding the distribution of their property upon their death. The Testator declares that this Will revokes all previously made Wills and codicils. Furthermore, the Testator asserts they are of legal age to create this Will and are under no undue influence.

Article I: Identification of Testator

I, __________________ [Testator’s Full Name], a resident of ___________________ [City, Town, or County], New Hampshire, being of sound mind and memory, do hereby declare this document to be my Last Will and Testament.

Article II: Declaration of Family

I hereby declare that I am married to ________________________ [Spouse’s Full Name], hereinafter referred to as "my spouse." Should this designation not apply, please indicate by writing "Not Applicable" or "N/A". Additionally, I declare that I have the following children:

- Name: _______________________, Relationship: ________________

- Name: _______________________, Relationship: ________________

- [Additional children can be added as necessary]

If there are no children, please indicate by writing "None."

Article III: Appointment of Executor

I hereby nominate and appoint _________________________ [Executor’s Full Name] of _________________________ [City, Town, or County], New Hampshire, as the Executor of this Will. In the event that this individual is unwilling or unable to serve in such capacity, I nominate _________________________ [Alternate Executor’s Full Name] as the alternate Executor.

It is my intention that my Executor shall have all powers authorized by New Hampshire law, including, but not limited to, the power to sell, lease, and distribute my estate without having to seek approval from any court.

Article IV: Bequests

I hereby bequeath my estate as follows:

- To my spouse, _________________________ [Full Name of Spouse], I bequeath ____________ [describe the specific gift, if any, or state "the remainder of my estate"].

- To my child(ren), I bequeath the following specific gifts:

- Name: _______________________, Bequest: __________________

- Name: _______________________, Bequest: __________________

- [Additional bequests can be added as necessary]

- If any of my above-named beneficiaries have predeceased me, I direct their share of my estate to be distributed equally among my surviving children. If I have no surviving children, such share shall be distributed in accordance with New Hampshire law.

Article V: Guardianship

In the event that I leave behind minor children, I hereby appoint ___________________ [Guardian’s Full Name] of ___________________ [City, Town, or County], New Hampshire, as their guardian. Should this person be unable or unwilling to serve, I appoint ___________________ [Alternate Guardian’s Full Name] as the alternate guardian.

It is intended that this guardian will make decisions regarding the education, health, and welfare of my minor children according to their best interests.

Article VI: Signatures

This Will was executed on __________________ [Date] in the State of New Hampshire. In witness whereof, I have set my hand and seal, hereby declaring this document to be my Last Will and Testament in the presence of the undersigned witnesses, who witnessed and subscribed this Will at my request, and in my presence.

____________________ [Signature of Testator]

____________________ [Printed Name of Testator]

Witnesses

The undersigned, being duly sworn, do hereby declare to the undersigned authority that the Testator declared this document to be their Last Will and Testament in our presence, asked us to sign as witnesses to the Will, and in the presence of each other, we do hereby subscribe our names on the date and at the location indicated below.

- Witness #1: ____________________ [Printed Name], Signature: ____________________, Date: _______________, Location: _____________________________________

- Witness #2: ____________________ [Printed Name], Signature: ____________________, Date: _______________, Campus International School: _____________________________________

This Last Will and Testament was prepared according to the Testator's instructions and beliefs and adheres to the requirements of New Hampshire law. It is advised that all parties consult with a legal professional when creating a will to ensure compliance with current laws and legal advice tailored to your specific situation.

File Information

| Fact | Detail |

|---|---|

| Governing Law | New Hampshire Revised Statutes, Title LVI: Probate Courts and Decedents' Estates, Chapter 551: Wills |

| Age Requirement | An individual must be 18 years of age or older to create a will. |

| Sound Mind Requirement | The person creating the will must be of sound mind. |

| Witness Requirement | A New Hampshire will must be signed in the presence of two competent witnesses. |

| Writing Requirement | The will must be in writing to be considered valid under New Hampshire law. |

| Self-Proving Affidavit | Although not a requirement, a self-proving affidavit can be attached to the will, making it unnecessary to prove the validity of the will in probate court. |

Detailed Instructions for Writing New Hampshire Last Will and Testament

Making a Last Will and Testament is a significant step in planning for the future of your estate and ensuring your wishes are carried out after your passing. This document serves as a roadmap for how you want your personal and financial affairs handled, who will inherit your assets, and who will be responsible for overseeing the distribution of your estate. It's a task that might seem daunting at first, but with the right guidance, it can be a straightforward process. The steps below outline how to fill out a Last Will and Testament form in New Hampshire, helping to ensure your intentions are clearly communicated and legally recognized.

- Gather all necessary information, including a list of your assets, the names and addresses of beneficiaries, and the details of your chosen executor.

- Download or obtain the correct Last Will and Testament form for New Hampshire. Ensure it meets the state’s requirements to be considered valid.

- Start by filling in your full name and address in the designated areas to establish your identity as the testator (the person creating the will).

- Appoint an executor by entering their full name and address. This is the person who will manage and distribute your estate according to the instructions in your will.

- List all beneficiaries along with their relationship to you and specific gifts or proportions of your estate that you wish to leave to each. Be as clear and precise as possible to avoid any confusion.

- If you have minor children, appoint a guardian for them in the event that both parents pass away before the children reach adulthood. Include the guardian’s full name and address.

- Review the entire document to ensure all your wishes are clearly expressed and that there are no errors.

- Sign and date the form in the presence of at least two witnesses, who should be adults and should not be beneficiaries in the will. Their role is to verify your signature and the voluntary nature of your decision.

- Have the witnesses sign and provide their addresses on the form, thereby validating your Last Will and Testament. Please note that steps might slightly vary depending on the specific form or any updates to New Hampshire law, and it’s always advisable to consult with a legal professional to ensure your will complies with current state statutes and fully represents your wishes.

Once completed and properly signed, your Last Will and Testament becomes a binding legal document that conveys your final wishes regarding your estate. It's a responsibility that requires thoughtfulness and precision, but with careful planning and adherence to New Hampshire's legal requirements, you can create a clear and effective will. Ensuring your estate is in good order can provide peace of mind to both you and your loved ones, knowing that your intentions will be honored.

Essential Queries on New Hampshire Last Will and Testament

What is a Last Will and Testament in New Hampshire?

A Last Will and Testament in New Hampshire is a legal document that allows you to communicate your wishes regarding your assets, dependents, and affairs after your passing. It ensures your wishes are honored and your loved ones are taken care of according to your instructions.

Who can create a Last Will and Testament in New Hampshire?

Any person 18 years of age or older and of sound mind can create a Last Will and Testament in New Hampshire. Being of "sound mind" means you understand the nature of the document, what you own, and who the beneficiaries of your estate will be.

Do I need a lawyer to create a Last Will in New Hampshire?

No, it is not legally required to have a lawyer to create a Last Will in New Hampshire. However, consulting with a legal professional can provide valuable guidance, especially if your estate is complex.

How do I make sure my Last Will is valid in New Hampshire?

To ensure your Last Will is valid in New Hampshire, it must be in writing, signed by you, and witnessed by at least two individuals who do not stand to benefit from your will. These witnesses must also sign the document in your presence.

Can I change my Last Will and Testament?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. To make changes, you can either create a new will or add a codicil to your existing will, which must also be signed and witnessed according to the same rules as the original will.

What happens if I die without a Last Will in New Hampshire?

If you die without a Last Will in New Hampshire, your estate will be distributed according to the state's intestacy laws. These laws dictate which relatives receive your assets, often starting with your closest family members, which might not align with your wishes.

Can I leave my property to anyone I choose?

Yes, in New Hampshire, you can leave your property to anyone you choose in your Last Will. However, laws are in place to protect spouses from being completely disinherited, unless they have agreed to such an arrangement in a prenuptial or postnuptial agreement.

Do I need to notarize my Last Will in New Hampshire for it to be valid?

No, notarization is not required for your Last Will to be valid in New Hampshire. However, having it notarized can help validate the signature if its authenticity is ever challenged.

Should I name an executor in my Last Will?

Yes, you should name an executor in your Last Will. The executor is responsible for carrying out the terms of your will, managing your estate's affairs, and ensuring your assets are distributed according to your wishes. Choose someone you trust and consider naming an alternate in case your first choice is unable or unwilling to serve.

What should I do with my Last Will after signing it?

After signing your Last Will, keep it in a safe, accessible place and inform your executor or a trusted individual of its location. Avoid putting it into a safety deposit box that could be sealed upon your death, as this can delay the execution of your will.

Common mistakes

Filling out a Last Will and Testament is a significant step in managing one’s affairs, ensuring that personal wishes regarding the distribution of assets are honored after passing. However, when completing this vital document, especially in the state of New Hampshire, people often make several mistakes that can lead to disputes, delays, or even the invalidation of the will. It’s critical to avoid these errors to ensure that the wishes of the deceased are carried out as intended.

One common mistake is neglecting to have the will properly witnessed. New Hampshire law requires that a Last Will and Testament be signed in the presence of two competent witnesses, who then must also sign the document in the presence of the will maker and each other. This step is crucial because it lends credibility to the document, making it harder for someone to challenge its validity later on.

- Another area where errors often occur is in the failure to provide clear instructions for the distribution of assets. Vague or ambiguous language can lead to conflicts among beneficiaries, which might require court intervention to resolve. It’s essential to be as specific as possible when designating who receives what, ensuring there's no room for interpretation that could lead to unintended outcomes.

- Many individuals overlook the importance of naming an executor, the person responsible for carrying out the terms of the will. When no executor is named, or an unqualified person is selected, it can significantly complicate the probate process. Choosing a reliable and capable executor, and ideally a backup, should be done with careful consideration.

People often assume that a will is a set-it-and-forget-it document. However, life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets necessitate updates to the will. Failing to update the will to reflect these life changes can result in assets being distributed in ways that no longer align with the individual’s wishes or the exclusion of important beneficiaries.

- Finally, a significant error is the use of “do-it-yourself” legal forms without consulting a professional. While New Hampshire allows for the use of such forms, nuances in the law and individual circumstances can lead to mistakes if one is not thoroughly familiar with the legal requirements. Seeking advice from a legal consultant or attorney can help ensure that the will is both valid and effective at carrying out the person's final wishes.

By avoiding these common mistakes, individuals preparing a Last Will and Testament in New Hampshire can better safeguard their intentions, making the probate process smoother and more reflective of their wishes. Taking the time to ensure the document is correctly filled out, witnessed, and updated as necessary will provide peace of mind to both the individual and their loved ones.

Documents used along the form

Creating a Last Will and Testament is a vital step in estate planning, ensuring that an individual's wishes are respected and legally protected after their passing. However, this document alone might not cover every aspect necessary for a comprehensive estate plan. In New Hampshire, alongside the Last Will and Testament, several other forms and documents are commonly used to ensure a smooth and thorough handling of one's affairs. Let's delve into some of these essential documents.

- Durable Power of Attorney (DPOA): This legal document allows an individual to appoint another person to make decisions about their finances and property in the event they become incapacitated and unable to make decisions for themselves. This arrangement can be invaluable during the lifespan of the individual for managing their affairs without court intervention.

- Advance Directive: Including a Living Will and a Healthcare Power of Attorney, this document serves two purposes. It outlines an individual's preferences regarding medical treatment if they become unable to communicate those wishes themselves and designates a healthcare agent to make decisions on their behalf.

- Beneficiary Designations: Often accompanying retirement accounts, life insurance policies, and other financial products, beneficiary designations specify who will receive the assets from these accounts. These designations can override instructions laid out in a Last Will and Testament, so it’s critical to keep them updated and consistent with one’s estate plan.

- Trust Documents: For those who establish a trust as part of their estate plan, various documents will be essential, including the trust agreement. Trusts can help manage and protect assets both during the individual's life and after their death, often allowing for a more private and expedited transfer of assets than a will.

- Letter of Intent: This document provides a more personal touch, offering instructions and wishes regarding one’s personal belongings or their funeral arrangements. Although not legally binding, it helps to guide executors and beneficiaries through the process, ensuring that personal wishes are honored.

- Digital Asset Inventory: As digital assets become increasingly significant, including a list of these assets – such as social media accounts, online banking credentials, and digital property – along with instructions for managing them, is becoming an essential part of estate planning.

Together, the Last Will and Testament and these accompanying documents form a cohesive estate plan that addresses not only the distribution of one's assets but also personal care and wishes in scenarios of incapacity. It's important to consult with legal professionals when preparing these documents to ensure that they are executed correctly and reflect the individual's current wishes and circumstances. By having a complete estate plan in place, individuals in New Hampshire can provide clarity and ease for their loved ones during difficult times.

Similar forms

The New Hampshire Last Will and Testament form is similar to several other legal documents, each designed with specific purposes that cater to various facets of personal and financial affairs. While the essence of a Last Will and Testament is to outline the distribution of one's estate upon death, other documents complement or serve alternative purposes yet share commonalities in structure, intention, and legal standing.

Living Will: Just like a Last Will and Testament, a Living Will is a document that reflects personal choices, but its focus is on healthcare decisions rather than asset distribution. Both documents echo the wishes of the individual—where a Last Will and Testament becomes effective after death, a Living Will applies when the individual is alive but incapacitated. In each, clear instructions are provided to help guide others in making decisions that align with the individual’s preferences, demonstrating a shared emphasis on personal autonomy and prior planning.

Durable Power of Attorney (DPOA): Similar to the Last Will and Testament, a Durable Power of Attorney is a powerful legal document, but instead of addressing posthumous matters, it allows an individual to appoint someone else to manage their affairs while they are still alive. This could include financial, legal, or healthcare decisions—depending on the scope indicated within the document. Both the DPOA and a Last Will share the crucial ability to designate representatives to act on one's behalf, ensuring that the individual's wishes are respected and executed, albeit during their lifetime in the case of a DPOA.

Healthcare Proxy: Comparable to a Last Will and Testament in its function to appoint another to act on behalf of the individual, a Healthcare Proxy specifically appoints someone to make healthcare decisions if the person is unable to do so themselves. This appointment underscores the shared objectives between these documents—both aim to ensure that choices regarding personal welfare and estate management are predetermined by the individual. However, the pertinent moment of activation differentiates them; a Last Will takes effect after death, while a Healthcare Proxy is relevant during life in scenarios of incapacitation.

Each of these documents serves to bridge the gap between personal autonomy and legal necessity, allowing individuals to tailor their end-of-life and healthcare plans according to their desires. While their activation points and specific purposes may vary, the core objective of ensuring that one's wishes are understood and respected binds them closely to the essence of a Last Will and Testament. Together, they form a comprehensive approach to personal and estate planning, emphasizing the importance of preparedness and foresight in legal and healthcare decisions.

Dos and Don'ts

When preparing a Last Will and Testament in New Hampshire, it's important to exercise precision and precaution. This document holds significant power in dictating how your estate will be handled after your passing. Therefore, to ensure your wishes are properly documented and legally upheld, here are some recommended dos and don'ts during the process:

Do:

- Review New Hampshire state laws related to wills to ensure compliance. Specific requirements, such as how many witnesses you need, can vary by state.

- Clearly identify your assets and decide how you want them distributed. Being precise can prevent misunderstandings or disputes among beneficiaries.

- Choose an executor you trust to manage your estate. This person will play a critical role in ensuring your wishes are carried out.

- Sign your will in the presence of witnesses. New Hampshire law requires witnessing to validate a will.

- Keep your will in a safe place and inform a trusted individual of its location. This helps ensure it can be found easily when needed.

Don't:

- Attempt to write your will without considering state-specific requirements. Overlooking local laws may result in parts of your will being invalidated.

- Forget to update your will as your circumstances change. Major life events, such as marriage or the birth of a child, can necessitate revisions.

- Overlook the importance of choosing an alternate executor. If your first choice is unable to fulfill their duties, having a backup is essential.

- Use vague language that could lead to interpretations. Clarity in your wishes ensures they are understood and executed as you intended.

- Fail to consult a legal professional if your estate is complex. For substantial or intricate estates, professional guidance can provide peace of mind and ensure legality.

Misconceptions

When it comes to creating a Last Will and Testament in New Hampshire, several misconceptions can lead individuals astray. Understanding these misconceptions is key to ensuring that your final wishes are properly documented and legally viable. Here we outline four common misunderstandings surrounding the New Hampshire Last Will and Testament form.

- One must use a specific state-provided form. Many people believe that New Hampshire provides a specific form that must be used to create a legally binding Last Will and Testament. This is not the case. While New Hampshire law outlines certain requirements for a will to be considered valid, there is no mandatory state-provided form. Individuals have the flexibility to draft a document that reflects their wishes, as long as it complies with state laws.

- It’s only necessary if you have a lot of assets. Another common misconception is that Last Wills are only for those with significant assets. This couldn't be further from the truth. A Last Will and Testament is crucial for anyone who wishes to have a say in how their possessions, regardless of their value, are distributed after their passing. It is also vital for appointing guardians for minor children.

- Creating a Will is complicated and expensive. Many are deterred from creating a Will because they assume the process is both complicated and costly. While it’s advisable to seek legal advice to ensure your Will complies with New Hampshire law, drafting a Will does not have to be an expensive or overly complex process. Various resources and legal services are available to suit different budgets and needs.

- Once created, it doesn’t need to be updated. Some individuals believe that once a Last Will and Testament is created, no further action is required. However, life circumstances change, such as marriages, divorces, the birth of children, or the acquisition of significant assets or debts. It’s important to review and possibly update your Will to reflect these changes to ensure it remains aligned with your current wishes.

Dispelling these misconceptions is crucial for anyone considering drafting a Last Will and Testament in New Hampshire. By understanding the truth behind these false beliefs, you can take the appropriate steps to ensure your wishes are honored and your loved ones are cared for according to your intentions.

Key takeaways

When preparing a Last Will and Testament in New Hampshire, individuals should pay careful attention to several important aspects to ensure their final wishes are legally recognized and accurately reflected. Below are key takeaways regarding the completion and utilization of the form:

- Adherence to State Laws: New Hampshire has specific requirements that must be met for a Last Will and Testament to be considered valid. These include the presence of two witnesses during the signing process, all of whom must not be beneficiaries in the will. Understanding and following these legal prescriptions safeguard the document's enforceability.

- Comprehensive Detailing of Assets and Beneficiaries: It is crucial to be thorough when listing assets and designating beneficiaries. This detail ensures that personal property, financial assets, and other items of value are distributed according to the testator's wishes. Ambiguities or omissions might lead to disputes or unintended allocation of assets.

- Selection of an Executor: Choosing a trustworthy and competent executor is paramount. This individual will be responsible for managing the estate, including paying off debts and distributing assets as specified in the will. The executor plays a pivotal role in the administration of the will's directives and thus should be chosen with care and consideration.

- Regular Updates Reflecting Life Changes: Life circumstances such as marriage, divorce, the birth of children, or the acquisition of significant assets necessitate updates to the Last Will and Testament. Regularly revising the document ensures that it accurately reflects current wishes and circumstances. Failure to update the will can result in outdated directives that no longer align with the testator's intentions.

Other New Hampshire Templates

Legal Separation Nh - This agreement can also address responsibility for any joint debts or financial obligations moving forward.

New Hampshire Lease Agreement - The agreement specifies rules regarding pets, smoking, and other restrictions within the rented property.

Nh Bill of Sale Template - The documentation can be beneficial in resolving any future disputes over vehicle condition or ownership, offering a clear transaction record.