Attorney-Approved General Power of Attorney Document for New Hampshire

Empowering someone to act on your behalf can be a significant decision, one that New Hampshire residents can formalize through the General Power of Attorney form. This crucial document allows individuals to designate an agent, granting them broad legal authority to manage affairs ranging from financial transactions to real estate decisions. It becomes an essential tool for those who, due to health issues, travel, or other reasons, may need someone to handle their matters efficiently. Unlike a Special Power of Attorney that limits the agent's powers to specific acts, the General Power of Attorney in New Hampshire provides a wide scope of powers, mirroring the principal's legal capabilities except for making health care decisions. Highlighting the importance of trust in this arrangement, it underscores the necessity for the chosen agent to act in the principal's best interest, adhering strictly to their directives. This document, which can be revoked by the principal at any time as long as they are competent, adds a layer of security for individuals by ensuring that someone they trust can keep their affairs in order, even in their absence.

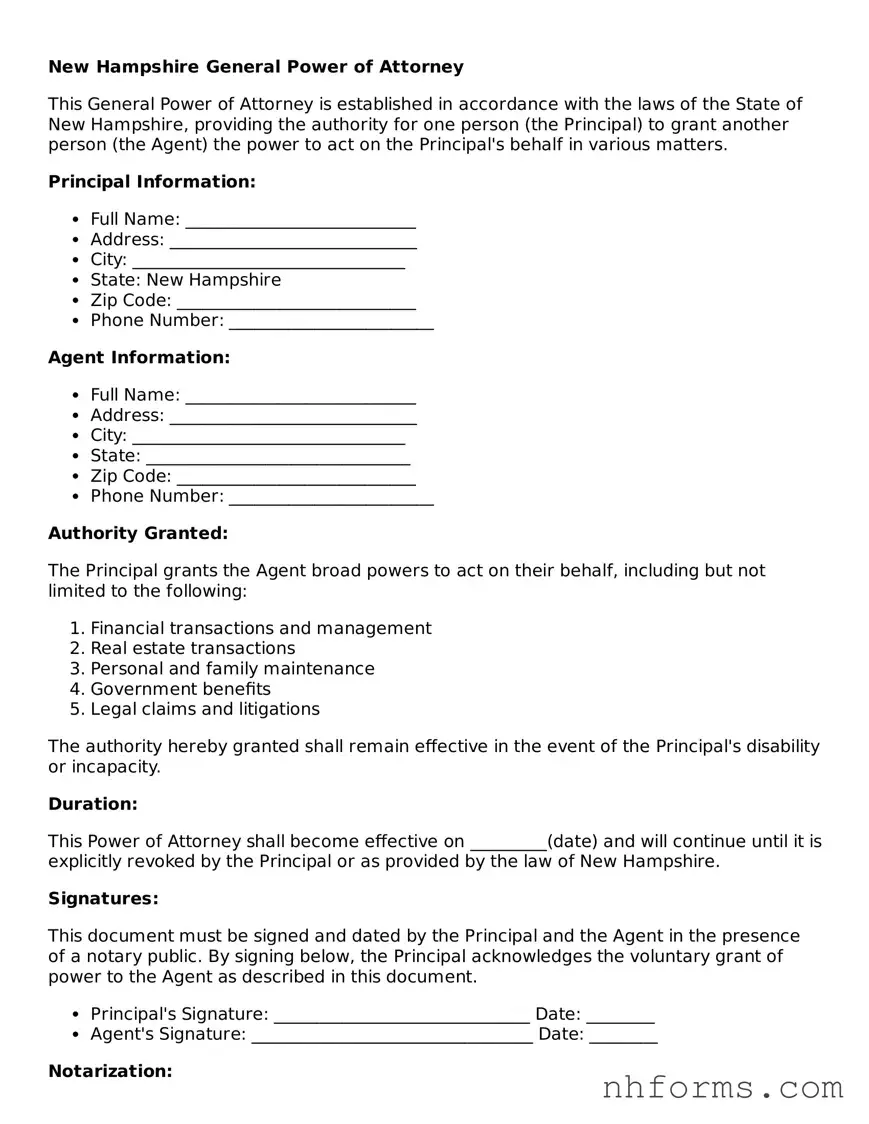

Document Preview Example

New Hampshire General Power of Attorney

This General Power of Attorney is established in accordance with the laws of the State of New Hampshire, providing the authority for one person (the Principal) to grant another person (the Agent) the power to act on the Principal's behalf in various matters.

Principal Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: New Hampshire

- Zip Code: ____________________________

- Phone Number: ________________________

Agent Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: _______________________________

- Zip Code: ____________________________

- Phone Number: ________________________

Authority Granted:

The Principal grants the Agent broad powers to act on their behalf, including but not limited to the following:

- Financial transactions and management

- Real estate transactions

- Personal and family maintenance

- Government benefits

- Legal claims and litigations

The authority hereby granted shall remain effective in the event of the Principal's disability or incapacity.

Duration:

This Power of Attorney shall become effective on _________(date) and will continue until it is explicitly revoked by the Principal or as provided by the law of New Hampshire.

Signatures:

This document must be signed and dated by the Principal and the Agent in the presence of a notary public. By signing below, the Principal acknowledges the voluntary grant of power to the Agent as described in this document.

- Principal's Signature: ______________________________ Date: ________

- Agent's Signature: _________________________________ Date: ________

Notarization:

This document was acknowledged before me on ________(date) by ________________(names of individuals acknowledged).

- Notary's Signature: ______________________________

- Commission Expires: _____________________________

File Information

| Fact | Details |

|---|---|

| 1. Purpose | A General Power of Attorney form allows you to give someone else the authority to make decisions on your behalf. |

| 2. Scope | It can cover a broad range of actions, including financial, legal, and personal decisions. |

| 3. Validity | For the document to be valid in New Hampshire, it must be signed in the presence of a notary public or two witnesses. |

| 4. Duration | This power remains effective until the principal dies or revokes the power, unless it is a durable power of attorney. |

| 5. Revocation | The power granted can be revoked at any time by the principal as long as they are mentally competent. |

| 6. Agent's Authority | The agent, also known as the attorney-in-fact, must act in the principal's best interest at all times. |

| 7. Governing Law | It is governed by the laws of the State of New Hampshire. |

| 8. Requirements for Agent | The agent must be 18 years of age or older and of sound mind. |

| 9. Durable Power of Attorney | A separate Declaration must be included for the power of attorney to remain effective if the principal becomes incapacitated. |

Detailed Instructions for Writing New Hampshire General Power of Attorney

Filling out a General Power of Attorney form in New Hampshire allows you to appoint someone to manage your financial and personal matters in case you are unable to do so yourself. This process involves several steps to ensure your document is valid and reflects your wishes accurately. It's important to follow these steps carefully to make sure your appointed agent has the correct authority to act on your behalf. Below are the detailed steps to accurately complete the General Power of Attorney form in New Hampshire.

- Begin by reading the form thoroughly to understand the nature and scope of authority you are granting. This ensures you are well-informed before making any decisions.

- In the section designated for the principal's (your) information, write your full legal name and address.

- Identify the person you are appointing as your agent (also known as an attorney-in-fact) and provide their full legal name and address in the specified section.

- Specify the powers you are granting to your agent. New Hampshire law allows you to grant general authority or to specify particular activities. Ensure you clearly define the extent of power you are giving.

- If you wish to limit your agent's powers in any way, specify these limitations clearly in the appropriate section of the form.

- Decide on the duration of the power of attorney. If it's meant to remain in effect indefinitely, state this clearly. If it has a specific end date, mention this date in the form.

- If applicable, nominate a successor agent who will take over should your primary agent be unable or unwilling to serve. Include the successor agent's full name and address.

- Review the form to ensure all the information you've provided is accurate and reflects your wishes.

- Sign and date the form in front of a notary public to validate the document. New Hampshire laws require notarization for the power of attorney to be considered legal.

- Have your agent sign the form, if required by the form or as advised by legal counsel. This step may vary depending on the specific requirements of the form you are using.

- Distribute copies of the completed and notarized document to your agent, any successor agents, and any institutions or individuals who may need to be aware of the power of attorney, such as banks or healthcare providers.

By following these steps, you will have successfully completed the General Power of Attorney form in New Hampshire, ensuring that your financial and personal matters can be managed according to your wishes should the need arise.

Essential Queries on New Hampshire General Power of Attorney

What is a New Hampshire General Power of Attorney form?

A General Power of Attorney form in New Hampshire is a legal document that allows one person (the principal) to designate another person (the agent) to make a wide range of financial decisions on their behalf. This includes managing finances, buying or selling real estate, and handling business transactions, among other responsibilities. The form grants broad powers to the agent, except for healthcare decisions.

How does one create a General Power of Attorney in New Hampshire?

To create a General Power of Attorney in New Hampshire, the principal must complete a form that clearly states their intention to grant power to the agent. This document must include the signatures of both the principal and the agent, and it is strongly recommended, although not legally required, to have the signatures notarized or witnessed to increase the form's validity.

Who can serve as an agent in New Hampshire?

Almost any competent adult can serve as an agent in New Hampshire. This includes family members, friends, or trusted professionals. The chosen agent should be someone the principal fully trusts, as they will have significant control over the principal's financial matters.

When does a General Power of Attorney become effective?

In New Hampshire, a General Power of Attorney typically becomes effective immediately upon signing unless the document specifies a different starting date or a triggering condition that must be met for it to become active.

Can a General Power of Attorney be revoked?

Yes, the principal has the right to revoke a General Power of Attorney at any time, as long as they are mentally competent to make such a decision. Revocation can be done by notifying the agent in writing and destroying all copies of the document.

Does a General Power of Attorney allow an agent to make healthcare decisions?

No, a General Power of Attorney in New Hampshire does not empower an agent to make healthcare decisions on behalf of the principal. For healthcare matters, a separate document, known as a Healthcare Power of Attorney or Advance Directive, is required.

What happens if the principal becomes incapacitated?

If not explicitly stated otherwise in the document, a General Power of Attorney in New Hampshire may become invalid if the principal becomes incapacitated. However, if the document is a Durable Power of Attorney, the agent retains the authority to act on the principal's behalf even if the principal becomes mentally incapacitated.

Where should a General Power of Attorney be stored?

After execution, the original General Power of Attorney should be stored in a safe and accessible place. Copies should be provided to the agent, financial institutions, and others who may need evidence of the agent’s authority. It’s also wise to discuss the location of the document with the agent and close family members.

Common mistakes

When filling out the New Hampshire General Power of Attorney form, individuals often make mistakes that can impact the validity and effectiveness of the document. These errors can range from simple oversights to more significant misunderstandings about the legal implications of certain decisions. It's crucial for individuals to approach this task with careful attention to detail and, if necessary, seek legal advice to avoid common pitfalls.

One of the primary mistakes people make is not specifying the powers granted clearly. The General Power of Attorney form allows individuals to grant broad or specific powers to their agent. However, without clear instructions, this can lead to confusion or misuse of authority. It's important to tailor the powers to the principal's needs, ensuring they are comprehensive but also clearly defined.

Here are nine mistakes frequently made on the New Hampshire General Power of Attorney form:

- Failure to include a termination date, which leaves the duration of the power of attorney ambiguous.

- Omitting the full legal names and addresses of both the principal and the agent, leading to potential identification and notification issues.

- Neglecting to specify conditions or events that will terminate the power of attorney, risking unintended longevity of the document.

- Not distinguishing between a durable and non-durable power of attorney, which determines whether the document remains effective if the principal becomes incapacitated.

- Skipping the requirement for witness signatures and a notary public, which are crucial for the document’s legality and enforceability.

- Lack of detail in enumerating the powers granted, resulting in ambiguities regarding the agent's authority.

- Failure to sign and date the document correctly, which can invalidate the document.

- Ignoring the need to notify relevant parties, such as financial institutions and family members, about the power of attorney.

- Assuming the form doesn't need to be reviewed by a legal professional, which can lead to oversights and challenges in the future.

In addition to these common mistakes, individuals often underestimate the importance of keeping the power of attorney document in a safe but accessible place. It's also advisable to review and update the document as circumstances change, ensuring its relevance and effectiveness are maintained over time. By avoiding these errors, individuals can ensure that their General Power of Attorney form accurately reflects their wishes and provides clear, lawful authority to their chosen agent.

Documents used along the form

Completing a General Power of Attorney form in New Hampshire is a significant step in managing one's financial affairs. However, it's often just one component of a comprehensive approach to planning. Several other documents frequently accompany this form, each serving a unique purpose in ensuring one's wishes are clearly communicated and legally enforceable. Here's a breakdown of some of these essential documents often used together with the General Power of Attorney.

- Advance Directive: This document allows you to specify your preferences for medical treatment and end-of-life care. It includes parts like a living will and a healthcare proxy or power of attorney for health care, empowering someone to make medical decisions on your behalf if you're unable to do so.

- Last Will and Testament: Essential for detailing how you want your assets distributed after you pass away. It names an executor to manage your estate and can outline guardianship wishes for any minor children.

- Durable Power of Attorney for Health Care: Similar to an Advance Directive, this document specifically grants someone authority to make healthcare decisions for you, should you become incapacitated.

- Limited Power of Attorney: Grants someone authority to act on your behalf in specific scenarios or for a limited time. Useful for financial transactions when you’re unable to be present.

- Revocation of Power of Attorney: This form is crucial if you need to cancel your existing Power of Attorney. It makes any previous POA documents null and void.

- Living Trust: Helps bypass probate by placing your assets in a trust for your beneficiaries. You can be the trustee and manage your assets during your lifetime, with a successor trustee stepping in after your death.

- Bank Forms: Many banks require their own forms to recognize a Power of Attorney over accounts held at their institution. Each bank’s requirements can differ.

- Real Estate Deeds: When transferring or managing real estate properties, different types of deeds may be necessary to confirm or alter ownership as directed by a Power of Attorney.

- Business Power of Attorney: If you own a business, this form allows you to appoint someone to make business decisions on your behalf, ensuring operations continue smoothly in your absence.

- Personal Record Keeping Documents: While not formal legal documents, keeping detailed personal records (e.g., account info, logins, key contacts) can be invaluable for the person you’ve given power of attorney, aiding them in managing your affairs efficiently.

Together, these documents can create a robust legal framework that protects your interests both during your lifetime and after. They work in conjunction to ensure your health, assets, and personal wishes are respected and managed according to your desires. Proper legal guidance is recommended when preparing these documents to ensure they are executed accurately and reflect your wishes clearly.

Similar forms

The New Hampshire General Power of Attorney form is similar to other power of attorney documents, but it has its unique characteristics and applications. Primarily, it grants broad powers to the designated agent, allowing them to manage financial and business affairs on behalf of the principal. This is analogous to a Durable Power of Attorney in that both authorize an agent to act on one's behalf. However, the durability aspect signifies that the document remains effective even if the principal becomes incapacitated, a feature specifically chosen or omitted based on the principal's preferences.

The Durable Power of Attorney (DPOA) shares a fundamental resemblance with the General Power of Attorney, but with a crucial distinction concerning the principal's mental capacity. While the General Power of Attorney may lose its validity if the principal becomes incapacitated or mentally incompetent, a Durable Power of Attorney is designed to withstand such circumstances. The durability clause ensures that the agent can continue to make decisions and manage affairs without interruption, a vital feature for long-term planning and security.

The Limited or Special Power of Attorney is another document that shares some characteristics with the New Hampshire General Power of Attorney, yet is distinct in its scope and application. Unlike the broad powers granted in a General Power of Attorney, a Limited Power of Attorney narrows an agent's authority to specific tasks or decisions. This might include selling a particular property, managing certain financial transactions, or making healthcare decisions. This targeted approach can be beneficial for principals looking to delegate authority for specific actions without granting blanket power over all their affairs.

The Medical Power of Attorney, while dealing with a completely different aspect of one’s personal affairs, also shares a foundational concept with the General Power of Attorney. It authorizes an agent to make healthcare decisions on the principal's behalf when they are incapable of doing so themselves. Although this document is focused on health-related decisions, the core idea of appointing someone to act in one's stead is a common thread. The major difference lies in the realm of decisions being made, highlighting the diverse applications of power of attorney forms.

Dos and Don'ts

Filling out the New Hampshire General Power of Attorney form is an important task that allows you to appoint someone to manage your financial affairs should you become unable to do so yourself. To ensure the process goes smoothly and your intentions are clearly expressed, here are some dos and don'ts to keep in mind:

Do:- Read the form thoroughly before you start filling it out to ensure you understand all the provisions and how they apply to your situation.

- Choose a trusted individual as your attorney-in-fact. This person should be reliable, trustworthy, and capable of managing your financial matters effectively.

- Be specific about the powers you are granting. The more detailed you are, the less room there is for interpretation or misuse of the power.

- Sign the form in the presence of a notary public to ensure that your document is legally recognized and valid.

- Keep the original document in a safe place, and provide copies to your attorney-in-fact and any financial institutions they will be dealing with.

- Review and update the form as necessary, especially if your situation or preferences change.

- Rush through the process without carefully considering who to appoint and what powers to grant. This decision has significant legal implications.

- Grant more power than necessary. Limit the powers to what is truly needed to manage your affairs effectively.

- Forget to specify any limitations or conditions that you want to apply to the attorney-in-fact’s powers.

- Use vague or ambiguous language that could lead to misinterpretation of your intentions.

- Neglect to tell family members or other interested parties about your General Power of Attorney to avoid surprises or conflicts later on.

- Assume the form doesn't need to be notarized. In New Hampshire, notarization is essential for the form to be legally effective.

Misconceptions

Many people believe that creating a New Hampshire General Power of Attorney form requires the services of a lawyer. While legal advice can be beneficial, New Hampshire law allows individuals to create their own power of attorney forms, as long as they comply with state requirements.

There's a common misconception that once a General Power of Attorney form is signed, the person who created it (the principal) loses all control over their affairs. This is not true. The principal retains the authority to revoke the power of attorney at any time, as long as they are mentally competent.

Some think that a General Power of Attorney grants the agent the right to do whatever they want with the principal's assets. In reality, the agent is legally obligated to act in the principal's best interests and within the scope of authority granted by the power of attorney document.

A frequent misunderstanding is that a General Power of Attorney continues to be effective after the principal's death. This is incorrect; the authority granted by a General Power of Attorney ends upon the principal’s death. At that point, the executor of the estate takes over.

There's a belief that a General Power of Attorney form is only for the elderly or those with significant assets. However, this form can be a useful legal tool for anyone who wants to ensure their affairs will be handled according to their wishes in case they become unable to do so.

Many assume that a General Power of Attorney is valid in all states once it is executed in New Hampshire. While many states will honor a power of attorney that is legally valid in its state of origin, there are differences in state laws. It's important to verify the document's validity if the principal moves to another state or owns assets in different states.

Key takeaways

When considering the completion and use of the New Hampshire General Power of Attorney form, it's important to understand its significance and the responsibilities it entails. A General Power of Attorney grants broad powers to an agent to make decisions and take action concerning the principal's finances and property. Here are some key takeaways to keep in mind:

- The importance of carefully selecting an agent cannot be overstated. This person will have extensive authority over the principal's financial affairs and should be someone the principal trusts implicitly.

- Detail is crucial in the General Power of Attorney form. The principal should specify exactly what powers the agent has, including but not limited to buying or selling property, managing bank accounts, and handling transactions.

- The document must comply with New Hampshire laws, which may require specific language or conditions to be met for the Power of Attorney to be considered valid.

- Signing requirements must be followed precisely. Typically, this means the Principal's signature must be notarized, and sometimes witnessed, to be legally binding.

- Powers granted by the General Power of Attorney can be as broad or as limited as the principal desires. It is often advisable to consult an attorney to tailor the document to the principal's specific needs and situation.

- Communicating with the chosen agent about the responsibilities and expectations is essential. The agent should understand the extent of their powers and the principal's wishes.

- The General Power of Attorney does not grant the agent the ability to make healthcare decisions for the principal. If this is desired, a separate healthcare directive or power of attorney is necessary.

- Revoking the Power of Attorney is possible at any time by the principal, as long as they are mentally competent. This revocation should be in writing and communicated to the agent and any institutions or parties informed of the original Power of Attorney.

To ensure the General Power of Attorney form effectively reflects the principal's intentions and complies with New Hampshire law, it may be beneficial to seek legal advice. Understanding and applying these key takeaways can help in creating a document that securely and accurately manages the principal's financial matters, providing peace of mind to all involved.

Other New Hampshire Templates

New Hampshire Rental Agreement - It protects tenants from unexpected evictions and rent increases, providing a level of certainty in their housing situation.

Small Estate Affidavit New Hampshire - Estate settlement through the Small Estate Affidavit can often be completed within a much shorter time frame compared to traditional probate.

Nh Bill of Sale Template - With a Motor Vehicle Bill of Sale, the entire vehicle transaction is solidified, marking the official handover of the vehicle.