Attorney-Approved Durable Power of Attorney Document for New Hampshire

Making arrangements for the future, especially when it comes to financial and health-related decisions, is a step toward ensuring peace of mind for both you and your loved ones. The New Hampshire Durable Power of Attorney form plays a crucial role in this process. This document grants someone you trust the authority to manage your affairs if you're unable to do so yourself due to illness or incapacity. It covers a broad spectrum of responsibilities, including but not limited to financial transactions, real estate management, and personal care decisions. Unlike other power of attorney documents that lose their validity if the principal becomes incapacitated, the durable power of attorney remains in effect, providing a seamless transition of authority and minimizing the need for court intervention. It's a proactive measure that's as much about protecting and simplifying life for your designated agent as it is about ensuring your wishes are honored no matter what the future holds.

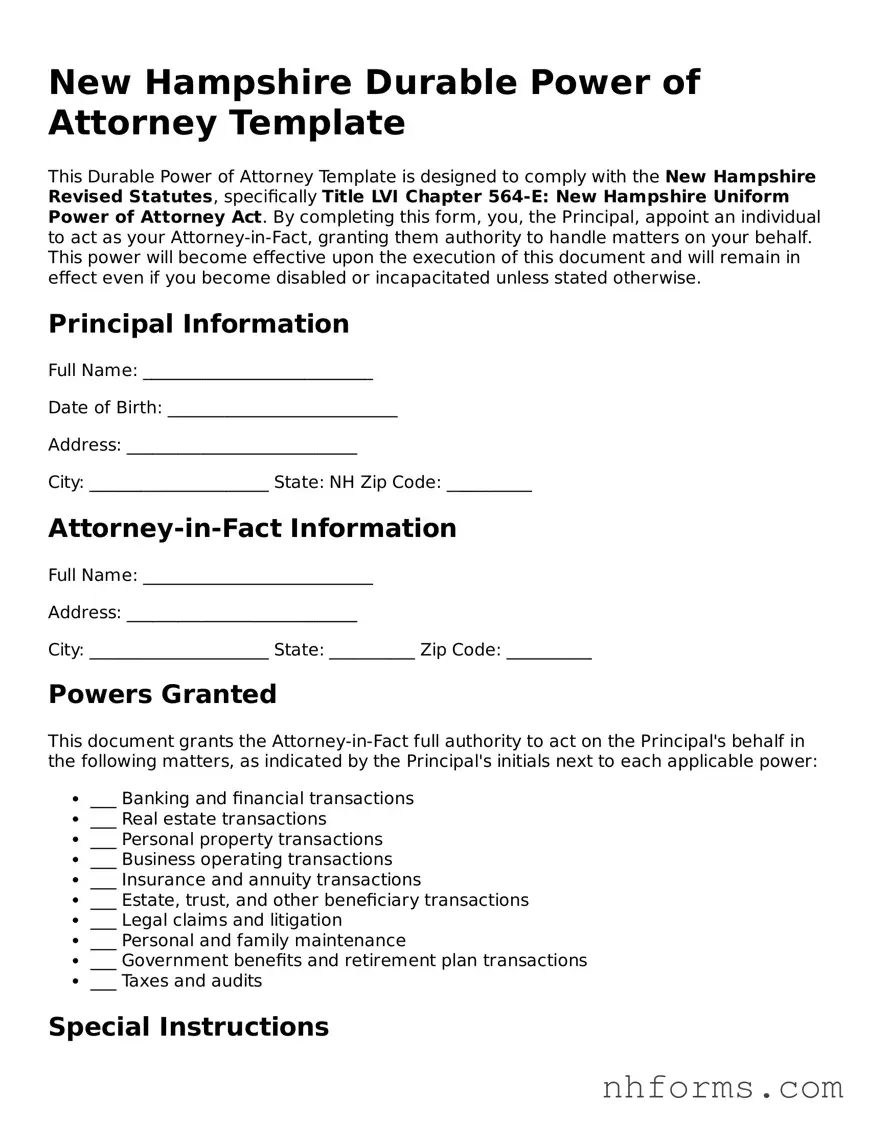

Document Preview Example

New Hampshire Durable Power of Attorney Template

This Durable Power of Attorney Template is designed to comply with the New Hampshire Revised Statutes, specifically Title LVI Chapter 564-E: New Hampshire Uniform Power of Attorney Act. By completing this form, you, the Principal, appoint an individual to act as your Attorney-in-Fact, granting them authority to handle matters on your behalf. This power will become effective upon the execution of this document and will remain in effect even if you become disabled or incapacitated unless stated otherwise.

Principal Information

Full Name: ___________________________

Date of Birth: ___________________________

Address: ___________________________

City: _____________________ State: NH Zip Code: __________

Attorney-in-Fact Information

Full Name: ___________________________

Address: ___________________________

City: _____________________ State: __________ Zip Code: __________

Powers Granted

This document grants the Attorney-in-Fact full authority to act on the Principal's behalf in the following matters, as indicated by the Principal's initials next to each applicable power:

- ___ Banking and financial transactions

- ___ Real estate transactions

- ___ Personal property transactions

- ___ Business operating transactions

- ___ Insurance and annuity transactions

- ___ Estate, trust, and other beneficiary transactions

- ___ Legal claims and litigation

- ___ Personal and family maintenance

- ___ Government benefits and retirement plan transactions

- ___ Taxes and audits

Special Instructions

If there are any specific limitations to the powers granted or special instructions for the Attorney-in-Fact, they should be detailed below:

______________________________________________________________________________

______________________________________________________________________________

Durability Provision

This Power of Attorney shall remain in effect in the event of the Principal's disability or incapacity. Should the Principal wish to revoke this document, it must be done so in writing and in accordance with New Hampshire law.

Signatures

Principal's Signature: ___________________________ Date: __________

Attorney-in-Fact's Signature: ___________________________ Date: __________

Witness Signature: ___________________________ Date: __________

Notarization

This document was acknowledged before me on (date) __________ by (name of Principal) ___________________________.

Notary Public Signature: ___________________________

My commission expires: __________

File Information

| # | Fact |

|---|---|

| 1 | The New Hampshire Durable Power of Attorney (DPOA) form allows an individual, known as the principal, to appoint an agent to make financial decisions on their behalf. |

| 2 | This form remains effective even if the principal becomes incapacitated, ensuring uninterrupted management of their affairs. |

| 3 | The DPOA form is governed by New Hampshire Revised Statutes Chapter 564-E, also known as the Uniform Power of Attorney Act. |

| 4 | To be considered valid, the form must be signed by the principal in the presence of a notary public or two non-related witnesses. |

| 5 | Principals have the flexibility to grant their agents broad or limited authority to act on their behalf. |

| 6 | The agent appointed in a DPOA has a legal obligation to act in the principal's best interests, known as a fiduciary duty. |

| 7 | The form can be revoked by the principal at any time, as long as they are mentally competent. |

| 8 | If a DPOA is termed "springing," it only becomes effective upon the occurrence of a specific event, usually the principal's incapacitation as determined by a medical professional. |

| 9 | Without a DPOA, a court may need to appoint a guardian or conservator to manage the affairs of an incapacitated individual, a process that can be lengthy and expensive. |

| 10 | The choice of agent is a critical decision and should be someone the principal trusts implicitly, as the agent will have significant control over the principal’s financial and legal matters. |

Detailed Instructions for Writing New Hampshire Durable Power of Attorney

Completing a Durable Power of Attorney (DPOA) form is a pivotal step in planning for future financial management and decision-making. This process demands careful attention to detail and a thorough understanding of your preferences for handling your affairs. It enables you to appoint a trusted individual to manage your financial and legal matters in the event you're unable to do so yourself. Here's how to accurately fill out the New Hampshire Durable Power of Attorney form to ensure your financial matters are in good hands.

- Gather necessary information including the full legal name, address, and contact details of the person you are appointing as your attorney-in-fact (agent) as well as your own information.

- Read through the Durable Power of Attorney form carefully to understand the scope and limitations of the powers you're granting.

- In the designated section, fill in your name and address as the principal, confirming your intent to grant power of attorney to your chosen agent.

- Enter the name, address, and contact information of your chosen agent in the specified area on the form.

- Specify the powers you are granting to your agent. Be clear if there are any restrictions or specific duties you want to enforce.

- If you wish to grant your agent the authority to handle real estate transactions, make sure to include detailed information about the properties and precise instructions.

- Review the special instructions section to add any additional terms or limitations not previously covered. This might include succession plans, compensation for your agent, or how disputes should be resolved.

- Sign and date the form in the presence of a notary public. The notarization process is crucial as it validates the authenticity of the document and your signature.

- Have your agent sign the form, if required by state law, acknowledging their acceptance of the responsibilities you’re entrusting to them. This step varies by jurisdiction; check New Hampshire's specific requirements.

- Store the original signed document in a secure location and provide copies to your agent, as well as any financial institutions or parties that might require it.

After finalizing the Durable Power of Attorney form, it's advisable to discuss the specifics with the person you've appointed as your agent. Providing them with guidance on your financial goals and expectations can help ensure they act in your best interest. Additionally, it's important to inform your family members or other relevant parties about the arrangement to avoid confusion and conflicts. Taking these cautious steps can safeguard your financial well-being and provide peace of mind for you and your loved ones.

Essential Queries on New Hampshire Durable Power of Attorney

What is a Durable Power of Attorney in New Hampshire?

A Durable Power of Attorney in New Hampshire is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to manage their financial affairs and make decisions on their behalf. The term "durable" means that the power of attorney remains effective even if the principal becomes incapacitated or unable to make decisions for themselves.

How do I create a Durable Power of Attorney in New Hampshire?

To create a Durable Power of Attorney in New Hampshire, you need to complete a form that specifies the powers you are granting to your agent. This form must be signed in the presence of a notary public. It's important to choose an agent who is trustworthy and capable of handling your financial affairs. You can specify the extent of the powers granted and any limitations in the document itself.

Who should I choose as my agent?

The choice of an agent is a critical decision. It should be someone you trust implicitly, such as a family member, a close friend, or a professional advisor. This person should have the capability to handle financial matters, be willing to act on your behalf, and understand your wishes. Consider their ability to act with your best interests in mind, especially under potentially stressful circumstances.

Can I revoke a Durable Power of Attorney?

Yes, as long as you, the principal, are mentally competent, you can revoke a Durable Power of Attorney at any time. To do so, you should inform your agent in writing and retrieve all copies of the document. It is also recommended to notify any financial institutions or other parties that were aware of the power of attorney of its revocation.

What happens if my agent is unable or unwilling to serve?

If the originally appointed agent is unable to serve due to unwillingness, incapacity, or any other reason, and a successor agent was named in the original document, the successor can take over the duties. If no successor was named, you may need to create a new Durable Power of Attorney if you are still competent to do so. Otherwise, it might become necessary for a court to appoint a guardian or conservator.

Does a Durable Power of Attorney need to be filed with the state of New Hampshire?

No, a Durable Power of Attorney does not need to be filed with the state of New Hampshire to be effective. However, it should be notarized to ensure its validity, especially when dealing with financial institutions and other organizations that may require a notarized document to recognize the agent's authority.

Are there any specific restrictions on what an agent can do with a Durable Power of Attorney in New Hampshire?

Yes, there are specific restrictions. For example, an agent cannot make decisions about the principal's healthcare unless specifically authorized in a separate healthcare directive. Additionally, the agent is expected to act in the principal's best interest, keep accurate records, avoid conflicts of interest, and cannot benefit personally from their actions. The document itself can also place limitations on the agent's powers.

Common mistakes

Filling out the New Hampshire Durable Power of Attorney form is a significant step in planning for future financial management and personal affairs. However, individuals often encounter common pitfalls that can undermine the document's effectiveness. Recognizing and avoiding these mistakes is crucial to ensure that the form serves its intended purpose without complications.

Not choosing the right agent. A frequent mistake is selecting an agent without considering their ability to handle financial or medical decisions effectively. The chosen agent should be trustworthy and capable of managing affairs in alignment with the principal's wishes.

Ignoring the need for specificity. Many people fail to specify the powers they are granting. A durable power of attorney can cover a broad range of actions, from managing bank accounts to making medical decisions. It's essential to be precise about what powers are being given to avoid confusion or abuse of authority.

Failing to add alternate agents. Life is unpredictable, and the initially chosen agent might be unavailable or unwilling to serve when needed. Including alternate agents ensures that there is always someone authorized to act on the principal's behalf.

Overlooking the importance of discussing wishes with the agent. A crucial step often missed is having a comprehensive conversation with the chosen agent about the principal's values, preferences, and specific wishes. This dialogue ensures that the agent is prepared and willing to act in the principal's best interest when the time comes.

Not keeping the document accessible. Once the durable power of attorney form is filled out, it's vital to store it in a secure yet accessible location. Both the agent and alternate agents should know where to find it if they need to act on the principal's behalf.

Skipping legal advice. Some people complete the form without consulting a legal expert. Seeking advice from a professional knowledgeable about New Hampshire law can prevent legal issues and ensure the document's validity.

Failing to regularly review and update the document. Circumstances change, and a durable power of attorney should reflect current wishes and relationships. Regularly reviewing and, if necessary, updating the form ensures it remains effective and relevant.

In conclusion, while the New Hampshire Durable Power of Attorney form is a tool for safeguarding one's future, it must be approached with care and thoroughness. Avoiding these common mistakes—selecting the right agent with clarity, specifying powers, planning for contingencies, communicating wishes, keeping the document accessible, consulting legal advice, and updating it as needed—will help ensure that the form fulfills its intended purpose without unintended complications.

Documents used along the form

When setting up a Durable Power of Attorney in New Hampshire, various additional documents are commonly utilized to ensure comprehensive legal and medical decisions can be made on an individual's behalf. Each document serves a specific purpose, complementing the Durable Power of Attorney by covering areas not addressed by it, ensuring an individual's wishes are respected in various scenarios.

- Advance Healthcare Directive: Outlines the medical treatments and life-sustaining measures an individual wants or does not want if they're unable to communicate their wishes due to illness or incapacity.

- Living Will: A type of advance directive that documents specific desires regarding medical treatment in scenarios where recovery is not expected.

- Healthcare Proxy: Names a specific person to make healthcare decisions on behalf of the individual, often included within the broader Advance Healthcare Directive.

- General Power of Attorney: Grants broad authority to another person (the agent) to conduct financial and legal transactions on the individual's behalf but becomes void if the individual becomes incapacitated.

- Limited Power of Attorney: Authorizes an agent to perform specific acts or functions on the individual's behalf for a limited duration or under specific circumstances.

- HIPAA Authorization Form: Permits designated persons to access an individual's protected health information, ensuring the agent can make informed decisions about the individual’s health care.

- Revocation of Power of Attorney: Allows an individual to officially cancel a previously granted power of attorney, requiring distribution to any involved parties and entities.

- Will: Specifies how an individual’s assets should be distributed after death and can appoint a guardian for minor children, ensuring wishes are followed when they're no longer there to communicate them.

- Trust Document: Establishes a trust to manage assets according to the individual's wishes either during their lifetime or after death, often used to avoid probate and manage estate taxes.

Collectively, these documents empower individuals to manage their legal, financial, and healthcare decisions proactively. By addressing a range of scenarios from medical care preferences to the management of assets, they ensure a person's wishes are honored and can ease the burden on family members during challenging times.

Similar forms

The New Hampshire Durable Power of Attorney form is similar to other legal documents that allow individuals to appoint representatives to make decisions on their behalf, but it has its unique aspects and applications. Each of these documents serves a slightly different purpose, outlining the scope and limitations of the power granted to another individual.

Health Care Proxy: Like the Durable Power of Attorney, a Health Care Proxy enables an individual to designate someone else to make medical decisions for them when they're unable to do so themselves. The key difference lies in the scope of authority granted. While the Durable Power of Attorney can cover a broad range of legal and financial decisions, the Health Care Proxy is specifically designed for medical decisions. This includes treatment options, life support decisions, and even preferences about organ donation.

General Power of Attorney: The General Power of Attorney and the Durable Power of Attorney share the objective of appointing someone to make decisions on the grantor's behalf. However, the "durable" nature of a Durable Power of Attorney means it remains in effect even if the grantor becomes incapacitated. In contrast, a General Power of Attorney typically becomes invalid if the grantor loses the ability to make informed decisions, making it less encompassing for long-term planning.

Springing Power of Attorney: A Springing Power of Attorney is quite unique but shares similarities with the Durable Power of Attorney. It is designed to "spring" into effect upon a specific event or condition, such as the incapacitation of the grantor. This feature provides an extra layer of control, allowing the grantor to maintain authority over their affairs until a predefined condition is met. The Durable Power of Attorney, while always in effect once signed, does not necessarily have this trigger-based activation.

Dos and Don'ts

When filling out the New Hampshire Durable Power of Attorney form, there are specific actions you should take to ensure the document is legally binding and reflects your wishes accurately. Here are the things you should and shouldn't do:

Things You Should Do:Read the entire form carefully before filling it out to understand all the provisions and how they apply to your situation.

Use clear and precise language to avoid any ambiguity regarding your intentions.

Include complete information for both the principal (the person granting the power) and the agent (the person being granted the power), such as full legal names and addresses.

Specify the powers being granted to the agent with as much detail as possible to prevent misinterpretation.

Have the document notarized to establish its authenticity and add an extra layer of legal protection.

Provide copies to relevant parties, such as the agent, family members, or an attorney, to ensure that your wishes are known and can be followed.

Review and update the document as necessary, especially after major life events or changes in your wishes.

Do not leave any sections blank. If a section does not apply, write "N/A" (not applicable) to indicate this.

Do not use vague language that could be open to multiple interpretations.

Avoid choosing an agent without discussing the responsibilities with them first to ensure they are willing and able to act on your behalf.

Do not forget to sign and date the form in front of a notary public; this step is crucial for the form's validity.

Do not fail to consider alternate agents in case your first choice is unable or unwilling to serve when needed.

Avoid using a generic form without checking that it complies with New Hampshire's specific legal requirements.

Do not keep the document in a place where no one can find it; make sure it is accessible to those who need it.

Misconceptions

The concept of a Durable Power of Attorney (DPOA) in New Hampshire is often misunderstood, leading to a number of misconceptions about its function and scope. Highlighted below are nine common misunderstandings, clarified to provide a better understanding of what a New Hampshire Durable Power of Attorney form entails.

- Misconception 1: Any Power of Attorney is durable by default.

In fact, for a Power of Attorney to be considered 'durable' in New Hampshire, it must explicitly state that the agent's authority continues despite the principal's incapacity. This is not an automatic feature of all Power of Attorney documents.

- Misconception 2: Creating a Durable Power of Attorney means losing control over your assets.

This is untrue. The principal retains control over their assets and can revoke or change the Durable Power of Attorney at any time, as long as they are mentally competent.

- Misconception 3: A Durable Power of Attorney covers medical decisions.

The standard Durable Power of Attorney in New Hampshire primarily deals with financial and property affairs, not health care decisions. A separate document, known as a Durable Power of Attorney for Health Care, is required for medical directives.

- Misconception 4: The appointed agent can do whatever they please.

Agents under a Durable Power of Attorney have a fiduciary duty to act in the principal's best interest. They are limited to the powers granted in the document and must act within those boundaries.

- Misconception 5: The form must be filed with a government agency to be valid.

While registering the document with certain government offices may be beneficial for record-keeping or specific transactions, it is not a requirement for the Durable Power of Attorney's validity in New Hampshire.

- Misconception 6: A lawyer must draft the Durable Power of Attorney.

Although it is advisable to consult with a legal professional to ensure that all aspects of the form are correctly addressed and tailored to the principal's needs, there is no legal requirement in New Hampshire that a lawyer must prepare the document.

- Misconception 7: Once incapacitated, it's too late to establish a Durable Power of Attorney.

This is correct. A Durable Power of Attorney must be executed while the principal is still competent to understand and make decisions about the authority they are granting.

- Misconception 8: There is a standard form that everyone must use.

Though New Hampshire provides general guidelines and forms for a Durable Power of Attorney, the specific document can be customized to suit individual needs and preferences, as long as it meets state legal requirements.

- Misconception 9: A Durable Power of Attorney is only for the elderly.

Individuals of any age can benefit from having a Durable Power of Attorney. It's a prudent measure to ensure that someone can legally manage your affairs should you become unable to do so, regardless of your age.

Key takeaways

When filling out and using the New Hampshire Durable Power of Attorney form, individuals are preparing for a future where they may not be able to make decisions for themselves. This document, deeply entrenched in the fabric of family planning and personal affairs, offers a safety net, ensuring that your choices and values are respected even when you're unable to articulate them. Here are nine key takeaways to guide you through the process:

- Understanding the Purpose: A Durable Power of Attorney (DPOA) allows you to appoint someone you trust, often referred to as an "agent" or "attorney-in-fact," to manage your financial affairs if you are unable to do so.

- Choice of Agent: Selecting an agent is a critical decision. It should be someone you trust implicitly, such as a family member or close friend, who understands your wishes and is capable of acting in your best interest.

- Durability Clause: The term “durable” implies that the power of attorney remains in effect even if you become incapacitated. This is crucial for ensuring that your agent can act when most needed.

- Specificity is Key: While filling out the form, be as specific as possible about the powers you are granting. You can choose to allow your agent to handle all your financial matters or limit them to specific actions.

- Signing Requirements: New Hampshire law requires that the DPOW form must be signed in the presence of a notary public or two witnesses (or both), making the document legally binding.

- Revocation is an Option: You have the right to revoke your DPOA at any time, provided you are competent. This should be done in writing and communicated to your agent and any institutions or individuals that were aware of the original power of attorney.

- Effective Immediately or Springing: You have the choice to make the DPOA effective immediately or to have it "spring" into effect upon a certain date or event, such as the determination by a physician that you have become incapacitated.

- Legal and Financial Implications: It’s important to consider the implications of handing over control of your financial matters. You may want to consult with a legal or financial advisor to ensure your interests are fully protected.

- Storage and Accessibility: Once signed, the DPOA document should be stored in a safe but accessible place. Your agent, family members, or other significant parties should know where it is kept and how to access it when needed.

By taking these considerations into account, you're not just preparing a document; you're ensuring peace of mind for both yourself and your loved ones. The New Hampshire Durable Power of Attorney form is a testament to your foresight, allowing you to have a say in your affairs, come what may. It’s a step that requires careful contemplation, one that underscores the importance of being prepared for any eventuality.

Other New Hampshire Templates

Acknowledgement Certificate Notary - They serve as an unbiased witness to the signing of crucial documents, lending credibility to the process.

New Hampshire Bill of Sale - The document can serve as evidence in a court of law if any disputes about the sale arise after the transaction has been completed.

Problems With Transfer on Death Deeds in Virginia - With its simplicity and effectiveness, the Transfer-on-Death Deed is an increasingly popular choice among property owners planning for their estate’s future.