Attorney-Approved Deed Document for New Hampshire

In New Hampshire, the process of transferring property ownership is governed by specific legal instruments, among which the deed form plays a crucial role. This form is not merely a document but a testament to the change of ownership, ensuring the transaction complies with state laws. It encompasses various aspects that are essential for both the grantor and the grantee to understand. These aspects include the precise identification of the parties involved, the legal description of the property being transferred, and any special warranties or covenants that apply to the transaction. Moreover, it demands acknowledgment by a notary public to validate its authenticity, thereby offering protection and peace of mind to all parties involved. Thus, the New Hampshire Deed Form stands as a pivotal document, balancing legal requirements with the interests of those engaged in property transactions.

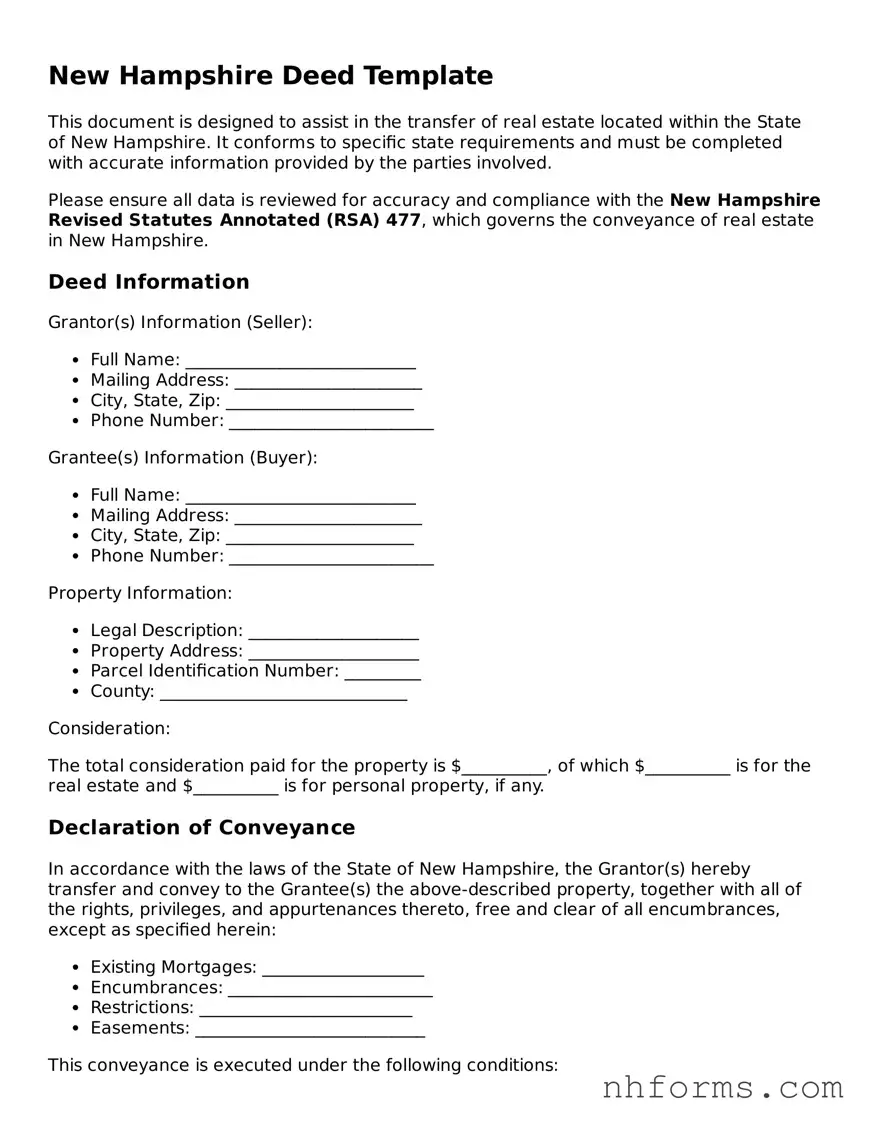

Document Preview Example

New Hampshire Deed Template

This document is designed to assist in the transfer of real estate located within the State of New Hampshire. It conforms to specific state requirements and must be completed with accurate information provided by the parties involved.

Please ensure all data is reviewed for accuracy and compliance with the New Hampshire Revised Statutes Annotated (RSA) 477, which governs the conveyance of real estate in New Hampshire.

Deed Information

Grantor(s) Information (Seller):

- Full Name: ___________________________

- Mailing Address: ______________________

- City, State, Zip: ______________________

- Phone Number: ________________________

Grantee(s) Information (Buyer):

- Full Name: ___________________________

- Mailing Address: ______________________

- City, State, Zip: ______________________

- Phone Number: ________________________

Property Information:

- Legal Description: ____________________

- Property Address: ____________________

- Parcel Identification Number: _________

- County: _____________________________

Consideration:

The total consideration paid for the property is $__________, of which $__________ is for the real estate and $__________ is for personal property, if any.

Declaration of Conveyance

In accordance with the laws of the State of New Hampshire, the Grantor(s) hereby transfer and convey to the Grantee(s) the above-described property, together with all of the rights, privileges, and appurtenances thereto, free and clear of all encumbrances, except as specified herein:

- Existing Mortgages: ___________________

- Encumbrances: ________________________

- Restrictions: _________________________

- Easements: ___________________________

This conveyance is executed under the following conditions:

- The Grantor(s) warrants that they have the right to convey the said property and that the property is free from all encumbrances not listed herein.

- The Grantor(s) will defend the title to the property against all persons who may lawfully claim the same.

- This deed is made with the understanding that the Grantee(s) accepts the property "as is," except as otherwise specified in this document.

IN WITNESS WHEREOF, the Grantor(s) have executed this deed on the _____ day of ______________, 20__.

Grantor(s) Signature: ___________________________

State of New Hampshire

County of ___________________

Subscribed and sworn before me this _____ day of ______________, 20__.

Notary Public Signature: ________________________

My Commission Expires: __________________________

File Information

| Fact | Detail |

|---|---|

| Governing Law | New Hampshire Revised Statutes, specifically Title LXII - Conveyances of Realty and Interests in Realty |

| Types of Deeds | New Hampshire recognizes several types of deeds, including warranty deeds, limited warranty deeds, and quitclaim deeds. |

| Recording Requirement | To be legally effective, the deed must be recorded with the Registry of Deeds in the county where the property is located. |

| Execution Requirements | For a deed to be valid in New Hampshire, it must be signed by the grantor(s) and witnessed by two individuals or acknowledged before a notary public or other official authorized to take acknowledgments. |

| Consideration Statement | A statement of consideration is required for the deed to be recorded, according to New Hampshire law. |

Detailed Instructions for Writing New Hampshire Deed

After identifying the property and deciding on the transfer details, the next critical step in the property exchange process in New Hampshire involves correctly completing the deed form. This form plays an essential role in legally documenting the transfer of ownership from one party to another. The steps lined out below serve to guide individuals through this process, ensuring the form is filled out accurately and thoroughly.

- Begin by entering the date of the deed execution at the top of the form.

- Fill in the grantor's (current owner's) full name and address in the designated space.

- Provide the grantee's (new owner's) full name and address in the space allocated.

- Clearly describe the property being transferred, including its legal description, address, and any identifiable parcel numbers, in the section provided for this purpose.

- If applicable, specify the amount of consideration (money) being exchanged for the property. This should be written in both words and numbers for clarity.

- Include any specific terms or conditions related to the transfer in the designated area of the form. This might involve rights, easements, or restrictions associated with the property.

- Both the grantor and the grantee must sign the deed in the presence of a notary public. The notary public will then complete their section, attaching their official seal to authenticate the document.

- Finally, file the completed deed with the local county registry office where the property is located to make the transfer public record. There may be a filing fee, which varies by county.