Attorney-Approved Articles of Incorporation Document for New Hampshire

Launching a corporation in New Hampshire is a significant step that requires careful planning and adherence to state regulations. At the heart of this process is the New Hampshire Articles of Incorporation form, a critical document that not only formalizes the existence of your business but also outlines its foundational structure. The form addresses various aspects, such as the proposed name of the corporation, its purpose, the duration of the corporation, information regarding the shares of stock it is authorized to issue, the details of the registered agent, and the incorporator's information, who files the document. Moreover, this form serves as a formal declaration to the New Hampshire Secretary of State, making the entity's presence officially recognized under state law. Completing and submitting this document accurately is essential for the legal establishment of a corporation in New Hampshire, setting the stage for its operations, tax obligations, and compliance with state corporate laws.

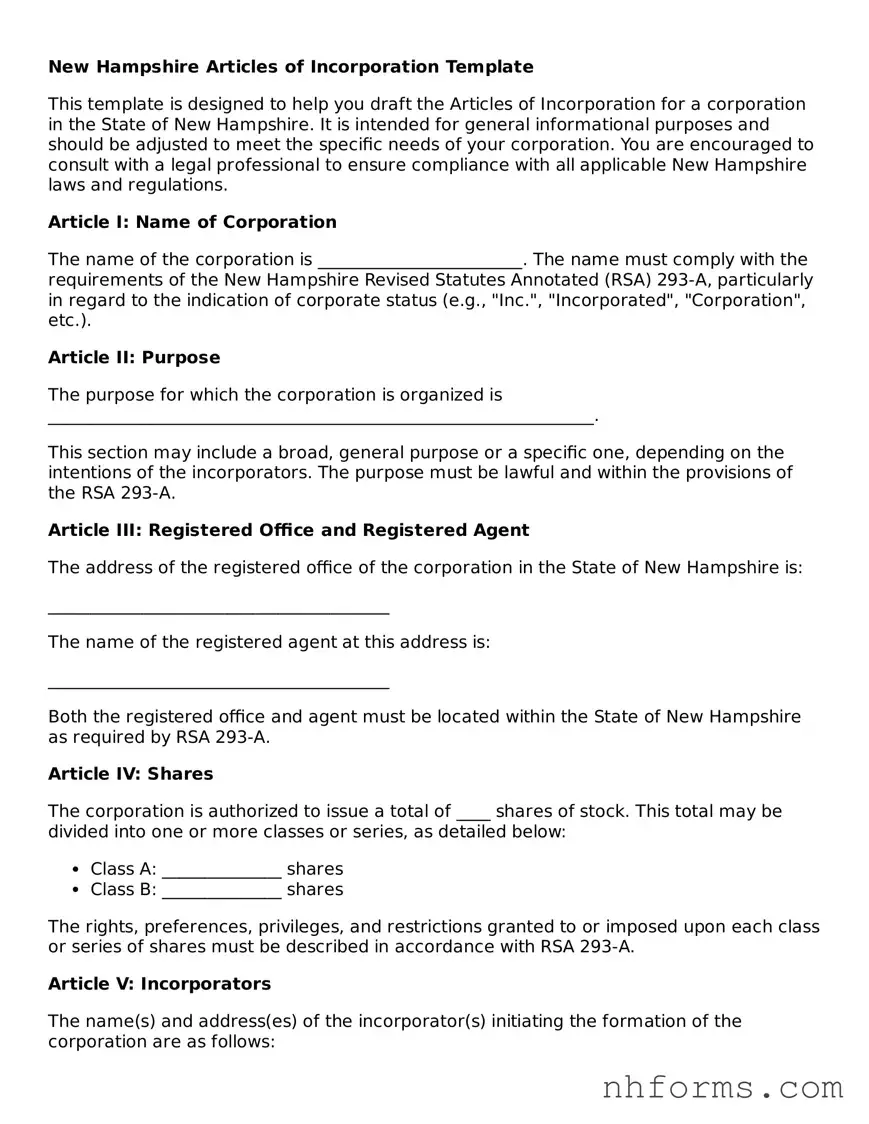

Document Preview Example

New Hampshire Articles of Incorporation Template

This template is designed to help you draft the Articles of Incorporation for a corporation in the State of New Hampshire. It is intended for general informational purposes and should be adjusted to meet the specific needs of your corporation. You are encouraged to consult with a legal professional to ensure compliance with all applicable New Hampshire laws and regulations.

Article I: Name of Corporation

The name of the corporation is ________________________. The name must comply with the requirements of the New Hampshire Revised Statutes Annotated (RSA) 293-A, particularly in regard to the indication of corporate status (e.g., "Inc.", "Incorporated", "Corporation", etc.).

Article II: Purpose

The purpose for which the corporation is organized is ________________________________________________________________.

This section may include a broad, general purpose or a specific one, depending on the intentions of the incorporators. The purpose must be lawful and within the provisions of the RSA 293-A.

Article III: Registered Office and Registered Agent

The address of the registered office of the corporation in the State of New Hampshire is:

________________________________________

The name of the registered agent at this address is:

________________________________________

Both the registered office and agent must be located within the State of New Hampshire as required by RSA 293-A.

Article IV: Shares

The corporation is authorized to issue a total of ____ shares of stock. This total may be divided into one or more classes or series, as detailed below:

- Class A: ______________ shares

- Class B: ______________ shares

The rights, preferences, privileges, and restrictions granted to or imposed upon each class or series of shares must be described in accordance with RSA 293-A.

Article V: Incorporators

The name(s) and address(es) of the incorporator(s) initiating the formation of the corporation are as follows:

- ______________________________________

- ______________________________________

Each incorporator must sign the Articles of Incorporation before filing with the New Hampshire Secretary of State.

Article VI: Duration

The corporation shall exist perpetually unless a specific duration is stated here: __________________________________________.

Article VII: Directors

The number of directors constituting the initial Board of Directors shall be ____ and the names and addresses of the persons who are to serve as the initial directors are:

- ______________________________________

- ______________________________________

It's mandatory for the corporation to have a board of directors. They manage the business and affairs of the corporation in accordance with RSA 293-A.

Article VIII: Indemnification of Directors and Officers

The corporation elects to indemnify its directors and officers to the fullest extent permitted by the RSA 293-A, as may be amended from time to time. This indemnification includes all expenses and liabilities reasonably incurred in connection with the defense of any action, suit, or proceeding in which they are made parties by reason of their positions.

Article IX: Bylaws

The initial bylaws of the corporation shall be adopted by the Board of Directors. The power to alter, amend, or repeal the bylaws or adopt new bylaws is granted to the Board of Directors, unless otherwise provided in the Articles of Incorporation or restricted by the RSA 293-A.

To complete the Articles of Incorporation, ensure that all required information is filled in and the document is signed by the incorporator(s). After review for completeness and accuracy, file with the New Hampshire Secretary of State along with the appropriate filing fee.

File Information

| Fact | Detail |

|---|---|

| 1. Purpose | The form is used for creating a corporation in New Hampshire. |

| 2. Governing Law | New Hampshire Revised Statutes, Chapter 293-A: Business Corporation Act. |

| 3. Mandatory Information | Includes corporation name, purpose, registered agent, office address, director(s) information, and incorporator(s) signature(s). |

| 4. Optional Provisions | May include indemnification of directors and officers, shareholder rights, and stock information. |

| 5. Filing Method | Submission can be completed online or by mail. |

| 6. Filing Fee | A fee is required; the exact amount can vary based on the specific type of corporation being formed. |

| 7. Annual Requirements | Corporations must file an annual report with the state. |

| 8. Duration of Processing | Processing time can vary, with expedited services available for an additional fee. |

| 9. Post-Filing Obligations | Corporations are required to maintain a registered office and a registered agent within the state. |

Detailed Instructions for Writing New Hampshire Articles of Incorporation

After deciding to form a corporation in New Hampshire, the next critical step is completing the Articles of Incorporation. This legal document establishes the corporation within the state, outlining basic information such as the corporation’s name, purpose, and the information about its incorporators. The process is straightforward, but requires attention to detail. Below are the steps you need to follow to ensure your Articles of Incorporation are filled out correctly and completely.

- Start by providing the name of the corporation. Make sure the name complies with New Hampshire state requirements, including the use of a corporate designator such as "Inc." or "Corporation".

- Next, specify the purpose of the corporation. This should be a brief description of the business activities the corporation will engage in. It's important for legal and tax purposes.

- Enter the name of the corporation’s registered agent. This is the individual or company authorized to receive legal documents on behalf of the corporation. The registered agent must have a physical address in New Hampshire.

- Provide the address of the registered office in New Hampshire. This must be a physical location (P.O. Boxes are not acceptable) where the registered agent is available.

- List the number of shares the corporation is authorized to issue. This figure should reflect the corporation's financing and equity distribution plans.

- Include the names and addresses of the incorporators. These are the individuals or entities responsible for the formation of the corporation.

- If desired, specify any additional provisions. These might include specific operational guidelines, special rights or restrictions for shareholders, or other relevant details that will govern the corporation’s operations. This step is optional and may not be applicable to all corporations.

- Have each incorporator sign and date the form. Their signatures certify the accuracy of the information provided and their intention to form the corporation.

- Check the form for completeness and accuracy. Make sure all necessary sections are filled out and all information is correct.

- Submit the Articles of Incorporation to the New Hampshire Secretary of State, along with the required filing fee. This can typically be done by mail or online, depending on the state's current options.

Following these steps will guide you through the process of filling out the New Hampshire Articles of Incorporation form. Once submitted, the document will be reviewed by the Secretary of State. If approved, your corporation will be officially registered in New Hampshire. You will receive a confirmation, marking the official beginning of your corporation’s existence under state law. It's crucial to keep a copy of the filed Articles of Incorporation for your records and future reference.

Essential Queries on New Hampshire Articles of Incorporation

What is the New Hampshire Articles of Incorporation form?

The New Hampshire Articles of Incorporation form is a legal document required to formally establish a corporation in the state of New Hampshire. This document outlines essential information about the corporation, including its name, purpose, the amount and type of stock it is authorized to issue, the address of its principal office, and the name and address of its registered agent. Filing this form with the New Hampshire Secretary of State's office officially registers your corporation, making it a legal business entity under state law.

Who needs to file the New Hampshire Articles of Incorporation form?

Anyone seeking to establish a corporation in New Hampshire must file the Articles of Incorporation form. This applies to both domestic corporations (those originally created in New Hampshire) and foreign corporations (those formed outside of New Hampshire but seeking to do business within the state) that wish to operate officially and legally as a corporate entity within New Hampshire.

What information do I need to provide in the Articles of Incorporation?

When completing the Articles of Incorporation, you will need to provide several pieces of information including the name of the corporation, which must be distinguishable from other business names already on file and comply with New Hampshire naming requirements; the purpose of the corporation; details on the authorized stock, such as the number of shares and classifications; the address of the corporation's principal office; and the name and physical address in New Hampshire of the registered agent who can receive legal documents on behalf of the corporation.

Where do I file the New Hampshire Articles of Incorporation form?

The completed Articles of Incorporation form must be submitted to the New Hampshire Secretary of State's office. Submissions can typically be made either online through the Secretary of State's website, by mail, or in-person at the Secretary of State's office. It is advisable to check the current filing methods, as available options may have changed.

Is there a fee to file the Articles of Incorporation in New Hampshire?

Yes, there is a filing fee for the Articles of Incorporation in New Hampshire. The exact fee can vary, so it's recommended to check the New Hampshire Secretary of State's website for the most current fee structure. Additional fees may apply for expedited processing or other optional services.

How long does it take to process the New Hampshire Articles of Incorporation?

The processing time for the Articles of Incorporation can vary depending on the method of submission and the current workload of the Secretary of State's office. Online submissions may be processed more quickly than paper submissions. For the most accurate and up-to-date processing times, it is best to consult directly with the New Hampshire Secretary of State's office or check their website.

Common mistakes

When filling out the New Hampshire Articles of Incorporation, several common errors can pose significant issues for prospective entities. Attention to detail during this process is crucial to ensure that the document accurately reflects the intention of the incorporators and complies with state regulatory requirements. Reviewing these common mistakes can help avoid delays or the potential for having to resubmit this important form.

- Incorrect or Incomplete Entity Name: Many people overlook the importance of specifying the complete and correct name of the entity, including necessary suffixes such as Inc., Corporation, or Limited. This name must be distinguishable from other names on record and properly reflect the legal structure of the entity. Failing to comply with naming conventions can result in an outright rejection of the application.

- Failure to Appoint a Registered Agent: A registered agent is essential for receiving official and legal documents on behalf of the corporation. This section is sometimes left blank or filled out with incorrect information. The registered agent must have a physical address in New Hampshire and be available during normal business hours. Incorporation cannot proceed without this designation.

- Lack of Specific Purpose Clause: While it’s acceptable to state a broad purpose for engaging in any lawful business, details regarding the corporation's specific objectives can greatly enhance clarity and direction. A well-defined purpose clause helps in setting clear expectations for stakeholders and guiding the corporation's operations.

- Inadequate Shares Information: The Articles must specify the number and type of shares the corporation is authorized to issue. This information often gets overlooked or entered inaccurately. A clear understanding and precise articulation of the share structure are vital for the governance and financial management of the corporation.

Ensuring accuracy and completeness when filling out the New Hampshire Articles of Incorporation is the first significant step in establishing a solid foundation for your entity. This process deserves careful attention to detail. Prospective incorporators are encouraged to review their submissions meticulously or seek professional assistance to avoid these common pitfalls. Doing so can significantly streamline the incorporation process, saving time and resources for all parties involved.

Documents used along the form

When incorporating a business in New Hampshire, the Articles of Incorporation form is a crucial first step. However, to effectively complete the incorporation process and comply with all legal requirements, several other forms and documents are often needed. These documents vary depending on the specific needs and structure of the corporation.

- Bylaws: A crucial document that outlines the rules and procedures for the governance of the corporation. It includes details on holding meetings, electing officers and directors, and other operational guidelines.

- IRS Form SS-4 (Application for Employer Identification Number): Necessary for the corporation to obtain an Employer Identification Number (EIN) from the IRS. This number is required for tax filing and banking purposes.

- Shareholder Agreement: A document used by corporations to outline the rights and obligations of shareholders. It covers details on the transfer of shares, resolution of disputes, and mechanisms for decision-making.

- Stock Certificates: Paper evidence of ownership in the corporation. These certificates indicate the number of shares owned by a shareholder.

- Initial Report: Many states require a newly formed corporation to file an initial report after incorporation. This report typically includes information on the corporation's directors, officers, and address.

Together, these documents support and elaborate on the information provided in the Articles of Incorporation. They help ensure the corporation is properly formed, operates smoothly, and complies with state and federal regulations. Keeping these documents in order, alongside the Articles of Incorporation, lays a solid foundation for any corporation's legal and operational structure.

Similar forms

The New Hampshire Articles of Incorporation form is similar to other foundational business documents used across the United States. These forms are essential for legally establishing an entity, outlining its structure, and defining its legal existence. While specific requirements can vary by state, they generally share common elements with the Articles of Incorporation, including the business name, purpose, registered agent details, and information about the incorporators.

Articles of Organization: Often used by Limited Liability Companies (LLCs), the Articles of Organization is a document similar to the Articles of Incorporation but tailored for LLCs. Like the Articles of Incorporation, it includes the business name, purpose, office address, and agent for service of process. The key difference lies in the management structure and operational flexibility that LLCs offer compared to corporations, which is reflected in the document’s content.

Corporate Charter: Another document similar to the Articles of Incorporation is the Corporate Charter. This document, essentially interchangeable with the Articles of Incorporation in many respects, serves as the official license for a corporation to operate within a state. It outlines the corporation's structure, authority, and basic operating principles. The terminology might differ, but the function and core information provided are very much aligned with what is found in Articles of Incorporation.

Business Registration Forms: While not as comprehensive in scope, business registration forms required for sole proprietorships and partnerships offer a simplified version of the information gathering seen in Articles of Incorporation. They typically need the business name, owner's information, and the nature of the business. Although less detailed, these forms represent a crucial step in legally identifying and recognizing a business.

Dos and Don'ts

Filling out the New Hampshire Articles of Incorporation form is a crucial step in forming your corporation. It provides the foundation on which your company will be built, establishes its legal presence, and is required for business operations in New Hampshire. Below is a list of do's and don'ts to keep in mind as you navigate this process.

Do's:

- Ensure that your corporation's name is unique and follows New Hampshire's naming requirements. It should not be easily confused with other business names registered in the state.

- Provide a complete and accurate address for the corporation's principal office. This is essential for official communications and legal notices.

- Appoint a registered agent who has a physical address in New Hampshire. This agent will be responsible for receiving important legal and tax documents on behalf of your corporation.

- Include detailed information about the corporation’s authorized stock, such as the number of shares, classes, and, if applicable, the par value of each. This information is vital for both legal and financial structuring.

- Outline the purpose of your corporation. While you may be tempted to keep this broad to allow for future flexibility, providing a clear purpose can streamline the approval process.

- Sign and date the form. An unsigned form is incomplete and will be rejected, potentially delaying your corporation's establishment.

- Review the entire form for accuracy and completeness before submission. Errors or omissions can cause delays.

- Pay the required filing fee. The process only officially starts once the fee is received.

Don'ts:

- Don't use unofficial forms. Always download the latest version of the Articles of Incorporation from the New Hampshire Secretary of State's website to ensure compliance with current requirements.

- Don't forget to specify the duration of your corporation if it's not intended to exist perpetually. This detail is often overlooked but can be important for certain business strategies.

- Don't neglect to list the names and addresses of the initial directors if required. This information is essential for establishing the initial governance structure of your corporation.

- Don't provide a P.O. Box as the address for your registered agent. A physical address in New Hampshire is required for legal service purposes.

- Don't underestimate the importance of the Articles of Incorporation. It's not just a formality, but a legal document that outlines key aspects of your corporation.

- Don't ignore local and state laws that may affect your filing. Being aware of these can help you avoid legal issues down the line.

- Don't try to file the form without thoroughly understanding each section. Seek clarification if needed to ensure accuracy.

- Don't rush through the process. Take your time to fill out the form correctly to avoid unnecessary complications later.

Misconceptions

Understanding the New Hampshire Articles of Incorporation requires navigating through common misconceptions. Let’s clear up some of the confusion surrounding this important document.

It's Only for Large Corporations: A common misconception is that the New Hampshire Articles of Incorporation are only necessary for large corporations. In reality, any entity wishing to establish itself as a corporation within the state, regardless of size, must file these articles. This process lays the foundation for both small businesses and larger enterprises to operate legally within New Hampshire.

You Can File Whenever You Want: Some people believe they can file the Articles of Incorporation at any time after starting their business operations. However, to legally operate as a corporation within New Hampshire, filing these articles is one of the first steps that must be taken before commencing business activities.

The Process Is Complicated and Requires a Lawyer: While legal advice can certainly aid in ensuring accuracy, the belief that filing the New Hampshire Articles of Incorporation is too complicated to do without a lawyer is misleading. The state provides resources and clear instructions to help individuals through the filing process. Many small business owners successfully file on their own.

It’s Very Expensive: Another misconception is that filing the Articles of Incorporation comes with a high cost. While there is a filing fee, it is relatively modest and should not deter someone from establishing a corporation. The actual cost can easily be found on the New Hampshire Secretary of State’s website.

The Same Form Is Used Across All States: One might think that the Articles of Incorporation form is standardized across all states. However, each state has its own requirements and forms for incorporation. The New Hampshire Articles of Incorporation are specific to the state's laws and may have different requirements than those in other states.

Filing Means Immediate Approval: Simply filing the Articles of Incorporation does not guarantee immediate approval. The New Hampshire Secretary of State’s office must review the submission to ensure it meets all legal requirements. This process can take time, so it’s wise to plan accordingly.

Once Filed, No Further Action Is Required: It's a mistake to think that once the Articles of Incorporation are filed, there are no more regulatory requirements. Corporations must comply with ongoing requirements such as annual reports and, if applicable, renewal fees to maintain good standing within the state.

Dispelling these misconceptions is crucial for anyone looking to incorporate in New Hampshire. Understanding the real process and requirements can help ensure a smoother establishment and operation of a corporation in the state.

Key takeaways

Starting a corporation in New Hampshire involves a critical step: filling out the Articles of Incorporation correctly. This document lays the foundation for your corporation's legal existence, so it's essential to pay attention to detail and ensure accuracy. Here are key takeaways to help guide you through this process:

- Know the Requirements: Before diving into the Articles of Incorporation, familiarize yourself with New Hampshire specific requirements. These may include specific language related to the corporation's purpose, information about the incorporators, and the details of the initial board of directors. Ensuring you understand each requirement will help prevent delays in the approval process.

- Choose a Name Wisely: Your corporation’s name must be distinguishable from other businesses registered in New Hampshire. It should end with a corporate designator such as “Incorporated,” “Corporation,” or an abbreviation of these terms. Conduct thorough research to avoid any potential conflicts or legal issues related to your chosen name.

- Detail Your Corporate Purpose: Though some states allow for a broad, all-encompassing purpose statement, it's crucial to check if New Hampshire requires more specificity. Clearly articulating the corporation's purpose not only fulfills state legal requirements but also guides your corporation's actions and decisions.

- Appoint a Registered Agent: A registered agent acts as the corporation’s official contact for legal correspondence. This role can be filled by an individual resident of New Hampshire or a business entity authorized to operate within the state. The agent’s physical address (P.O. Boxes are not allowed) and consent to serve must be included in the Articles of Incorporation.

- File with Precision: Ensure that the form is completed thoroughly and accurately. Double-check details like addresses, names, and signatures. Any incorrect or incomplete information can delay the approval process or cause your filing to be rejected. Keep a copy of the filed document for your records and future reference.

Remember, the process of incorporating goes beyond submitting the initial paperwork. Once your Articles of Incorporation are successfully filed, you'll need to comply with additional regulatory requirements, including the creation of bylaws, holding an initial meeting of the board of directors, and issuing stock. Taking the time to understand and properly complete your Articles of Incorporation is the first step in establishing a strong legal and operational foundation for your corporation.

Other New Hampshire Templates

Another Name for Living Will - The process of drafting a Living Will encourages individuals to think deeply about their healthcare wishes and to discuss these preferences with their physicians.

Nh Bill of Sale Template - Sellers can use the form to confirm the relinquishment of their legal rights and responsibilities towards the boat.